January 2025

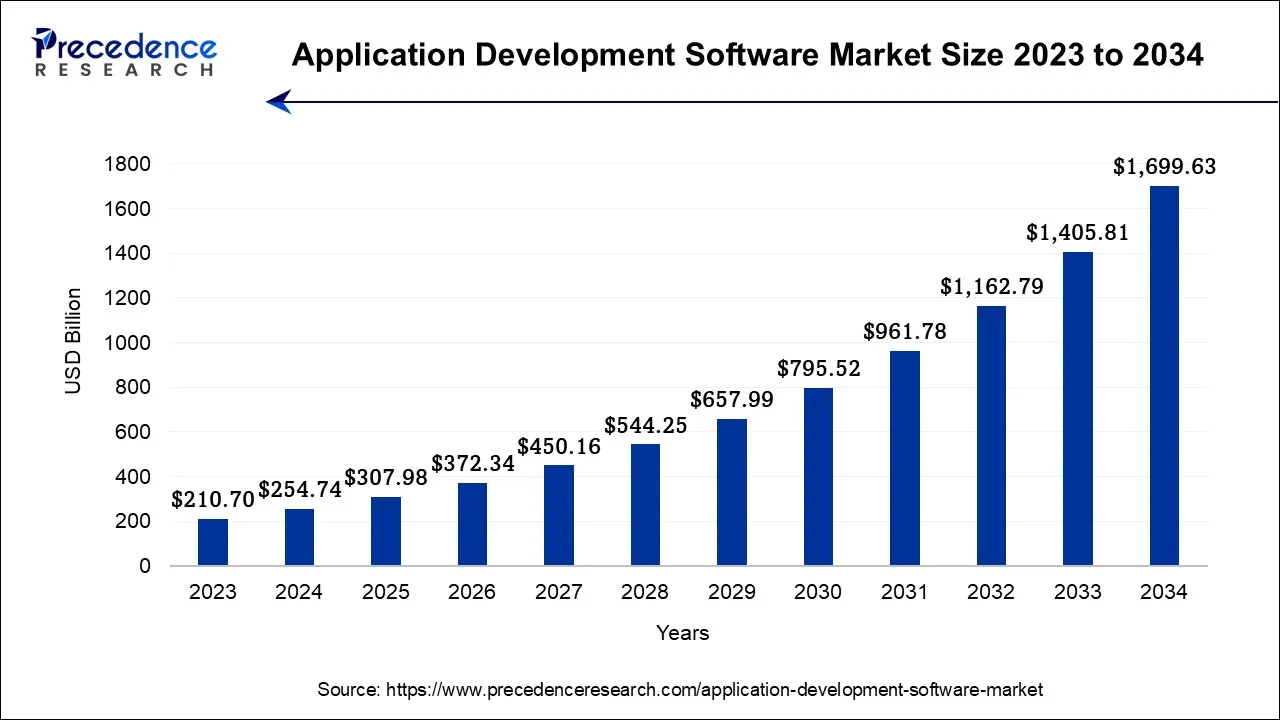

The global application development software market size is calculated at USD 254.74 billion in 2024, grew to USD 307.98 billion in 2025, and is predicted to hit around USD 1,699.63 billion by 2034, poised to grow at a CAGR of 20.9% between 2024 and 2034. The North America application development software market size accounted for USD 99.35 billion in 2024 and is anticipated to grow at the fastest CAGR of 21.05% during the forecast year.

The global application development software market size is expected to be valued at USD 254.74 billion in 2024 and is anticipated to reach around USD 1,699.63 billion by 2034, expanding at a CAGR of 20.9% over the forecast period from 2024 to 2034.

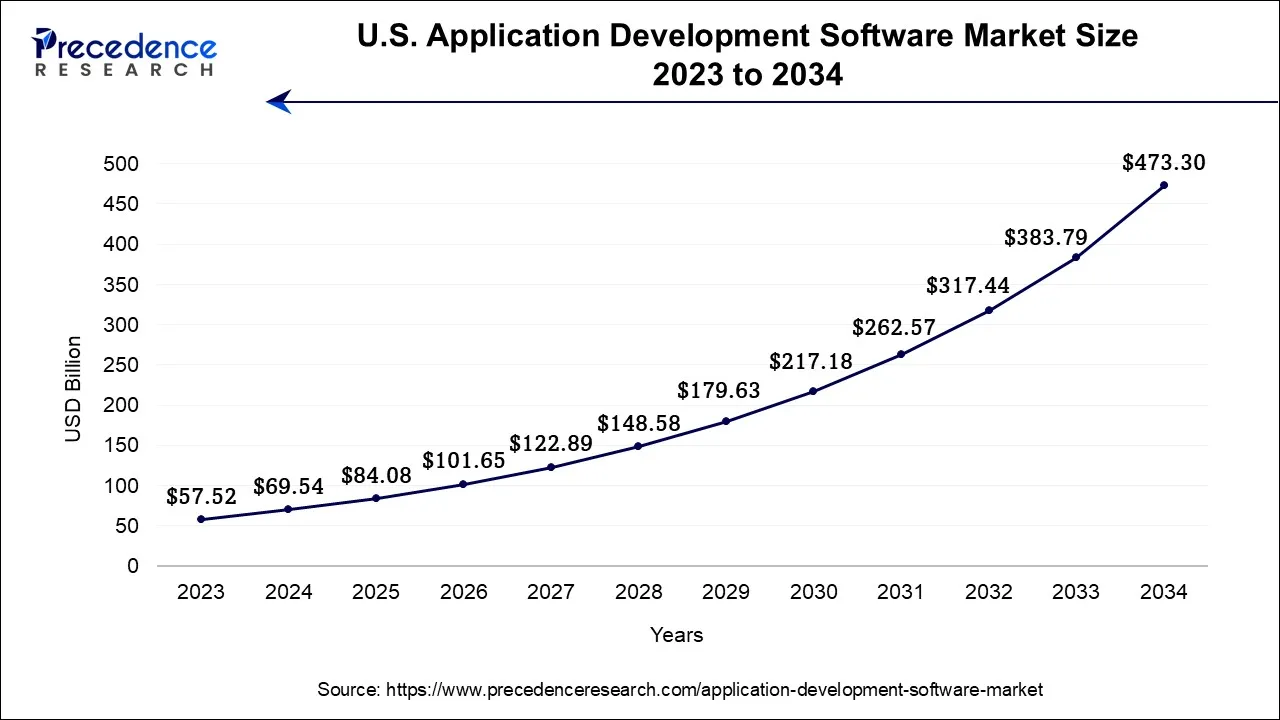

The U.S. application development software market size is accounted for USD 69.54 billion in 2024 and is projected to be worth around USD 473.3 billion by 2034, poised to grow at a CAGR of 21.14% from 2024 to 2034.

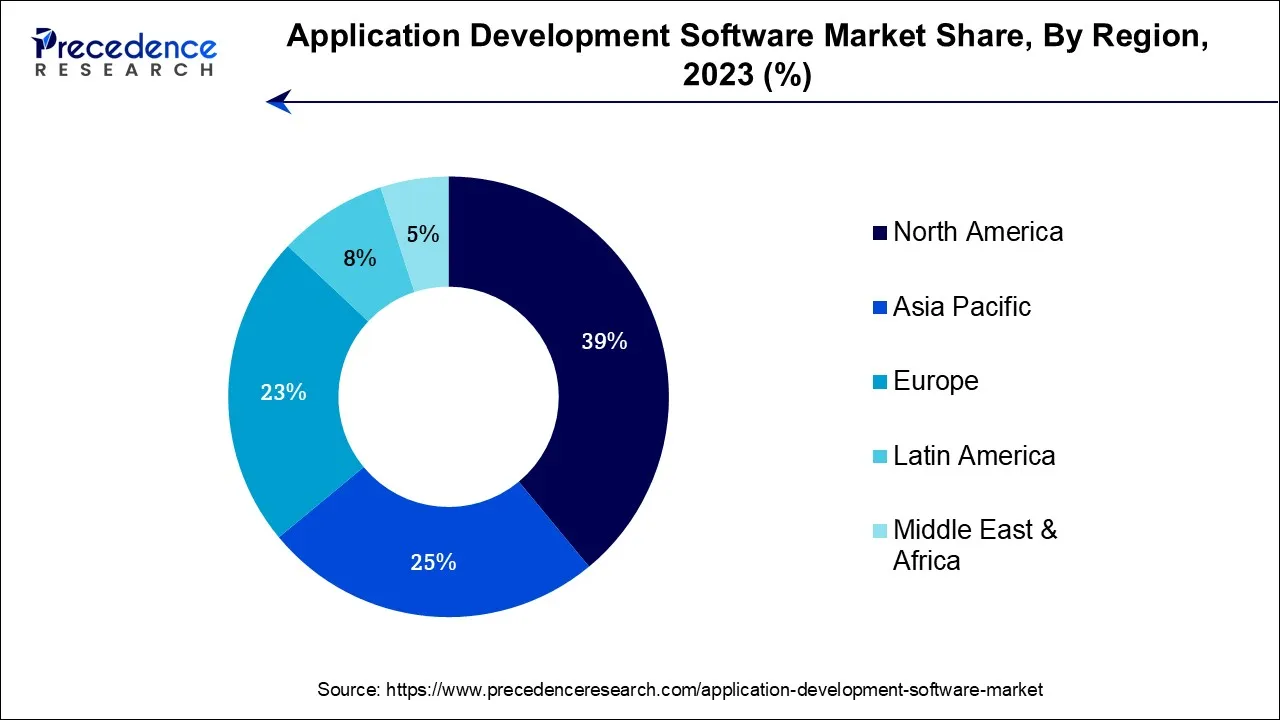

North America has held the largest revenue share 41% in 2023. North America commands a major share in the application development software market due to several key factors. The region boasts a robust technology ecosystem, with a high concentration of tech companies, startups, and enterprises driving demand for application development tools. Moreover, North American businesses prioritize digitalization, leading to substantial investments in software solutions. Additionally, the region's strong emphasis on innovation, research, and development contributes to the growth of this market. The presence of skilled developers and a mature IT infrastructure further cements North America's dominance in the market.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific boasts significant growth in the application development software market due to several compelling factors. The region is home to a vast and rapidly expanding technology-savvy population, fostering increased demand for software solutions across diverse industries. Furthermore, Asia-Pacific economies are experiencing a robust digital transformation, propelling the need for application development software in various sectors, from finance to e-commerce. Additionally, the presence of thriving tech hubs and a burgeoning startup ecosystem fosters innovation and software development.

The application development software market is a dynamic and diverse sector encompassing a broad spectrum of tools and platforms geared towards streamlining the creation, testing, and deployment of applications across various computing environments, including desktop, web, and mobile platforms. With the surging demand for digital solutions spanning numerous industries, this market is experiencing notable growth.

Prominent trends include the adoption of low-code and no-code platforms, the integration of cloud-based development solutions, and the rising influence of AI and machine learning in automating processes. Challenges encompass cyber security vulnerabilities and the enduring scarcity of skilled professionals.

Nonetheless, this market brims with abundant business prospects, especially in the domain of mobile app development and software tailored for the expanding Internet of Things (IoT) landscape, where enterprises are increasingly seeking to engage users and leverage the potential of data generated by interconnected devices.

The application development software market is currently in the midst of robust expansion, propelled by the growing appetite for software solutions across diverse sectors. Within this market, there exists a wide spectrum of software tools and platforms that facilitate the creation, testing, and deployment of applications tailored for desktop, web, and mobile environments. As organizations continue to advance their digital transformation endeavors, the imperative demand for efficient and scalable application development software becomes increasingly apparent. This market is poised for substantial growth in the foreseeable future, driven by a confluence of pivotal factors.

A salient trend within the market is the surging adoption of low-code and no-code platforms. These user-friendly tools empower individuals with limited coding proficiency to rapidly construct applications, reducing reliance on highly skilled developers and expediting project timelines. Furthermore, cloud-based application development platforms are gaining momentum, delivering scalability, cost-effectiveness, and seamless collaboration across geographically dispersed teams.

The surging demand for mobile applications emerges as a pivotal driver of market growth. As smartphones continue to proliferate, enterprises exhibit a keen interest in crafting user-centric mobile apps to actively connect with clientele and enhance their operational efficiency. Furthermore, the burgeoning Internet of Things (IoT) landscape contributes to the increased appetite for application development software, empowering the construction of applications designed to oversee and process data originating from interlinked devices.

The COVID-19 pandemic has further accelerated the demand for application development software, as organizations hurried to digitize their services and facilitate remote work capabilities. This accelerated digital transformation has nurtured a sustained requirement for robust application development solutions. Additionally, the market benefits from the burgeoning landscape of e-commerce and online services, prompting businesses to invest in software that elevates user experience and operational efficiency.

Despite its auspicious growth prospects, the application development software market grapples with challenges intertwined with cybersecurity and data privacy. As applications become increasingly interconnected and handle sensitive data, the risk of cyberattacks and data breaches escalates, accentuating the critical need for application security. Additionally, the perpetual quest for talent proficient in application development remains a formidable challenge for many organizations.

The market offers substantial commercial opportunities for software vendors, particularly those specializing in AI and machine learning-infused development tools. These technologies have the potential to automate various facets of application development, thereby enhancing efficiency and trimming costs. Moreover, venturing into burgeoning markets and sectors, such as healthcare and finance, holds untapped growth potential for application development software providers.

In conclusion, the application development software market is on the brink of significant expansion, driven by trends such as the adoption of low-code platforms, integration of cloud technologies, and the burgeoning demand for mobile and IoT applications. While grappling with challenges related to cybersecurity and the scarcity of skilled talent, this market beckons with lucrative prospects for innovative solutions and forays into uncharted territories. Remaining competitive in this dynamic industry necessitates vigilant monitoring of these trends and factors by businesses and software providers.

| Report Coverage | Details |

| Market Size in 2024 | USD 254.74 Billion |

| Market Size by 2034 | USD 1,699.63Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.8% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Deployment Mode, By Platform, By Enterprise Size, and By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising mobile app usage

The surging prevalence of mobile app utilization serves as a potent force propelling the vigorous expansion of the application development software industry. In our contemporary digital era, mobile applications have seamlessly integrated into various facets of daily life, permeating diverse industries and sectors. This upswing in mobile app engagement owes its momentum to several pivotal factors, which exert a direct influence on the flourishing market for application development software. Foremost among these factors is the omnipresent proliferation of smartphones, cultivating an unparalleled user base actively seeking innovative and user-friendly mobile apps.

Enterprises spanning a wide spectrum of industries are acutely aware of the immense potential inherent in connecting with their clientele via these ubiquitous devices, thus spurring relentless efforts to conceive and deliver captivating mobile applications. Moreover, the realm of mobile apps extends far beyond consumer-facing services, with a deep-rooted penetration into the domains of enterprise solutions and internal workflows. This dual mode of adoption, encompassing both B2C and B2B landscapes, engenders a multifaceted demand for application development software expressly engineered to cater to a diverse array of requisites.

As organizations fervently vie for elevated user engagement, heightened customer satisfaction, and enhanced operational efficiency, they increasingly turn to application development software to craft bespoke mobile experiences. This heightened demand serves as a crucible for innovation within the software development arena and fuels the ongoing expansion and evolution of the market. The burgeoning utilization of mobile apps is not merely a passing trend; it constitutes a fundamental propellant that is actively shaping the trajectory of the market.

Complexity and learning curve

The hindrance posed by the intricacy and formidable learning curve inherent to application development tools is a substantial constraint on market growth. These complexities present formidable challenges for developers, regardless of their level of experience. Firstly, the intricate nature of many development platforms necessitates a significant investment of time and effort to attain proficiency, resulting in potential project delays and a hindered capacity to swiftly respond to shifting market dynamics or evolving business requisites. Secondly, the intricacies of these tools also contribute to a dearth of proficient developers, leaving organizations grappling with recruitment and retention issues, which in turn obstruct project advancement.

Furthermore, the relentless evolution of technology, coupled with the constant introduction of novel programming languages and frameworks, adds to this dilemma, requiring developers to engage in a perpetual cycle of adaptation and skill enhancement that can strain both resources and time. Cumulatively, these factors collectively render the effective utilization of application development software a more daunting task for organizations, potentially impeding their capacity for innovation and responsiveness to market dynamics.

Rising demand for customization

The burgeoning desire for customization within the market is unveiling a plethora of opportunities for software providers. Across various industries, enterprises are actively pursuing personalized software solutions that intricately align with their distinct operational nuances, compliance prerequisites, and strategic aspirations. This surge in demand underscores the pivotal role played by application development software providers in delivering highly adaptable and effortlessly customizable tools and platforms.

By offering functionalities that empower developers to craft tailor-made applications while streamlining the development process, providers can seize this opportunity. Moreover, enterprises are willing to invest in solutions that confer the agility to swiftly respond to evolving circumstances, thereby nurturing a market for fluid and adjustable development software.

In essence, the escalating yearning for customization begets an environment where application development software providers can harness the appetite for bespoke solutions, drive innovation, and cultivate enduring alliances with businesses intent on securing a competitive edge through software that caters precisely to their unique specifications.

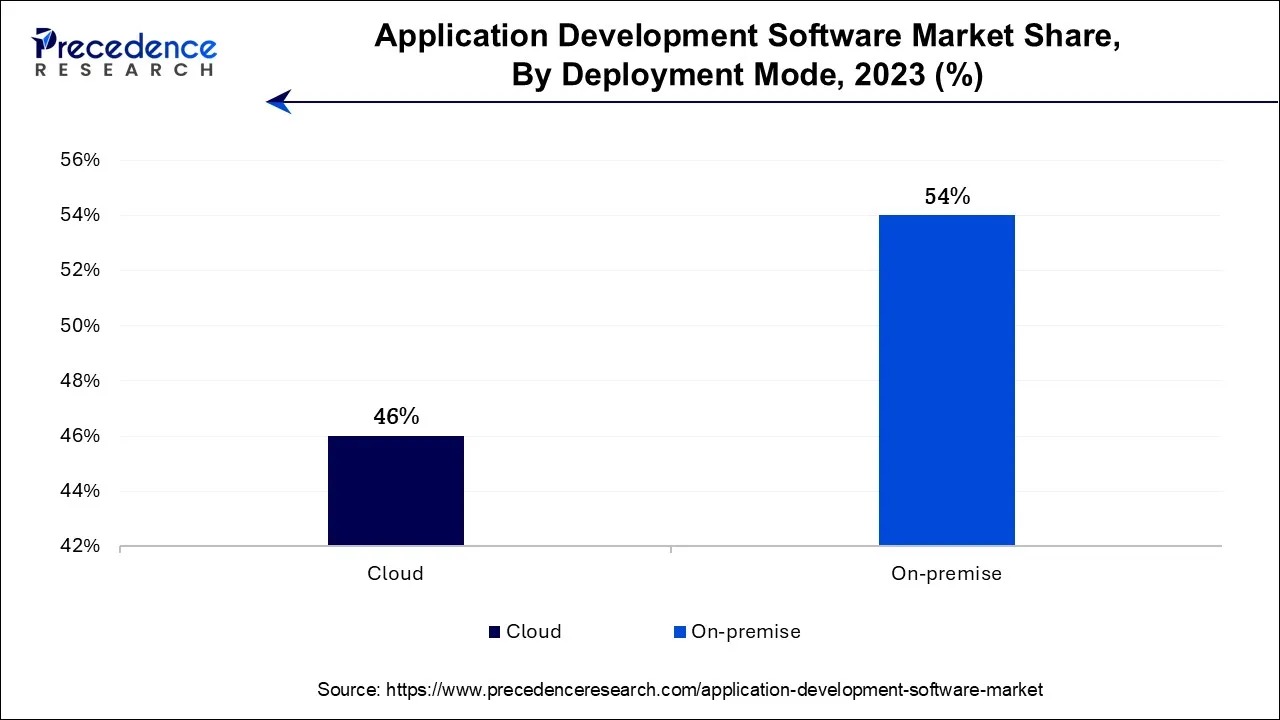

According to the deployment mode, the on premise sector has held a 54% revenue share in 2023. The On-Premise segment retains a significant market share due to several factors. First, certain organizations, especially in highly regulated industries like finance and healthcare, prioritize keeping their data and applications in-house to maintain control and security. Second, legacy systems and existing infrastructure often necessitate on-premise solutions. Moreover, data sensitivity and compliance requirements compel some enterprises to opt for on-premise application development software. While cloud-based solutions gain traction, the on-premise segment remains vital for businesses seeking to maintain a higher degree of autonomy, control, and data security within their environments.

The cloud sector is anticipated to expand at a significant CAGR of 23.1% during the projected period due to its compelling advantages. Cloud-based development platforms offer scalability, cost-efficiency, and streamlined collaboration across geographically dispersed teams. They eliminate the need for extensive on-premises infrastructure, reducing operational expenses. Moreover, cloud solutions facilitate remote development and deployment, aligning with the trend of remote work. The scalability of cloud platforms enables businesses to adjust resources according to project needs, making them highly adaptable. These benefits have made cloud-based application development a preferred choice, contributing to its substantial share in the market.

Based on the platform, low code development platforms is anticipated to hold the largest market share of 59% in 2023. Low-code development platforms hold a major share in the market due to their ability to accelerate application development while reducing the reliance on extensive coding expertise. These platforms offer user-friendly visual interfaces and pre-built components that enable even non-technical users to create applications efficiently. With organizations increasingly seeking faster time-to-market and cost-effective solutions, low-code platforms align perfectly with these needs. They empower businesses to swiftly respond to changing market dynamics and customer demands. Moreover, low-code platforms cater to a broad user base, expanding their market reach and solidifying their dominant position in the application development software landscape.

On the other hand, the no-code development platforms sector is projected to grow at the fastest rate over the projected period. No-code development platforms have garnered substantial growth in the market due to their transformative approach to application development. These platforms enable individuals with limited coding expertise to create applications through visual interfaces and pre-built templates, reducing the reliance on traditional development teams. Their user-friendly nature accelerates project timelines, significantly cuts development costs, and empowers non-technical stakeholders to actively engage in app creation. This democratization of app development has resonated with businesses seeking agility, cost-efficiency, and rapid innovation, making no-code platforms a major player in the market and a preferred choice for many organizations.

The media and entertainment Sector segment held the largest revenue share of 29.9% in 2023. The media and entertainment segment holds a significant share in the application development software market due to several factors. First, the industry's rapid digital transformation has led to a heightened demand for software tools to create and enhance digital content, streaming platforms, and user experiences. Second, the increasing popularity of mobile apps for entertainment and media consumption has fuelled the need for application development software. Additionally, this sector is highly competitive, driving companies to invest in innovative software solutions for content delivery, user engagement, and personalized experiences, further contributing to its substantial market share.

Travel and tourism is anticipated to grow at a significantly faster rate, registering a CAGR of 21.9% over the predicted period. The travel and tourism segment holds a significant growth in the market due to its reliance on digital solutions. Travel companies require robust software to manage bookings, reservations, and customer interactions, especially in the wake of the COVID-19 pandemic, which accelerated the need for touchless and online services. Additionally, mobile apps have become integral for travelers, enhancing their experiences. To stay competitive and cater to changing consumer preferences, the travel and tourism industry invests heavily in application development software, making it a major contributor to the market's growth.

The large enterprise sector has generated a revenue share of 59.1% in 2023. The large enterprise segment commands a significant share in the market due to its extensive resources and complex software requirements. Large enterprises have substantial budgets, allowing them to invest heavily in application development tools and platforms. They often operate on a global scale, necessitating intricate, scalable software solutions. Moreover, large enterprises prioritize innovation and efficiency, relying on sophisticated application development software to streamline operations, enhance customer experiences, and gain a competitive edge. As a result, they represent a major stakeholder driving the demand for advanced application development solutions and holding a substantial share of the market.

The Small and Medium-Sized Enterprise (SMEs) sector is anticipated to grow at a significantly faster rate, registering a CAGR of 29.8% over the predicted period. The Small and Medium-Sized Enterprise (SMEs) segment commands a substantial growth of the market due to several factors. SMEs often have agile and innovative business models, making them quick adopters of technology, including application development software. Additionally, these businesses seek cost-effective solutions, which align with the affordability of many application development tools. Furthermore, the flexibility of these software solutions caters to the unique needs and resource constraints of SMEs. As a result, SMEs represent a significant portion of the market, leveraging application development software to enhance competitiveness, streamline operations, and expand their digital presence.

Segments Covered in the Report

By Deployment Mode

By Platform

By Enterprise Size

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

November 2024

January 2025

February 2025