March 2025

Aquaculture Vaccines Market (By Type of Vaccines: Inactivated Vaccines, Live Vaccines, Others; By Route of Administration: Immersion Vaccines, Injection Vaccines, Oral Vaccines; By Application: Bacterial Infection, Viral Infection, Others; By Species: Salmon, Trout, Tilapia Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

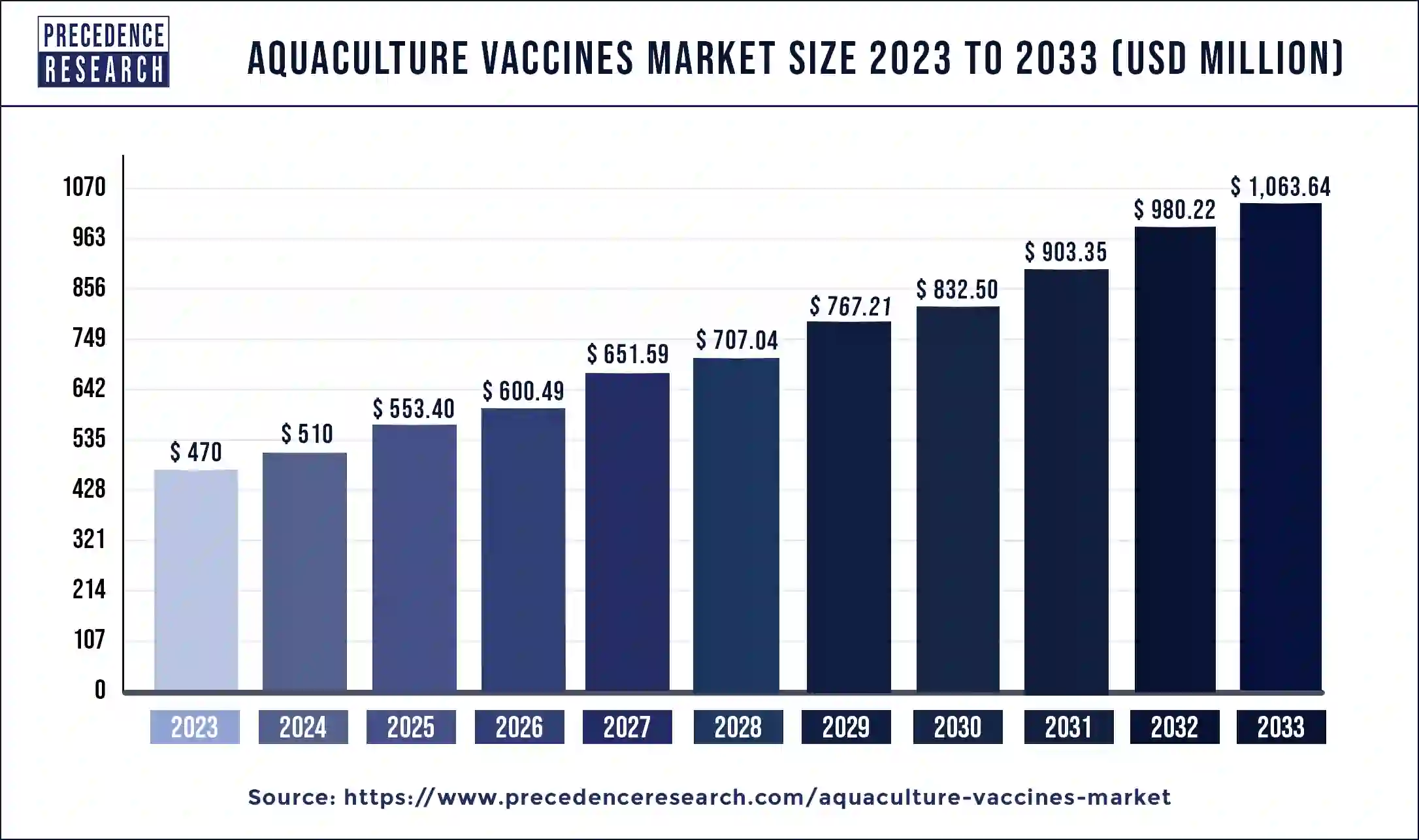

The global aquaculture vaccines market size was USD 470 million in 2023, calculated at USD 510 million in 2024, and is expected to reach around USD 1,063.64 million by 2033, expanding at a CAGR of 8.51% from 2024 to 2033. The aquaculture vaccines aid in boosting the immune system of aquatic animals, which may raise the aquaculture vaccines market.

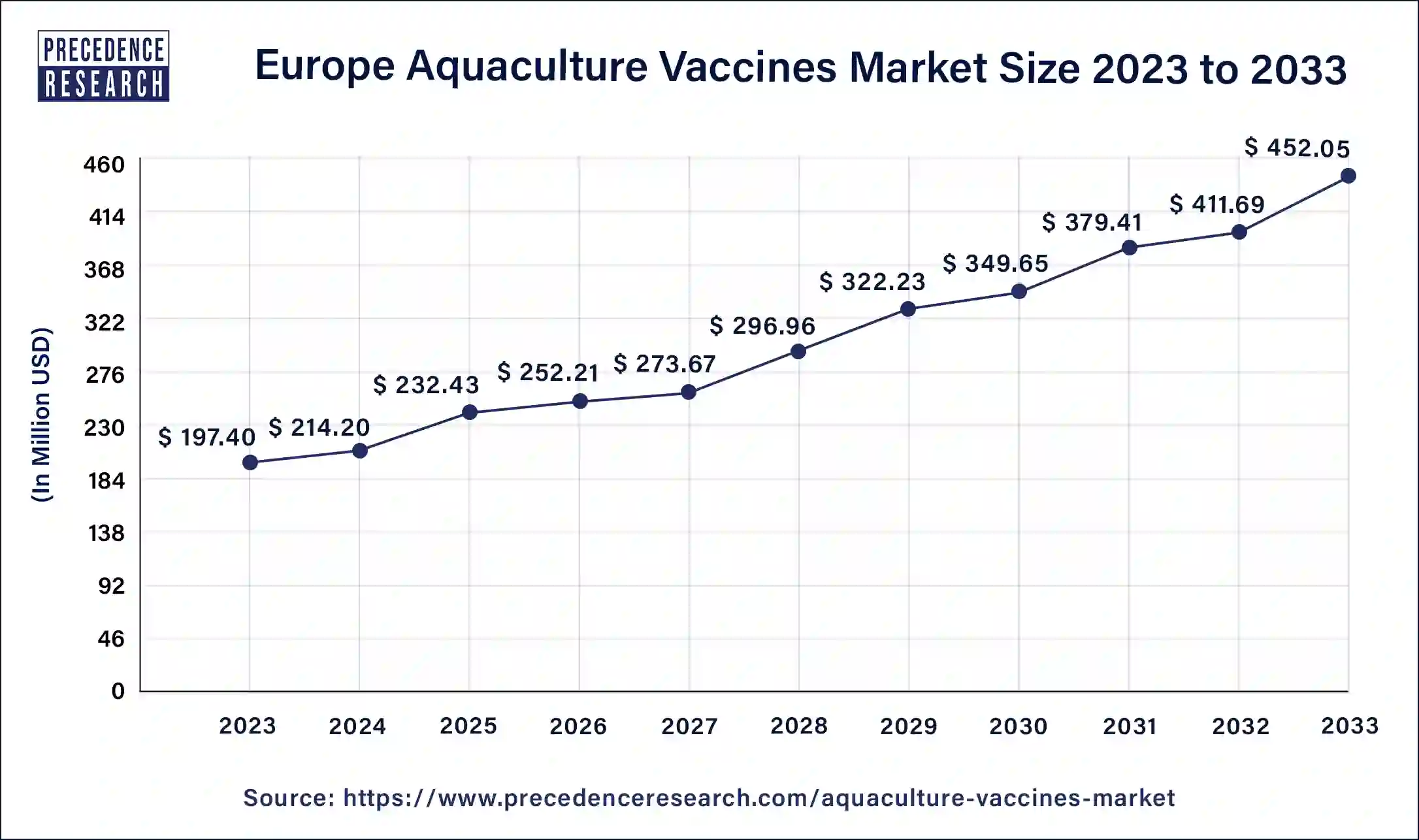

The Europe aquaculture vaccines market size is valued at USD 197.40 million in 2023 and is expected to be worth around USD 452.05 million by 2033 with a CAGR of 8.63% from 2024 to 2033.

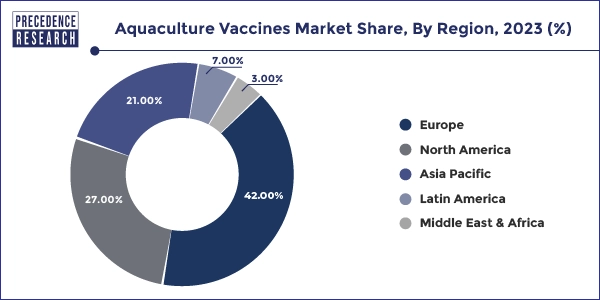

Europe dominated the aquaculture vaccines market in 2023. The aquaculture sector is well-established and developed throughout Europe, especially in nations like Norway, Scotland, and Spain. These areas have vast expertise in raising fish and have made large expenditures in technology and infrastructure. The high-value species like salmon and trout, which are important market drivers for aquaculture vaccines, are mostly produced in Europe. Due to their great susceptibility to illness, many species require extensive immunization programs in order to maintain healthy populations and good yields. The use of cutting-edge veterinary procedures and a focus on fish health management are beneficial to European aquaculture. The vaccines are often used to control disease outbreaks and maintain sustainable production. The European Medicines Agency (EMA) and other regulatory authorities strongly advocate for the use of vaccinations in aquaculture.

Asia Pacific is expected to grow at the highest CAGR in the aquaculture vaccines market by region during the forecast period. The rising demand for seafood is fueling the fast rise of aquaculture output in Asia. China, India, Vietnam, Indonesia, and Thailand are among the world's leading manufacturers of aquaculture goods. The region's intensive aquaculture methods frequently result in high stocking numbers, which raise the possibility of disease outbreaks. Therefore, to maintain healthy fish populations and ensure sustainable output, effective disease control solutions—including vaccines—are essential. With the use of grants, subsidies, and legislative frameworks, several governments in the Asia-Pacific area are actively encouraging the creation and use of aquaculture vaccines. These programs seek to strengthen fish health, lessen the need for antibiotics, and increase the aquaculture industry's sustainability.

Aquaculture Vaccines Market Overview

The aquaculture vaccines market refers to the industry that provides vaccines that are used to boost the energy, immunity, and ability of aquatic animals to fight against bacteria-causing diseases and protect the aquatic animals. The aquaculture vaccines are classified into a replicative antigen delivery system and a non-replicative antigen delivery system. Further, the replicative antigen delivery system is classified into live-attenuated vaccine, DNA vaccine, vector vaccine, and RNA vaccine as well as the non-replicative antigen delivery system is classified into whole-cell inactivated vaccine, sub-unit vaccine, toxoid vaccine, peptide vaccine, anti-idiotype vaccine, and edible vaccine.

| Report Coverage | Details |

| Aquaculture Vaccines Market Size in 2023 | USD 470 Million |

| Aquaculture Vaccines Market Size in 2024 | USD 510 Million |

| Aquaculture Vaccines Market Size by 2033 | USD 1,063.64 Million |

| Aquaculture Vaccines Market Growth Rate | CAGR of 8.51% from 2024 to 2033 |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type of Vaccines, Route of Administration, Application, Species and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver

Rising aquaculture businesses in developing countries

The rising aquaculture businesses in developing countries can grow the aquaculture vaccines market. Disease outbreaks are a greater risk as the aquaculture business grows. In order to prevent and control diseases, which might result in large financial losses, vaccinations are an essential tool. The productivity of fish populations results in increased yields and profits. Fish health is preserved through vaccination, which boosts the aquaculture vaccines market.

Restraint

Limited knowledge about the immune system of aquatic animals

The limited knowledge about the immune systems of aquatic animals may slow down the aquaculture vaccines market. The development, approval, and successful applications of vaccines are hampered by the limited knowledge of the immune systems of aquatic animals, which, in turn, reduces the growth of the aquaculture vaccines market.

Opportunity

Rising partnership between companies and the institute of fisheries education

The rising partnership between companies and institutes of fisheries education can be the opportunity to grow the aquaculture vaccines market. These partnerships may help produce vaccines for common bacterial diseases, which is the opportunity to grow the demand for the aquaculture vaccines market.

In November 2022, Indian Immunologicals Limited (IIL), a vaccine manufacturer based in Hyderabad, announced a collaboration with the Central Institute of Fisheries Education (CIFE), an Indian Council of Agricultural Research Institute situated in Mumbai, to commercially develop vaccines against prevalent bacterial diseases that affect freshwater fish. As part of this collaboration, CIFE will supply the technology for two inactivated bacterial vaccines: one for Columnaris disease, which affects species of freshwater fish, and another for Edwardsiellosis, which has a high fatality rate and results in significant financial losses.

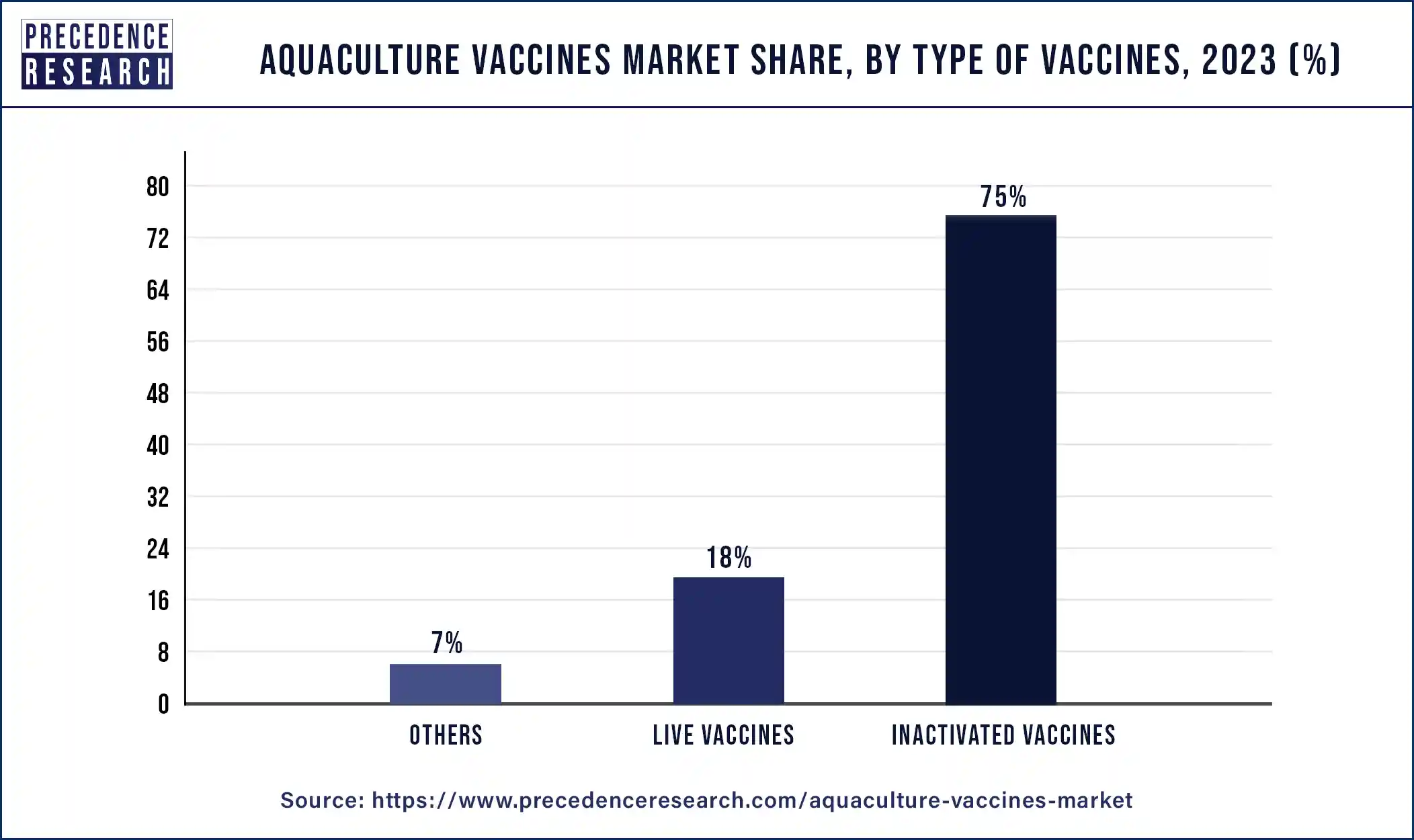

The inactivated vaccines segment dominated the aquaculture vaccines market in 2023. Since the pathogens in inactivated vaccines have been rendered inert, rendering them incapable of causing illness, they are well-known to be safe. This safety profile is especially significant in aquaculture, where the general prosperity of the farming enterprise depends on the health of the fish population. The live vaccinations can occasionally carry the danger of returning to a virulent form, but inactivated vaccines often have an easier time gaining regulatory approval. The larger range of aquaculture practitioners embrace the simpler regulatory procedure, which facilitates faster market penetration. Generally speaking, inactivated vaccinations are more stable and have a longer shelf life than live vaccines. As a result, they become more feasible for transportation and storage, particularly in areas with little established infrastructure.

The live vaccines segment also has a significant share of the aquaculture vaccines market. As opposed to inactivated vaccines, live vaccinations usually elicit a more potent and sustained immune response. The live attenuated pathogen replicates in the host, simulating a real infection and powerfully stimulating the immune system. This strong immunity is the result of this process. The creation of safer and more effective live vaccinations is the result of recent developments in genetic engineering and biotechnology.

Through these advancements, live vaccines become more appealing for application in aquaculture because they lower the chance of reversion to virulence and enhance their overall safety profile. The capacity of live vaccines to reproduce in the host means that fewer dosages are frequently needed to elicit the intended immunological reaction. Live vaccines may become more affordable as a result of potential cost reductions in vaccination delivery and manufacture.

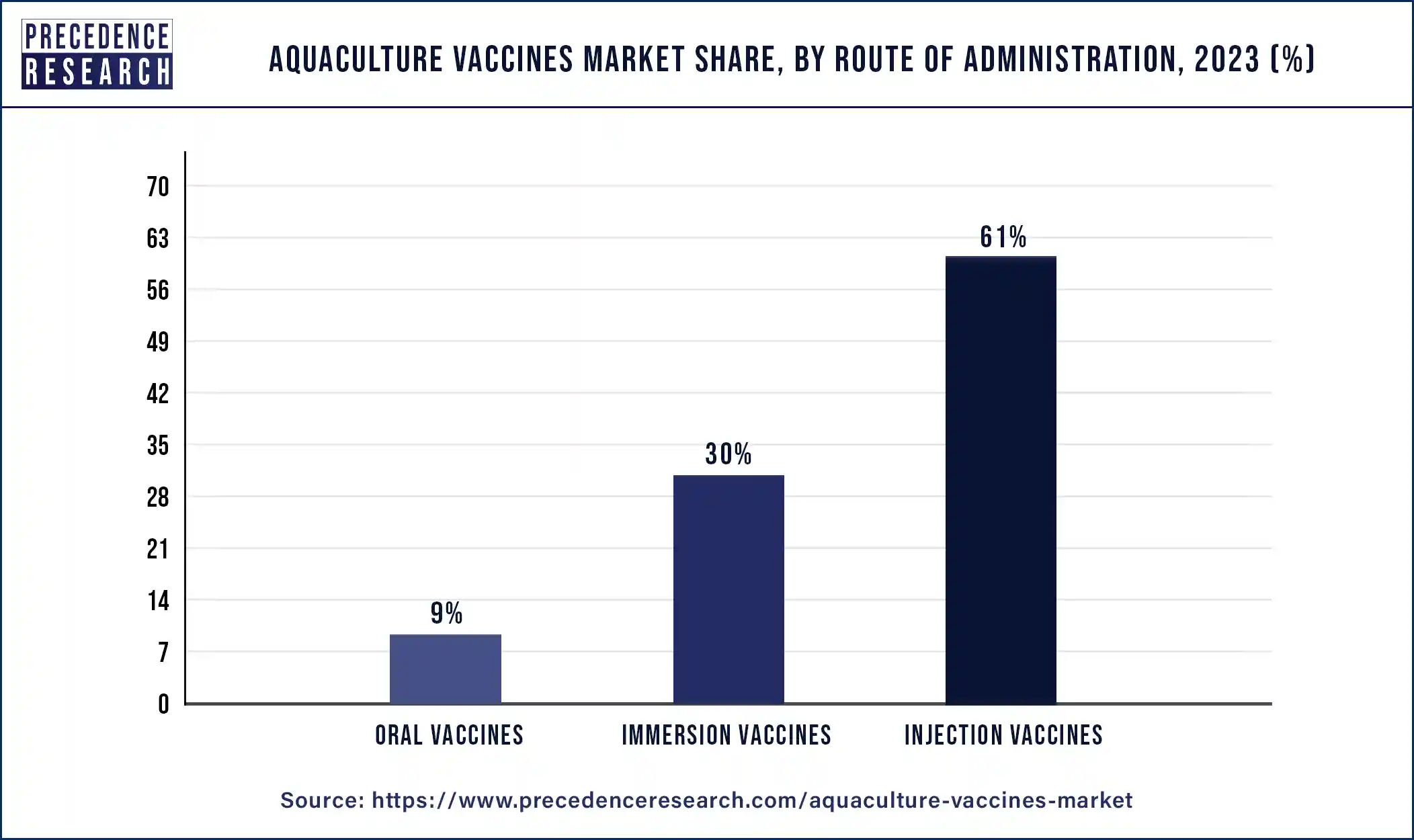

The injection vaccines segment dominated the aquaculture vaccines market by route of administration in 2023. The capacity of injection vaccinations to administer an exact dosage of antigens straight into the body of the fish guarantees a strong and stable immune response. When compared to alternative delivery methods like oral or immersion, this technique improves the vaccine's efficacy. The immunity produced by injection-based vaccinations usually lasts longer. This is especially important for aquaculture operations because fish may spend a lot of time exposed to diseases. Unlike oral or immersion techniques, where a sizable amount of the vaccine may be lost to the environment, decreasing its efficiency, injectable vaccinations result in very little vaccine material loss. The targeted vaccination of individual fish is made possible by injection, which is especially helpful for high-value species where accurate immunization is essential.

The immersion vaccines segment is expected to grow at the highest CAGR in the aquaculture vaccines market during the forecast period. The vaccinations against immersion are quite simple to administer, particularly for big schools of fish. This strategy for mass immunization is feasible and time-efficient since it involves submerging fish in a vaccine solution. The fish are less harmed and intrusive during immersion vaccinations than during injections. This may result in improved well-being outcomes for vaccinated fish as well as improved growth and health. In large-scale aquaculture operations, immersion vaccination may prove to be a more economical option than injections. It is a more cost-effective method of immunizing big populations since it requires less work and time than individual immunizations.

The bacterial infection segment dominated the aquaculture vaccines market by application in 2023. In aquaculture, bacterial infections are a major source of morbidity and mortality. Because outbreaks can result in significant financial losses, the industry makes investments in vaccines and other preventive measures. Because of the overuse of antibiotics in aquaculture, bacteria have become resistant to them, decreasing the efficacy of conventional treatments. The vaccines present a viable substitute for antibiotics in the prevention of disease. In an effort to stop antibiotic resistance, governments and regulatory agencies are progressively limiting the use of antibiotics in aquaculture. Because vaccines are a safer and greener option, the current regulatory environment encourages their adoption. Aquaculture operators find vaccines to be a more appealing and feasible option due to advancements in vaccine technology, which have led to the development of more effective and broad-spectrum vaccines.

The viral infection segment is expected to grow at the highest CAGR in the aquaculture vaccines market by application during the forecast period. In aquaculture species, viral diseases can result in substantial morbidity and mortality. They are also very common. They frequently spread quickly and are challenging to contain, resulting in significant financial losses. Viral infections in aquaculture have few therapeutic options, in contrast to bacterial infections, which are frequently treated with antibiotics. This makes immunization as a preventative measure crucial. Numerous economically significant aquaculture species, including tilapia, shrimp, and salmon, are extremely vulnerable to viral infections. Maintaining these species' productivity and financial success in the sector depends on their vaccination.

The tilapia segment dominated the aquaculture vaccines market by species in 2023. One of the fish species most often farmed worldwide, tilapia, is produced in large quantities in Asia, Africa, and Latin America. Robust disease preventive methods, such as immunization, are required due to the enormous volume of output. The numerous bacterial, viral, and parasite illnesses can affect tilapia. Effective vaccinations are in high need in order to maintain the well-being and productivity of tilapia stocks, as well as to manage and prevent certain illnesses. The significant and reasonably priced source of protein for many communities worldwide is tilapia. Their financial significance to the aquaculture sector drives large expenditures for health management, which include the creation and application of vaccines.

The salmon segment is expected to grow at the highest CAGR in the aquaculture vaccines market during the forecast period. The high-value species like salmon are in high demand worldwide, especially in North America, Europe, and Asia. Effective immunization programs are necessary to protect the health and production of salmon because of its premium price and economic significance. These efforts need significant expenditure. Salmon are extremely vulnerable to a wide range of illnesses, such as parasite infestations like sea lice, viral illnesses like Infectious Salmon Anemia (ISA), and bacterial infections like pscirickettsiosis. Comprehensive vaccination programs are required due to the high disease load in order to stop outbreaks and reduce fatalities. There have been notable breakthroughs in the creation of vaccinations specifically designed for salmon, such as the creation of multivalent vaccines that offer protection against several infections with a single dose. The efficiency and uptake of salmon vaccines are being improved by innovations like DNA and recombinant vaccines, which are also being investigated.

Segment Covered in the Report

By Type of Vaccines

By Route of Administration

By Application

By Species

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

February 2025

April 2025

January 2025