January 2025

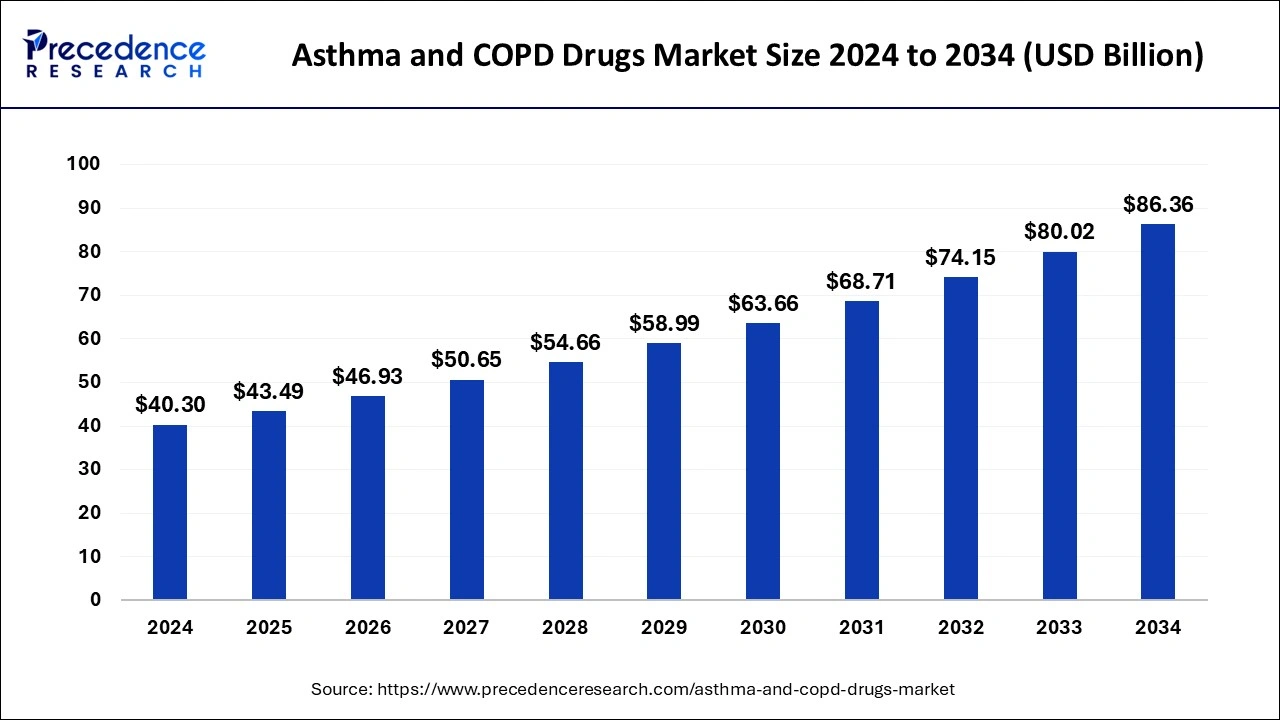

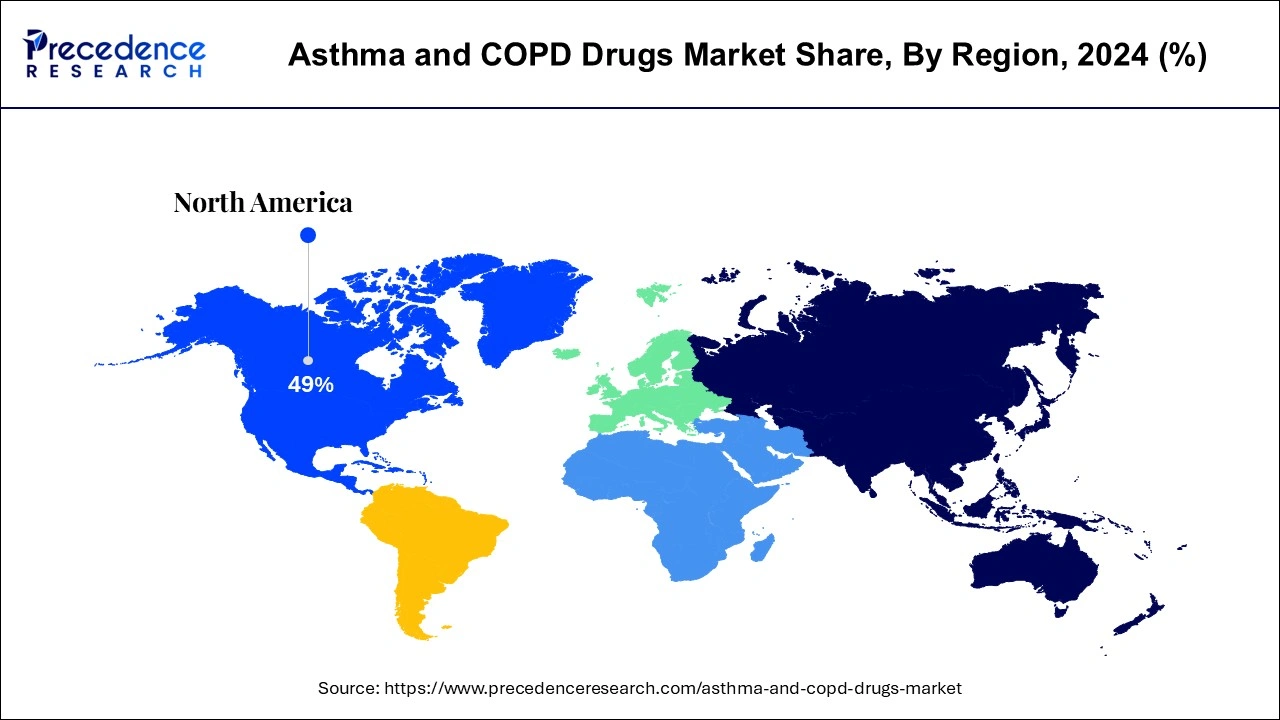

The global asthma and COPD drugs market size is accounted at USD 43.49 billion in 2025 and is forecasted to hit around USD 86.36 billion by 2034, representing a CAGR of 7.92% from 2025 to 2034. The North America asthma and COPD drugs market size was estimated at USD 19.75 billion in 2024 and is expanding at a CAGR of 8.03% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global asthma and COPD drugs market size was worth around USD 40.3 billion in 2024 and is anticipated to reach around USD 86.36 billion by 2034, growing at a CAGR of 7.92% from 2025 to 2034. The growing urbanization, ageing population, pollution, and smoking have increased the cases of asthma and COPD which influence the development of the asthma and COPD drugs market.

The integration of AI in the asthma and COPD drugs market helps to provide personalized medication or treatment plans. AI is utilized to analyse huge data gathered which include clinical data, genomic, and proteomic which help to recognize new medicinal marks. It can process huge datasets to extract all the essential information that can help market players understand the demands of the consumers. It is helpful for professionals to track patient details and plan personalized medication which enhances the effectiveness of the treatment. It can track the real-time effect of the drugs on patients and help professionals if changes are required. AI helps to decrease the time and charges related to the treatment of asthma and COPD.

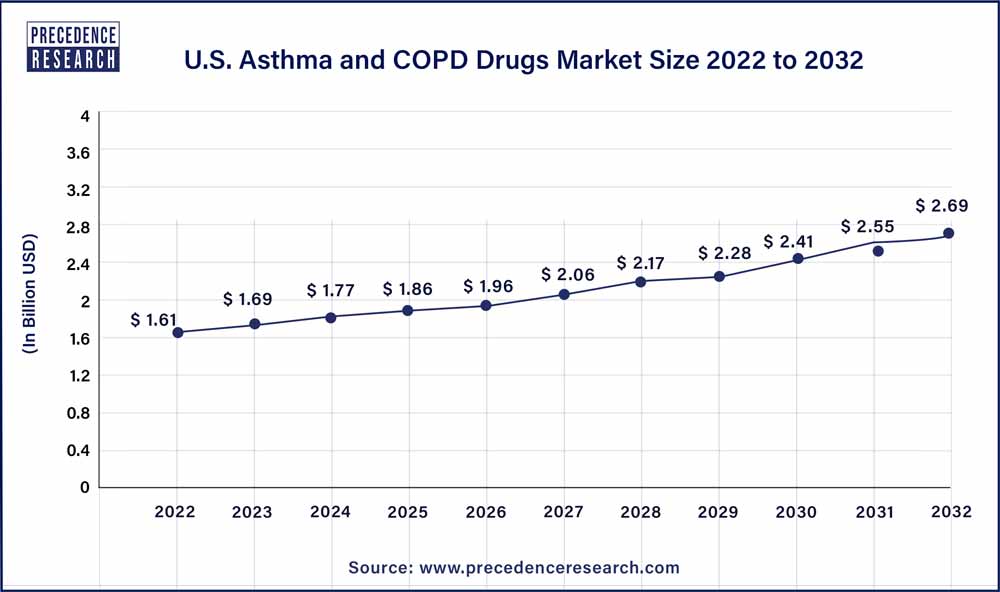

The U.S. asthma and COPD drugs market size was exhibited at USD 13.82 billion in 2024 and is projected to be worth around USD 30.14 billion by 2034, growing at a CAGR of 8.11% from 2025 to 2034.

North America dominated the asthma and COPD drugs market in 2022. The main factor for the growth of asthma and COPD drugs market in North America region is rising prevalence of asthma and COPD. Adult women are more likely than adult men to have asthma in the U.S. As per the Centers for Disease Control’s 2020 estimates, asthma affects about 25 million people in the U.S. This equates to roughly one in every thirteen Americans with 7% of children and 8% of adults falling in this category. Asthma affects around 20 million persons in the U.S. Thus, the surge in number of asthma patients is boosting the growth of asthma and COPD drugs market in the region.

Europe, on the other hand, is expected to develop at the fastest rate during the forecast period. The UK dominates the asthma and COPD drugs market in Europe region. The growth of the asthma and COPD drugs market in Europe region is attributed to the growing awareness of asthma and COPD among people. For example, the United Action for Allergy and Asthma was started in Europe in April 2017 to promote asthma knowledge across the globe. Thus, the asthma and COPD drugs market in this region is expected to grow at rapid pace in the near future.

| Report Coverage | Details |

| Market Size in 2025 | USD 43.49 Billion |

| Market Size by 2034 | USD 86.36 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.92% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Diseases, Medication Class, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Respiratory issues among older adults and smokers

An increasingly geriatric population and the continued use of cigarettes, along with other tobacco and nicotine products is leading to growing incidences of lung issues such as asthma and chronic obstructive pulmonary disease. This is leading to increasing demand for medications and therapeutics to treat and manage these conditions. Advances in drug development and the increasing healthcare expenditure in emerging economies is also boosting demand in the space.

High development and production costs

With the growth in biomedical technology and the creation of improved formulations by pharmaceuticals comes an increasing price tag on asthma inhalers and COPD medication. Companies are looking to make up for the significant research and development expenditure undertaken in the development of novel drugs. This is leading to higher costs for patients looking for newer, more effective treatment.

Continued expansion of healthcare infrastructure

Global economic growth is allowing emerging economies in Asia Pacific, Africa, and the Middle East to devote more government expenditure to improve healthcare

facilities and infrastructure in these regions. This allows previously underserved patients more consistent access to medication and healthcare providers for diagnoses. This is expected to notably spur demand in the asthma and COPD drugs market in the coming years.

By distribution channel, the retail pharmacies segment dominated the market globally. Retail pharmacies provide patients with greater access to asthma and COPD medication, especially for repeated prescriptions. Unlike certain healthcare providers, retail pharmacies have convenient operating hours and allow for medicine customization in consultation with the pharmacist. These factors contribute to the segment’s larger share of the market.

By distribution channel, the online pharmacies segment is predicted to witness significant growth in the market over the forecast period. Worldwide smartphone penetration, increased internet connectivity, and the advent of accessible online payment gateways are expected to lead to high demand in the online segment in the coming years. The convenience offered by e-commerce which is shifting consumer purchasing habits, is also expected to drive demand for online ordering of medication. Several pharmaceutical delivery apps are integrating online prescription verification and virtual physician consultations, allowing for an increasing number of prescribed medication deliveries apart from their current generic drug offerings.

The asthma segment dominated the asthma and COPD drugs market in 2022. The asthma is considered as one of the life-threatening diseases around the world. According to World Health Organization (WHO), in 2019, asthma afflicted an estimated 262 million individuals, resulting 46,1000 mortalities. The most frequent chronic disorder among children is asthma. Inhaled medicine and drugs can help patients with asthma manage their symptoms and live a healthy life. Thus, the market for asthma and COPD drugs is expected to expand due to this factor.

The CPOD segment is fastest growing segment of the asthma and COPD drugs market in 2022. According to the Institute of Health Metrics and Evaluation’s Global Burden of Disease Study (2016), there are 215 million cases with COPD worldwide. As per the World Health Organization (WHO), around 200 million people worldwide were diagnosed with COPD in 2016. The factors such as growing air pollution and toxic gases emissions are boosting the growth of asthma and COPD drugs market.

The combination drugs segment dominated the asthma and COPD drugs market in 2022. The usage of combination of medications and drugs for the treatment of a variety of disorders has steadily increased during the past decade. The patients with COPD and asthma can now gain benefit from combination drugs according to several research studies.

The inhaled corticosteroids (ICS) segment is fastest growing segment of the asthma and COPD drugs market in 2022. The inhaled corticosteroids (ICS) aid in the prevention of asthma attacks as well as the improvement of lung function. They may also be utilized for the treatment of other lung disorders such as COPD. The inhaled corticosteroids (ICS) are quite effective for the treatment of asthma as compared to other types of drugs.

Segments Covered in the Report

By Diseases

By Medication Class

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

January 2025

July 2024