August 2024

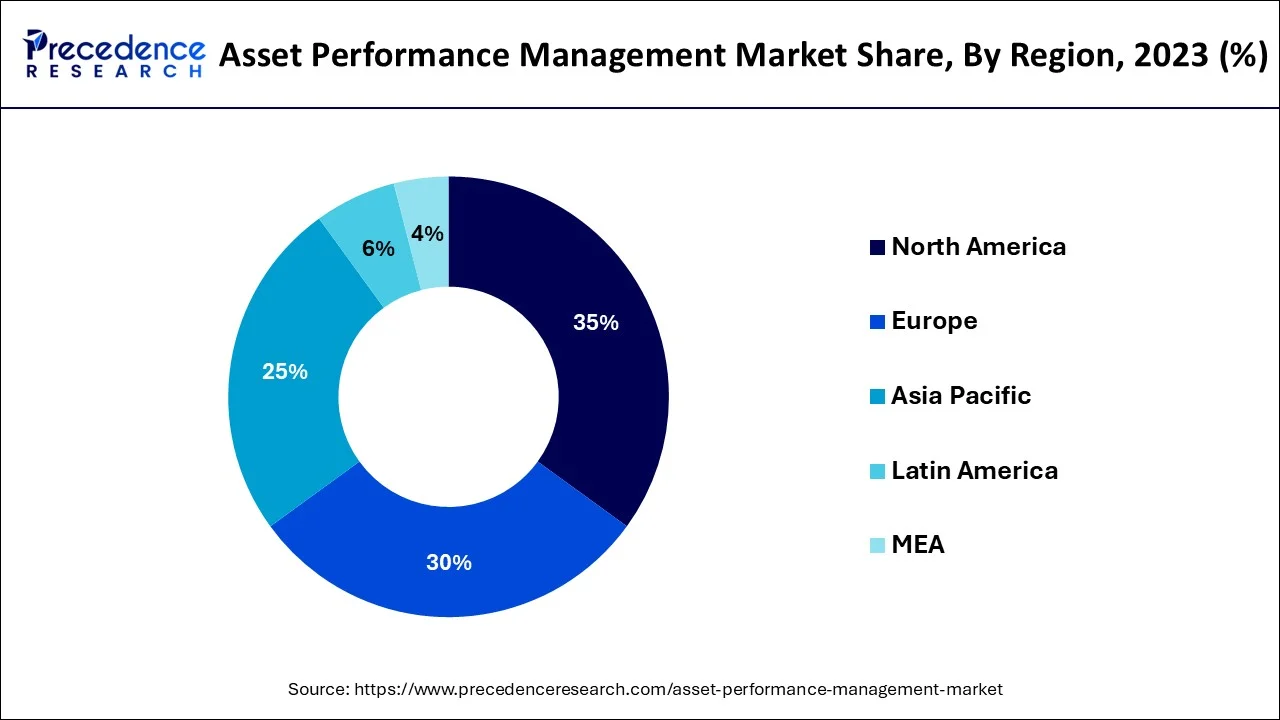

The global asset performance management market size accounted for USD 23.27 billion in 2024, grew to USD 25.80 billion in 2025 and is predicted to surpass around USD 65.47 billion by 2034, representing a healthy CAGR of 10.90% between 2024 and 2034. The North America asset performance management market size is calculated at USD 8.14 billion in 2024 and is expected to grow at a fastest CAGR of 11.05% during the forecast year.

The global asset performance management market size is estimated at USD 23.27 billion in 2024 and is anticipated to reach around USD 65.47 billion by 2034, expanding at a CAGR of 10.90% from 2024 to 2034.

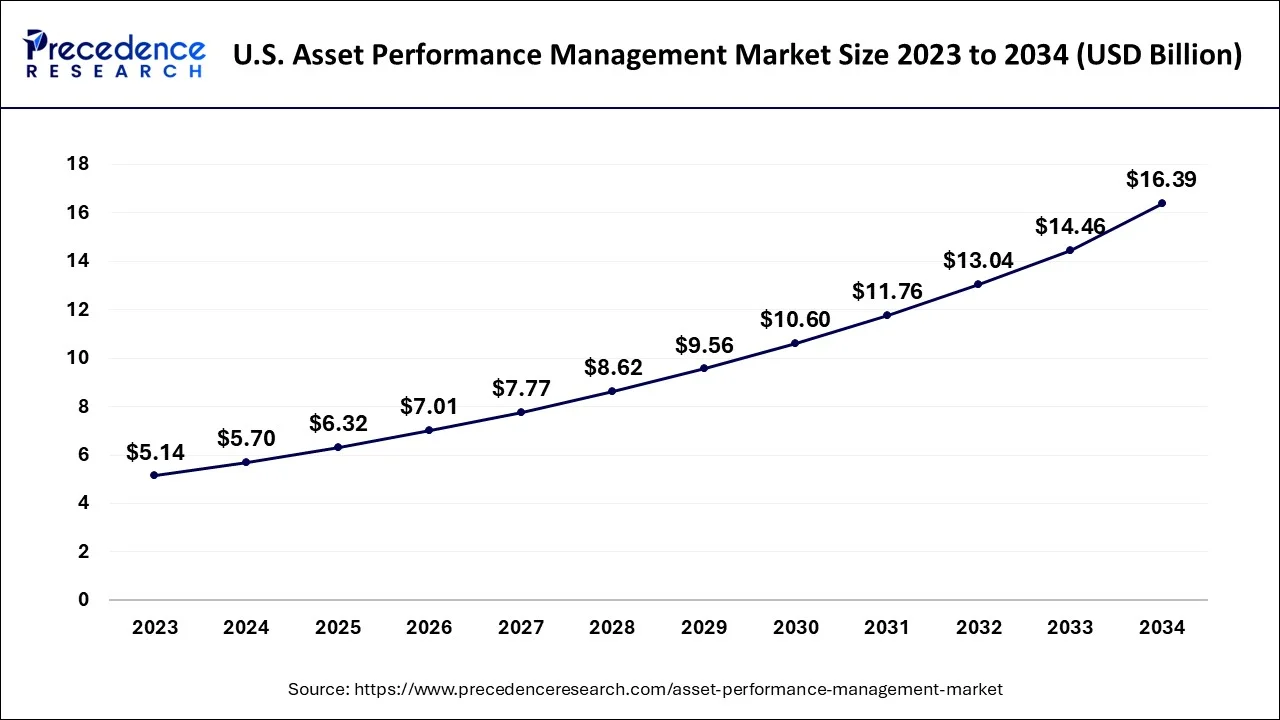

The U.S. asset performance management market size is evaluated at USD 5.70 billion in 2024 and is predicted to be worth around USD 16.39 billion by 2034, rising at a CAGR of 11.12% from 2024 to 2034.

The Asia Pacific to hold the largest revenue with the highest position in the asset performance management as a software with developed innovative technologies in the software with increased demands from the market for easy work flow management, with increased digitalization and improved infrastructures with improved connectivity encouraged the asset performance management market to grow at a larger extent with increased reliability of APM.

Increased development of asset performance management with increased number of players involves in precedence of the market in large scale industries and small and medium scale enterprises which involves utilization such as government, defense, chemicals, manufacturing, pharmaceuticals, telecommunications, food beverage, logistics and transport, consumer goods with increased digitalization improved connectivity such as cloud based and on premises which helped to interconnection between the machines and humans.

Asset performance management basically it is a software for examining the information, understanding and analysing and storing the large amount of data from different sources and servers for insight data of asset performance management. Increased reliability and availability of APM. Asset performance management includes maintaining and updating of the data to the insight of APM, increased process of developing, execution of maintenance, increase business performance. Impact of pandemic situation covid-19 across the various regions with the positive impact of corona virus with increase growth rate of asset performance management.

Increased rules and regulations for business developers. Increase demands from the industrial areas for improving digitalization with increased features and to access the information online or offline with increased efficiency and performance of work. Asset performance management shows the increased growth in different industries with improved reliability and access to the data and easy analysing during the forecast period.

Asset performance management as a software with developed technologies and new innovative features with increased digitalization and increased urbanization across the regions have developed the market of APM with increased demands from the consumers to ease of access to the data and analysing the data with improved reliability in input and output of the data with updating the software. By utilizing the statistical method of asset performance management, a decision-making software with the reliability and availability of the physical asset.

APM system is imposed with complimentary solutions such as geographical information system and mobile solutions with increased utilization and efficiency in the APM system. Increased connectivity with improved software and increase internet of things in the APM system which gained the attention of the consumers towards asset performance management. It is integrated with various software used to detect the aspects for example asset health and asset reliability. Increased strategies to develop more management and plan for maintaining the market growth during the forecast period.

Due to pandemic situation covid-19 outbreak has a positive impact on the asset performance management with increased digitalization and improved connectivity in health sector and other industries due to imposed rules and regulations and shutdown of the nation led to stoppage of industries and increased work from home increased control over the business which enhanced the asset performance management market during the forecast period. The key market players involved in IT industry with improved internet of things and updating of the software has helped to boost the market rate during the forecast period.

| Report Coverage | Details |

| Market Size in 2024 | USD 23.27 Billion |

| Market Size by 2034 | USD 65.47 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 10.90% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Deployment Type, Enterprises Size, Vertical, and Geography |

Rising needs for management of the asset with increased efficiency, sustainability management and the required total cost. Enterprises with the challenge to obtain a larger return on assets. Increased data management, budget management and insight lack has driven the asset management with improved performance and expansion of market rate during the forecast period.

Increased pressure for operating reliably with any adjustments in the standards of health and safety. With compilations of industry an environmental regulation.

Increased development and new features in technology with rising digitalization and increased connectivity with increased transformations and increased connectivity with machines with more efficiency and efficacy which led to thrive the asset performance management market. Increased help to the organizations from asset management by maintenance of operations with rising approaches preventive to predictive maintenance.

The deployment type it is majorly divided in two types includes such as cloud and on - premises. Cloud segment to be the most prominent with increased demand from the market with increased revenue share in the asset performance management transmission of the data from the various sources and servers through increased connectivity. Increased rapid digitalization with improved technology and new adapting features across various regions in health sectors and industries with continuous software developments striving the market of asset performance management market. Basically, large enterprises are acquiring the on-premises which require high budget for installing the asset performance management.

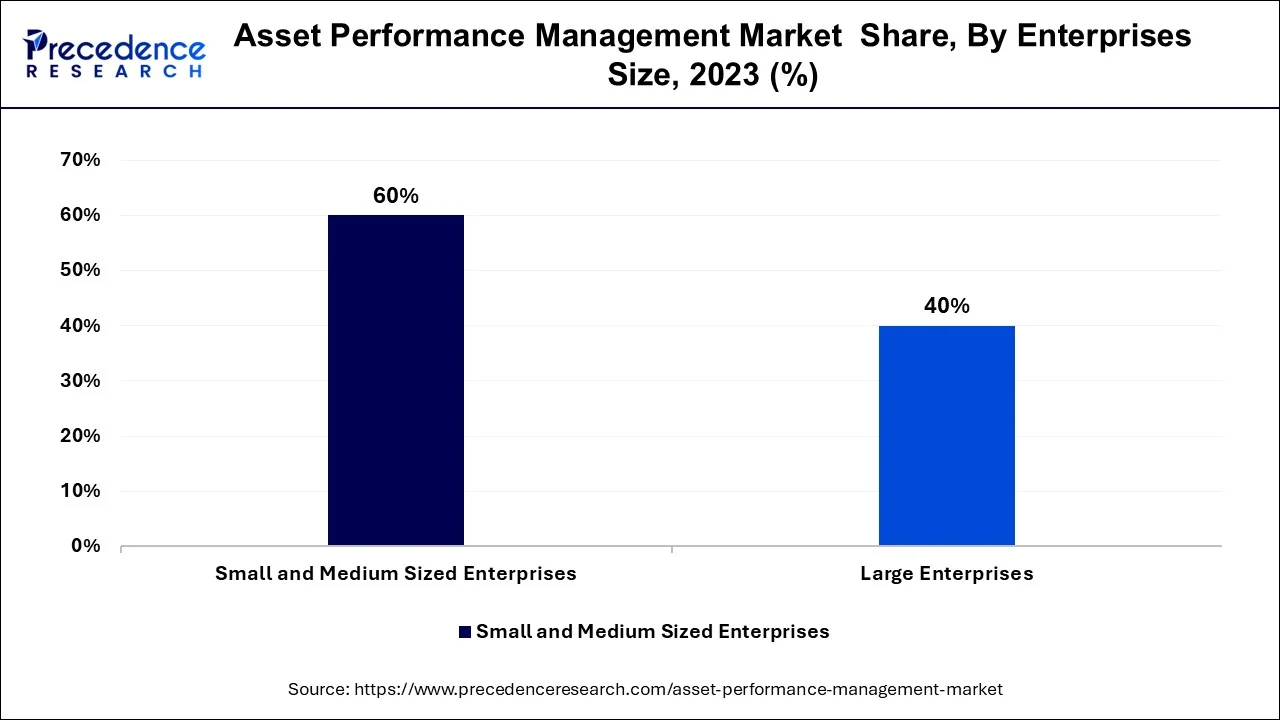

Increased revenue share of the small medium enterprises in the asset performance management. Which involves the employees of about 1 - 1000. Small medium sized enterprises with decreased budget of market and low number of capability and sources small enterprises estimated to grow at the annual compound rate and increased CAGR during the forecast period of asset performance management market of asset performance management.

Increased data generation with improved analysis and increase understanding of the data. Improved efficiency with increased network connectivity. Which majorly affects the market to gain a significant position in asset performance management.

Chemical industries to be the largest growing segment in the verticals with increase demand with increased adaption of the newly developed innovative technologies in the asset performance management. The increased development with continuous research and new technology requires improved control, maintenance and rising productions have thrived the market rate.

By Component

By Deployment Type

By Enterprises Size

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

May 2024

June 2024

February 2025