February 2025

Artificial Intelligence (AI) in Oil and Gas Market (By Component: Software, Hardware, Services; By Function: Predictive Maintenance, Machinery Inspection, Material Movement, Production Planning, Field Services, Quality Control, Reclamation; By Application: Upstream, Midstream, Downstream) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

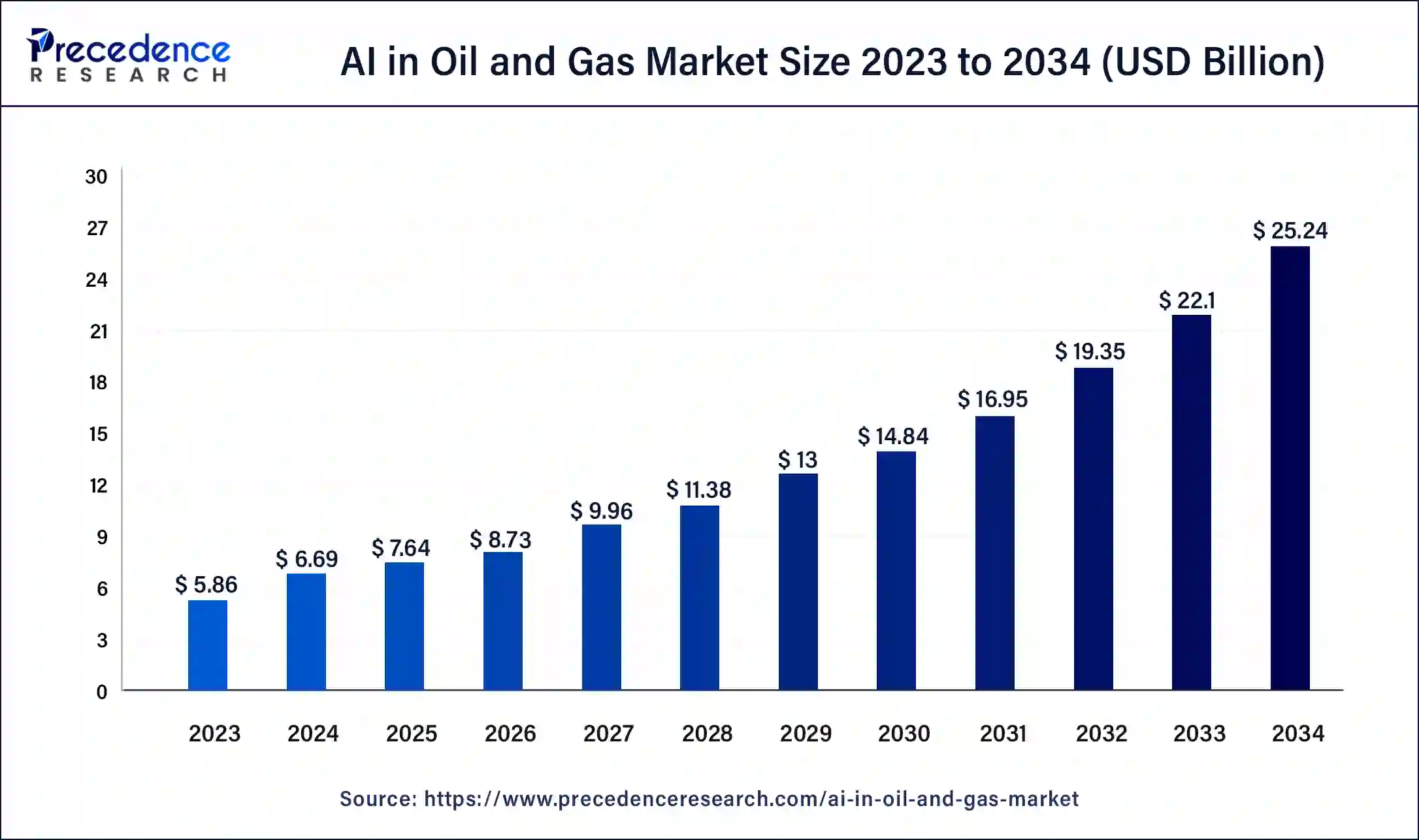

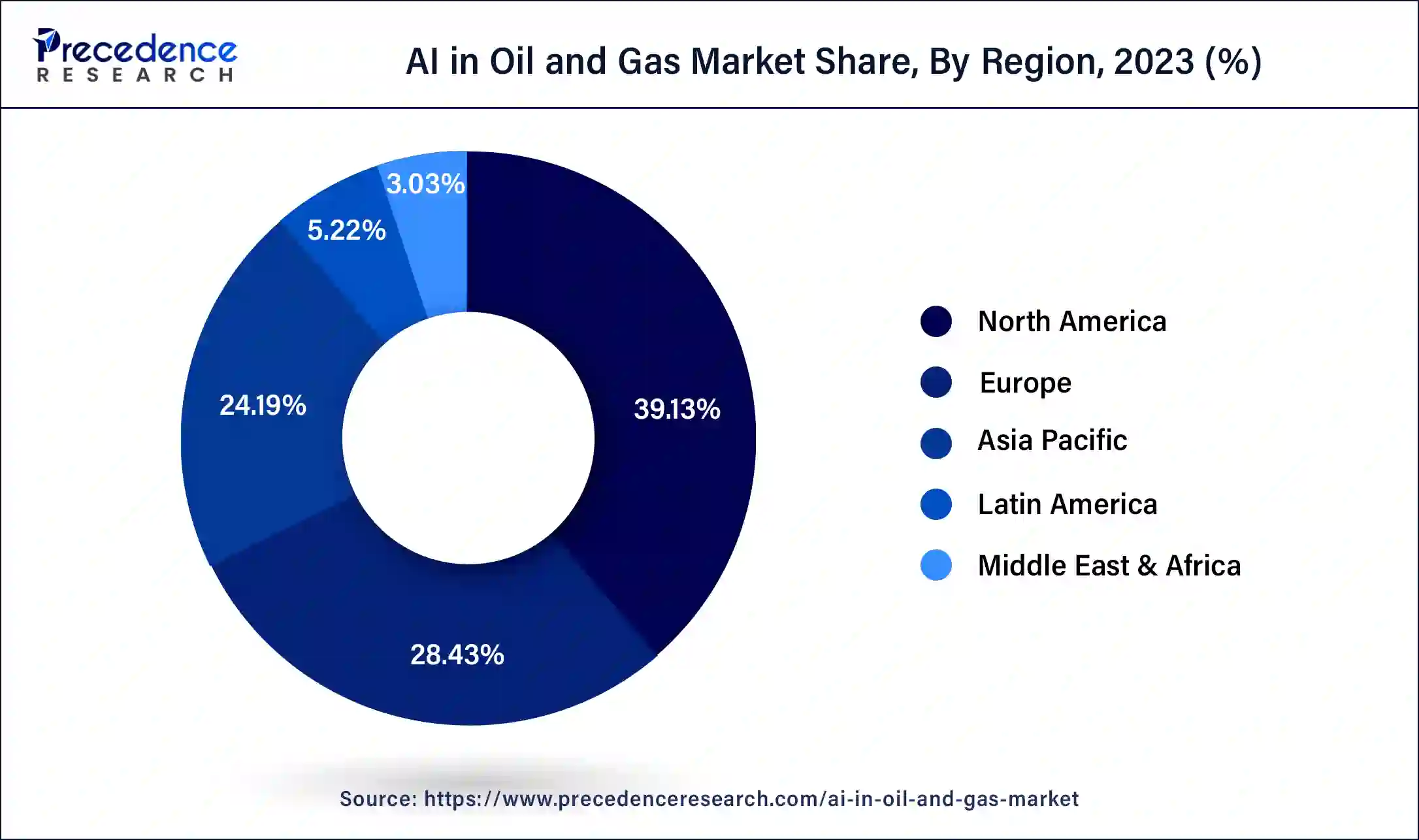

The global artificial intelligence (AI) in oil and gas market size was USD 5.86 billion in 2023, calculated at USD 6.69 billion in 2024, and is expected to reach around USD 25.24 billion by 2034. The market is expanding at a solid CAGR of 14.2% over the forecast period 2024 to 2034. The North America artificial intelligence (AI) in oil and gas market size reached USD 2.29 billion in 2023.

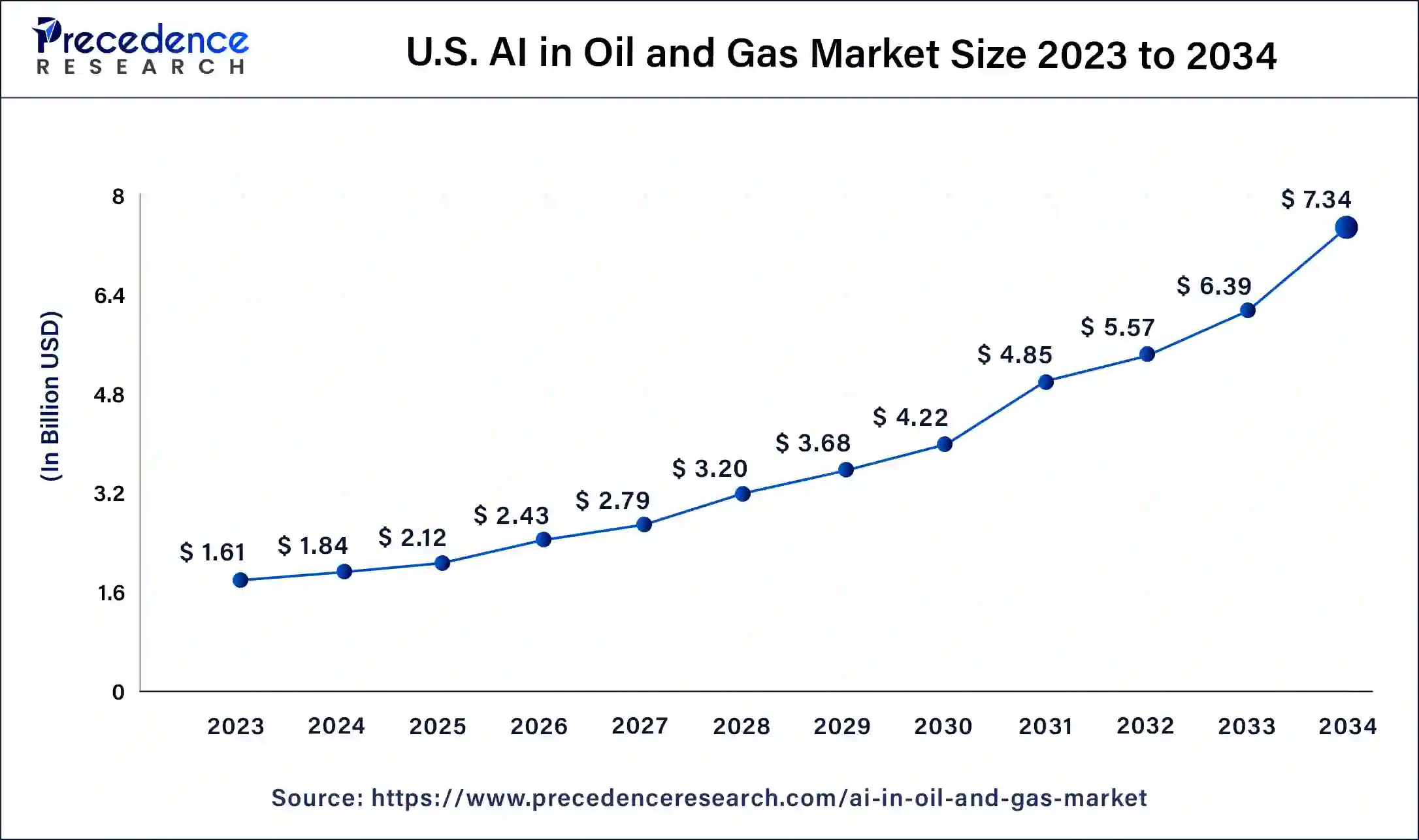

The U.S. artificial intelligence (AI) in oil and gas market size was estimated at USD 1.61 billion in 2023 and is predicted to be worth around USD 7.34 billion by 2034, at a CAGR of 14.8% from 2024 to 2034.

North America is expected to dominate the market over the forecast period. The market growth in the region is attributed to the presence of major players such as Google LLC, IBM Corporation, and C3.ai, Inc. These players continuously launch the innovative AI solution in the regional market. For instance, in May 2023, IBM released IBM Watsonx, as a latest AI and data platform that in planned to be available for business to hasten the impact of the most cutting-edge artificial intelligence with accountable data. Moreover, the oil & gas companies in North America utilize AI to optimize exploration efforts. Machine learning algorithms process vast amounts of geological and geophysical data to identify potential reserves more accurately.

For instance, BP is utilizing artificial intelligence to optimize its operations and improve reservoir modeling. The company has developed an artificial intelligence algorithm which can analyze geologic data to help identify the best locations for drilling. Earlier, BP has also used artificial intelligence to perform predictive maintenance on its equipment while improving safety.

Asia Pacific is expected to grow at the highest CAGR during the forecast period. The market growth in the region is owing to the increasing oil & gas exploration and production activities. For instance, according to the International Energy Agency, By 2025, Asia Pacific will produce 676 bcm more gas than it did in 2019. Due to ongoing policy support for domestic production, China will add 54 bcm/y of additional output by 2025 while traditional gas-producing nations (such as Indonesia, Malaysia, Myanmar, and Thailand) see steady reductions.

The second-largest producer of gas in the area, Australia, stabilizes production at just about 150 bcm/y as a result of new developments substantially offsetting reductions from mature fields. India increased output by 12 bcm/y in 2019–25, with a small number of ongoing deepwater development projects accounting for the majority of the net increase. Furthermore, the growing digitalization initiatives are also propelling the market growth over the forecast period. As part of digitalization efforts, companies in the Asia Pacific oil & gas sector are implementing AI solutions to transform data into actionable insights, streamline processes, and enhance operational efficiency. Thus, this is expected to propel the market growth in the Asia Pacific region.

Market Overview

Artificial Intelligence (AI) in the oil and gas industry refers to the application of advanced computer algorithms and machine learning techniques to enhance and automate various processes and operations within the exploration, production, distribution, and management of oil and natural gas resources. AI technologies in this sector leverage large volumes of data, including geological, geophysical, and operational data, to provide insights, optimize decision-making, and improve overall efficiency and safety.

By analyzing and interpreting this data, AI systems can help oil and gas companies make informed decisions, predict equipment failures, optimize production processes, reduce operational costs, and mitigate environmental risks, ultimately leading to increased profitability and sustainability in the industry. The AI in oil & gas industry is being driven by several factors such as rising collaborations, increasing product launches, increasing operational efficiency, rising government initiatives, and growing technological advancements.

| Report Coverage | Details |

| Market Size in 2023 | USD 5.86 Billion |

| Market Size in 2024 | USD 6.69 Billion |

| Market Size by 2034 | USD 25.24 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 14.2% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Component, By Function, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Reduced production and maintenance cost

Oil & gas remain in a single spot after extraction. Pipelines are used to distribute them afterward. Variable temperature and weather cause oil and gas components to corrode and deteriorate, which can decrease the condition of the pipeline and cause the threading to fade. This is one of the main issues facing the sector. To prevent catastrophic events, the oil & gas business must address these challenges right now. The industry may benefit from the incorporation of AI technologies by avoiding such occurrences.

By evaluating the data captured for many criteria, technologies like AI and IoT can find early indications of any such damage. To detect the likelihood of corrosion and inform managers to deal with the problems before they occur, several algorithms are delivered into AI solutions that employ knowledge graphs and predictive intelligence. Companies may schedule their maintenance procedures to prevent equipment failure-related downtime. Thus, these benefits of implementing AI in the oil & gas industry are expected to propel the market growth over the forecast period.

High initial investment and integration complexity

Implementing AI technologies, including infrastructure, software, and skilled personnel, can involve substantial upfront costs. Smaller companies may find it challenging to allocate the necessary resources. Moreover, integrating AI systems with existing legacy systems and workflows can be complex and time-consuming. Compatibility issues may arise, requiring customized solutions. Therefore, the high initial investment and integration complexity are expected to be a major challenging factor to the market growth over the forecast period.

Requirement of precised defect detection

The machinery always runs under extreme pressures and temperatures. Natural processes like material deterioration and corrosion can cause major mishaps and damage. It is prone to errors to monitoring the equipment manually. The ML models monitor each component, recognize possible dangers, and supply the solutions in conjunction with the IoT, a smart system that employs small sensors to track anything from individual pieces of equipment to whole manufacturing lines. Thus, this is expected to offer a lucrative opportunity for the market growth.

Based on the component, the global artificial intelligence in oil and gas market is segmented into software, hardware and services. The software segment is expected to hold the largest market share over the forecast period. These platforms form the foundation of AI applications in the industry. They allow companies to process, analyze, and gain insights from large datasets. Software such as TensorFlow, PyTorch, and scikit-learn is used to develop and deploy machine learning models for tasks like reservoir prediction, equipment maintenance, and demand forecasting. Predictive maintenance software leverages AI to monitor the condition of equipment and predict when maintenance is required. Popular solutions include IBM Maximo predictive maintenance and GE Digital Predix APM. Thus, this is expected to drive the segment expansion during the forecast period.

Based on the function, the global artificial intelligence (AI) in oil and gas market is segmented into predictive maintenance, machinery inspection, material movement, production planning, field services, quality control and reclamation. The predictive maintenance segment is expected to dominate the market during the forecast period. Predictive maintenance is a critical application of AI in the oil & gas industry. It involves the use of AI algorithms and data analysis to predict when equipment and machinery in the oil & gas sector will require maintenance or replacement.

There are various benefits of predictive maintenance in the oil & gas industry such as reduced downtime, cost savings, extended equipment lifespan, and others. Unplanned downtime in oil & gas operations can be extremely costly. Predictive maintenance helps prevent unexpected equipment failures, minimizing production interruptions and losses. Moreover, by identifying maintenance needs in advance, companies can plan and schedule maintenance activities more efficiently. This reduces the overall maintenance cost and avoids unnecessary replacements or repairs. Thus, this is expected to be a reason for segment growth during the forecast period.

Based on the application, the global artificial intelligence In oil and gas market is segmented into upstream, midstream and downstream. The upstream segment is expected to capture the largest market share over the forecast period. AI is making a significant impact on the upstream sector of the oil & gas industry, which involves activities related to exploration, drilling, and production.

AI technologies are being leveraged in several ways to optimize operations and improve efficiency in upstream activities. AI algorithms analyze seismic data to identify potential hydrocarbon reserves more accurately. Machine learning models can identify subsurface structures and predict the presence of oil and gas with greater precision. AI systems process real-time data from drilling operations to optimize drilling parameters, detect anomalies, and make immediate adjustments to improve drilling efficiency and minimize downtime.

For instance, companies like BP and Royal Dutch Shell are under increased pressure to reduce their carbon footprint to comply with the Paris Agreement and their commitment to achieve net-zero carbon emissions by 2050. To reduce its carbon impact, Shell is using AI technology to do proactive maintenance on specific equipment or entire systems, this enables businesses to anticipate and address any equipment failures before they arise. Thus, this is expected to propel the segment expansion during the forecast period.

Recent Developments:

Segments Covered in the Report:

By Component

By Function

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

March 2025

December 2024

December 2024