July 2024

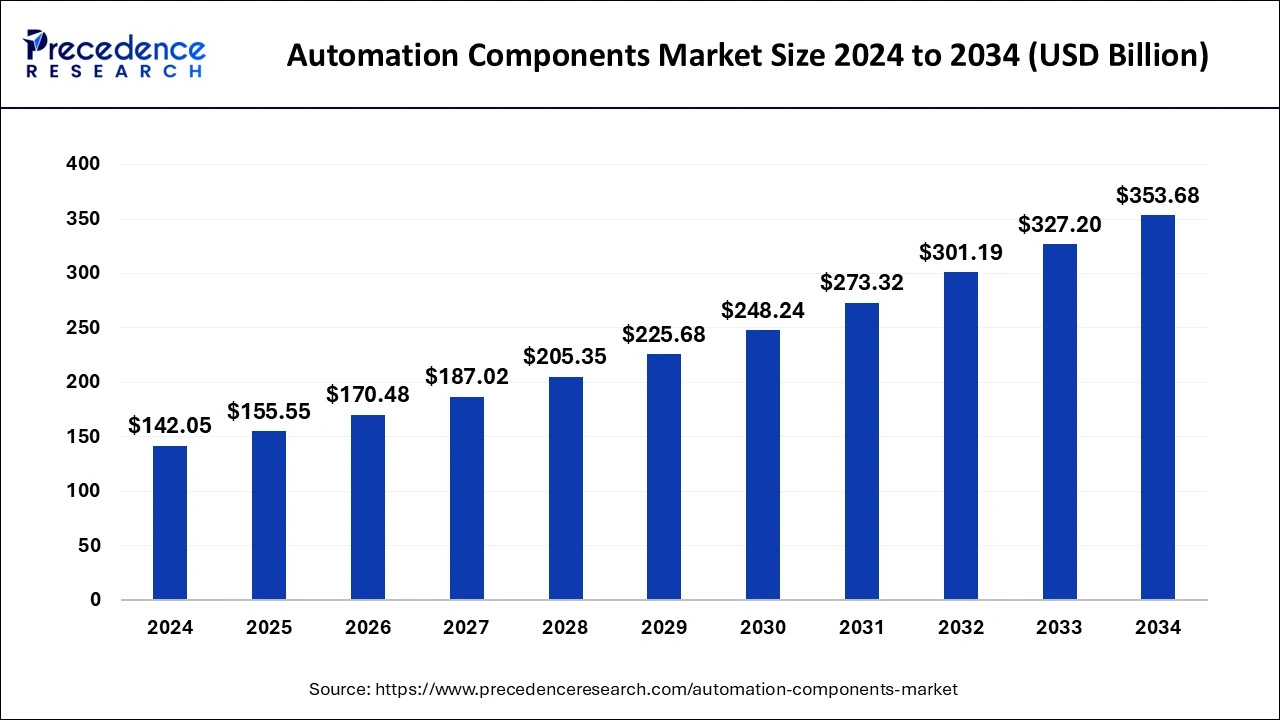

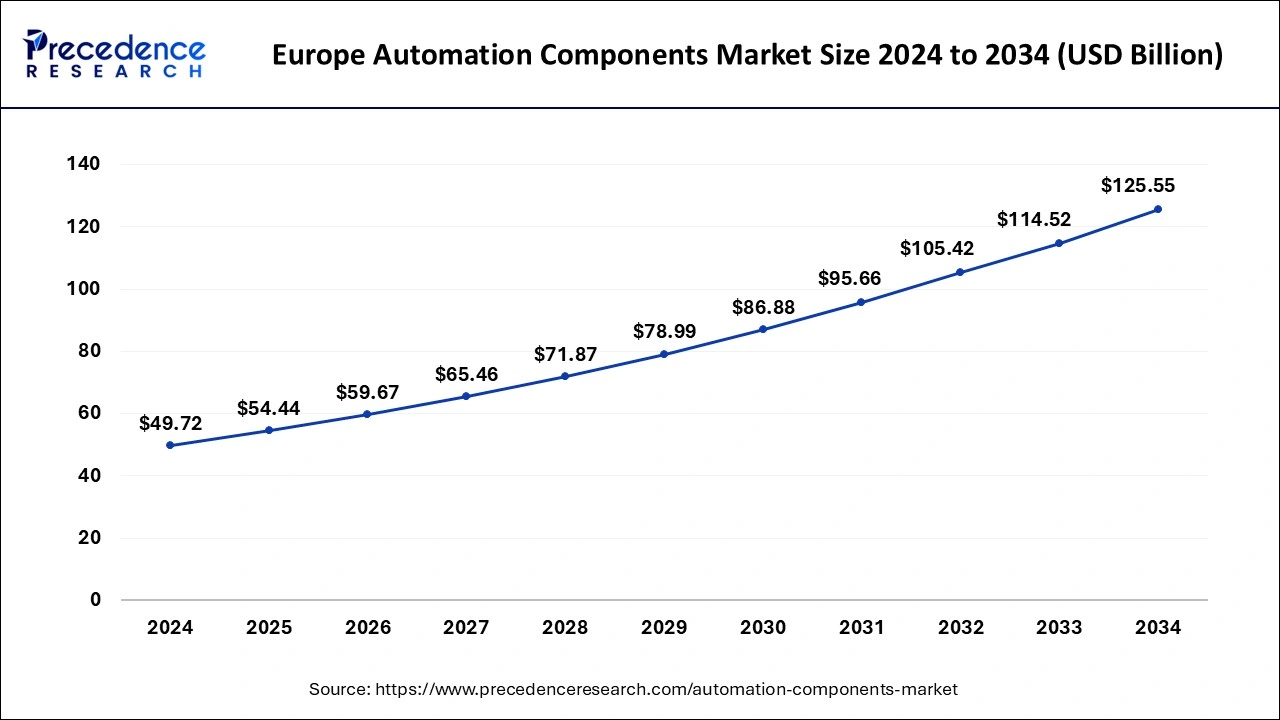

The global automation components market size is estimated at USD 155.55 billion in 2025 and is predicted to reach around USD 353.68 billion by 2034, accelerating at a CAGR of 9.55% from 2025 to 2034. The Europe automation components market size surpassed USD 54.44 billion in 2025 and is expanding at a CAGR of 9.70% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automation components market size was estimated for USD 142.05 billion in 2024 and is anticipated to reach around USD 353.68 billion by 2034, growing at a CAGR of 9.55% from 2025 to 2034. The increasing growth of automation components is noticed due to the rising demand to streamline business operations, reduce errors, and improve work efficiency.

The integration of artificial intelligence in automation components brings business productivity and cost savings and enhances customer experience. This is achieved by analyzing large volumes of data to create predictions. Artificial intelligence utilizes various other technologies to automate repetitive tasks, rule-based tasks, and data-intensive tasks such as algorithms, machine learning, and cognitive computing, which helps minimize human interventions. Additionally, with the help of robotic process automation, business process management, and workflow automation, AI holds the potential to optimize business processes. As there is high adoption of both AI and automation, the future is expected to present an immersive transformation towards augmented intelligence, a collaboration between humans and machines. This is anticipated to offer a wide range of creativity, adaptability, and personalization.

The Europe automation components market size was estimated at USD 49.72 billion in 2024 and is anticipated to be surpass around USD 125.55 billion by 2034, rising at a CAGR of 9.70% from 2025 to 2034.

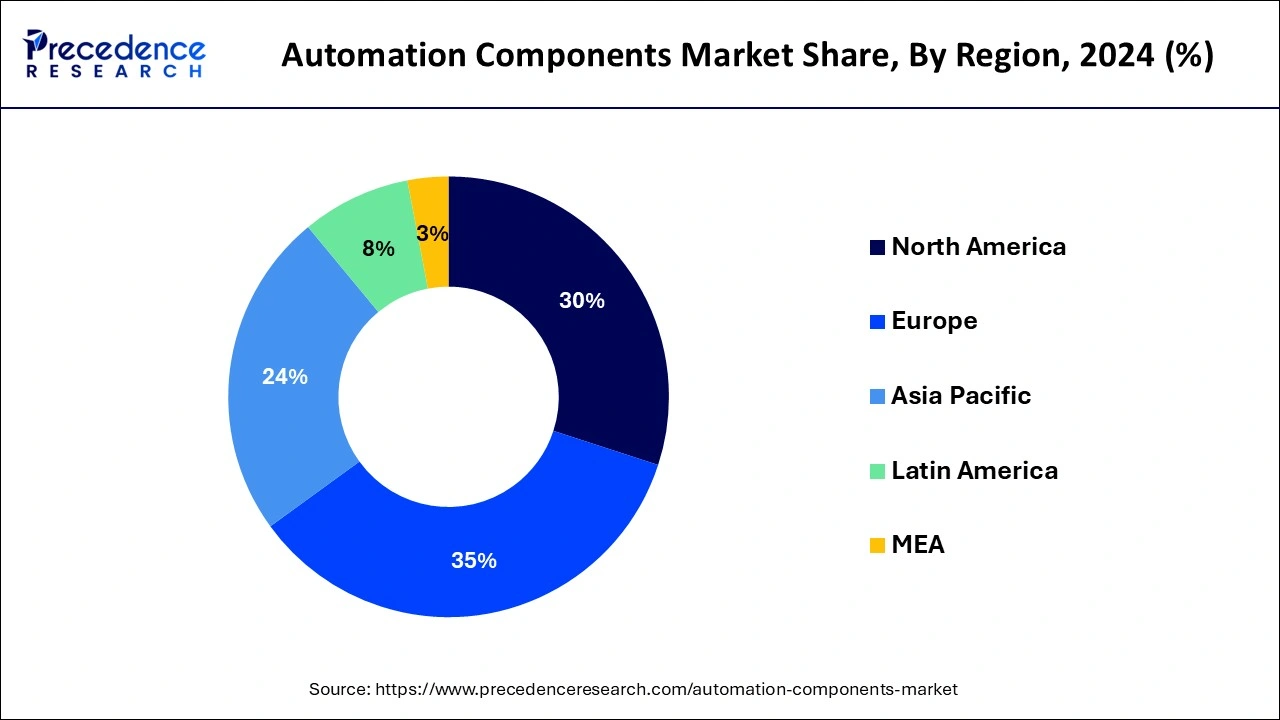

Europe dominated the global market with the largest market share of 35% in 2024. Europe, as a region, defines a dynamic landscape in the automation components market. It encompasses diverse industries and sectors, with a notable emphasis on precision engineering, manufacturing, and industrial innovation. Recent trends in the European automation components market highlight a growing adoption of Industry 4.0 principles, integrating advanced sensors, actuators, and controllers into smart manufacturing systems.

Additionally, there is a heightened focus on sustainable automation solutions to reduce energy consumption and environmental impact, aligning with Europe's commitment to sustainability. These trends signify a region at the forefront of automation technology adoption and environmental consciousness in industrial practices.

Asia Pacific is expected to grow at a significant CAGR during the forecast period. In the automation components market, this region is witnessing substantial growth owing to rapid industrialization and a thriving manufacturing sector. Notable trends in the Asia Pacific automation components market include a pronounced focus on Industry 4.0 technologies, a rising need for smart manufacturing solutions, and an increasing adoption of automation in sectors such as automotive, electronics, and healthcare. The region's vibrant economic environment remains a driving force behind innovation and the expansion of automation technologies.

Automation components refer to integral elements in industrial automation systems, serving as the core components that facilitate the automation of tasks and processes. These components encompass a diverse set of physical and digital tools, including sensors, actuators, controllers, and communication systems. Sensors are responsible for gathering data from the environment by monitoring variables like temperature, pressure, and position. Controllers process this data and make informed decisions, subsequently transmitting commands to actuators such as motors and valves to execute specific actions. Furthermore, communication systems ensure seamless data exchange among these components, enabling real-time control and monitoring.

Automation components serve as the fundamental building blocks of modern industrial automation, enabling industries to optimize operations, enhance productivity, and minimize human involvement in repetitive or potentially hazardous tasks. Their integration across various sectors, spanning manufacturing, agriculture, and healthcare, has catalyzed a transformation in operations, leading to increased precision, reduced errors, and enhanced safety across a wide array of applications.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 9.55% |

| Market Size in 2025 | USD 155.55 Billion |

| Market Size by 2034 | USD 353.68 Billion |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component and By End User Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Efficiency and productivity and quality control

Efficiency and productivity are pivotal drivers behind the growing demand for automation components in various industries. Automation systems, equipped with advanced components, enable businesses to streamline their operations and enhance productivity significantly. By automating routine tasks, organizations can operate around the clock, reducing downtime and improving overall output. This boost in efficiency leads to reduced operational costs, as fewer human resources are required for manual labor, and resources are utilized more effectively.

Quality control is another vital factor propelling the market demand for automation components. These components ensure consistent and precise quality standards, minimizing errors and defects in manufacturing and production processes. By automating inspections, measurements, and quality assurance procedures, businesses can deliver higher-quality products or services to their customers.

Improved quality control not only enhances the reputation of businesses but also reduces costly recalls and rework, ultimately leading to increased customer satisfaction. As industries increasingly prioritize efficiency, productivity, and quality, the demand for automation components continues to surge, driving innovation and growth in the automation components market.

High initial investment

The substantial initial investment required for automation components serves as a notable impediment to the growth of the market. Incorporating automation systems necessitates a significant financial commitment, encompassing the procurement of hardware, software, and essential infrastructure. This financial outlay can be a formidable deterrent, especially for smaller businesses with constrained budgets, as justifying this upfront cost may be challenging, despite the potential long-term benefits in terms of operational efficiency, productivity gains, and cost reduction.

Moreover, the return on investment (ROI) associated with automation may not manifest immediately, making it a less attractive option for organizations seeking more immediate financial returns. Alongside the cost of the components, there are supplementary expenses tied to system integration, employee training, and potential disruptions during the implementation process. Overcoming this obstacle entails a thorough evaluation of the enduring advantages automation offers and exploring financial strategies or incentives to make the initial investment more feasible. As technology continues to advance and costs potentially decrease, this hindrance may become less onerous over time.

AI and machine learning integration

The integration of AI and machine learning is creating substantial opportunities in the automation components market. These technologies are revolutionizing automation systems by making them smarter and self-learning. Machine learning algorithms excel at sifting through extensive datasets, detecting patterns and trends, ultimately leading to better predictive maintenance, quality assurance, and process optimization. This data-driven methodology elevates efficiency, trims expenses, and lessens operational interruptions.

Moreover, AI integration enables automation components to make autonomous decisions and adapt to changing circumstances, leading to more responsive and intelligent systems. This advancement benefits various industries, boosting efficiency, productivity, and competitiveness. With ongoing progress in AI and machine learning, the automation components market is projected to witness continuous growth, offering opportunities to develop increasingly intelligent and adaptive automation solutions.

The motors segment has held the biggest market share of 25% in 2024. Motors in the automation components market are electromechanical devices designed to convert electrical energy into mechanical motion. They are pivotal for driving various automated systems, including conveyor belts, robotic arms, and manufacturing equipment.

Trends in motor technology are increasingly geared towards energy efficiency and compact designs. Brushless DC motors, for instance, offer improved efficiency and longevity compared to traditional brushed motors. Additionally, the integration of smart sensors and IoT connectivity is becoming more prevalent, allowing for remote monitoring, predictive maintenance, and enhanced automation control, contributing to the evolving landscape of automation components.

The stages segment is anticipated to grow at a remarkable CAGR during the forecast period. In the automation components market, the "Stages" segment refers to the various stages of the automation process, encompassing critical elements such as sensors, actuators, controllers, and communication systems. These components collectively enable the automation of tasks and processes across industries.

Current trends in this segment revolve around the integration of advanced sensors, IoT-enabled devices, and smart controllers. The industry is witnessing a shift towards greater connectivity and data-driven decision-making, enhancing the precision and adaptability of automation systems. As a result, the "Stages" segment continues to evolve to meet the increasing demand for more efficient, intelligent, and interconnected automation solutions.

The automotive segment generated the highest market share of 26% in 2024. In the automation components market, the automotive segment encompasses the integration of automation solutions within the automobile manufacturing process. This involves the use of robotic arms, sensors, actuators, and control systems to streamline vehicle assembly, quality control, and testing procedures.

Trends in the automotive segment of the automation components market include the increasing adoption of collaborative robots (cobots) to work alongside human operators, enhancing precision and safety. Additionally, there is a growing emphasis on the integration of artificial intelligence and machine learning for predictive maintenance, real-time quality control, and the development of autonomous vehicles, driving innovation in the industry.

The 3D printing segment is expected to expand at the fastest CAGR over the projected period. In the automation components market, the 3D printing segment refers to the utilization of automated systems and components for additive manufacturing processes across various industries. This technology involves the layer-by-layer creation of physical objects from digital designs, with applications in aerospace, automotive, healthcare, and more.

A notable trend in the 3D printing segment is the increasing integration of automation components to enhance precision and speed in the production of complex, customized parts. Additionally, advancements in materials and software are expanding the capabilities of 3D printing in end-user industries, driving its growth and adoption.

By Component

By End User Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

January 2025

January 2025

January 2025