January 2025

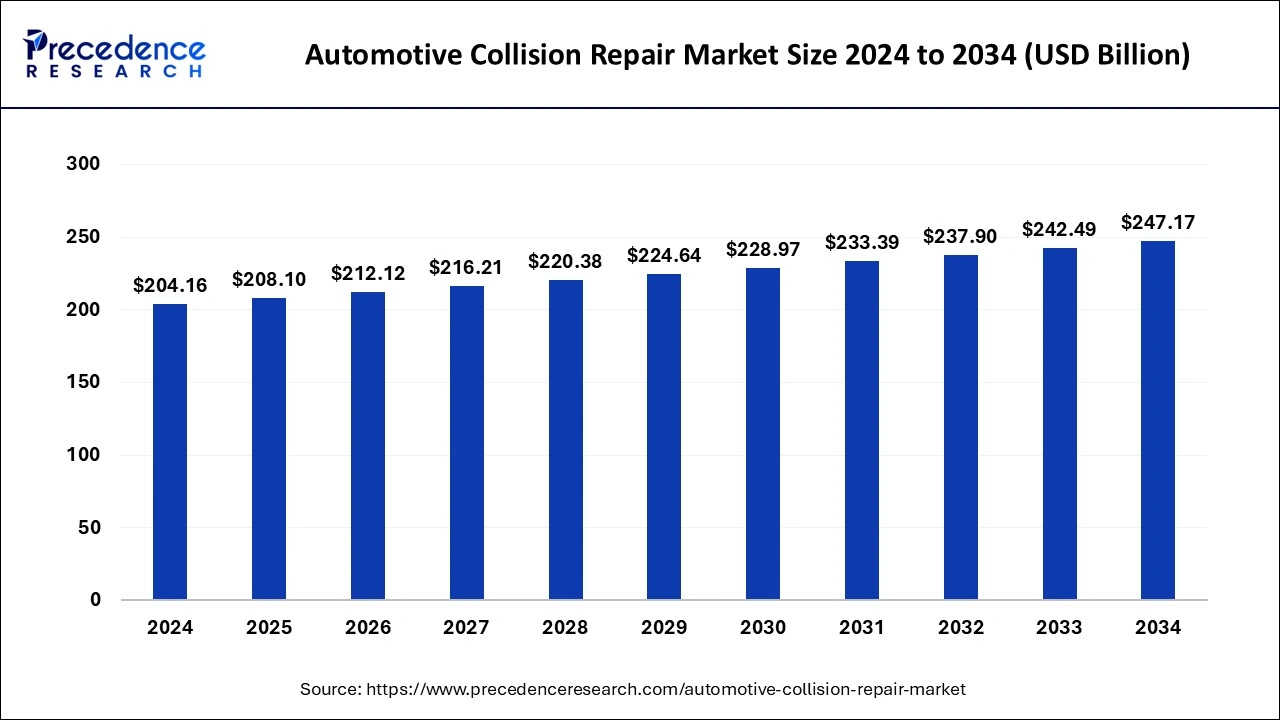

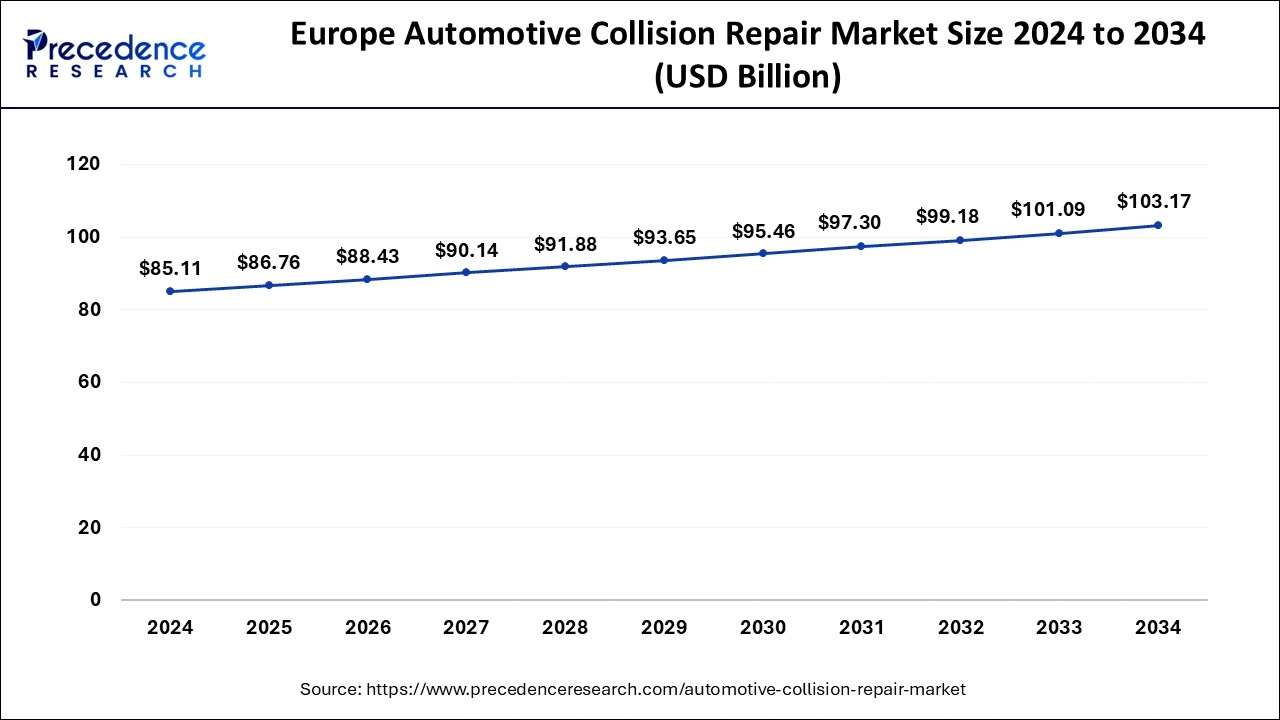

The global automotive collision repair market size is calculated at USD 208.10 billion in 2025 and is forecasted to reach around USD 247.17 billion by 2034, accelerating at a CAGR of 1.93% from 2025 to 2034. The Europe automotive collision repair market size surpassed USD 86.76 billion in 2025 and is expanding at a CAGR of 1.94% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive collision repair market size was accounted for USD 204.16 billion in 2024 and is anticipated to reach around USD 247.17 billion by 2034, growing at a CAGR of 1.93% from 2025 to 2034. The growing automobile sector across the world is directly leading to the growth of automotive collision repair market in the forecast period.

Artificial Intelligence (AI) is being integrated widely in the automobile industry and the collision repair market is no exception. With AI technology, frequently performed reductant tasks can be given over to automation. This eases the workload on the labor and helps them focus on complex repair work that requires their skills. AI technology can create an efficient system through data analysis that gives customers proper estimation which helps them make an informed decision and be useful in any claims filed for insurance. The streamlining of operations by utilizing AI technology can make the processes efficient and quicker.

The Europe automotive collision repair market size was evaluated at USD 85.11 billion in 2024 and is predicted to be worth around USD 103.17 billion by 2034, rising at a CAGR of 1.94% from 2025 to 2034.

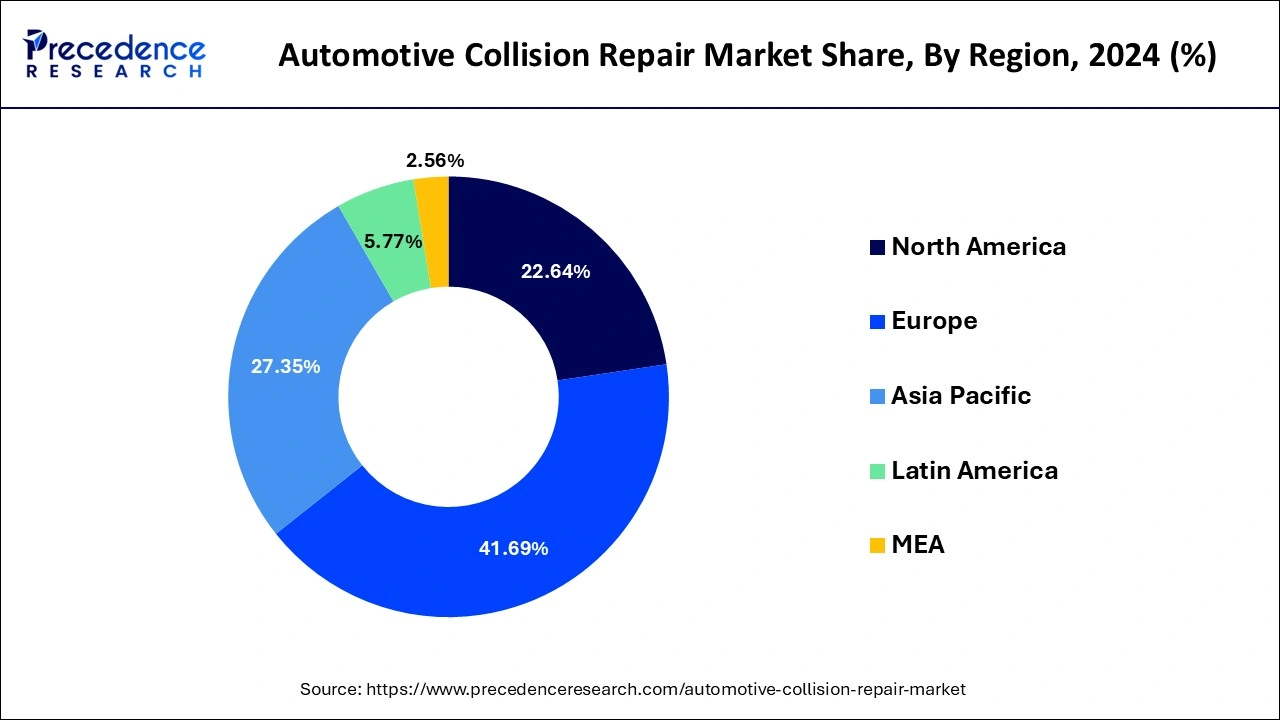

In terms of geography, Europe emerged as the market leader in the global automotive collision repair market and accounted to hold more than 41.69% of revenue share in the year 2024 and exhibit significant growth over the upcoming years. The prominent growth of the region is primarily attributed to the penetration of large automobile manufacturers in the region. In addition to being an automotive hub, the region witnesses prominent demand for luxury and smart vehicles every year that in turn also triggers the need for the repair equipment and parts. Further, the rate of road fatalities has also been increasing every year in the region that again anticipated thriving the demand for automotive collision repair products and services in the region.

The Asia Pacific region predicted to witness the highest CAGR of about 4% during the analysis period due to higher rate of road traffic crashes along with high sale of passenger cars in the region. Asia Pacific is observed to grow at the fastest rate in the automotive collision repair market during the forecast period.

The ever-growing automotive sector in Asian nations along with rising vehicle ownership is seen to expand the market in the upcoming years. Additionally, the rising requirement of services by commercial vehicle owners is seen to promote the market’s growth. Multiple Asian countries are seen integrating artificial intelligence, garage management software, advanced technologies and other additional ways to make repair services and their offering more efficient. These practices are observed to boost the attention of key players in the industry.

The automotive collision repair market has witnessed a steady growth in the last few years. The increasing awareness amongst the younger and educated generation of people towards vehicle maintenance and importance helps market growth. The regular maintenance and repair improve the lifecycle and performance of the automobiles. Rising utilization of automobiles has led to an increase in number of road accidents. This has positively impacted the market. Vehicle insurance is becoming a common thing for vehicle owners which is regulated by the government. The requirement of consumers for better performance and enhancing lifecycle even after collision are key factors for the growth of automotive collision repair market.

| Report Highlights | Details |

| Market Size in 2024 | USD 204.16 Billion |

| Market Size in 2025 | USD 208.10 Billion |

| Market Size by 2034 | USD 247.17 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 1.93% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Vehicle, Service Channel |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Advancements in technology

The number of advancements in technology has proven beneficial for the automotive collision industry. The digitalization has enabled the industry to offer more personalized service, faster service, and quick access to support for consumers. The availability of repair specialist service and innovative solutions available because of technology are helping the market. There are many advantages associated with inspection and repair by a collision repair specialist helps consumer address the specific needs. These advancements in technology is a key driver for the automotive collision repair market.

Cost of repair

The support by automobile companies for repair and diagnosing issues for vehicles. This is a part of service preventive measures. Often collision repairs are not part of these service and even insurance has contingencies in place. Customers are concerned with the high cost of repair of the automobile after collision. These services are specialist services that require more equipment and skilled labor which adds costs. The key players of the automotive collision repair market need to address to challenges of high costs for consumers and find a way to make these services more affordable.

Regulatory compliances

All over the world, there are strict regulations being put in place for stringent safety standards for automobiles as well as environmental sustainability. The rising compliances and regulations by government and other agencies on the automobile sector could be an opportunity of growth from automotive collision repair market. The growing focus on reducing environmental impact is can create new opportunities for research and development for the automotive collision repair market during the forecast period.

Spare parts segment led the global automotive collision repair market with a revenue share of nearly 65% in the year 2024 and anticipated to maintain its dominance during the analysis time frame. The prominent growth of the segment is mainly attributed to rising number of automotive crashes across the world that is causing significant harm to the automobile parts.

The paints & coatings product segment is projected to grow at a CAGR of 2.72% during the forecast period owing to rising environmental concern for the use of synthetic coating materials and other refinishing products used in the automobiles.

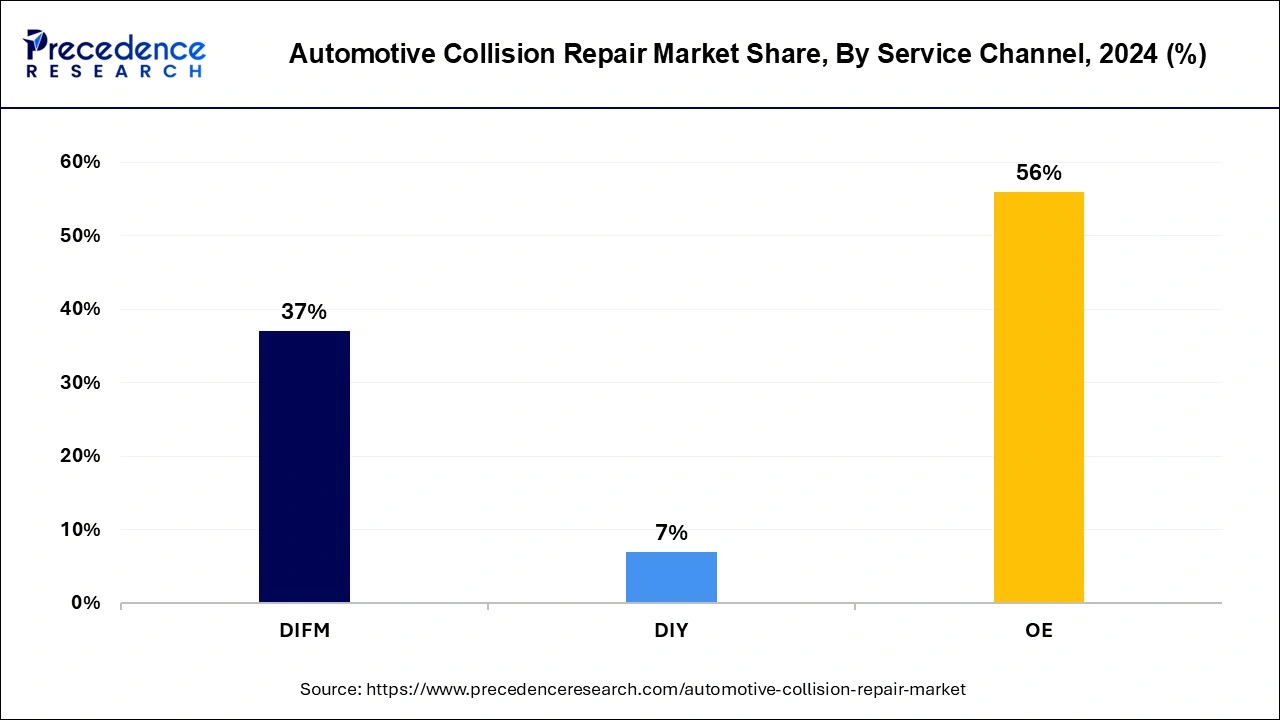

OE segment that are handled by the OEMs held the majority of the revenue share of approximately 56% in the year 2024 and expected to witness a stagnant growth during the forthcoming years. This is mainly because the Original Equipment Manufacturers (OEMs) provide long term guarantee and warrantee for the product that increases the customer loyalty towards the company and product.

The vehicle type segment is classified in to heavy-duty vehicle and light-duty vehicle. Heavy-duty vehicles accounted the revenue share of 28% in 2024.

Light-duty vehicles capture the maximum market revenue share of 72% in the year 2022 and estimated to grow at a significant rate owing to large share of sales percentage for the vehicle type. Light-duty vehicles include sedans, hatchbacks, crossover cars, and SUVs. Light-duty vehicles capture nearly 75% of the total vehicle sales across the globe because of it significant demand for transporting light weight cargos and passengers. Further, the introduction of electric vehicles and other environment-friendly vehicles are supposed to spur the sale of light-duty vehicles in the coming years.

By Product

By Service Channel

By Vehicle Type

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025