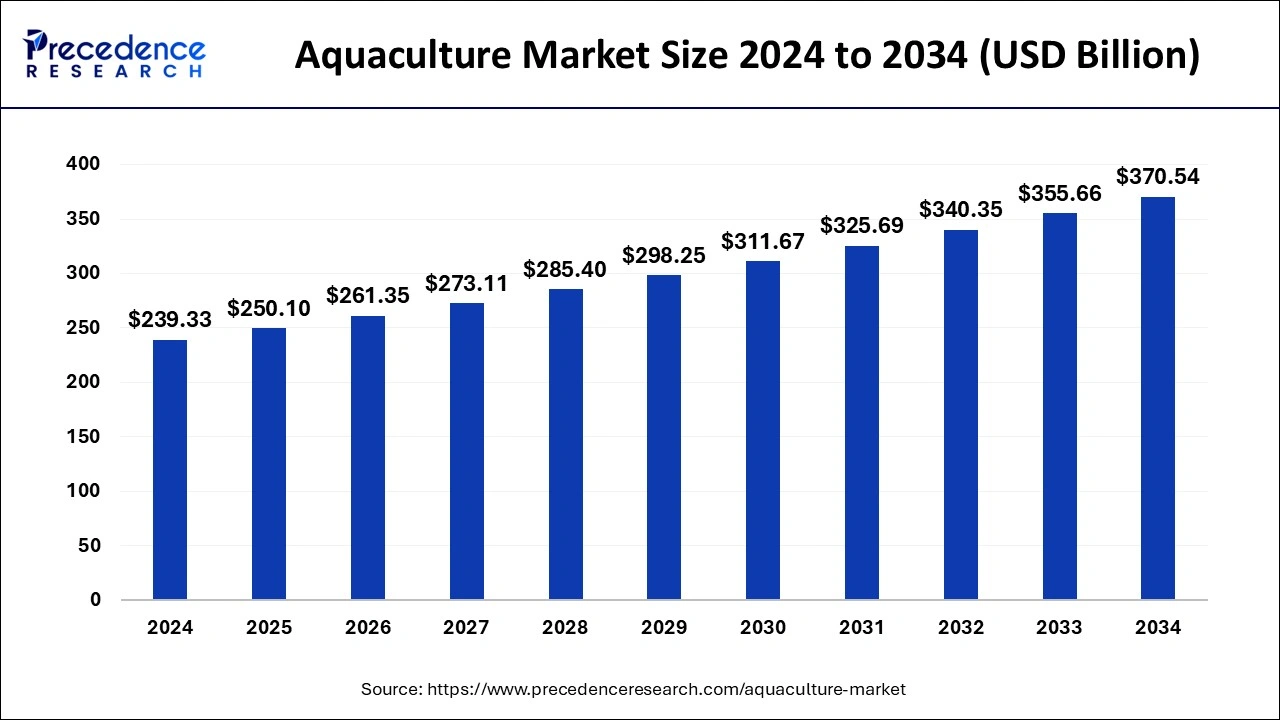

The global aquaculture market size is accounted at USD 250.10 billion in 2025 and is forecasted to hit around USD 370.54 billion by 2034, representing a CAGR of 4.47% from 2025 to 2034. The Asia Pacific market size was estimated at USD 102.91 billion in 2024 and is expanding at a CAGR of 4.59% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global aquaculture market size was calculated at USD 239.33 billion in 2024 and is predicted to reach around USD 370.54 billion by 2034, expanding at a CAGR of 4.47% from 2025 to 2034. The aquaculture market is driven by the rising demand to efficiently complement the variety of fish to increase the amount of seafood available worldwide.

The integration of artificial intelligence into aquaculture is anticipated to reshape the health challenges faced in aquaculture and offer more precision, efficiency, and sustainable disease control. AI offers to monitor fish population and identify net damage which is essential for efficient operation of fish farming. The traditional way is expensive and risk-worthy, whereas AI-driven digital transformation collects data and analyses it in real time. AI models provide aquaculture farms with crucial benefits such as saving time in creating management plans, delivering data-driven recommendations, and promoting sustainability by proposing environmentally friendly alternatives.

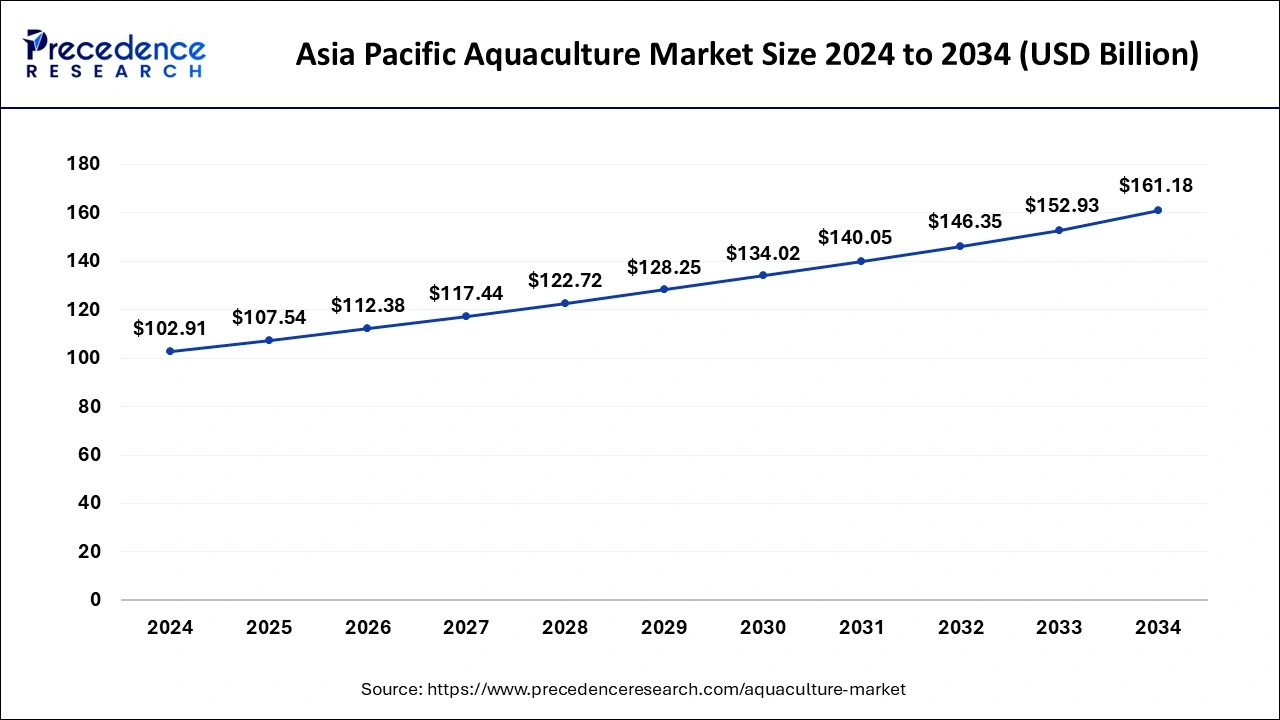

The Asia Pacific aquaculture market size was evaluated at USD 102.91 billion in 2024 and is projected to be worth around USD 161.18 billion by 2034, growing at a CAGR of 4.59% from 2025 to 2034.

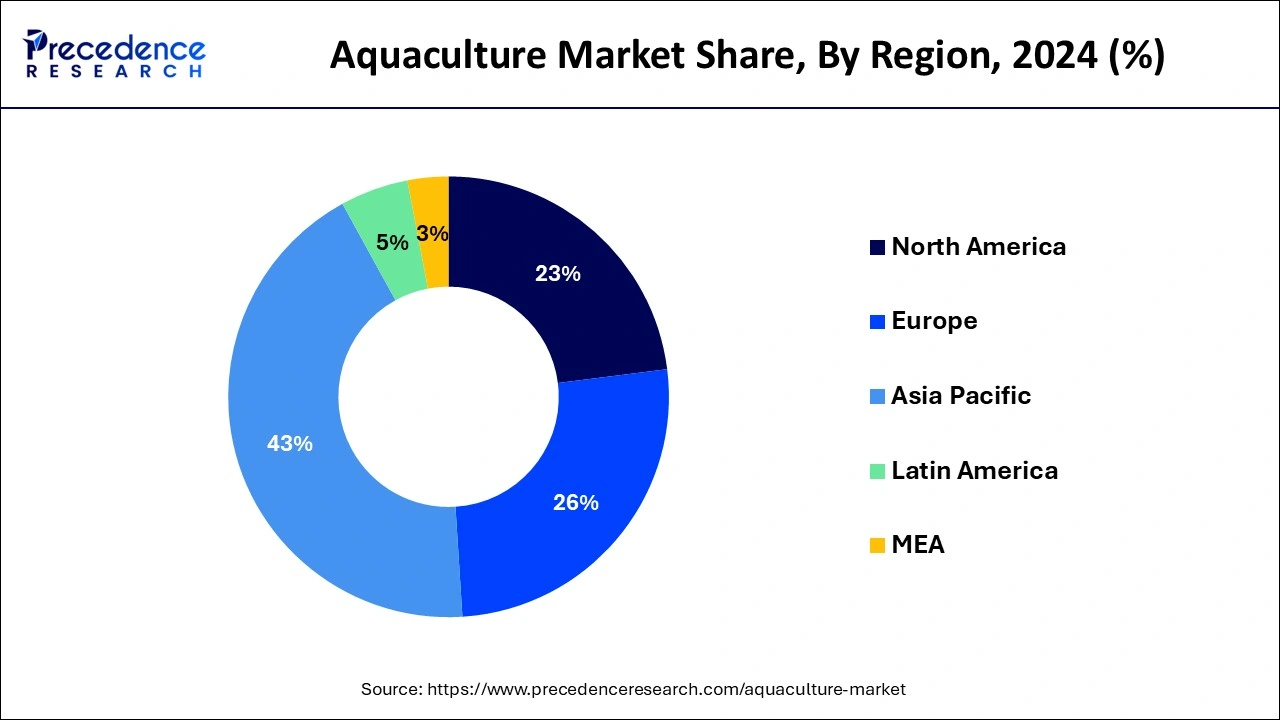

Asia Pacific witnessed enormous growth in the aquaculture market in 2024; the region is expected to maintain its dominance during the forecast period. Several factors, including the increasing population, rising disposable incomes, and changing dietary habits, drive the Asian-Pacific region's demand for aquaculture products. Moreover, favorable government policies to support the growth of aquaculture practices in countries of Asia Pacific are observed to drive the development of the aquaculture market in the region.

The Indian government has been taking various initiatives to promote the growth of the aquaculture market in the country. The National Fisheries Development Board (NFDB) is a government body that aims to promote and develop the Indian fisheries sector, including aquaculture. The board provides financial assistance to farmers and entrepreneurs engaged in fisheries and aquaculture.

The Asia-Pacific region is also home to several large aquaculture companies, including Thai Union Group, Marine Harvest, and Charoen Pokphand Foods. These companies have been expanding their regional operations to meet the growing demand for aquaculture products and take advantage of the favorable production conditions in many countries.

North America is expected to witness steady growth in the aquaculture market during the forecast period. With the changing dietary preferences and rising incomes, the demand for seafood in North America has been increasing. With increasing awareness about the environmental impact of traditional food production systems, there has been a growing interest in sustainable food systems; this is another considerable factor in the growth of the aquaculture market in North America.

The aquaculture market in Europe is booming at a noticeable rate. The rising investments in the aquaculture industry by potential players in the region are expected to fuel the market’s growth in Europe during the forecast period. Moreover, the enormous demand for premium aquatic products from the European food industry is observed to boost the revenue share of Europe in the global aquaculture market.

In April 2024, Hatch, a European aquaculture development company, announced to launch of a new investment fund to promote regenerative and sustainable aquaculture practices. With this investment, the company aims to boost aquaculture practices to fulfill the rising demand for aquatic organisms from various end-users.

The aquaculture market in Latin America is growing due to increasing demand for seafood and favorable government policies to support the industry. Brazil is the largest aquaculture producer in the region, followed by Chile, Ecuador, and Peru. The aquaculture market in the Middle East and Africa is relatively small compared to other regions, but it is growing due to increasing demand for seafood and government initiatives to support the industry. Major aquaculture producers in the region include Egypt, Nigeria, and South Africa.

The aquaculture market refers to the industry involved in the production, processing, and distribution of aquatic organisms and plants, which are grown and harvested under controlled conditions. This market includes stakeholders such as fish farmers, aquaculture equipment manufacturers, feed suppliers, processing and packaging companies, distributors, and retailers.

The rising focus on sustainability in aquaculture practices is expected to drive the growth of the global aquaculture market during the period analyzed. Several governmental and non-governmental bodies are focused on promoting sustainable aquaculture practices with increased efficacy and productivity.

In September 2024, the Global seafood alliance launched a consumer-facing website, ‘Best Aquaculture Practices,’ to raise awareness about sustainable aquaculture. Efforts are taken to promote sustainably sourced seafood. The new website offers detailed information about sustainable aquaculture practices; along with this, the website also helps customers in buying seafood products that are ultimately better for eaters and the environment.

In July 2024, a strategic partnership between US chefs, business leaders, and environmental NGOs started a Coalition for Sustainable Aquaculture. The newly launched sustainable aquaculture project focuses on safe, equitable, and science-based sustainable aquaculture practices. The step has been taken by considering the rising demand for seafood and increased exports of fish and other aquatic products from the United States.

| Report Coverage | Details |

| Market Size in 2025 | USD 250.10 Billion |

| Market Size in 2034 | USD 370.54 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.47% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Environment, Type, and End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for aquatic animals and plants from the pharmaceuticals industry

Aquaculture provides a sustainable and reliable source of these aquatic organisms for the pharmaceutical industry. Aquaculture ensures the consistency and quality of marine organisms, making them ideal for pharmaceutical research. Aquatic animals and plants have been found to have a wide range of medicinal properties. As a result, they are increasingly being used to develop new drugs and pharmaceutical products.

For example, various fish species, such as salmon, trout, and cod, are rich in omega-3 fatty acids, linked to several health benefits, including reduced risk of heart disease and improved brain function. Other aquatic organisms, such as certain algae and sea sponges, are being studied for their potential to treat various diseases, including cancer, HIV, and Alzheimer's. Overall, the demand for these organisms from the pharmaceutical industry is likely to increase, significantly boosting the aquaculture market's growth.

Regulatory hurdles

Regulatory hurdles can be a significant restraint to the growth of the aquaculture market. Regulations can vary significantly between countries and regions, and compliance with these regulations can be complex and expensive. Regulatory requirements can create barriers to entry for new aquaculture producers. For example, obtaining the necessary permits and approvals to construct a new facility can be time-consuming and expensive, discouraging new producers from entering the market.

Compliance with regulations can be expensive, particularly in countries with strict environmental regulations. Compliance costs may include monitoring and reporting requirements, permit fees, and environmental assessments, all of which can add to the cost of production.

Rising investment is research and development activities

Rising investments in research and development activities can open up numerous opportunities in the aquaculture market by driving innovation and improving efficiencies. Investments in research and development can help to develop new aquaculture technologies that will enhance production efficiency and reduce costs. This includes new techniques for fish breeding, disease control, and feed production.

Research into sustainable aquaculture practices can help to reduce environmental impacts and improve the overall sustainability of the industry. This includes developing new ways to recycle waste and reduce water usage. Rising investments in such activities lead to increased productivity, profitability, and sustainability. This creates opportunities for businesses and entrepreneurs to develop new products and services.

The freshwater segment held the largest share of the global aquaculture market in 2024; the segment is predicted to grow with the easy availability of freshwater sources around the world. The demand for less specialized equipment in freshwater aquaculture has supplemented the entry of small-scale players into the practices.

Along with the wide range of fishes, freshwater aquaculture can also be used to grow plants such as watercress and lettuce using aquaponic systems, which provide both food and income opportunities. Moreover, Freshwater aquaculture is generally less expensive to set up and maintain than marine aquaculture.

The marine water segment is expected to register the fastest growth during the forecast period; the rising demand for seafood due to factors such as population growth, rising incomes, and changing dietary preferences is observed to boost aquaculture practices in marine water sources. Rising demand for premium or high-value marine water species, including salmon, shrimp, and oysters, is propelling the segment’s growth.

Additionally, the rising focus on sustainable marine aquaculture practices by multiple initiatives by government and private bodies is expected to highlight the development of marine water aquaculture practices. However, the high cost of setting up aquaculture practices in marine water sources restrains market players from growing.

The fish segment holds the dominating position in the global aquaculture market; with the growing worldwide population and increasing demand for protein-rich food, the demand for fish as a source of food is increasing. Rising investments in coastal regions, especially in the food industry, are predicted to maintain the dominance of the fish segment.

Additionally, aquaculture practices are observed to reduce the pressure on wild fish stocks, and the efficiency of aquaculture practices for fish reduces the overall environmental impact of fish production. Such beneficial factors are predicted to continue the development of the fish segment.

The aquatic plant segment is expected to grow the fastest during the forecast period. The global aquaculture industry is experiencing an enormous demand for nutrient-rich seaweed that can be used in various food products, including plant-based protein powders, snacks, and supplements. As the population continues focusing on plant-based products, the aquatic plants segment will continue to grow.

Aquatic plant cultivation can be a sustainable form of agriculture, as it does not require large amounts of land or freshwater resources. The rising focus on sustainable aquaculture practices is expected to boost the development of the aquatic plant segment.

The seafood industry segment dominates the global aquaculture market; the advancements and presence of potential key players in aquaculture practices have led to increased production of farmed fish. This has helped to meet the growing demand for seafood. The rising demand for packaged fish products, along with growing preferences for plant-based food products, will increase aquaculture activities in the upcoming years.

Additionally, the rising demand for aquaculture practices from the seafood industry is attributed to the diversification of products offered. Aquaculture can provide a means of diversifying the types of seafood products available to consumers, including species that may not be readily available through wild fishing.

The pharmaceutical industry segment is expected to register the fastest growth during the forecast period. Aquaculture for the pharmaceutical industry is becoming popular due to its ability to provide a sustainable and cost-effective source of marine organisms for pharmaceutical production, as well as its potential to diversify the industry and provide new sources of high-value products.

Moreover, several national and international bodies/organizations are rapidly approving the utilization of fish and other aquatic resources to develop drugs, including antibiotics, vaccines, and medicines. This factor is predicted to fuel the segment’s growth during the forecast period.

By Environment

By Type

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client