January 2025

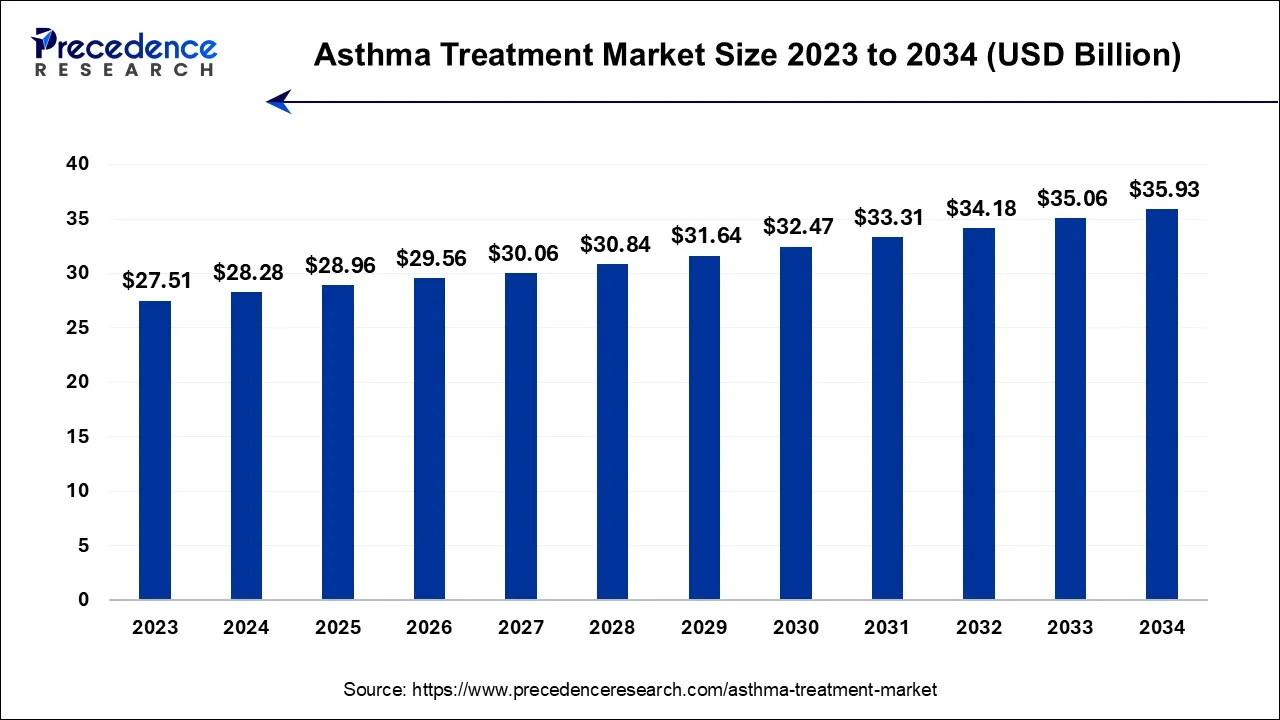

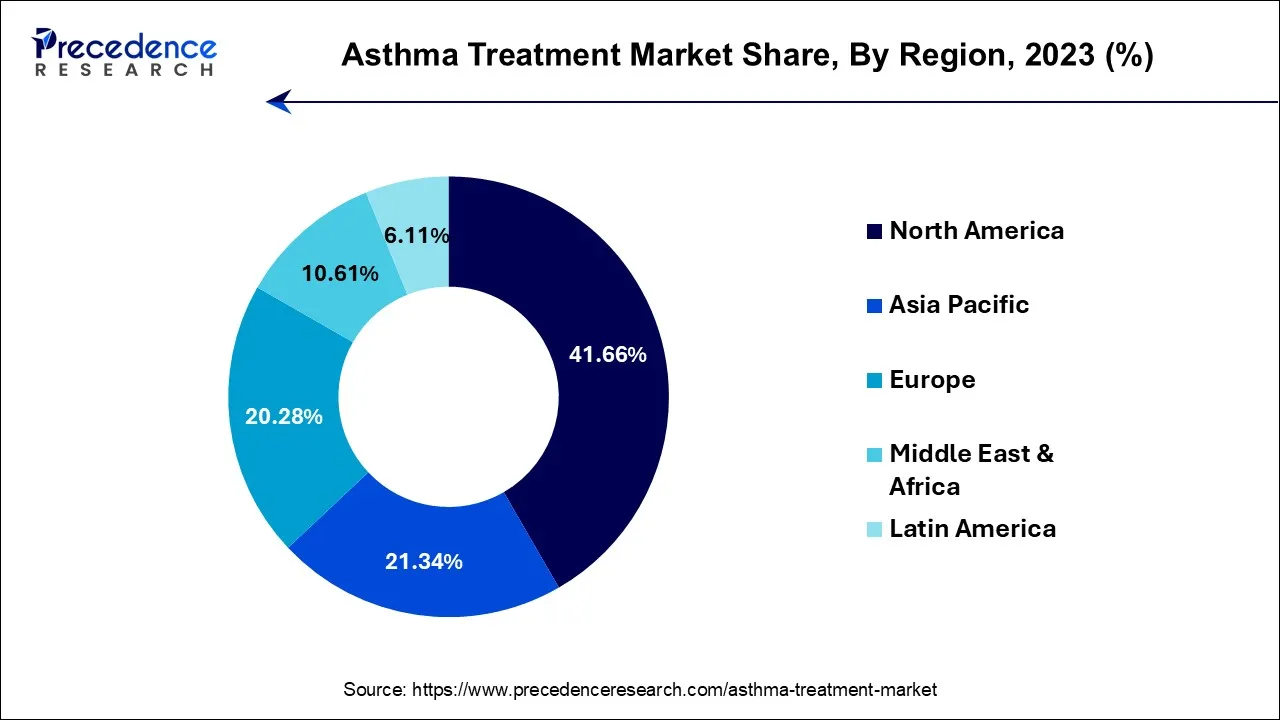

The global asthma treatment market size is calculated at USD 28.28 billion in 2024, grew to USD 28.96 billion in 2025, and is predicted to hit around USD 35.93 billion by 2034, poised to grow at a CAGR of 2.42% between 2024 and 2034. The North America asthma treatment market size accounted for USD 11.71 billion in 2024 and is anticipated to grow at the fastest CAGR of 1.88% during the forecast year.

The global asthma treatment market size is expected to be valued at USD 28.28 billion in 2024 and is anticipated to reach around USD 35.93 billion by 2034, expanding at a CAGR of 2.42% over the forecast period from 2024 to 2034. The rising prevalence of asthma due to increasing levels of pollution is expected to augment the growth of the market.

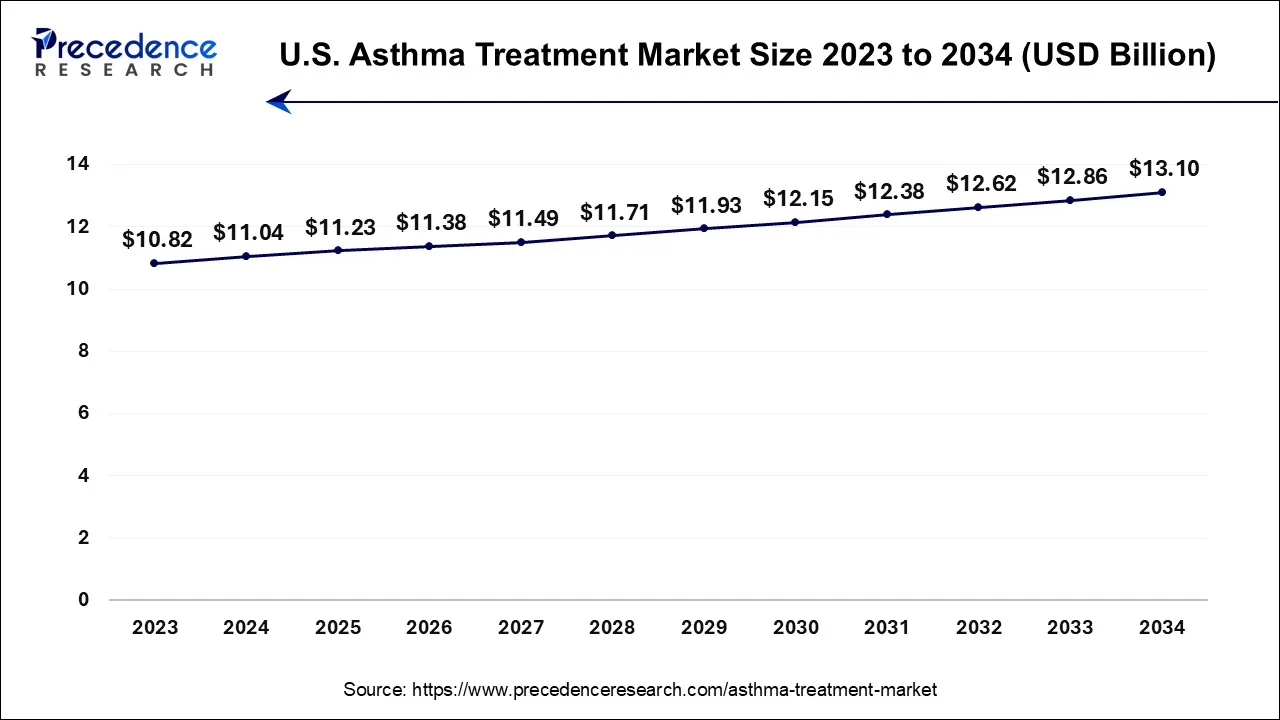

The U.S. asthma treatment market size is accounted for USD 11.04 billion in 2024 and is projected to be worth around USD 13.10 billion by 2034, poised to grow at a CAGR of 1.73% from 2024 to 2034.

U.S.

In 2018, 24.8 million Americans, or 7.7% of the population, had ever been diagnosed with asthma and reported that they still had asthma. Current asthma prevalence rates increased at a statistically significant average rate of 0.1 points per year from 2001 to 2010. Between 2010 and 2018, the average annual change was statistically insignificantly different and remained flat.

Asthma is linked to a variety of factors, including gender, race, ethnicity, and socioeconomic level, with males experiencing the condition at a higher rate than girls in childhood. In maturity, the trend reverses, with more women than males suffering from asthma. Race and ethnicity have a substantial impact on prevalence rates. When compared to any other racial or ethnic group in the United States, Puerto Ricans have the highest rate of asthma prevalence. In addition, black Americans are diagnosed with asthma at a higher rate than white Americans.

Canada

Asthma is a chronic lung illness that causes airflow restriction in the lungs, making breathing difficult for almost 3.8 million Canadians. It is Canada's third most frequent chronic condition. Many environmental variables provoke asthma symptoms, which include shortness of breath, chest tightness, wheezing, and coughing, all of which narrows the airways (bronchial tubes). Every day, almost 300 Canadians are diagnosed with asthma, and around 250 Canadians die as a result of an asthma attack.

For good asthma management and symptom control, timely access to quality health care, treatment, and education is critical. Despite this, over half of respondents (44%) said their current drug coverage is insufficient, and 24% said they have avoided filling a prescription because they couldn't afford it. Although family doctors, pediatricians, and emergency room doctors are more likely to diagnose asthma (63%) than asthma specialists (23%), the primary source of care and management for those living with asthma remains a family doctor or pediatrician (52%) followed by an asthma specialist (23%). Access issues, wait times to see a specialist, a lack of information and education on managing asthma, as well as referrals and follow-up following emergency care, are all top needs in our community. In a pandemic, this can be much more difficult and concerning, given the influence that heightened safety procedures, as well as the worry and dread associated with COVID-19, have on patients seeking treatment.

The poll also revealed that people's perceptions of asthma control differ significantly from the clinical definition of control. Even during a worldwide pandemic, this can be a substantial impediment to optimizing asthma management. Although 83 percent of respondents believe their asthma is moderate to very well controlled (up from 63 percent during COVID-19), 59 percent report difficulty sleeping as a result of asthma symptoms, and 71 percent avoid exercise or physical activities as a result of asthma symptoms. Improved access to affordable drugs, reliable testing, and diagnosis, and early diagnosis and care can all help people with asthma live a better life.

There has been a strong relation established between psychological disorders and its impact on asthma. The increasing occurrence of psychological disorders is expected to trigger asthma in patients, especially for those whose ailment in severely undertreated. This is expected to drive the global market growth. However, studies have found that there is a severe lack of adherence to asthma treatment, especially, in underdeveloped countries and an array of unmet needs. These factors are expected to hamper the market growth. Nonetheless, biologics for asthma management are expected to open new growth opportunities.

The global asthma treatment market is consolidated with the top 5 companies accounting for 75 percent of the total market share in 2020. The global market was dominated by GSK, AstraZeneca, Sanofi-Aventis, Boehringer Ingelheim, and Teva. The corporations have been concentrating their efforts on product development and regulatory approval. In addition, the companies sell asthma medications as well as accessories such as inhalers.

Increasing air pollution triggering asthma cases

Air pollution may impact DNA associated with asthma

Rising prevalence of psychological disorders to impact asthma in patients

Exposure to coarse particulate matter linked with asthma in children

Biologics for asthma management to open new market opportunities

A biologic is a drug derived from the cells of a live organism, such as bacteria or mice, then tailored to target specific molecules in humans. Antibodies, inflammatory chemicals, and cell receptors are the targets for asthma. Biologics attempt to disrupt the processes that contribute to inflammation, which causes asthma symptoms, by targeting these molecules.

Patients who continue to experience symptoms despite taking normal daily controller drugs are given a biologic. Symptoms of poorly controlled asthma include recurrent hospital admissions, emergency room visits, or the need for oral steroids for exacerbations; waking up at night with difficulty breathing; requiring a fast-acting reliever medication, such as albuterol, several times a day or week; and requiring a fast-acting reliever medication, such as albuterol, several times a day or week. Before prescribing a biologic, clinicians should ensure that the patient is taking all of their other controller medications as prescribed, avoiding any potential triggers, and treating any other medical illnesses that may be exacerbating their asthma.

The main advantage of biologics has been a reduction in the number of asthma exacerbations, which includes ER visits, hospitalizations, and the need for oral steroids. Reduced asthma symptoms, lower dosages of other controller medications, and fewer missed school and work days are among the other advantages. Biologics have been found to improve asthmatic patients' quality of life. Some biologics have been reported to help people with severe asthma improve their lung function.

Currently, five biologics for asthma are approved: omalizumab, mepolizumab, reslizumab, benralizumab, and dupilumab, with numerous more in the works. Omalizumab is an antibody that targets IgE allergy antibodies. Mepolizumab, reslizumab, and benralizumab all target eosinophils, a type of cell that plays a role in allergic inflammation. Dupilumab is a monoclonal antibody that targets a receptor for two molecules that cause allergic inflammation. To determine which biologic might be best for treating asthma, a doctor will obtain screening tests such as blood work or environmental allergen skin prick testing. Except for reslizumab, omalizumab is approved for patients as young as six years old. All other biologics, except for reslizumab, are approved for individuals as young as twelve years old. Adults aged 18 and up are permitted to use Reslizumab.

Biologics have been proved in trials to be quite safe and have little side-effects. Although biologics are more expensive than other controller drugs, the price is likely to drop as demand grows, the introduction of new biologics, and manufacturing economies of scale are realized.

Based on medication, the long-term control medication segment accounted largest revenue share of 59.86% in 2023. Increasing prevalence of asthma is expected to drive the growth of this sector during the forecast period. The majority of people with asthma require one or more long-term controller medicines that must be taken daily, regardless of their symptoms or lack thereof. Regardless of their symptoms or lack thereof, the majority of persons with asthma require one or more long-term controller drugs that must be taken daily. Asthma exacerbations are prevented by a controller medication, which reduces chronic airway inflammation over time. The most prevalent type of asthma management medication is long-acting inhalers. They normally take a few days to a few weeks to start working, but you should notice that you need your rescue prescription less and less after that.

The quick-relief inhalers, also known as rescue inhalers, are short-term drugs that are used to treat acute asthma symptoms such as wheezing, chest tightness, shortness of breath, and coughing. A quick-relief inhaler should be carried by everyone with asthma. It could be the only treatment for:

Global Asthma Treatment Market, By Medication, 2020-2023 (USD Million)

| By Medication | 2020 | 2021 | 2022 | 2023 |

| Quick-relief medication | 9,792.80 | 10,292.20 | 10,681.80 | 11,044.40 |

| Long-term control medication | 14,796.40 | 15,482.20 | 15,997.30 | 16,467.10 |

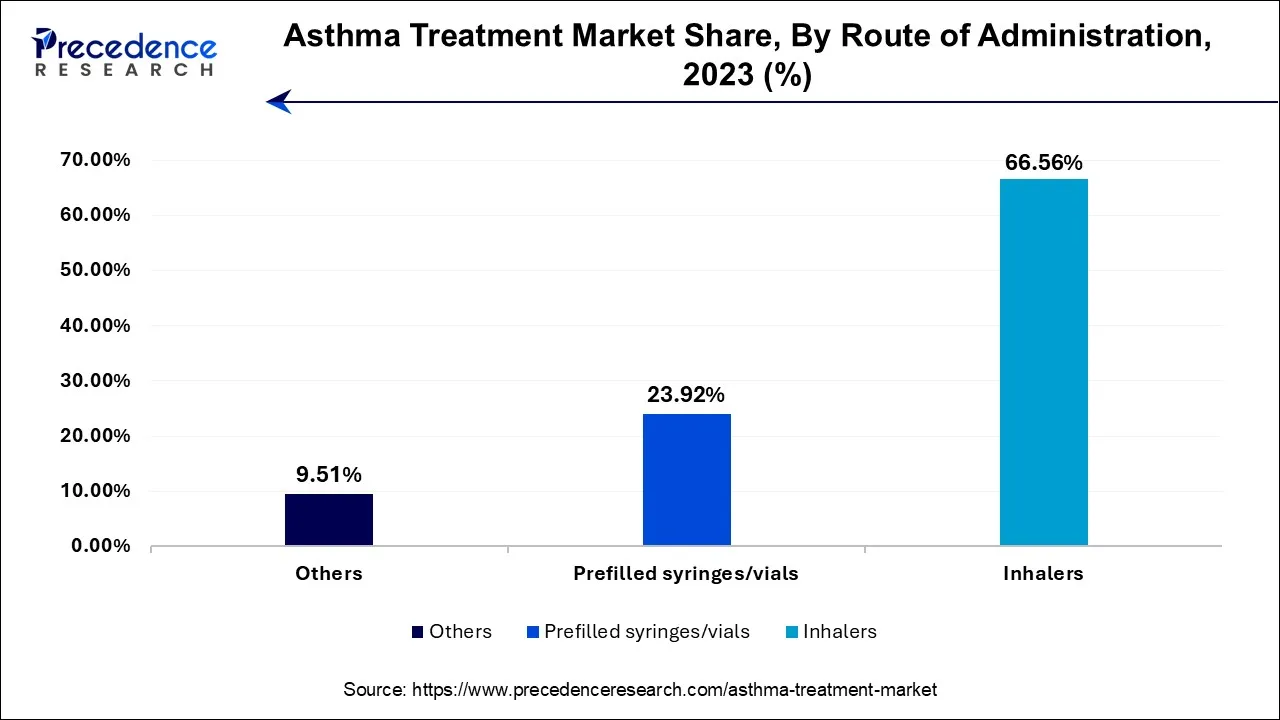

Asthma inhalers accounted for the largest market share of over 66.56% in 2023 and the trend is expected to continue during the forecast year. Asthma inhalers are the most common and effective way to get asthma medication into your lungs. However, the demand for prefilled syringe/vials is expected to outdo every segment during the forecast period.

The safety of prefilled syringes is expected to drive their demand. Additionally, the global spread of COVID-19 is pushing up demand for prefilled syringes and vials. Hospital pharmacies and retail pharmacies & drugstores together dominated the global asthma treatment market in 2020. However, the demand from online pharmacies has increased tremendously due to the lockdown across the world.

Global Asthma Treatment Market, By Route of Administration, 2020-2023 (USD Million)

| By Route of Administration | 2020 | 2021 | 2022 | 2023 |

| Inhalers | 17,279.70 | 17,794.00 | 18,088.70 | 18,313.00 |

| Prefilled syringes/vials | 4,838.20 | 5,436.50 | 6,005.10 | 6,582.10 |

| Others | 2,471.20 | 2,543.90 | 2,585.20 | 2,616.30 |

Based on adjunct therapy, the LABA (long-acting beta antagonists) segment garnered a market share of over 23.52% in 2023. This segments was valued at USD 6,469.5 million in 2023 and is projected to reach a CAGR of 3.26% during the forecast period 2024 to 2034.

Long-acting beta-agonists (LABAs) are bronchodilators with a 12-hour or longer duration of action. They are not used to treat acute asthma or asthma exacerbations and are only used as an add-on medication for symptom prevention. LABAs should only be used in combination with inhaled steroids, and they should only be used when a low dose of inhaled corticosteroids isn't enough to control symptoms.

Long-term asthma control is achieved with combination asthma inhalers. They combine two inhaled drugs: a corticosteroid and a long-acting beta-agonist (LABA). LABAs are bronchodilators that expand and open constricted airways to allow free passage of air. Corticosteroids suppress inflammation, while LABAs are bronchodilators that widen and open constricted airways to allow free flow of air. These drugs, when taken together, can reduce airway hyper responsiveness and help prevent asthma attacks.

Based on the Distribution Channel, the retail pharmacies & drug stores segment accounted largest revenue share 42.31% in 2023. Online pharmacies segment held the revenue share of 25.56% in 2023. The Internet has unquestionably had an impact on every part of our lives, including how we work, learn, and purchase. The recent global pandemic of COVID-19 has only strengthened the position of digital commerce, which has experienced rapid and sustained growth. The second COVID-19 wave has increased sales by 25-65% for online pharmacies in India. Similarly, While Czech and Slovak's citizens are no strangers to online shopping (70 percent of Czechs have made at least one online purchase in their lives and nearly 59 percent in the last 12 months; in Slovakia, 63 percent of citizens aged 16 to 74 made an online purchase in the last year), purchasing health-related products has been relatively limited in the Czech Republic. The sales of online pharmacies for asthma products are expected to increase tremendously over the next few years due to the continued prevalence of COVID-19. Asthma patients prefer ordering medications online due to the fear of being exposed to the virus as well as the dread of insufficient availability.

The hospital pharmacies segment was valued at USD 8,839.4 million in 2023 and is projected to reach a CAGR of 1.67% during the forecast period 2024 to 2034. Hospital pharmacy sales have been impacted by the COVID-19 pandemic. In certain cases, patients with controlled asthma visited hospital pharmacies at a lower frequency than where asthma was not controlled. Furthermore, breathing complications associated with coronavirus patients boosted hospital pharmacy sales.

Global Asthma Treatment Market, By Distribution Channel, 2020-2023 (USD Million)

| By Distribution Channel | 2020 | 2021 | 2022 | 2023 |

| Online pharmacies | 6,165.10 | 6,503.70 | 6,775.00 | 7,030.70 |

| Hospital pharmacies | 8,114.40 | 8,430.80 | 8,649.40 | 8,839.40 |

| Retail pharmacies & drug stores | 10,309.70 | 10,839.90 | 11,254.70 | 11,641.30 |

Market Segmentation

By Medication

By Route of Administration

By Adjunct Therapy

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

July 2024