July 2024

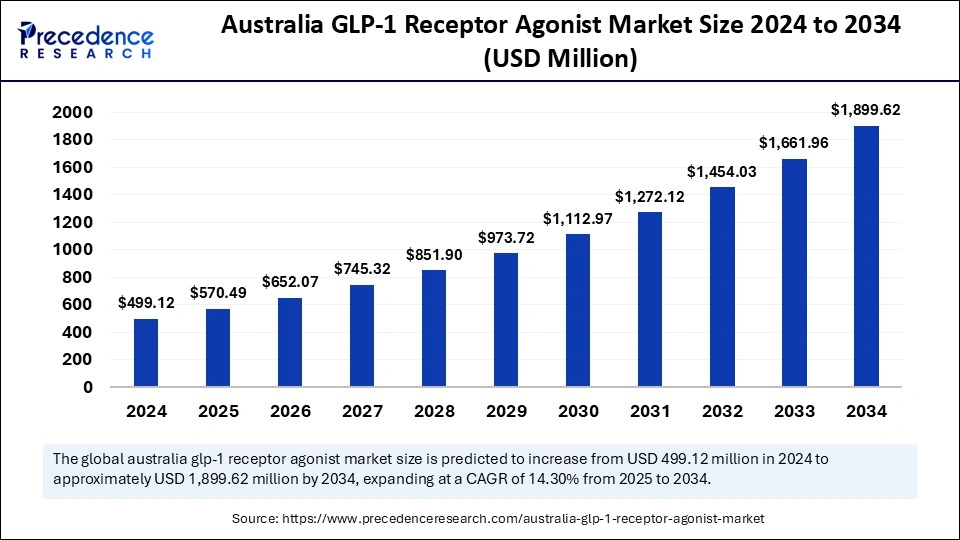

The Australia GLP-1 receptor agonist market size is calculated at USD 570.49 million in 2025 and is forecasted to reach around USD 1,899.62 million by 2034, accelerating at a CAGR of 14.30% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The Australia GLP-1 receptor agonist market size accounted for USD 499.12 million in 2024 and is predicted to increase from USD 570.49 million in 2025 to approximately USD 1,899.62 million by 2034, expanding at a CAGR of 14.30% from 2025 to 2034. The growth of the Australia GLP-1 receptor agonist market is driven by the rising demand for effective medications, the need for management of diabetes and obesity, ongoing clinical trials and increased research on developing long-term single-dose formulations.

Artificial Intelligence is widely being implemented for enhancing the development and applications of GLP-1 receptor agonists with the ultimate aim of better management of obesity and diabetes. AI algorithms can be applied for accelerating drug discovery and development processes like optimizing formulations and dosing strategies for existing drugs as well as for identifying novel compounds which includes plant-derived compounds. Development of personalized treatment strategies by analyzing patient data and prediction of treatment outcomes for enhanced patient selection and monitoring processes as well as tracking the side effects of GLP-1 receptor agonist (GLP-1 RA) therapies can be streamlined with the integration of AI.

Furthermore, AI and machine learning methodologies can be incorporated for real-world data analysis such as for surveying social media trends for better understanding of patient experiences and misconceptions about GLP-1 RAs, in identification of potential treatment barriers like insurance coverage limitations and concerns regarding side effects for developing targeted interventions and also in evaluation of treatment efficacy in real-world settings.

GLP-1 receptor agonists, also referred as incretin mimetics, represent a class of drugs that imitate the effects of the GLP-1 (glucagon-like peptide-1) which is a natural incretin hormone for lowering blood sugar levels and management of metabolism. These medications have several beneficial effects such as elevated insulin secretion, reduced glucagon secretion, delayed gastric emptying and increased satiety making them a suitable candidate for the treatment of type 2 diabetes and obesity.

The Australia GLP-1 receptor market growth is driven by the surging demand for safe and effective medications for type 2 diabetes and obesity management, rising investments in conducting clinical trials for developing combination therapies and long-term effective therapies, increased government efforts for addressing supply shortages and supportive regulatory frameworks.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,899.62 Billion |

| Market Size in 2025 | USD 570.49 Billion |

| Market Size in 2024 | USD 499.12 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.30% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, End Use, Distribution Channel |

Burgeoning demand for potent metabolic therapies

The rising cases of type 2 diabetes and obesity in Australia, growing trend of early diagnosis for timely interventions, changing lifestyles and the need for effective treatment strategies to lower the disease burden and improving patient health outcomes are boosting the demand for GLP-1 receptor agonists in Australia. Additionally, the benefits of GLP-1 RAs for treating diabetes as well as obesity and also expanded applications like cardiovascular disease management are paving the way for developing novel metabolic therapies. The ongoing advancements in creating innovative drug delivery techniques, long acting formulations and combination therapies to treat metabolic disorders with safe and effective therapies are driving the market expansion.

Supply shortages and compounding restrictions

Australia is facing widespread shortages of GLP-1 receptor agonists such as semaglutide (Ozempic) and dulaglutide (Trulicity), since late 2022 and has been a major issue which is due to growing demand surpassing production, further affecting type 2 diabetes care, cardiovascular risk reduction and weight management in patients. Additionally, the ongoing shortages of branded drugs made patients to shift towards compounding pharmacies providing their own version of drugs which made the government to impose compounding restrictions on GLP-1 receptor agonists (GLP-1 RA) owing to the lack of regulatory supervision of compounded versions and rising safety concerns for preventing serious adverse events and hospitalization of patients. These factors curb the market growth.

Government initiatives and increased research activities

Supportive government policies and initiatives for managing concerns regarding care of diabetes and obese patients as well as developing regulatory frameworks for developing effective and safe medications are boosting the market expansion. The need for addressing the Pharmaceutical Benefits Scheme (PBS) funding by the Australian government for type 2 diabetes and developing strategies for broadening its coverage for weight management patients with the development of cost-effective solutions in collaboration with manufacturers and formulating combination therapies can create opportunities for market growth.

Furthermore, the increased emphasis on expanding therapeutic applications of GLP-1 receptor agonists (GLP-1 RAs) with ongoing research activities in various fields for developing potential applications like in cardiovascular diseases for prevention and management of heart attacks and strokes, for reducing progression of chronic kidney disease (CKD), in neurodegenerative diseases as well as for anti-inflammatory and anti-infection effects are expected to drive the market growth.

The injectables segment dominated the market with the largest share in 2024. Injectable GLP-1 receptor agonists such as Ozempic (semaglutide), Mounjaro (tirzepatide) among others are widely utilized for treating type 2 diabetes and obesity owing to their demonstrated efficacy in lowering blood sugar levels and in managing weight.

Furthermore, increased research activities for developing innovative drugs and formulations, rising demand, ease of administration of injectables with immediate onset of action, availability of single-dose formulations in the market and utilization of social media platforms as well as celebrity endorsements for promoting GLP-1 receptor agonists are the factors boosting the market growth of this segment.

The oral GLP-1 receptor agonists market segment is anticipated to witness lucrative growth during the forecast period. The ease of administration and long-term management of diabetes and obesity with oral GLP-1 receptor agonist is driving their widespread adoption. The availability of Novo Nordisk’s Rybelsus which is an oral semaglutide with minimal gastrointestinal side effects and increased acceptability in Australia is expanding the market growth.

The type 2 diabetes management segment accounted for the largest market share in 2024. According to the State of the Nation 2024 report published by Diabetes Australia, there are 65,209 patients registered with the National Diabetes Services Scheme (NDSS), as of 31 March 2024. The increasing investments by private investors and government bodies for research purposes, focus on developing strategies for expanding health workforce, rising awareness and early detection programs for high-risk individuals, combination therapies for glycemic control, and stringent regulatory guidelines are the factors boosting the market growth of this segment.

The obesity and weight management segment is expected to grow at the fastest rate over the forecast period. The growing number of obese individuals due to several chronic disorders, changing lifestyle habits, rapid urbanization and digitalization fostering sedentary lifestyles. Additionally, surging demand for effective medications and therapies for weight management, growing research activities for developing combination therapies, increased awareness among the population for adopting healthy lifestyles and, rising investments by manufacturers and government bodies are the factors fostering the market growth of this segment.

The hospitals segment held the largest market share in 2024. The rising incidences of diabetes and obesity as well as other associated diseases such as cardiovascular diseases due to unhealthy and sedentary lifestyles, rapid urbanization, aging population and hereditary factors are driving the demand for advanced treatment and management solutions which are readily available at hospitals.

Furthermore, increased healthcare expenditure, demand for innovative therapies, growing awareness for early detection and diagnosis, supportive government initiatives and regulatory frameworks, access to expert healthcare professionals and, the proven efficacy and safety of GLP-1 receptor agonists for managing blood sugar and promoting weight loss are the factors fuelling the market dominance of this segment.

The homecare/direct-to-patient segment is expected to grow at the fastest rate during the forecast period. Surging demand for home healthcare services, advancements in telemedicine, progress of e-commerce sector facilitating home delivery of medications through online platforms, reduced costs with holistic care and increased adoption of digital biomarkers for continuous monitoring of patients at home are the factors expected to fuel the market growth of this segment in the upcoming years.

The retail pharmacies segment dominated the market with the largest share in 2024. The market growth of this segment is can be linked to rising demand for safe and effective medications for type 2 diabetes and obesity, growing awareness of patients, rising disposable incomes, increased availability of drugs through widespread retail pharmacy network, government policies such as Pharmaceutical Benefits Scheme (PBS) and customer preference of purchasing drugs from pharmacies.

The online pharmacies segment is expected to witness lucrative growth during the predicted timeframe owing to the increased availability of utilization of online platforms and applications providing essential medical delivery services to patients at their doorstep. Additionally, the online pharmacies provide variety of medications with increased focus on customer centric approach and at discounted prices are driving the market growth.

In December 2024, Vivani Medical Inc., a pioneering biopharmaceutical company, declared the initiation of its first-in-human clinical trial, LIBERATE-1 at two centers in Australia for investigating the safety, tolerability and complete pharmacokinetic profile of a miniature, GLP-1 (exenatide) implant through the NPM-115 clinical program. The company’s proprietary NanoPortal drug implant platform technology will be applied for the first time in this clinical study which focuses on treating obese and overweight individuals.

By Product Type

By Application

By End User

By Distribution Channel

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

August 2024