The global autoinjectors market size was USD 5.91 billion in 2023, calculated at USD 6.47 billion in 2024 and is projected to surpass around USD 16.05 billion by 2034, expanding at a CAGR of 9.5% from 2024 to 2034.

The global autoinjectors market size accounted for USD 6.47 billion in 2024 and is expected to be worth around USD 16.05 billion by 2034, at a CAGR of 9.5% from 2024 to 2034. The North America autoinjectors market size reached USD 24.10 billion in 2023.

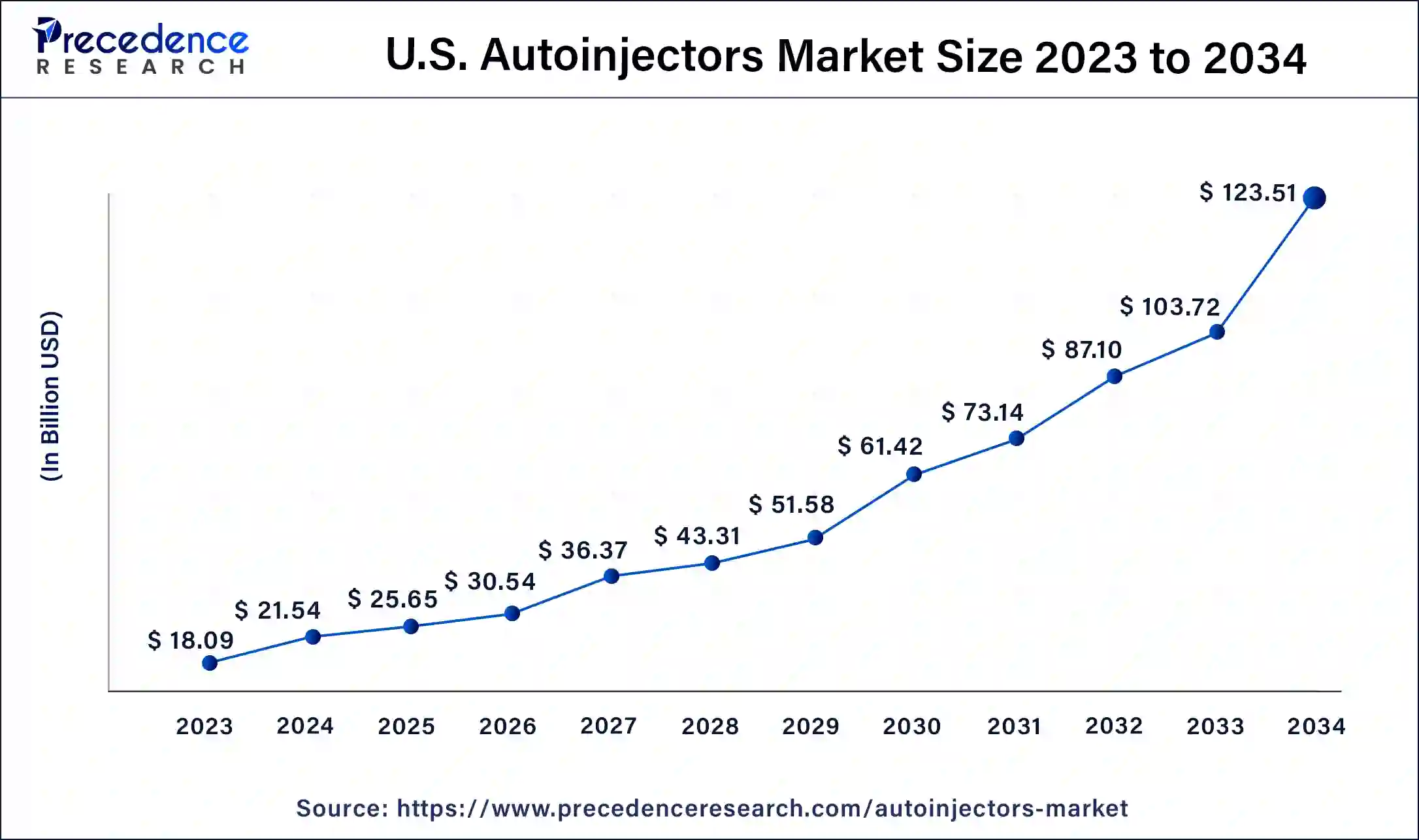

The U.S. autoinjectors market size was estimated at USD 1.77 billion in 2023 and is predicted to be worth around USD 4.82 billion by 2034, at a CAGR of 9.7% from 2024 to 2034.

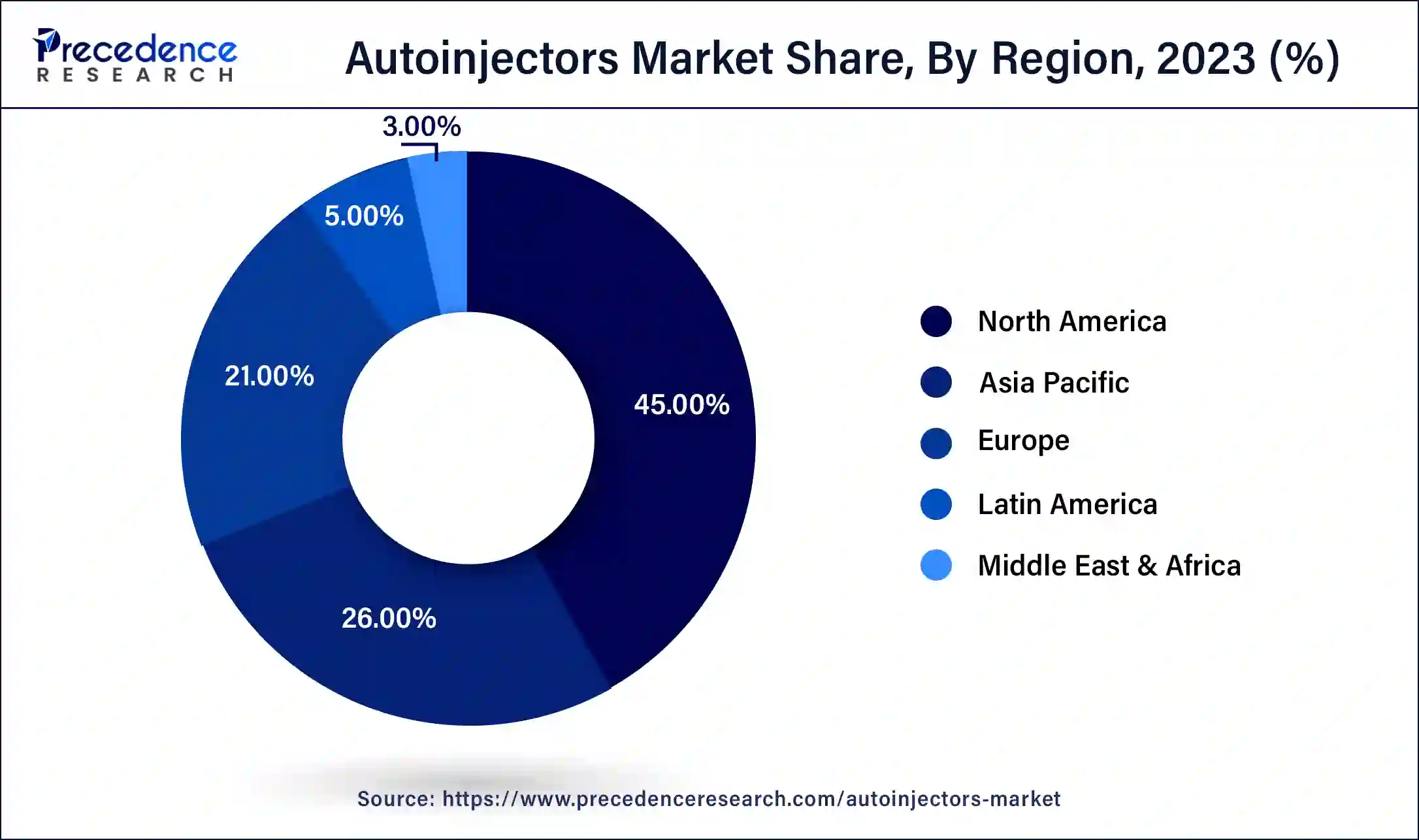

North America is the largest market for autoinjectors market, followed by Europe and the Asia Pacific. Factors such as the increased incidence of anaphylaxis and the availability of advantageous reimbursements are driving growth in the North American market. Furthermore, the United States and Canada are developed economies with high consumer awareness and the use of modern devices such as autoinjectors, which is favorable to market expansion. Other microeconomic elements that contribute to market growth include increased healthcare expenditures, a high rate of affordability, and an improving regulatory environment.

Asia-pacific is anticipated to be the fastest growing market during the forecast year. The huge diabetic population and rising healthcare expenditures in Asia Pacific region are driving the market expansion which in turn is attracting a number of key autoinjector device manufacturers to this region. The key players are increasingly expanding their presence in the Asia Pacific market in a variety of ways, including opening sales offices and forming partnerships with local pharmaceutical companies.

The growth of the autoinjectors market is majorly driven by the increasing prevalence of targeted therapies, the growing occurrence of anaphylaxis, increasing consumer preferences for self-administration of drugs, advantages of usability, the rising number of regulatory body approvals, the easy accessibility of generic autoinjectors, government assistance, and advantageous reimbursements, and advancement of technology and others.

Additionally, according to a study published in 2019 by the European Journal of Allergy and Clinical Immunology, global Overall anaphylaxis in children occurs at a rate of 1 to 761 per 100,000 person-years, while food-related anaphylaxis occurs at a rate of 1 to 77 per 100,000 person-years. Anaphylaxis is a severe, potentially fatal allergic reaction caused due to food, latex, Hymenoptera stings and medicines. Thus, the growing incidence of anaphylaxis is propelling the market growth.

Anaphylaxis is treated with epinephrine as the first line of defense. For anaphylaxis, pharmaceutical companies are developing technologically enhanced epinephrine autoinjectors (EAIs). This technological advancement includes portable devices, innovative designs, autoinjectors with two auto-injectable doses in one device, temperature-stabilized autoinjectors and longer shelf life for epinephrine, gadgets that alert patients when a dose has been administered effectively and others. Therefore, such technological advancements is expected to fuel the demand for autoinjectors in the upcoming years contributing towards the market growth.

| Report Coverage | Details |

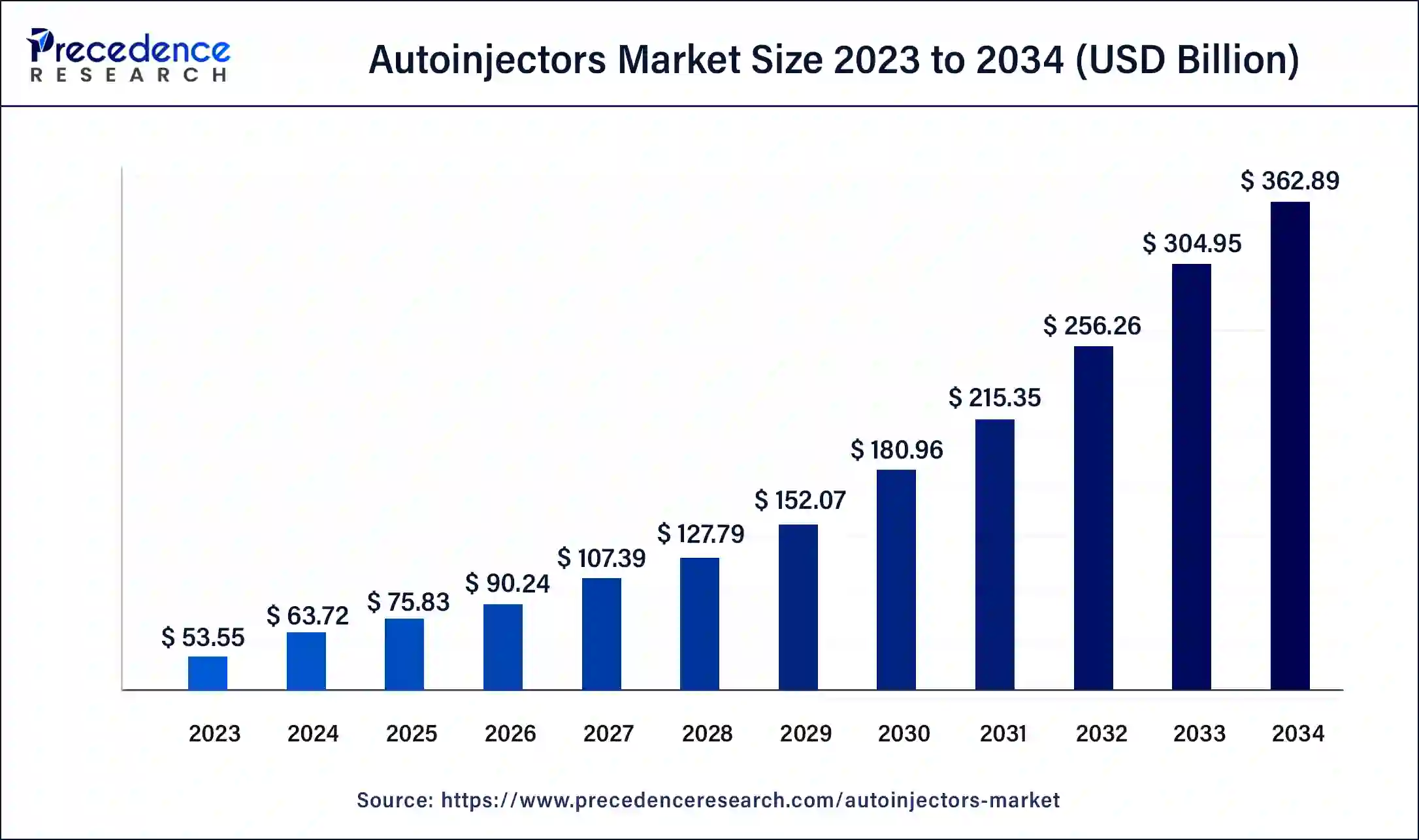

| Market Size in 2023 | USD 53.55 Billion |

| Market Size in 2024 | USD 63.72 Billion |

| Market Size by 2034 | USD 362.89 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 19% |

| Largest Market | North America |

| Fastest Growing Market | Asia-Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Therapy, Type, Route of Administration, Type of Molecule, and End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Based on therapy, the autoinjector market is divided into rheumatoid arthritis, anaphylaxis, diabetes, multiple sclerosis, multiple sclerosis, and others. In 2023, the rheumatoid arthritis segment accounted for the lion market share. This was majorly attributable to its high rate of occurrence globally. According to the CDC, arthritis, rheumatoid arthritis, gout, lupus, and fibromyalgia affect an estimated 43.7 million individuals (22.7 percent of the total population) in the United States each year. Thus, the growing incidence of rheumatoid arthritis propelling the demand for autoinjectors ultimately contributing towards the growth of the market.

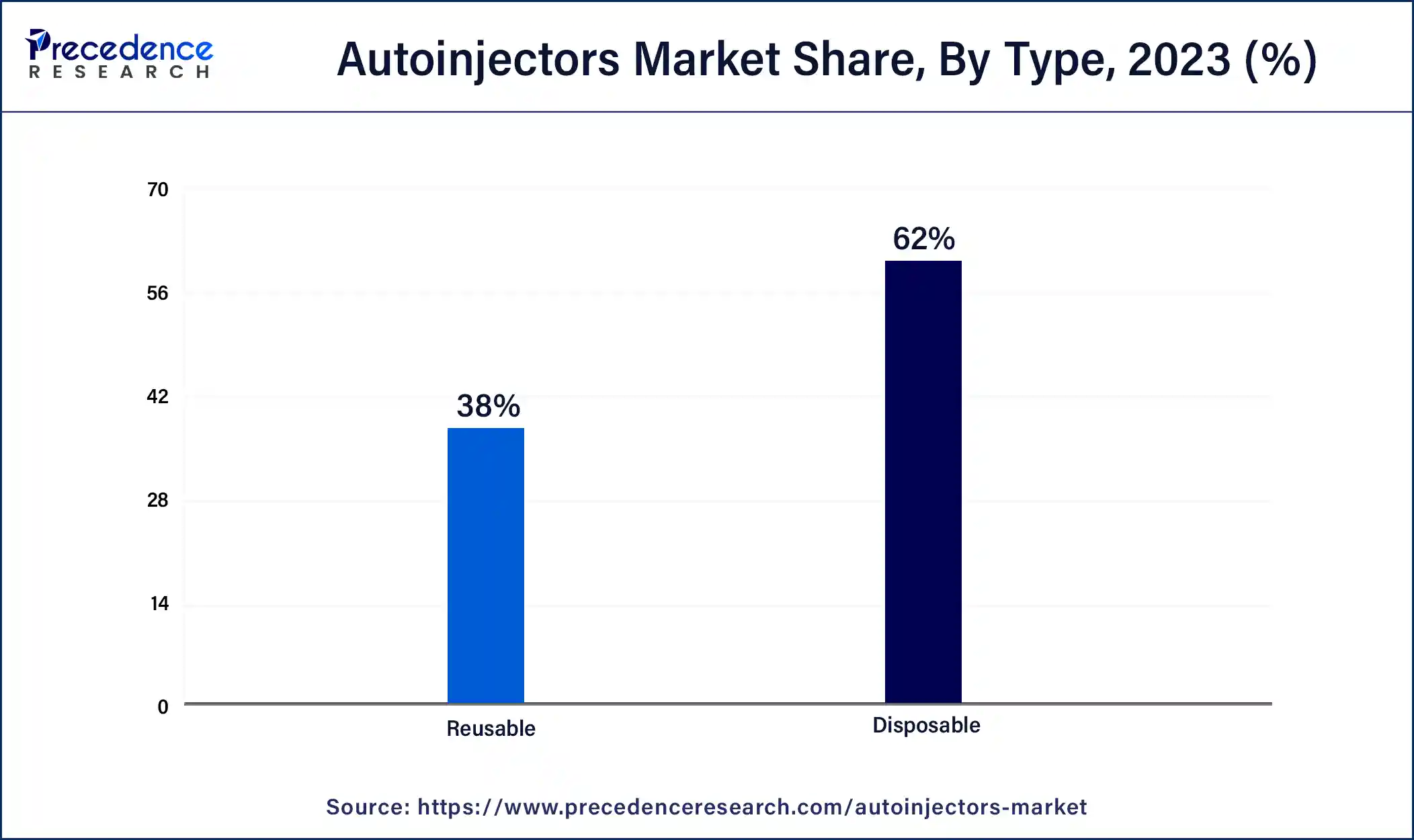

By type, the autoinjectors market is bifurcated into disposable and reusable autoinjectors. In 2023, the disposable autoinjectors segment accounted for the highest share of the autoinjectors market.

This is attributable to its ease of use and the existence of a built-in glass syringe (which eliminates the need to manually load a glass syringe), making it the most popular autoinjectors among patients with poor dexterity or visual impairments.

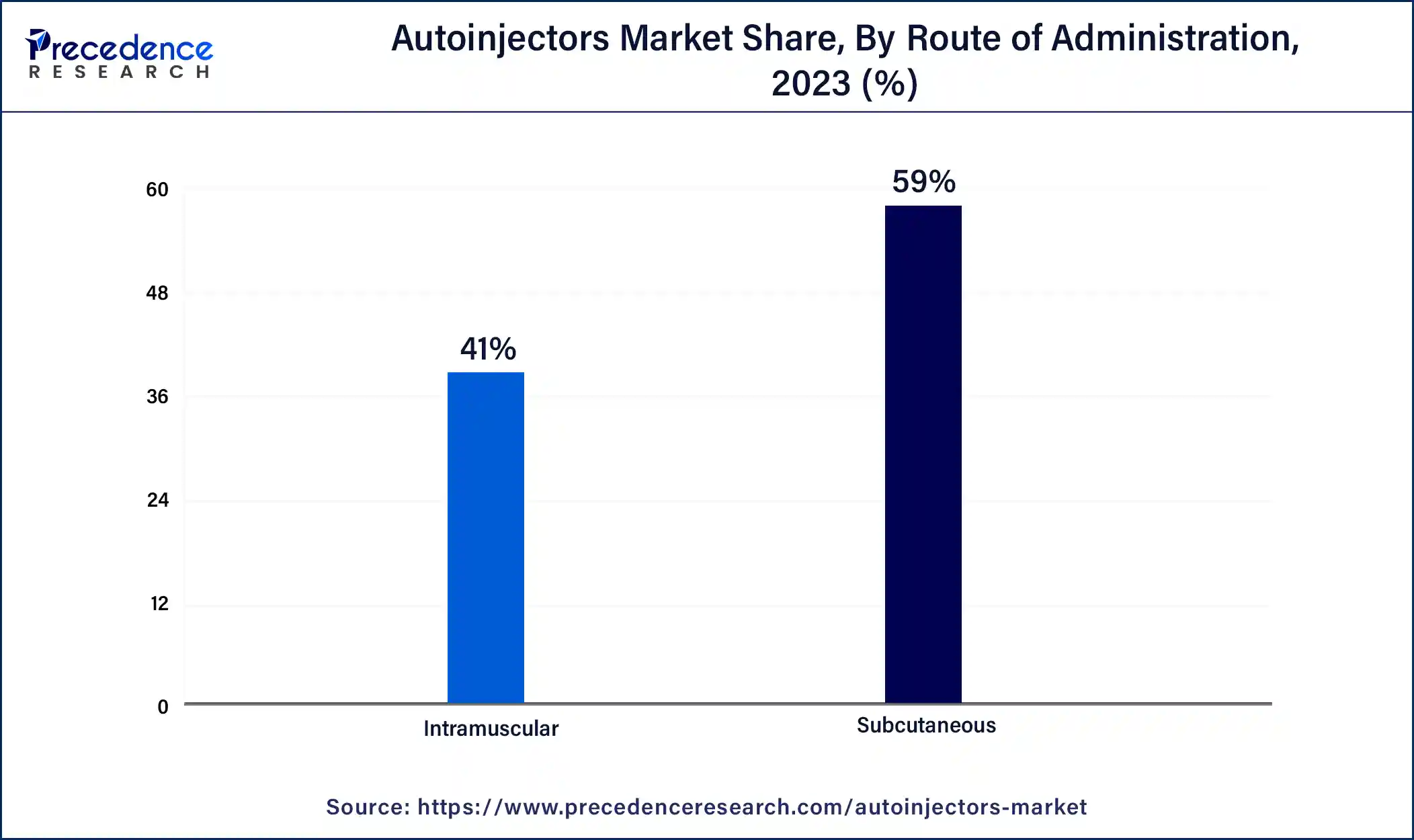

Based on the route of administration, the market is divided into subcutaneous and intramuscular. The subcutaneous segment accounted for the highest market share and is anticipated to be the fastest growing segment during the forecast period.

This is mainly attributable to the rising number of product acceptance by the regulatory bodies for chronic disease treatment.

Based on end users, the autoinjectors market is segregated into hospitals & clinics, ambulatory care settings and home care settings. The home care settings segment holds the largest market share in the year 2023, owing to the speedy growth in the aging population globally coupled with the growing demand for low-cost drug administration.

Segments Covered in the Report

By Therapy

By Type

By Route of Administration

By Type of Molecule

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client