February 2025

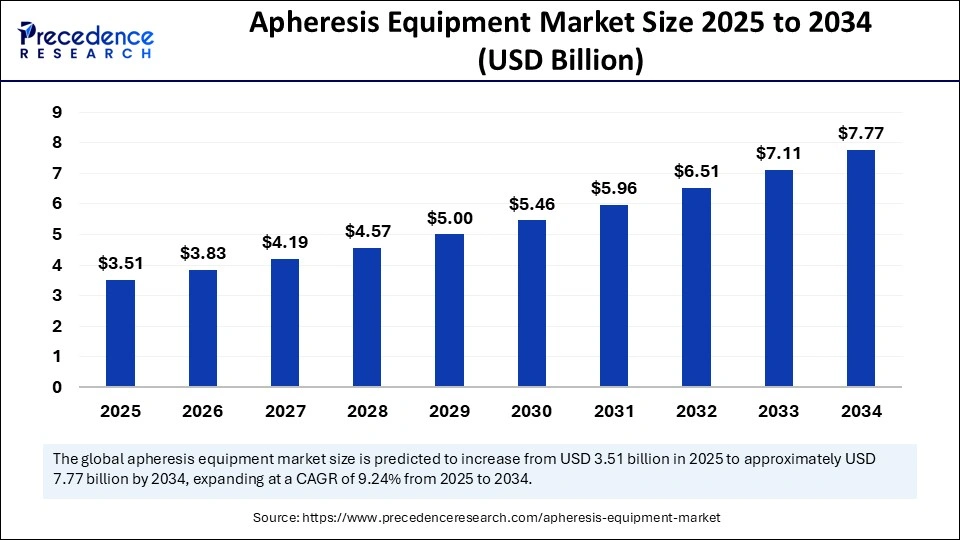

The global apheresis equipment market size is calculated at USD 3.51 billion in 2025 and is forecasted to reach around USD 7.77 billion by 2034, accelerating at a CAGR of 9,.24% from 2025 to 2034. The North America market size surpassed USD 1.12 billion in 2024 and is expanding at a CAGR of 9.44% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global apheresis equipment market size accounted for USD 3.21 billion in 2024 and is predicted to increase from USD 3.51 billion in 2025 to approximately USD 7.77 billion by 2034, expanding at a CAGR of 9.24% from 2025 to 2034. The increasing incidence of blood-related disorders is the key factor driving market growth. Also, technological advancements in apheresis devices coupled with the growing demand for blood components can fuel market growth further.

Artificial Intelligence is transforming the market by improving accuracy, enhancing monitoring, and streamlining procedures, which leads to desired patient outcomes with more convenient treatments. Furthermore, AI algorithms can process real-time data to optimize separation processes that ensure the collection of some blood components with better precision and can automate tasks such as data logging, reporting, and processing, allowing medical professionals to emphasize patient care.

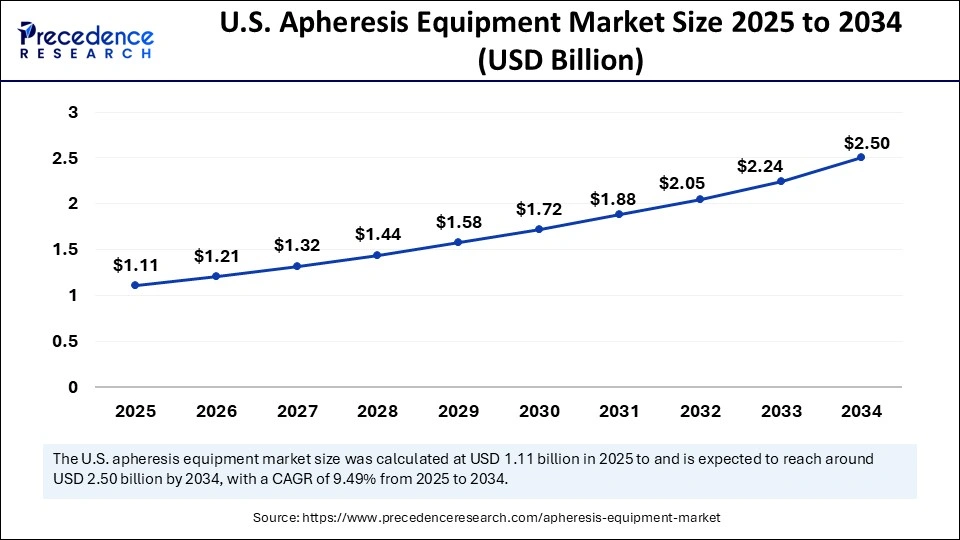

The U.S. apheresis equipment market size was exhibited at USD 1.01 billion in 2024 and is projected to be worth around USD 2.50 billion by 2034, growing at a CAGR of 9.49% from 2025 to 2034.

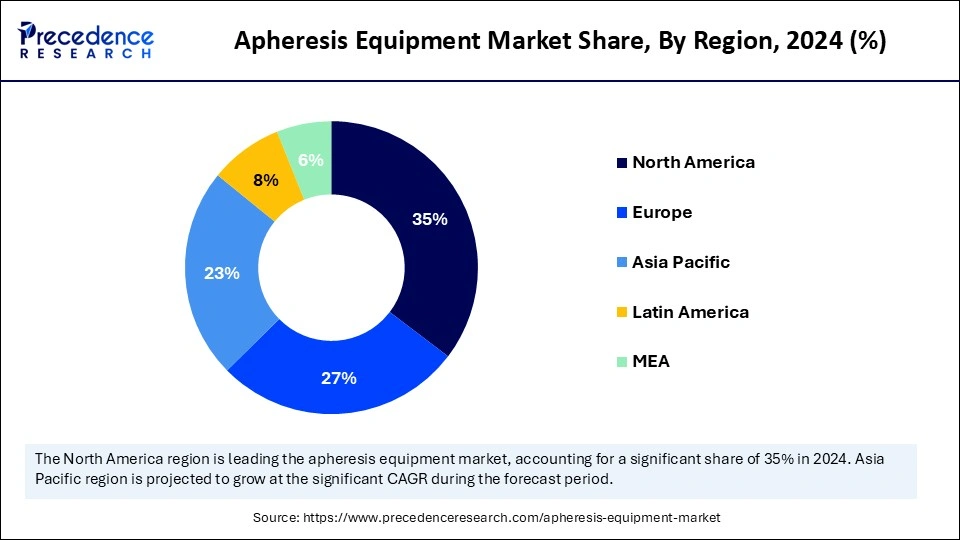

North America held the largest apheresis equipment market share in 2024. The dominance of the region can be attributed to the increasing incidence of blood-related disorders, coupled with the demand for blood components. Furthermore, the region's strong healthcare systems, especially in countries like the United States and Canada, have the potential to integrate sophisticated apheresis procedures.

In North America, the U.S. led the market owing to the increasing healthcare spending, the need for plasma-derived medicines, and the growing incidence of blood-related & chronic diseases. Also, major market players in the region are Haemonetics Corp., Braun Melsungen AG, Asahi Kasei Medical Co., Ltd., and Mallinckrodt.

Asia Pacific is expected to witness the fastest growth I the apheresis equipment market during the forecast period. The growth of the segment can be credited to the ongoing economic development and enhanced healthcare infrastructure in nations such as China, India, and Japan. Moreover, the increasing incidence of hematologic disorders and chronic diseases in the region is boosting the demand for apheresis treatments.

In Asia Pacific, Japan dominated the market. The dominance of the country can be driven by a surge in the geriatric population and an increasing shift towards the Western lifestyle and diet. Japan's healthcare system is experiencing a transition, propelling the service portfolio in disease management.

Apheresis equipment is a medical device created for the direct separation of blood components during the apheresis process. It is a process that includes removing components from an individual's blood, like platelets, plasma, or white blood cells, while giving the remaining blood back to the patient. The apheresis equipment market produces specialized machines designed for this purpose and uses techniques such as filtration and centrifugation to separate and collect desired blood components.

| Report Coverage | Details |

| Market Size by 2034 | USD 7.77 Billion |

| Market Size in 2025 | USD 3.51 Billion |

| Market Size in 2024 | USD 3.21 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.24% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Procedure, Technology, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Enhancement in healthcare infrastructure

The growth of healthcare infrastructure, particularly in developing countries, and growing awareness regarding apheresis procedures and blood donation are the major factors driving market growth. In addition, the use of apheresis is growing beyond conventional applications to include cardiovascular, neurological, and hematological disorders, strengthening the market reach.

Lack of awareness

Lack of awareness regarding the procedures and their advantages is the major factor constraining the apheresis equipment market. Due to limited awareness, many people are unaware of these innovative therapeutic procedures. Moreover, apheresis procedures need highly trained nurses and technicians to operate the equipment effectively and safely, hindering the market growth soon.

Growth in emerging markets

As medical infrastructure continues to enhance and countries develop in regions such as Latin America, Asia Pacific, and the Middle East, there is an increasing need for innovative medical technologies, such as apheresis equipment. Furthermore, factors like increasing healthcare expenditure, growing incidence of chronic diseases, and escalating access to healthcare services are fuelling the demand for the apheresis process in these countries.

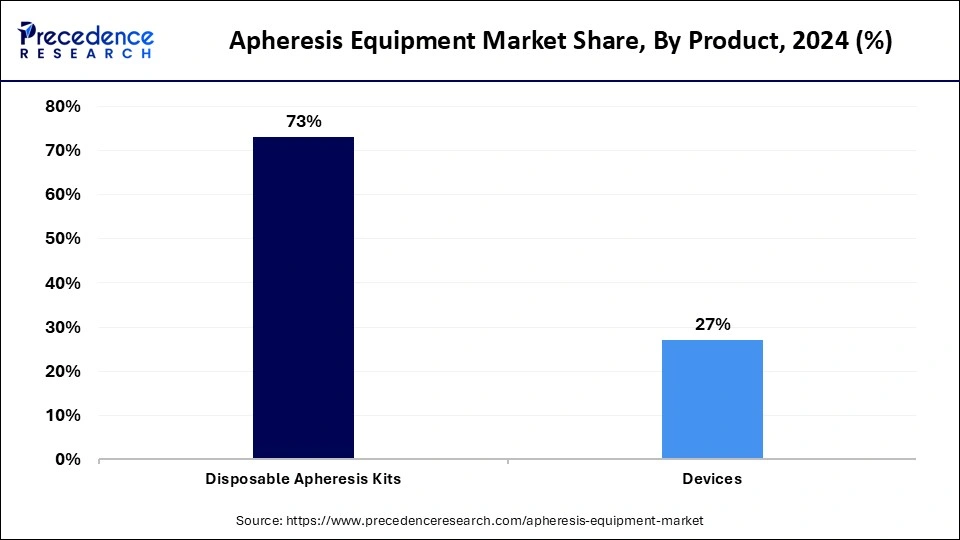

The disposable apheresis kits segment dominated the apheresis equipment market in 2024. The dominance of the segment can be attributed to the increasing usage of disposable kits and the surge in the incidence of blood-related disorders. This kit includes items like filters, tubing, and collection bags, which are important for ensuring safety and sterility during apheresis procedures, minimizing the risk of infection and cross-contamination. The rising focus on patient safety and infection control in medical facilities has boosted the demand for high-quality disposable kits.

The devices segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the innovations in healthcare infrastructure, along with the surge in blood donation numbers. Additionally, the growing number of apheresis practices due to the increasing incidence of chronic diseases and the escalating use of apheresis for donor and therapeutic purposes has further positively impacted the segment's growth.

The neurology segment dominated the apheresis equipment market in 2024 and is estimated to grow at the fastest rate over the forecast period. The dominance of the segment is owing to the growing incidence of neurological disorders such as myasthenia gravis, Multiple Sclerosis (MS), and Guillain-Barre syndrome (GBS), which necessitates therapeutic plasma exchange as an initial treatment. Also, these neurological disorders require specialized treatment solutions to cure them completely.

The plasmapheresis segment held the largest apheresis equipment market share in 2024. The dominance of the segment can be linked to the rising prevalence of lymphoma, leukemia, and myeloma across the globe. Plasmapheresis is a procedure utilized to treat many conditions by removing toxic substances or adding missing components. The growing need for plasma-derived products will likely contribute positively to the market expansion.

The leukapheresis segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be driven by the increasing incidence of cancer, especially prostate& breast cancer, and leukemia. Moreover, the innovations in leukapheresis technologies and the growing demand for individualized medicine cell therapies like CAR-T are driving the segment's growth during the forecast period.

The membrane filtration technology segment led the apheresis equipment market in 2024. The dominance of the segment is owing to the effectiveness of this technology in addressing crucial challenges confronted during the apheresis procedures. In addition, the growing need for therapeutic apheresis procedures and the increasing incidence of blood disorders and chronic diseases, which necessitate specific blood component separation, are key factors driving the segment's growth.

The centrifugation segment is projected to grow at the fastest rate during the forecast period. The growth of the segment can be linked to the innovations in automated and high-speed centrifuges, which have enhanced efficiency. Furthermore, the specific centrifugation parameters can impact the concentration and distribution of the final PRF or CGF product. Automatic centrifugation decreases processing times, enhancing overall operational efficiency.

By Product

By Procedure

By Technology

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

March 2025

September 2024

January 2025