January 2025

The global automotive braking system market size is calculated at USD 56.45 billion in 2025 and is forecasted to reach around USD 92.97 billion by 2034, accelerating at a CAGR of 5.70% from 2025 to 2034. The Asia Pacific market size surpassed USD 30.97 billion in 2024. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive braking system market size was estimated at USD 53.40 billion in 2024 and is predicted to increase from USD 56.45 billion in 2025 to approximately USD 92.97 billion by 2034, expanding at a CAGR of 5.70% from 2025 to 2034.4.

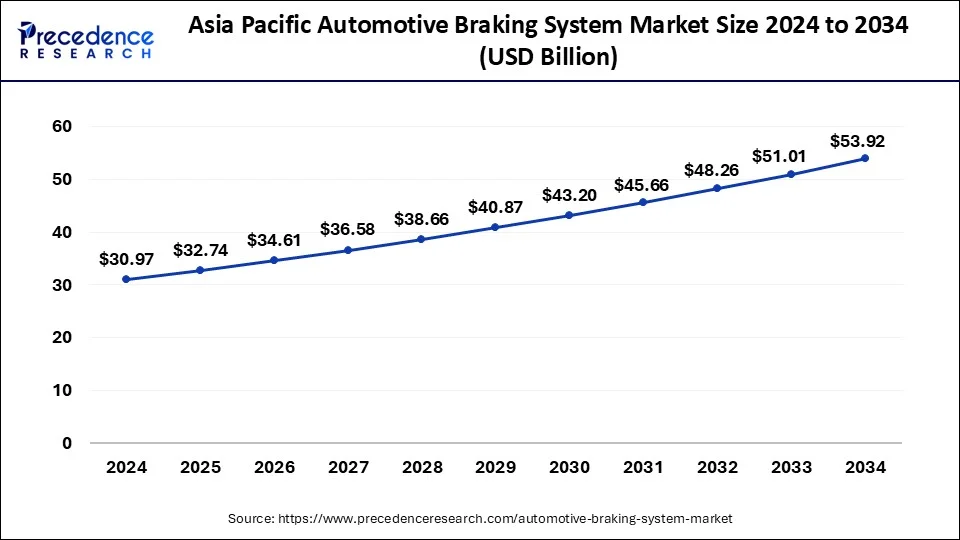

The Asia Pacific automotive braking system market size was estimated at USD 30.97 billion in 2024 and is predicted to be worth around USD 53.92 billion by 2034, at a CAGR of 5.73% from 2025 to 2034.

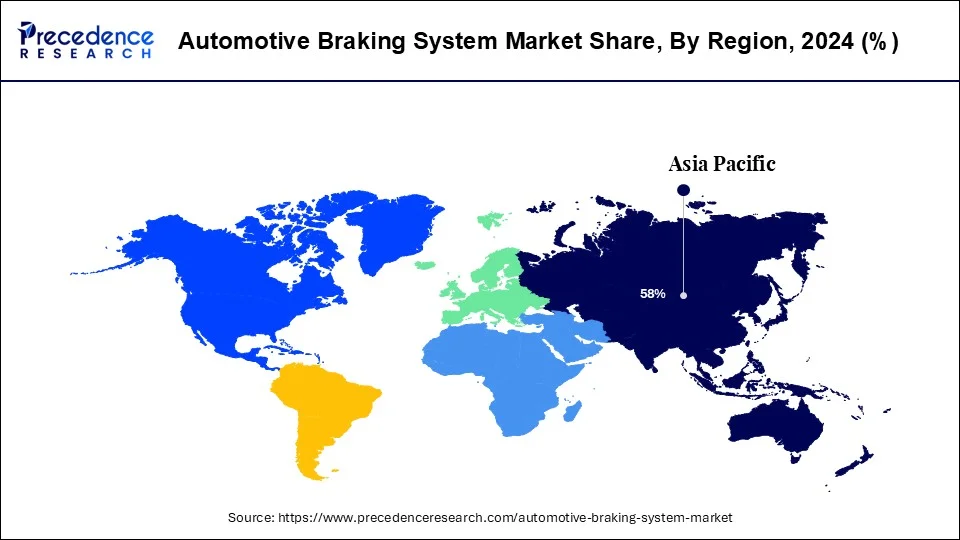

On the regional front, the Asia Pacific led the global automotive braking system market. This is attributed to the low production cost along with rising demand of transportation in countries such as China and India. Furthermore, increasing penetration of auto parts manufacturers and foreign automakers in this region has created lucrative opportunities in this region. In addition, significant participation from BRICS nations in trade affairs in China and India expected to boost the growth of automotive braking system market in the regions.

Moreover, increasing demand for electric and battery-powered vehicles in the Asian countries such as India, Japan, China, Singapore, Malaysia, Korea, and other nations expected to propel the market growth of automotive braking system during the forecast years. High population along with significant presence of youth population in the region again influences the market growth of automotive braking system. Young population prefer high driving speed that in turn require advanced and efficient braking system to curb the rate of accidents, thereby driving the growth of advanced braking system in the region.

However, Europe and North America are other most prominent markets in the automotive braking system. The regions have strict safety regulations along with competitive dynamic of the trucking industry that expected to propel the pneumatic segment in the automotive braking system in the regions.

Automotive braking systems have gained significant traction in the recent times due to increasing requirement for advanced technology automotive brakes in passenger as well as commercial vehicles. Increasing number of road accidents across the globe has forced governments along with international organizations to pass stringent safety norms, thereby leading to boost the demand of advanced braking technologies that include Anti-lock Braking System (ABS). Government mandates have surged the implementation of ABS by automotive manufacturers. In addition, 40 members of the United Nations Economic Commission for Europe (UNECE) have adopted the mandatorily implementation of Automatic Emergency Braking (AEB) systems for vehicles by the end of 2020. The aforementioned factors expected to propel the growth of the market.

However, lack of considerable efforts for reducing the counterfeit of brake-related products estimated to hamper the growth of the market along with compromising the vehicle’s safety.

| Report Highlights | Details |

| Market Size in 2034 | USD 92.97 Billion |

| Market Size in 2025 | USD 56.45 Billion |

| Market Size in 2024 | USD 53.40 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.70% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America, Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vehicle, System, Sales Channel, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Disc brakes are expected to witness an escalating demand compared to other types of braking systems available in the market. The demand for disc brakes are higher as it offers shorter stopping distance as well as the brake is more efficient while emergency braking condition.

In addition, these brakes allow cooler running and need less external casing. Disc brakes are also prominently used in most of the heavy–duty trucks. Moreover, the integration of front-disc/rear-drum setup that can be mounted on medium and low-priced vehicles projected to fuel the demand for the disc brakes in the coming years.

As brakes are an integral part of every vehicle, the rising production of vehicles along with its increasing demand anticipated to positively influence the market growth. Passenger vehicles captured significant production share of nearly 75% per year that in turn boost the demand for advanced braking system in the passenger vehicle segment. However, demand for commercial vehicles expected to proliferate in the coming years because of accelerating growth of logistics and transportation industry. For instance, demand for SUVs has increased in North America primarily for its application in off-terrain activities, thereby creating numerous opportunities for the automotive braking system market in the region.

Moreover, the government of U.S. has invested prominently in the development of logistics &infrastructure that has triggered the demand for commercial vehicles in the country. Further, rising implementation of automotive braking system in coaches and buses as well as in other heavy commercial vehicles for high efficiency and better brake response predicted to surge the demand of braking technology in commercial vehicle segment during the forecast period.

The global automotive braking system market is highly competitive and fragmented with the presence of numerous global and regional players in the market. These players adopt several inorganic strategies to support their growth in the years to come along with strengthening their market position. For instance,

By Vehicle

By Part Type

By System Type

By Sales Channel

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025