February 2025

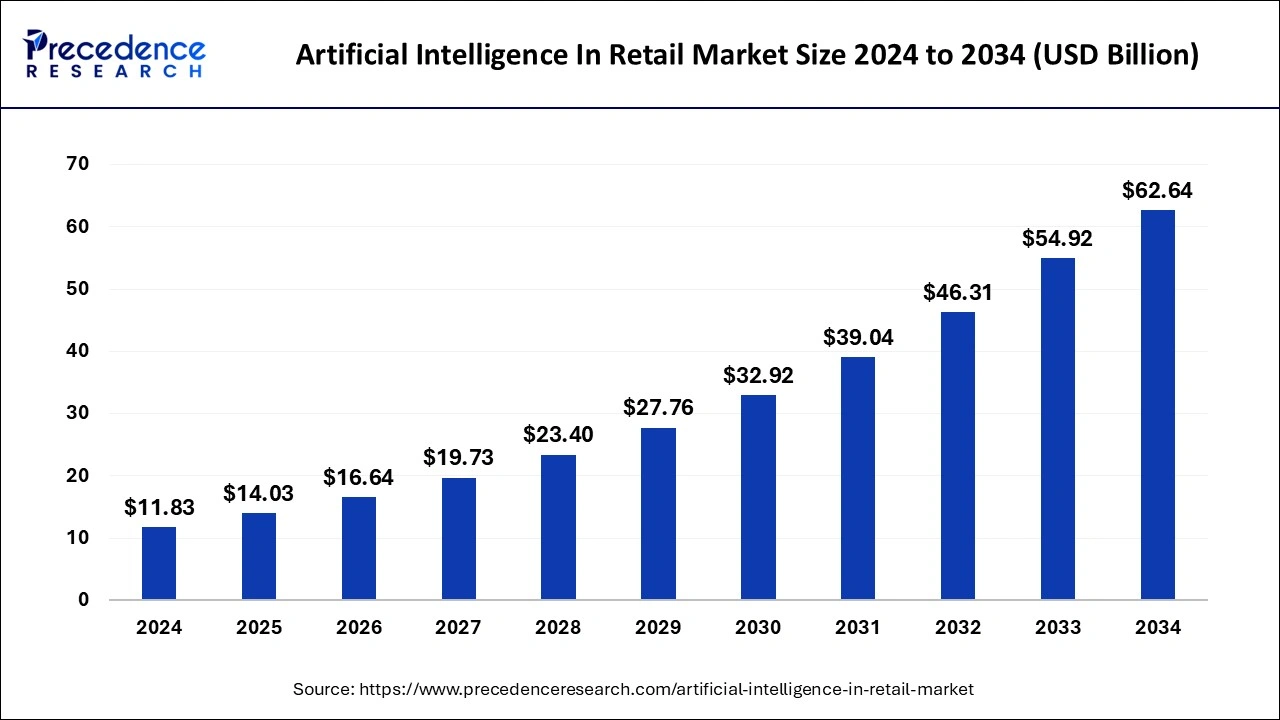

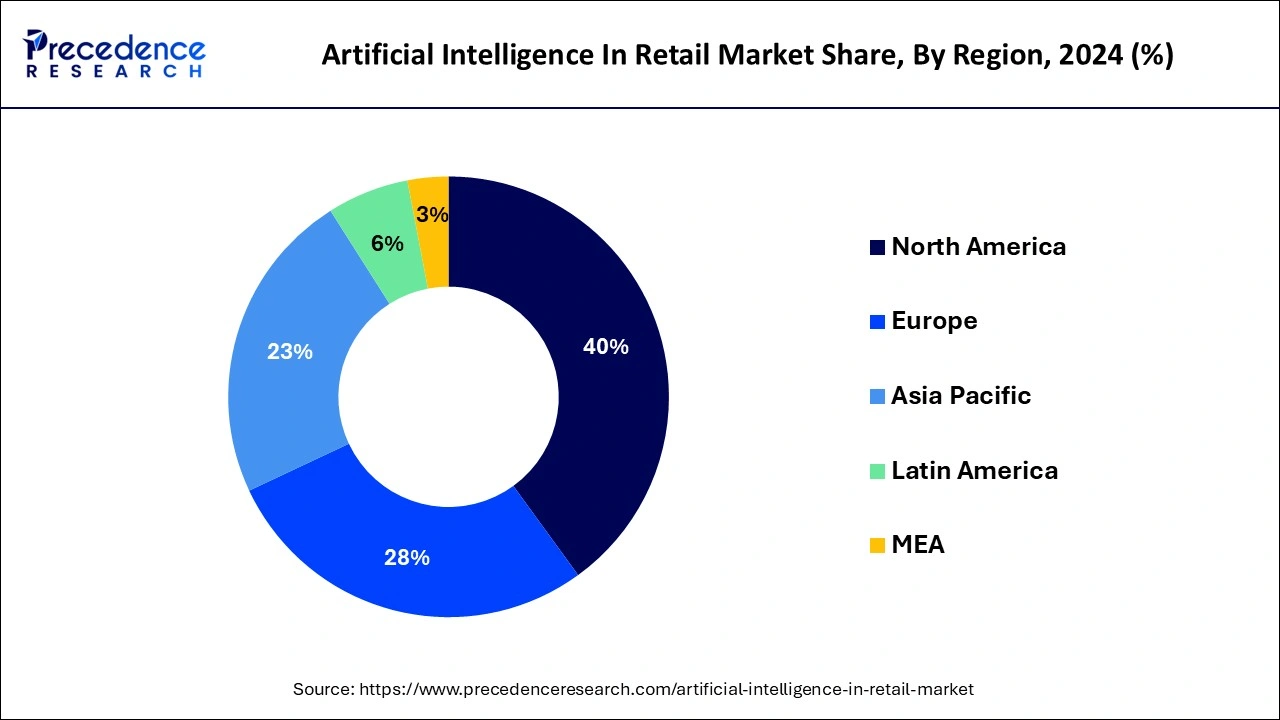

The global artificial intelligence (AI) in retail market size is calculated at USD 14.03 billion in 2025 and is forecasted to reach around USD 62.64 billion by 2034, accelerating at a CAGR of 18.14% from 2025 to 2034. The North America artificial intelligence (AI) in retail market size surpassed USD 4.73 billion in 2024 and is expanding at a CAGR of 18.16% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global artificial intelligence (AI) in retail market size was accounted for USD 11.83 billion in 2024, and is expected to reach around USD 62.64 billion by 2034, expanding at a CAGR of 18.14% from 2025 to 2034.

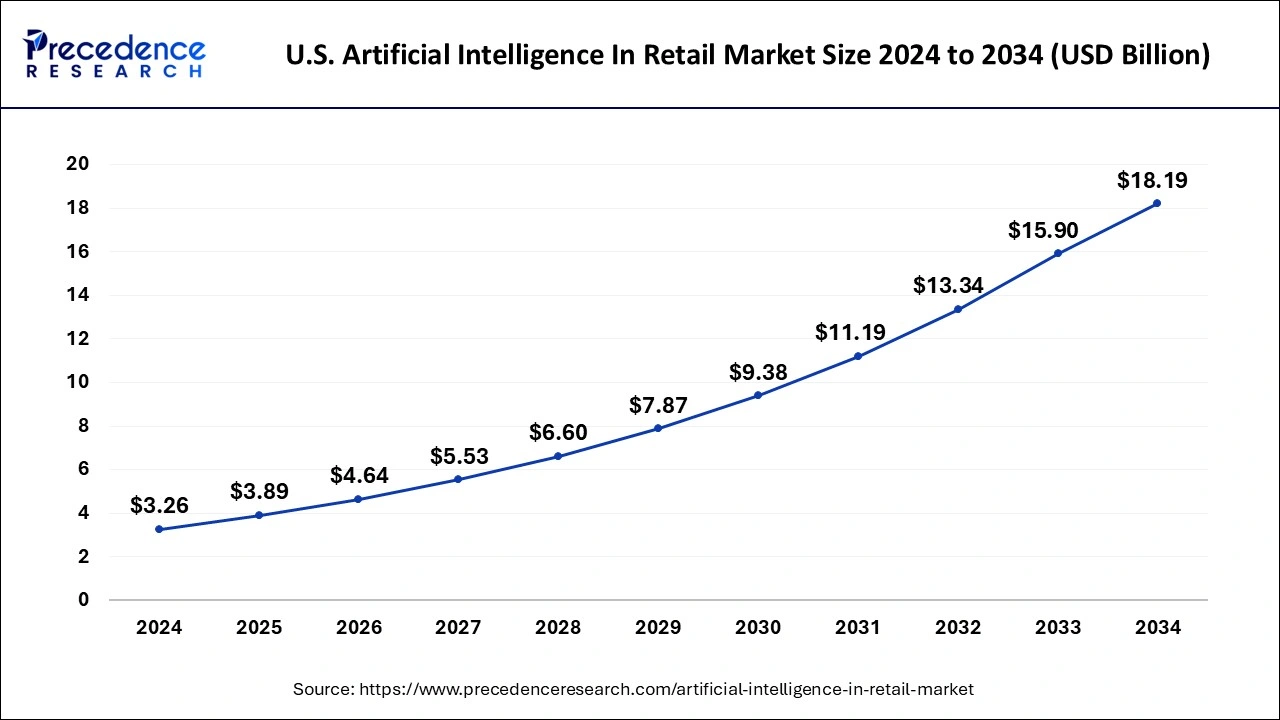

The U.S. artificial intelligence (AI) in retail market size was estimated at USD 3.26 billion in 2024 and is predicted to be worth around USD 18.19 billion by 2034, at a CAGR of 18.76% from 2025 to 2034.

Artificial intelligence in the retail sector generated most of its revenue in North America. There is potential for industrial growth as significant investments are being made in AI projects and related R&D activities initiated by the companies. To improve the efficacy of their customer service, regional retail providers are concentrating on obtaining insightful consumer preferences. The industry leaders use both inorganic & organic methods to expand. The United States pioneered AI technology adoption and is seeing significant investment in the field. Due to the country's growing need for technology, new start-ups and small businesses are also emerging. This should accelerate the growth of artificial intelligence in the retail sector.

Regarding AI in retail market share dominance, Europe is probably in second place. The region’s significant merchants, including those in the apparel, cosmetics, and fashion industries, actively invest in cutting-edge technology to improve the customer experience. Thus, the need for artificial intelligence in the retail sector is anticipated to increase. Additionally, due to the increasing digitalization, Asia Pacific is predicted to experience rapid growth during the projection period. The regional retail market is experiencing an immediate era of change, and the demand for cutting-edge technologies to enhance operations and customer experience is propelling the market.

As physical storefronts continue to dominate the retail industry, they face intense competition. As with traditional stores, digital platforms may quickly access their competitors in the market where they compete. Retailers may use AI to improve the customer shopping experience and gain the competitive advantage they need to stay relevant. The most widely utilized AI technologies are those based on machine learning and deep learning. Businesses in the retail sector use machine learning and deep learning technology to provide end consumers with a more personalized experience and an engaging setting.

However, a reluctance to adopt technology advancements may hinder the market's expansion. The market expansion is also being hampered by a need for a competent workforce to integrate AI in retail. Artificial intelligence (AI) is making advances in the retail sector, and retailers may utilize AI to interact with customers and operate more efficiently. Techniques include using computer vision to adjust marketing in real-time and machine learning for inventory management.

| Report Coverage | Details |

| Market Size in 2025 | USD 14.03 Billion |

| Market Size by 2034 | USD 62.64 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 18.14% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component, By Technology, By Sales Channel, By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

In the coming years, AI has the potential to significantly change the retail industry, impacting the value chain from cost elements to shopping participation. Adopting AI is crucial because e-commerce and AI work in tandem and the coronavirus outbreak has increased e-commerce growth rates. The benefits of AI will convert the industry. Sellers must subsequently begin planning as soon as it is practical, and these plans must include both technology and company strategy.

The main advantage of AI is that it can help consumers with tedious, repetitive activities. A large number of workers think that productivity has grown as a result of the greater use of AI at work. The usage of AI in retail may result in the same outcome. Artificial intelligence is a tool drivers in the logistics sector can use to determine the optimal delivery routes. Robots can also assist with order selection and packing, freeing staff employees to focus on other essential duties.

Numerous factors are expected to impede the spread of artificial intelligence in the retail sector, even though well-known retail companies continue to invest in cutting-edge technology to enhance client engagement. Large firms and significant retailers like Walmart have already included artificial intelligence technologies for managing online portals and in-store operations. Small and medium-sized firms and new start-ups need more infrastructure and technological know-how to utilize the technology. A lack of AI knowledge is a barrier to deploying such technology. Also, the adoption of the intelligent retail solution needs to be improved by its high implementation costs, which represent substantial challenges for small retailers. These factors are expected to limit market expansion.

Artificial intelligence in the retail market has a wealth of lucrative potential due to the increased usage of IoT, Big Data analytics, and e-commerce marketing. Computer vision and other technological developments in the retail industry are becoming more popular in brick-and-mortar stores. This development creates possibilities for new retail in areas such as customer experience, demand forecasting, and inventory management. Furthermore, using AI in retail will increasingly focus on planning and product recommendations. Growth in artificially intelligent products and services across various industrial domains and verticals will be fueled by developments in big data analytics.

Based on components, artificial intelligence (AI) in retail market is segmented into services and solutions. The solution segment occupies the retail market's highest share of global artificial intelligence (AI) in the estimated year. New automated technology is being developed in response to the management problems many retail companies are experiencing. With AI-powered technologies, retailers can manage supply chain operations, logistics, and warehouse management while improving the consumer experience.

On the hand, the services segment is expected to see strong growth in the projected period. This growth is attributed to the rapid adoption of AI solutions as it contributes to the creation of intelligent functions, improves the customer experience, increases the potential for revenue development, leads to faster innovation, and lowers human error.

Based on technology, the market is bifurcated into natural language processing, machine learning (ML), image & video analytics, chatbots, and swarm intelligence. Amongst the mentioned segments, the ML segment acquired the largest revenue share of the market. Machine learning technology's greater precision and flexibility contribute to the segment’s increasing expansion. As it serves data rapidly and deeply, machine learning is excellent for offering personalized experiences to customers. Furthermore, it aids merchants in streamlining supply chain strategies and demand projections to increase inventory productivity. For instance, the fully managed service - Amazon Sage Maker enables the deployment of machine learning models for any activity, from customer experience to predictive analytics.

Additionally, NLP is expected to progress as data analysis increases and chatbots powered by AI become more popular. Thus, demand for natural language processing will be expected to increase rapidly throughout the forecast period.

Based on sales channels, the market is segregated into brick-and-mortar, omnichannel, and pure-play online retailers. The pure-play market category gained a sizeable revenue share of AI in the retail industry. The increased acceptance of online and virtual purchasing would hasten the growth of pure-play internet businesses. Social media, IoT, and AI would grow in popularity, boosting AI in the retail industry.

Based on application, the global market for AI in retail is segmented into customer relationship management (CRM), inventory management, supply chain & logistics, product optimization, payment & pricing analytics, in-store navigation, virtual assistant (VA), and others. CRM in the retail market saw the highest revenue share. The CRM market would rise to prominence if there were a pressing need to enhance customer service & retention. With the use of chatbots, search engines, and other technologies, retail providers may encourage customer loyalty and strong relationships.

Virtual assistant technologies have ample opportunities to explore in the retail industry, such as streamlining the supply chain, invoicing, ordering inventory, and bookkeeping. Therefore, virtual assistance is expected to experience rapid growth in the projected period.

By Component

By Technology

By Sales Channel

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

March 2025

December 2024

December 2024