January 2025

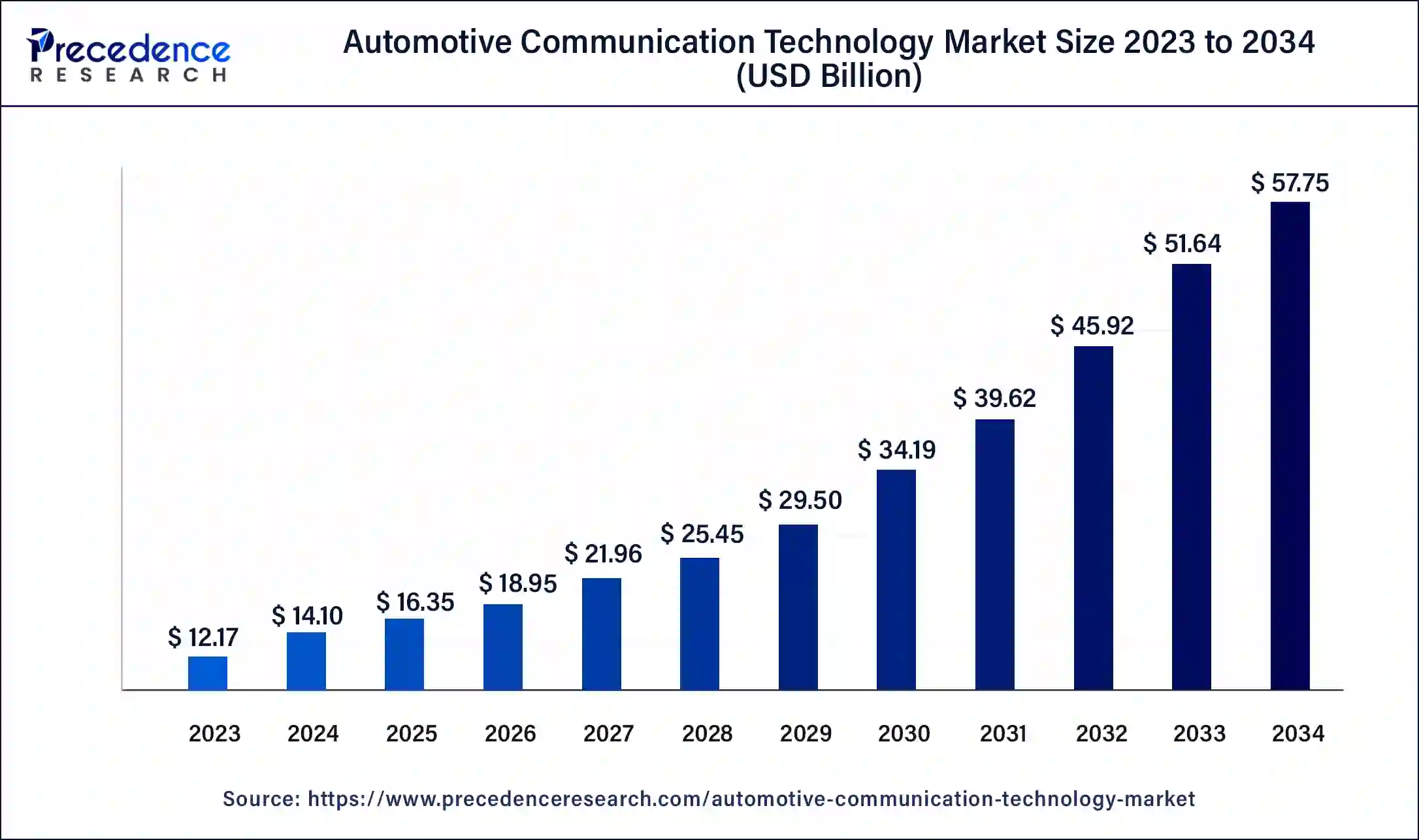

The global automotive communication technology market size was USD 12.17 billion in 2023, estimated at USD 14.10 billion in 2024 and is anticipated to reach around USD 57.75 billion by 2034, expanding at a CAGR of 15.14% from 2024 to 2034.

The global automotive communication technology market size accounted for USD 14.10 billion in 2024 and is predicted to reach around USD 57.75 billion by 2034, growing at a CAGR of 15.14% from 2024 to 2034.

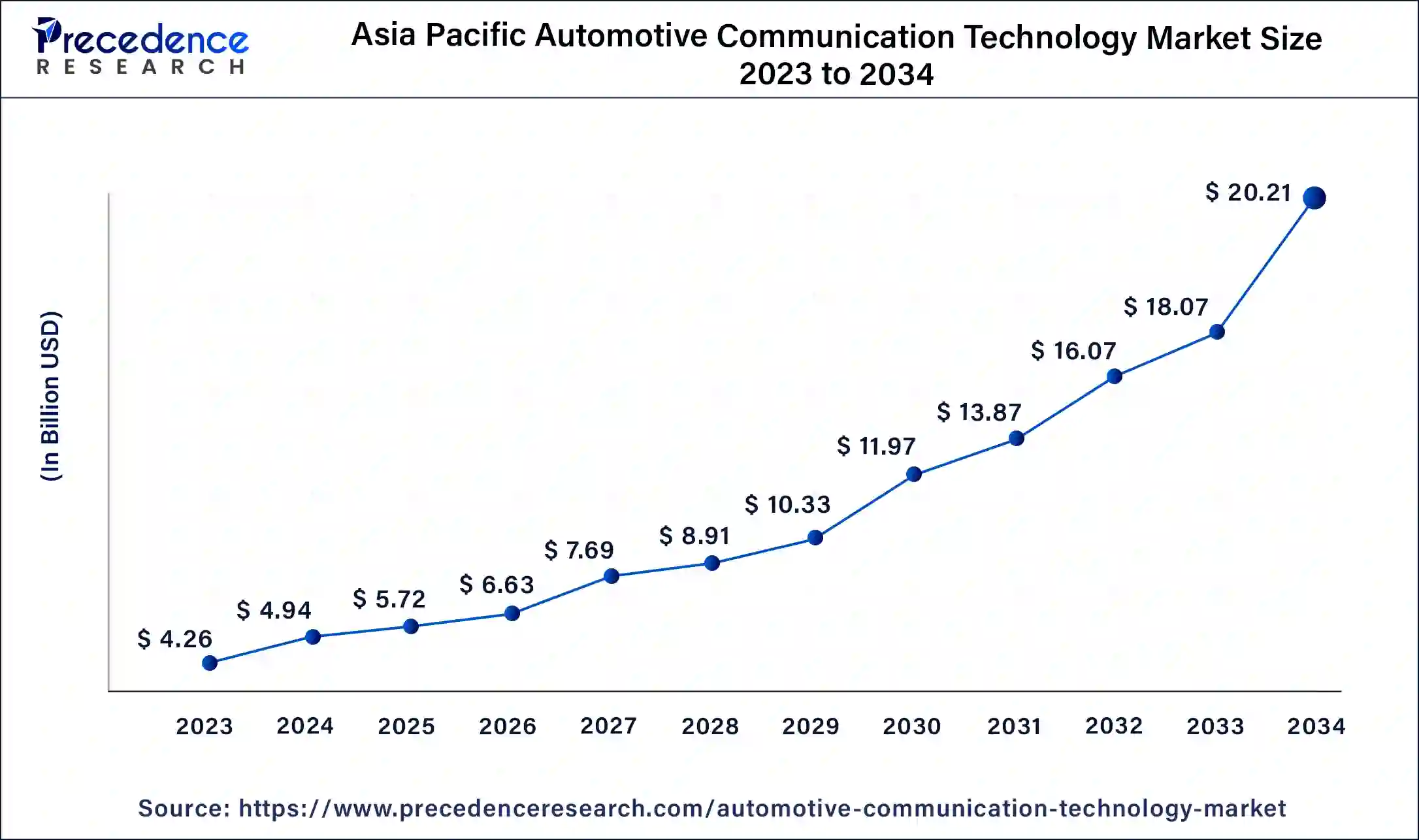

The Asia Pacific automotive communication technology market size accounted for USD 4.26 billion in 2023 and is projected to grow around USD 20.21billion by 2034, at a CAGR of 16% between 2024 and 2034.

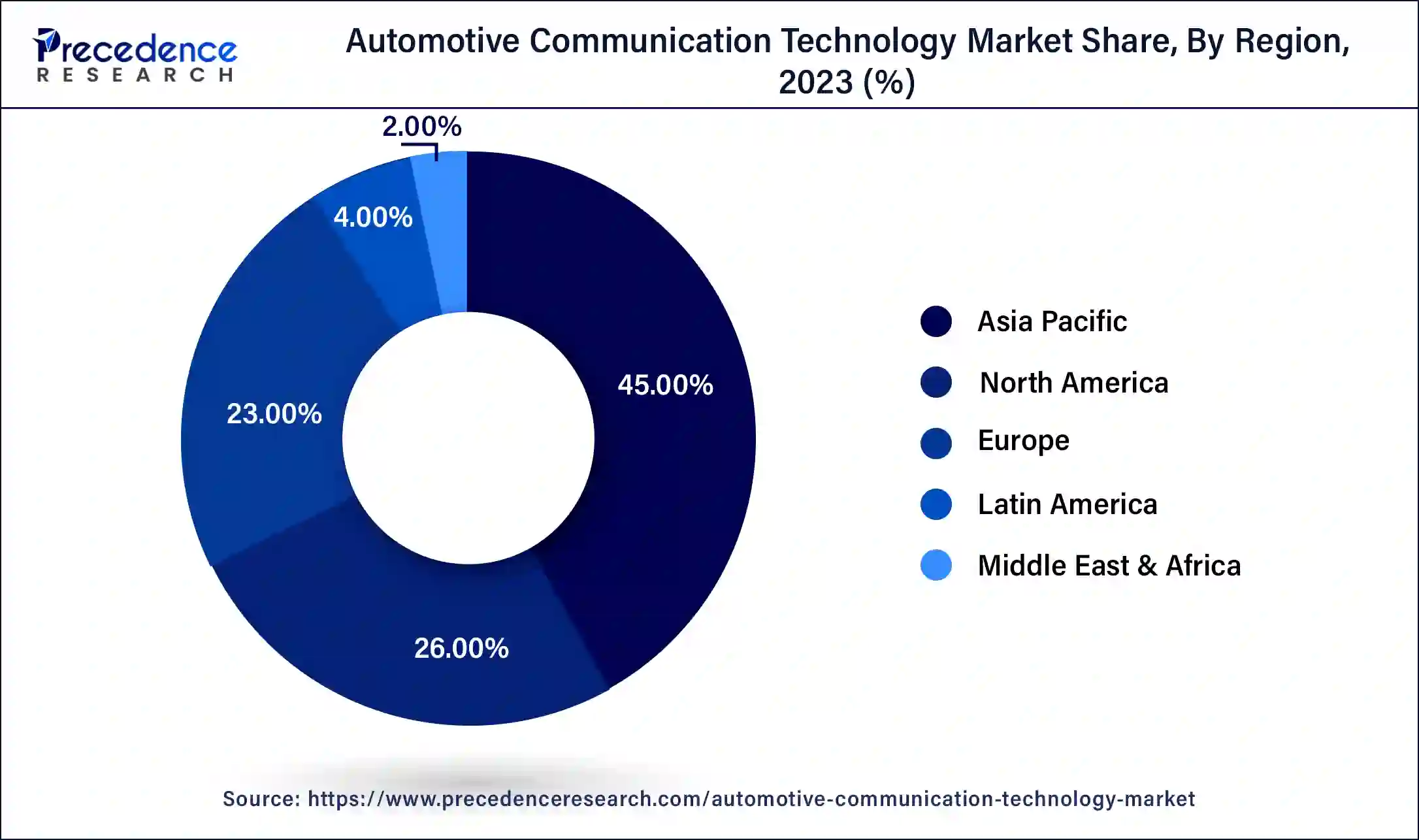

Based on geography, the global automotive communication technology market was analyzed for North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. The Asia Pacific is the front-runner with holding 44.7% of market share in 2023 and anticipated to forecast its dominance during the analyzed timeframe. This is mainly attributed to the region being hub for automobile manufacturers as well as the fastest growing region in automotive market.

Moreover, increasing investments from international manufacturers in the Asian automotive market owing to its high vulnerability for the advanced and upcoming technologies makes the region more lucrative. For instance, in October 2022, Autohome Inc. announced to invest in TTP Car Inc., one of the leading auction platforms in China. This investment helps in the robust development of used cars market in China. Similarly, other auto manufacturing companies mainly among the top automotive giants found Asia as the most opportunistic region because of low labour cost and increasing sales value.

However, developing regions such as Middle East & Africa and Latin America shows accelerating growth in the global automotive communication technology market as these regions have the largest consumer base across the globe and are less explored areas for advanced technologies. Further, the developing nations invest significantly in the adoption of upcoming technologies in order to increase their Gross Domestic Product (GDP).

Presently, the global market for automotive communication technology seeks stupendous growth owing to rising penetration of Internet of Things (IoT), big data, facial recognition, artificial intelligence, machine learning, and many others for upgrading the automotive features along with miniaturization of electronic devices that provides ease for integration in vehicles. Further, the automotive manufacturers and dealers also find alluring opportunity in the integration of advanced technologies in modern vehicles. These initiatives take by the automotive manufacturers have increased the number of Electronic Control Units (ECUs) per vehicle. For example, there are nearly 70 ECUs deployed in the modern vehicle and the number expected to rise up to 500 in the near future that is higher than a rocket or space shuttle.

Apart from manufacturers and dealer, consumer’s purchasing trend has also shifted from old large model vehicles to small vehicles with more advanced features. Car buyer also prefer high-grade vehicles because of their concern for safety as well as need for increased level of comfort. In addition, decline in price for advanced technology also favors the growth of integration of new technologies in vehicles. For instance, price for IoT chips has seek a significant decline from US$ 10 per chip to nearly US$ 6 per chip. The total IoT chip market estimated to be valued at approximately US$ 12 billion in the year 2020 and witnessing a double-digit growth in the forecast timeframe. Because of this, the price for IoT chips is likely to decline further in the coming years.

| Report Coverage | Details |

| Market Size by 2034 | USD 57.75 Billion |

| Market Size in 2023 | USD 12.17 Billion |

| Market Size in 2024 | USD 14.10 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 15.14% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Bus Module, Application, Vehicle Class, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Based on bus module, the global automotive communication technology market was bifurcated into Controller Area Network (CAN), Local Interconnect Network (LIN), Media-Oriented Systems Transport (MOST), FlexRay, and Ethernet. CAN module captured major revenue share of 38.7% in the year 2022 and expected to continue its dominance during the forthcoming years. With its increasing applications, CAN bus has become a standard choice for automobiles (cars, buses, trucks, tractors, and others), as well as for other applications too such as EV batteries, planes, ships, machineries, and many more. Looking in to the future perspective, CAN bus expected to stay relevant as it impacted major trends in automotive for instance rise in cloud computing, growth in demand for connected vehicles & IoT integration in cars, rise in autonomous vehicles, and increasing necessity for advanced vehicle functionality.

On the contrary, ethernet technology anticipated to grow at the fastest rate during the projected years registering a CAGR of 20.87% owing to its advantages in high data transfer. An average data transmission speed of ethernet port is 100 Mbps that comparatively higher compared to other communication ports. High data transmission is need of present automotive technologies such as adaptive cruise control, advanced driver assistance system, smart parking system, advanced engine control system, and many others. Presently, there are 400 million ethernet ports in a vehicle and the number anticipated to rise at an exponential rate.

On the basis of application, body control & comfort acquired the maximum market revenue of USD 2.62 billion in 2023 because of rising adoption of higher level of safety and comfort features in modern cars & vehicles. This is mainly because of rising number of deaths related to road accidents. Further, increasing demand for luxury cars and premium vehicles is significantly responsible for the notable revenue share of body control & comfort segment.

On the other hand, powertrain segment witnessed exponential growth over the forthcoming years due to increasing demand for smooth driving as well as high power engines. Rapid growth in the need for more secure and smooth driving has accelerated the powertrain segment. In addition, new government policies for reducing the pollution rate from passenger cars have triggered the need to improve the engine efficiency of vehicles this again impacts the growth of powertrain segment to a greater extent.

By vehicle class, mid-size vehicle class captured majority of revenue share in the year 2023 and anticipated to lead the market during the forthcoming years as well. This is mainly attributed to the average price range of vehicles that is suitable for the major share of population across the world. In addition, all necessary features are incorporated in the mid-sizes vehicles that make them more comfortable as well as affordable. However, Luxury cars segment seek exponential growth over the upcoming timeframe because of increase in purchasing power of consumers.

Key Companies & Market Share Insights

The major players in the global automotive communication technology market are majorly focused towards entering into a strategic alliance with the semiconductor manufacturing companies in order to develop more advanced automotive solutions. Further, they are concentrated towards product development and advancement. For instance, in January 2019, Toshiba America Electronic Components Inc., a subsidiary of Toshiba Corporation, introduced announced TC9562 series that provides advanced ethernet capability for infotainment & telematics system for the automotive sector.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2032. For the purpose of this study, Precedence Research has segmented the global Automotive Communication Technology Market report on the basis of bus module, application, vehicle class, and region:

By Bus Module Outlook

By Application Outlook

By Vehicle Class Outlook

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025