April 2025

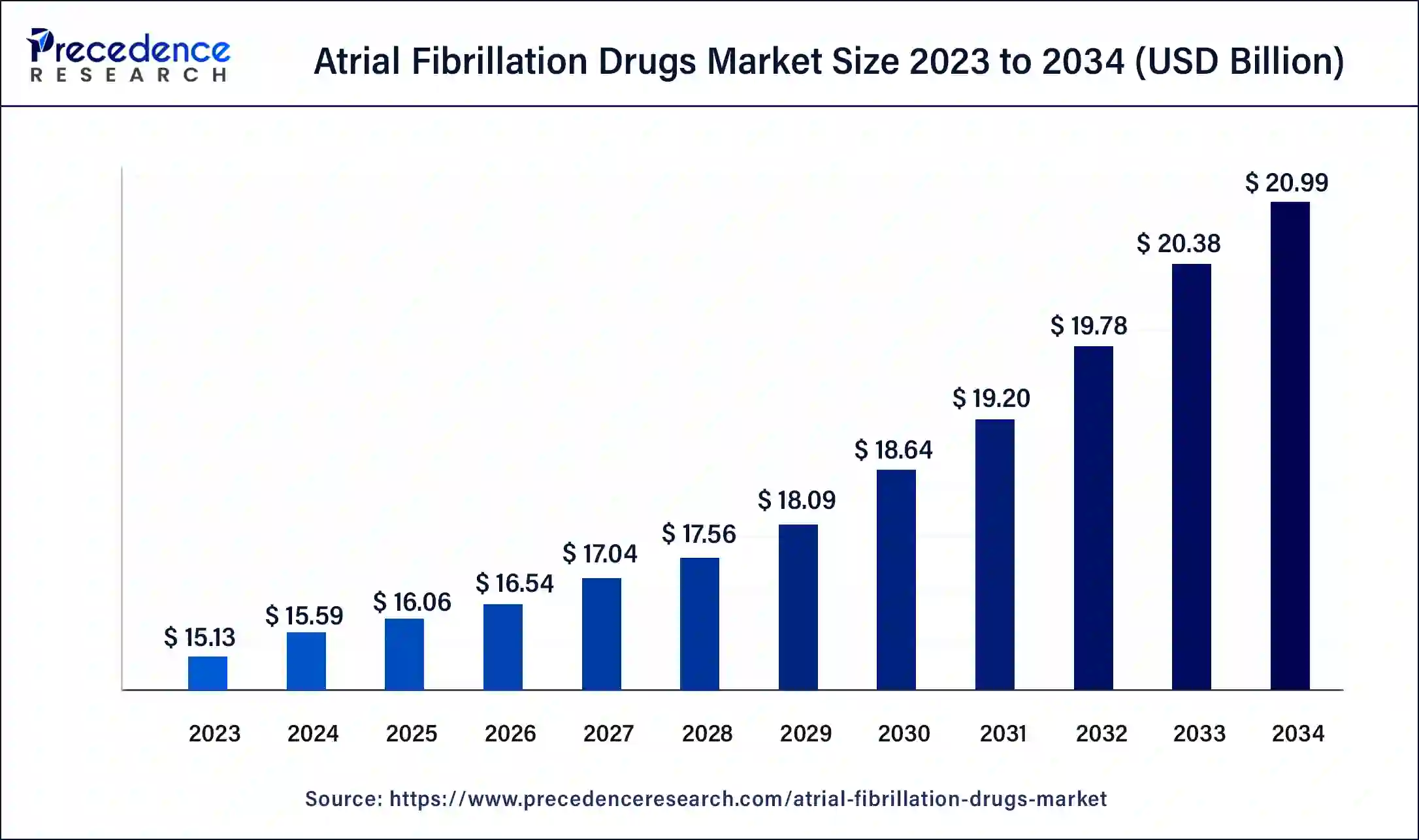

The global atrial fibrillation drugs market size was USD 15.13 billion in 2023, calculated at USD 15.59 billion in 2024 and is expected to be worth around USD 20.99 billion by 2034. The market is slated to expand at 3.02% CAGR from 2024 to 2034.

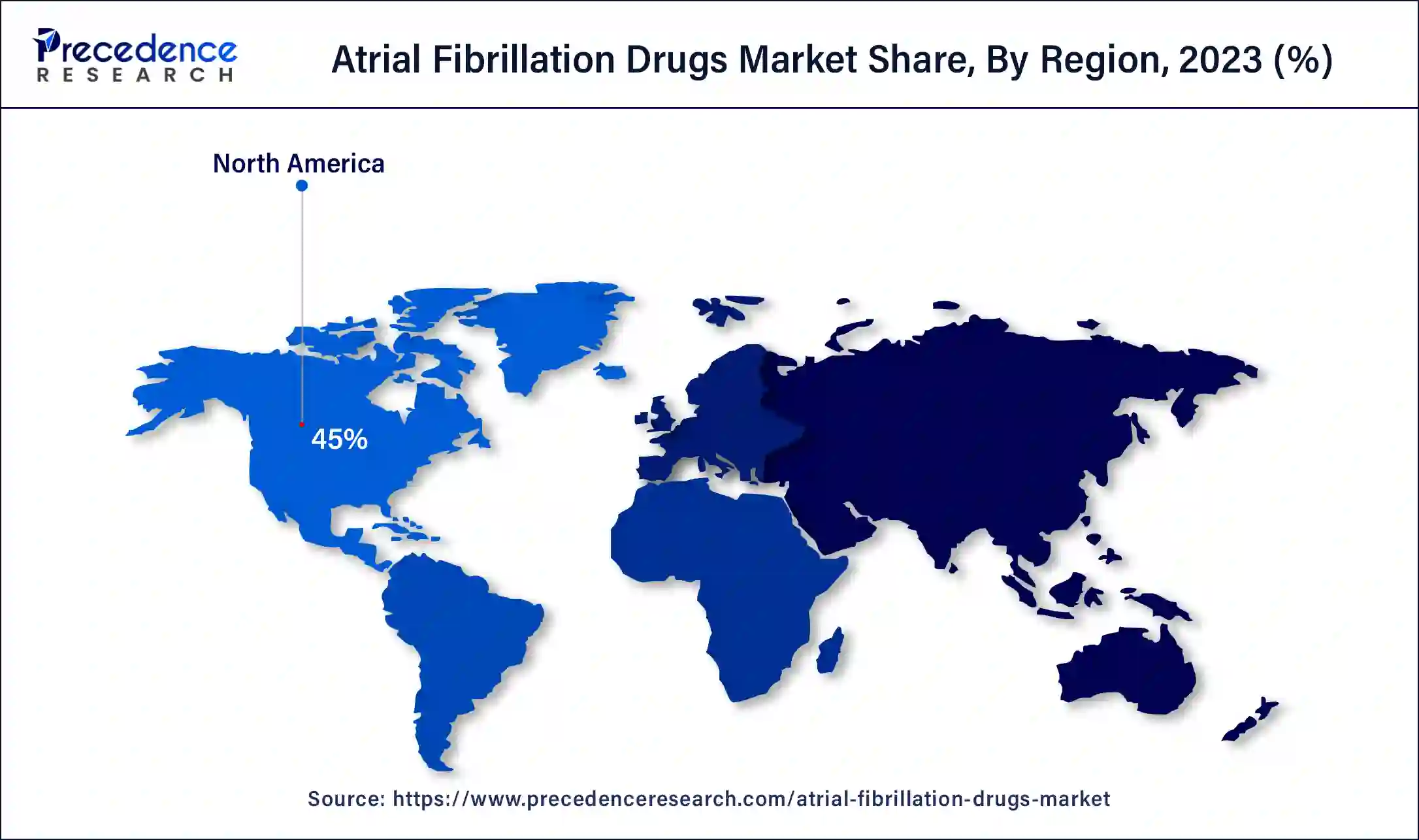

The global atrial fibrillation drugs market size is expected to be valued at USD 15.59 billion in 2024 and is anticipated to reach around USD 20.99 billion by 2034, expanding at a solid CAGR of 3.02% over the forecast period 2024 to 2034. The North America atrial fibrillation drugs market size reached USD 25.88 billion in 2023. The increasing demand is due to high incidences of AF, a growing population of elderly, an improved health care system, and better diagnosis and management of the disease are driving the atrial fibrillation drugs market.

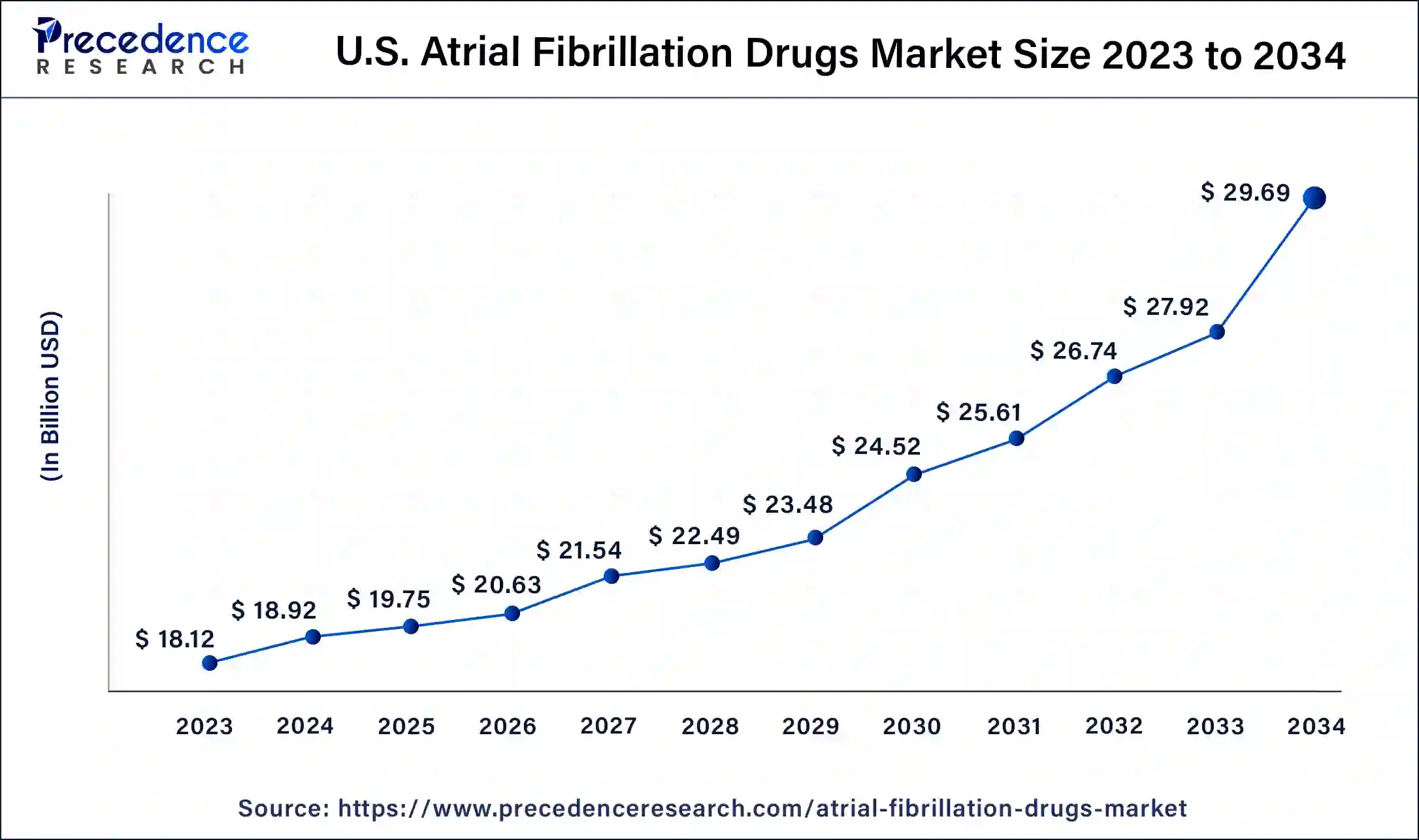

The U.S. atrial fibrillation drugs market size was exhibited at USD 18.12 billion in 2023 and is projected to be worth around USD 29.69 billion by 2034, poised to grow at a CAGR of 4.59% from 2024 to 2034.

North America led the global atrial fibrillation drugs market in 2023, owing to the strong healthcare industry of the region, high spending on healthcare, and the availability of modern technological facilities, which add to the dominating market of this region. The incidence of atrial fibrillation is rather high, and it is most prevalent in elderly patients, thereby increasing the market’s potential for drug and therapeutic solutions.

Asia Pacific is anticipated to grow notably in the atrial fibrillation drugs market during the forecast period due to factors such as the rising occurrence of atrial fibrillation and the aging population escalating the high rate of AF patients and the need for treatment. This region also has an increasing patient population with chronic diseases, i.e., hypertension and diabetes, which are associated risk factors for AF.

Countries, including China, India, and Japan, are expected to focus on enhancing the healthcare facilities and availability of various elevated procedures and other specialized services, such as specialized clinics and cardiac centers.

Atrial fibrillation (AF) is the most common type of cardiac arrhythmia. It is the top cardinal cause of stroke. Risk factors of AF include age, hypertension, heart and lung disorders, congenital heart disease, and excessive alcohol intake. While atrial fibrillation may be a lifelong condition, certain treatments and risk-reducing approaches were designed to prevent the worsening of the condition or to prevent the development of a stroke in patients.

Treatments for atrial fibrillation include medicines to control heart rate and reduce the risk of stroke and procedures to restore normal heart rhythm. Treatments include rate control medication, cardioversion, ablation, rhythm control medication, anticoagulation, and other interventional cardiac procedures.

Common Medications for Atrial Fibrillation

| Heart Rate Medications | Beta-blockers | Acebutolol, Atenolol, Betaxolol, Labetalol, Bisoprolol, Carvedilol, Metoprolol tartrate, Pindolol |

| Heart Rhythm Medications | Sodium channel blockers | Disopyramide, Mexiletine, Quinidine |

| Blood Thinners to Prevent Clots and Stroke | Anticoagulant drugs | Non-vitamin k oral anticoagulants Dabigatran, Edoxaban, Rivaroxaban Injectable anticoagulants include: Enoxaparin (Lovenox), Dalteparin (Fragmin), Fondaparinux (Arixtra) |

How is AI Changing the Atrial Fibrillation Drugs Market?

Identifying atrial fibrillation at an early stage prevents other cardiac complications, such as strokes and other related heart problems, and is a crucial step in the atrial fibrillation drugs market. In addition, AF and AI research is a fast-growing field in healthcare research and development. Specifically, Eden et al. developed an AI that will forecast atrial fibrillation within 31 days with the sinus rhythm ECGs of outpatients. AF is a well-known stroke cause. It prevails in millions of participants and is often difficult to identify. This strategic model of presenting clinical artificial intelligence solutions for physicians enables the capability to predict cardiovascular diseases and conditions.

| Report Coverage | Details |

| Market Size by 2034 | USD 20.99 Billion |

| Market Size in 2023 | USD 15.13 Billion |

| Market Size in 2024 | USD 15.59 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.02% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Products, Atrial Fibrillation Type, Route of Administration, Application, End-use Hospitals, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increase in incidence of cardiovascular diseases

Atrial fibrillation is a common cardiac arrhythmia that is associated with an increased risk of cardiovascular disease. Thus, an increasing prevalence of cardiovascular conditions drives the atrial fibrillation drugs market. It has been noted that there has been an increasing number of people with atrial fibrillation. The probability of a stroke is five-fold higher in patients who have already been diagnosed with atrial fibrillation compared with the general population.

Atrial fibrillation is the most common and worrisome cardiac arrhythmia that is known to have a poor prognosis because of the higher risks of stroke and death. While formerly anticoagulation therapy for cardiovascular diseases has always been related to the presentation of AF, growing data shows high rates of the disease in patients with non-cardiovascular disorders like cancer, sepsis, chronic obstructive pulmonary disease, obstructive sleep apnea, and chronic kidney disease.

Comorbidities Associated with Atrial Fibrillation

Side effects are a concern in the atrial fibrillation drugs market because their consequences affect patient safety and outcomes significantly. Some of the drugs prescribed to treat AF include anticoagulants and antiarrhythmic drugs, which may cause side effects such as a high risk of bleeding, gastrointestinal disorders, renal/ hepatic problems, or other dysfunctions. These are distributed with the following by the pharmaceutical industry: regulatory scrutiny, pharmacovigilance, and constant research for safer drugs. These are important to enhance patients’ outcomes and address challenges arising from the management of AF.

Blood thinners have several possible side effects. These include

Personalized management of atrial fibrillation

The continuous changes in the management of AF are a good opportunity to improve the care of the patients by developing better treatment plans in the atrial fibrillation drugs market. Perhaps the most significant advantage is that clinicians can offer treatments that are even more accurate by validating parameters, which include the type of AF presentation, clinical factors, ECG analysis, and cardiac imaging. This marks the potential for further inclusion of these new biomarkers to improve patient-specific management strategies responsive to the specific pattern exhibited by each individual.

The anticoagulant drugs segment accounted for the biggest share of the atrial fibrillation drugs market in 2023. Anticoagulants, useful in managing atrial fibrillation patients, are used to minimize the formation of clots and thus decrease the likelihood of stroke. These are now preferred over warfarin for patients with nonvalvular atrial fibrillation.

The antiarrhythmic drugs segment is expected to witness significant growth in the atrial fibrillation drugs market during the forecast period. The most common type of atrial arrhythmia is called atrial fibrillation. With advancing age, the prevalence of AF rises, and more patients receive antiarrhythmic drugs (AADs), an antiarrhythmic medication that could be used in the treatment of AF and atrial flutter. It also has the potential to decrease the hospital readmissions of patients with high-risk AF.

The paroxysmal segment held the largest share of the atrial fibrillation drugs market in 2023. If recurrent AF reverts spontaneously, it is called paroxysmal AF. They last less than one week and, most times, do not require any treatment since they are temporary episodes. Many people experience influenza-like symptoms even during the short time of AF, and patients experiencing paroxysmal AF remain at increased risk of stroke compared to people without AF at all.

The persistent segment is expected to grow at the fastest rate in the atrial fibrillation drugs market over the forecast period. When AF continues, requiring either pharmacological or electrical conversion back to sinus rhythm, it is called persistent AF. The episodes last more than one week and generally require specialized treatment to either slow the heart rate down or restore the Afib to normal sinus rhythm. In this case, the episodes are more than seven days.

The oral segment dominated the global atrial fibrillation drugs market in 2023. Oral drug therapies have been the most prescribed drug therapies for deciding atrial strokes due to their efficacy in the prevention of clotting formation, which in turn fuel the market growth. These drugs are available in tablet or capsule forms, which may enhance patients' ability to stick to their prescriptions.

The injectable segment is estimated to grow significantly in the atrial fibrillation drugs market during the forecast period. Injectable drugs, such as low molecular weight heparins, for example, using enoxaparin or unfractionated heparin, are in a position to offer immediate anticoagulant necessities, normally in the hospital settings or for some circumstances of specific clients. Injectable options can either be subcutaneously or intravenously given, and professional staff can be required to give them. In most cases, they come with specific monitoring. Lanoxin is an injectable drug used to treat patients with atrial fibrillation, AF for short, and heart failure. It increases the force of the contraction of the heart and reduces the rate of rapid electrical activity in your heart.

The heart rhythm control segment generated the biggest share of the atrial fibrillation drugs market in 2023. The strategy of restoring rhythm control, either pharmacological or electrical, pharmacological or electrical is a condition, symptom status, age, and other comorbidities. Such strategies can include cardioversion and the administration of antiarrhythmic drugs (AADs), as well as catheter ablation.

The heart rate control segment is expected to grow significantly in the atrial fibrillation drugs market during the forecast period. For all the asymptomatic patients with AF, rate control is the best strategy. In many patients, rate control might be maintained for the long term, mainly where rhythm control is ineffective, not advised, or has no possibility of success. In many cases, simple and adequate rate control can effectively alleviate the symptoms related to atrial fibrillation. Rate control is very practical, requires a short time for initiation and monitoring, and no significant complications resulting from AF and related to the treatment have been observed.

The hospital segment dominated the global atrial fibrillation drugs market in 2023. This growth is due to high surgical procedures that are carried out within hospitals, immense focus on skilled personnel and appropriate surgical implements. Also, the increase in the prevalence of chronic diseases that cause more patients to be admitted to hospitals will help fuel this segment.

The cardiac center segment is anticipated to grow significantly in the atrial fibrillation drugs market during the forecast period. There are certain reasons behind it, such as the inclination towards surgeries in specialty clinics and the growing incidence of atrial fibrillation, which requires specialty care. These cardiac centers, with their specific focus and better technology, are much better placed to address this demand.

Segments Covered in the Report

By Products

By Atrial Fibrillation Type

By Route of Administration

By Application

By End-use Hospitals

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

March 2025

January 2025

March 2025