October 2024

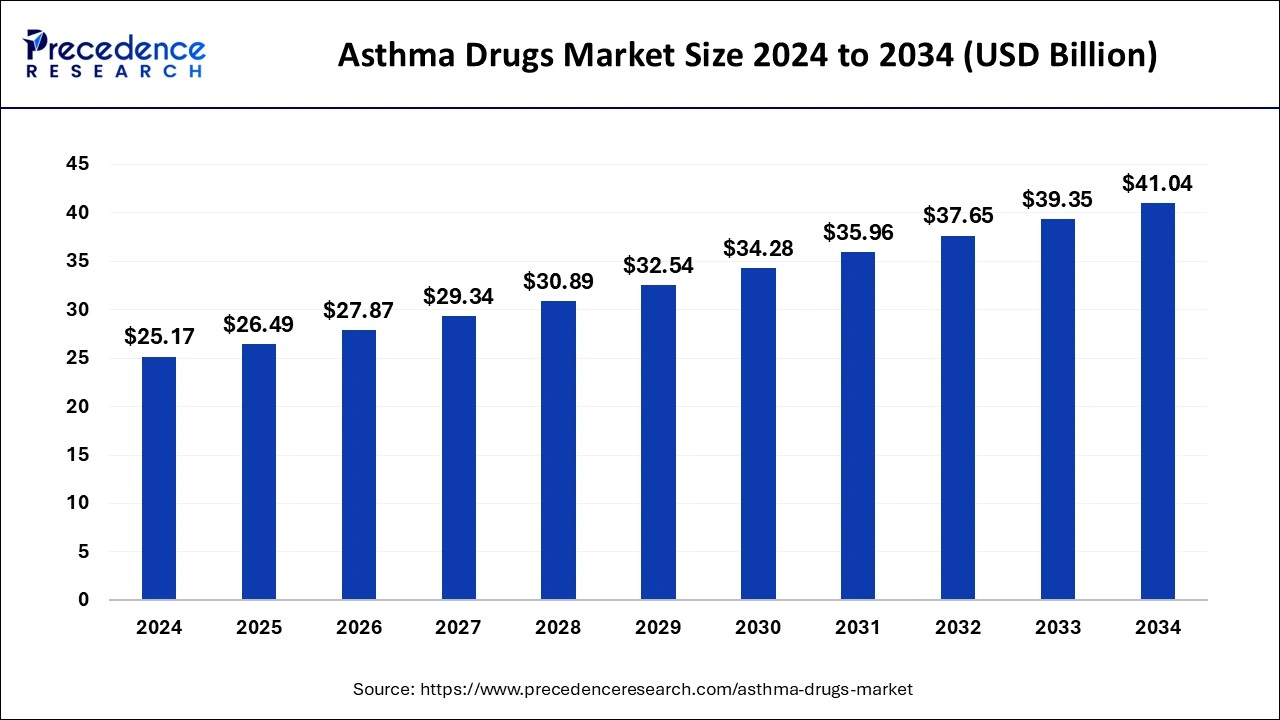

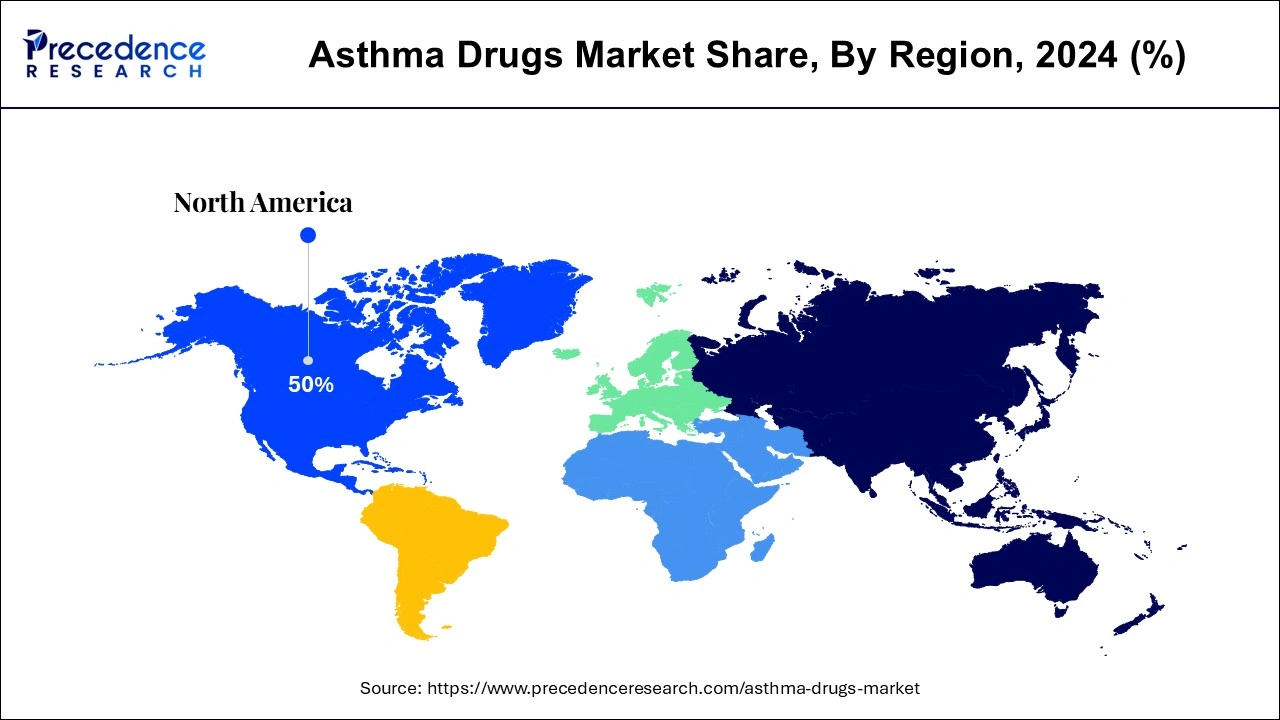

The global asthma drugs market size is calculated at USD 26.49 billion in 2025 and is forecasted to reach around USD 41.04 billion by 2034, accelerating at a CAGR of 5.01% from 2025 to 2034. The North America market size surpassed USD 12.59 billion in 2024 and is expanding at a CAGR of 5.02% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global asthma drugs market size accounted for USD 25.17 billion in 2024 and is expected to exceed around USD 41.04 billion by 2034, growing at a CAGR of 5.01% from 2025 to 2034. The need for medicines, including the most promising asthma treatment options, has increased dramatically due to the rise in asthma prevalence worldwide.

Accelerating the medication research and development process is one of the most important ways AI is changing the market. Long cycles of research and clinical trials have historically made the process of creating new drugs expensive and time-consuming. However, AI has made it possible to evaluate enormous volumes of data at remarkably fast speeds. AI may find possible medication candidates by evaluating biological data, forecasting therapeutic efficacy, and even identifying patterns that people would overlook through the use of machine learning algorithms. The development of more potent asthma therapies depends on this expedited discovery process.

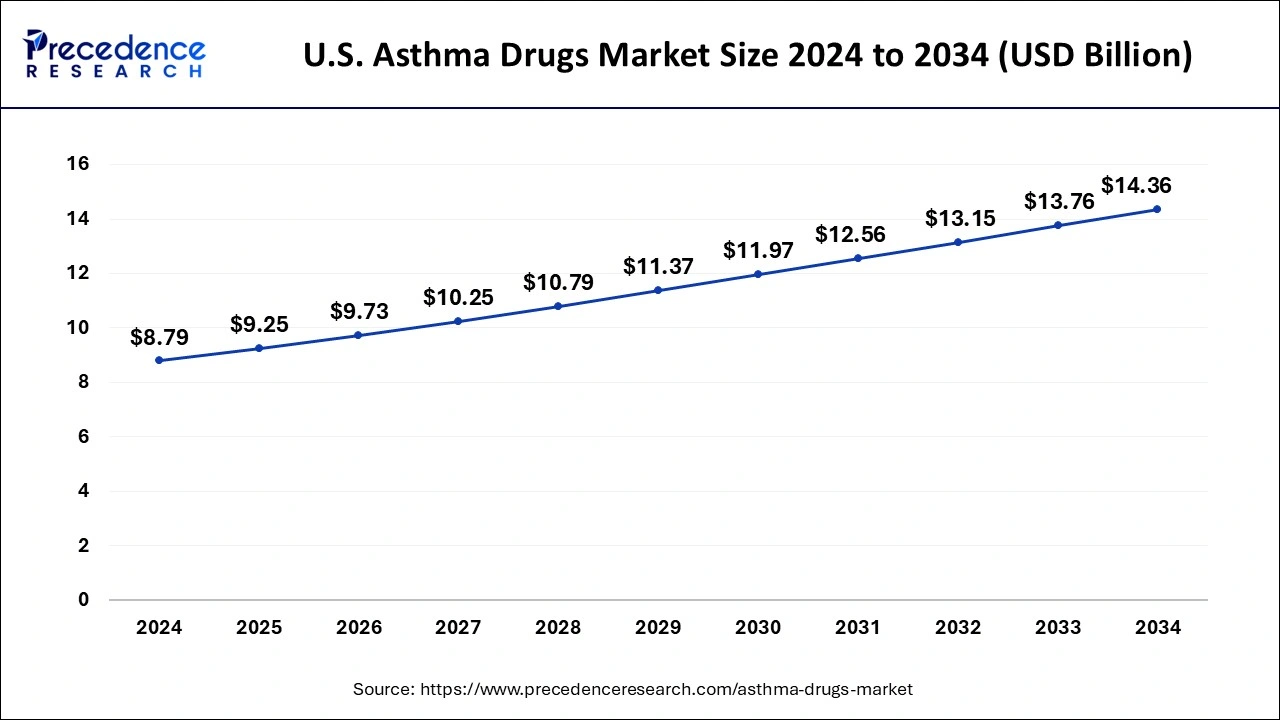

The U.S. asthma drugs market size was evaluated at USD 8.79 billion in 2024 and is projected to be worth around USD 14.36 billion by 2034, growing at a CAGR of 5.03% from 2025 to 2034.

The research report deals with the industry prospects of asthma drugs products around regions including Europe, North America, Latin America, Asia-Pacific, and Middle East and Africa. Asthma Drugs market is taken by North America owing to increasing numbers of patients suffering from the asthma diseases, advanced healthcare infrastructure, favorable government policies, and growing ageing population U.S. of the North America. Addition to this, presence of leading players in the region along with strategies that are implemented by the major players in the countries of North America is expected to witness substantial growth in the target industry in the near future.

Asia Pacific is likely to list the noteworthy CAGR, on account of growth in the demand for the asthma drugs in emerging economies owing growing prevalence. Also, most of the key players operating in the industry are investing heavily in order to get the competitive edge in the asthma drugs market in Asia Pacific. Further, the Latin America as well as Middle East and Africa regions will likely to register moderate growth in the coming.

Increasing prevalence of asthma and growth in the old age population are driving factors for the growth of asthma market. Ongoing R&D activities and technological advancements can create lucrative growth opportunities for the key players operating in the global asthma drugs market. High costs associated with the research and development of the asthma drugs is key factor hampering growth of the global market. Key players operating in the target market are focusing on the technological advancements as well as research and developments in order to produce low cost drugs. Increasing launches of pipeline drugs and strategic developments by the major players are creating numerous growth prospects in the target industry.

| Report Highlights | Details |

| Market Size in 2025 | USD 26.49 Billion |

| Market Size by 2034 | USD 41.04 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 5.01% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Medication, Mode of Administration, Organization Type, Application |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

| Companies Mentioned | GlaxoSmithKline, Pfizer, Vectura Group, Boehringer Ingelheim, Roche, Novartis, Merck, AstraZeneca, Teva Pharmaceutical |

Prevalence of asthma across the globe

The rising incidence of chronic respiratory conditions like asthma worldwide is one of the key factors propelling this market. Since asthma is thought to be the most prevalent chronic illness in the world, there is a special need for cutting-edge treatments for the condition. The prescription of asthma treatment medications is necessary since severe asthma is a very incapacitating condition that is more prevalent in those with it. Therefore, it is anticipated that the growing demand for improved quality of life for individuals receiving treatment for asthma would further propel market expansion.

High cost of drugs

Many patients may find the high cost of asthma medications and treatment alternatives to be unaffordable, especially in areas with low incomes. This financial obstacle prevents patients from accessing essential treatments, which results in less-than-ideal asthma control and perhaps increased long-term medical expenses because of exacerbations and hospital stays.

Collaboration among various stakeholders

Partnerships among pharmaceutical firms, academic institutions, and medical professionals can hasten the creation of innovative treatments and enhance patient outcomes. Innovative developments in asthma treatments may result from joint ventures and strategic alliances centered on research, clinical trials, and data exchange. Companies may stand out in the competitive asthma treatment market by concentrating on patient-centric strategies, such as solving unmet requirements, increasing accessibility to medications, and improving patient experience. Loyalty and trust may be increased by creating resources and support programs for patients and caregivers.

The quick relief medications segment held the largest share of the asthma drugs market in 2023. Quick relief medications, such as short-acting beta-agonists (SABAs) like albuterol, provide rapid relief from asthma symptoms such as wheezing, chest tightness, and shortness of breath. Their fast-acting nature makes them essential for managing acute asthma attacks. Quick relief medications are often recommended as the first-line treatment for acute asthma symptoms and exacerbations. They are the go-to medications during asthma attacks to provide immediate relief and prevent worsening of symptoms.

The inhalers segment held the largest share of the asthma drugs market in 2023 and the segment is observed to sustain the position throughout the forecast period. Inhalers are compact, portable, and easy to use, making them convenient for asthma patients to carry with them wherever they go. This allows patients to have quick access to their medication whenever they experience symptoms or asthma exacerbations. Inhalers deliver medication directly to the lungs, bypassing the digestive system and minimizing systemic side effects commonly associated with oral medications. This targeted delivery helps to reduce the risk of adverse reactions and improves the safety profile of asthma drugs.

The public segment led the asthma drugs market in 2023. Public organizations are responsible for managing healthcare infrastructure, including hospitals, clinics, and public health programs. They ensure the availability and accessibility of asthma drugs to patients through government-funded healthcare services and distribution networks. Public organizations collaborate with pharmaceutical companies, academic institutions, and research organizations to conduct clinical trials, advance scientific research, and develop innovative asthma treatments. These collaborative efforts drive drug discovery and development in the asthma therapeutics market.

The adults segment dominated the asthma drugs market in 2023. Asthma is a chronic respiratory condition that often persists into adulthood. The prevalence of asthma tends to be higher among adults compared to children, leading to a larger patient population in the adult segment. As the global population ages, the proportion of adults with asthma is increasing. Older adults may develop asthma later in life or have existing asthma that requires ongoing management with medication.

By Medication

By Mode of Administration

By Organization Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

January 2025

January 2025

July 2024