January 2025

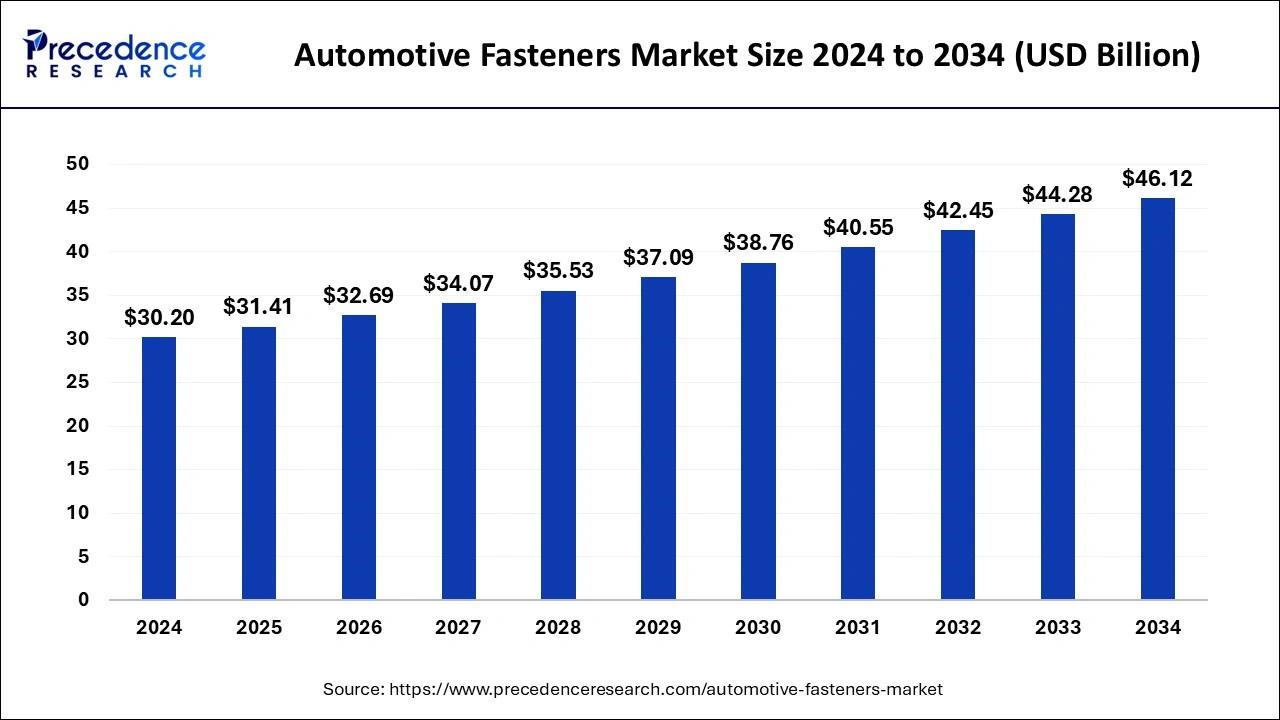

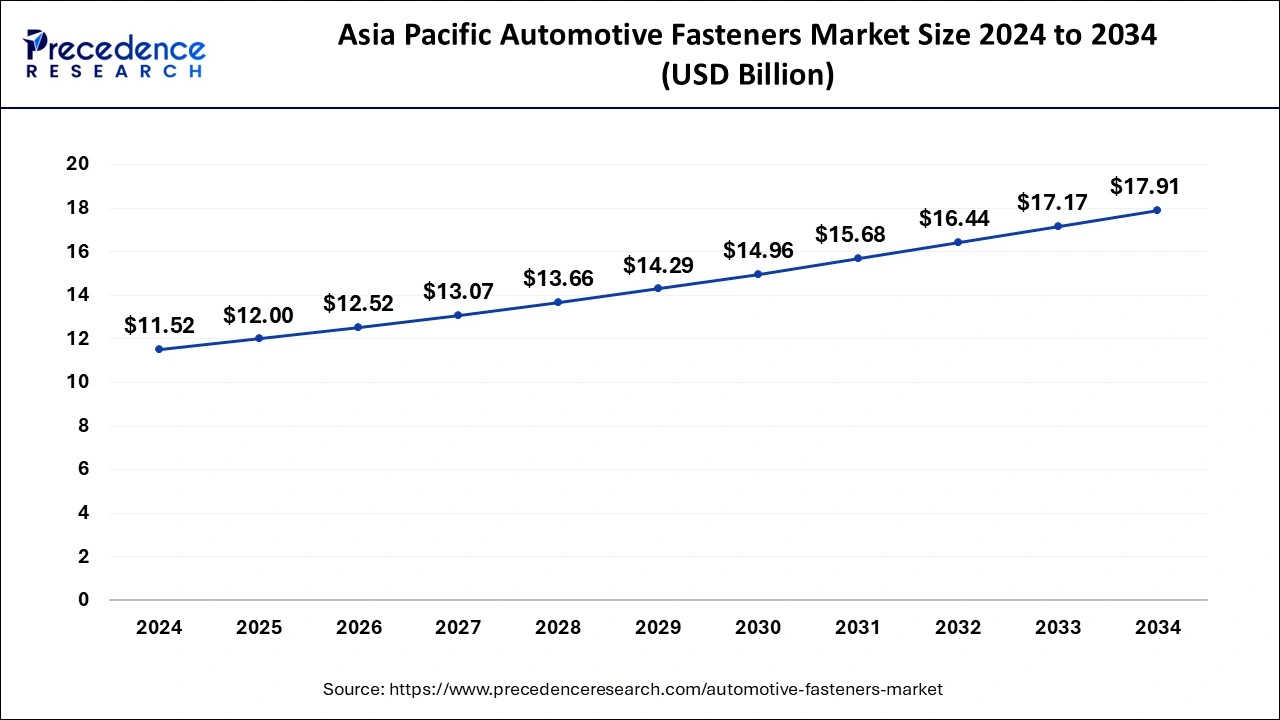

The global automotive fasteners market size is accounted for USD 31.41 billion in 2025 and is forecasted to hit around USD 46.12 billion by 2034, representing a CAGR of 4.33% from 2025 to 2034. The Asia Pacific market size was estimated at USD 11.52 billion in 2024 and is expanding at a CAGR of 4.51% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive fasteners market size was calculated at USD 30.20 billion in 2024 and is predicted to reach around USD 46.12 billion by 2034, expanding at a CAGR of 4.33% from 2025 to 2034. The rising consumer demand leading to increased manufacturing of vehicles, expansion of manufacturing facilities, growing use of electronics for safety and entertainment purposes in automobiles and technological advancements in research and development are fuelling the growth of automotive fasteners market.

AI integration in automotive fasteners industry can help in transforming manufacturing processes by automating production lines, in predictive maintenance, real-time monitoring, quality control and assurance, for product designing, customization, supply chain optimization and for testing real-world applications thereby enhancing the accuracy, reliability and efficacy with reduced costs contributing to the overall consumer and vehicle safety.

The Asia Pacific automotive fasteners market size was exhibited at USD 11.52 billion in 2024 and is projected to be worth around USD 17.91 billion by 2034, growing at a CAGR of 4.51% from 2025 to 2034.

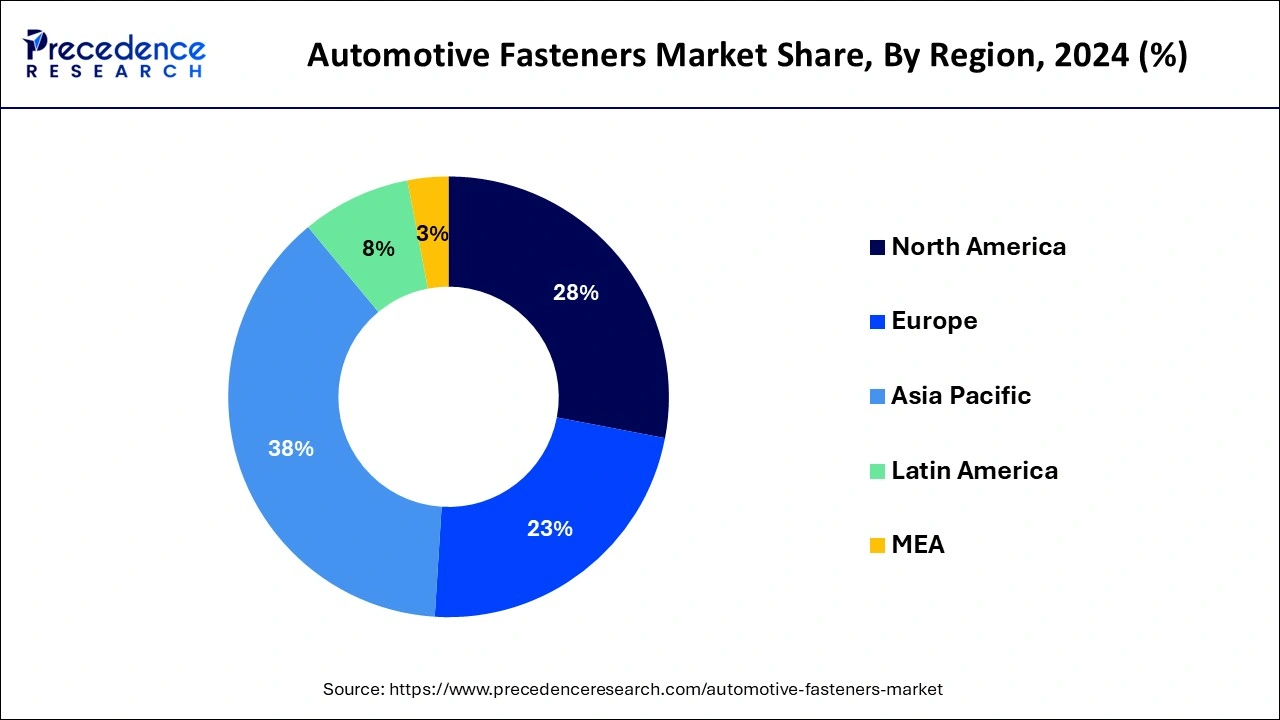

Asia-Pacific dominated the automotive fasteners market in 2024. The need for vehicles that are safer and more fuel efficient is driving the growth of the automotive fasteners market in the region. In addition, the government regulatory framework for light weight automobiles has resulted in technological developments in the region. China accounted 55% market share of the total global production of automotive fasteners in 2020.

North America is expected to develop at the fastest rate during the forecast period. As the number of vehicles on the road grows, so does the need for replacement parts. Moreover, the presence of major automotive and automobile manufacturers in this region as well as the availability of advanced technology allows automotive fasteners to thrive in this region.

The automotive fasteners market is expected to rise as a result of factors such as increased vehicle production, more usage of electronics in vehicles, and a shift towards lighter vehicles. Furthermore, the key market players are moving away from standard fasteners and toward customized fasteners, which fuel the growth of the automotive fasteners market.

The thriving vehicle industry as well as the critical relevance of fasteners in automobiles is important factors boosting the growth of the automotive fasteners market. Another factor driving the expansion of the automotive fasteners market is technological advancements and developments in fastener durability and quality. The easily changeable nature of automotive fasteners makes it convenient for end users to acquire fasteners for their automobiles, boosting the automotive fasteners market growth. The alternatives to automotive fasteners like as clutching and assembling parts, on the other hand, may slow the growth of the automotive fasteners market.

The mechanical innovations as well as improvements in the quality of fasteners are expected to raise market demand. Furthermore, the growing demand for lighter automobiles and their stability is driving a preference for automotive fasteners over welding, resulting in the growth of the global automotive fasteners market over the forecast period.

| Report Coverage | Details |

| Market Size in 2025 | USD 31.41 Billion |

| Market Size by 2034 | USD 46.12 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.33% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Characteristics, Material, Electric Vehicle Type, Vehicle Type, Distribution, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

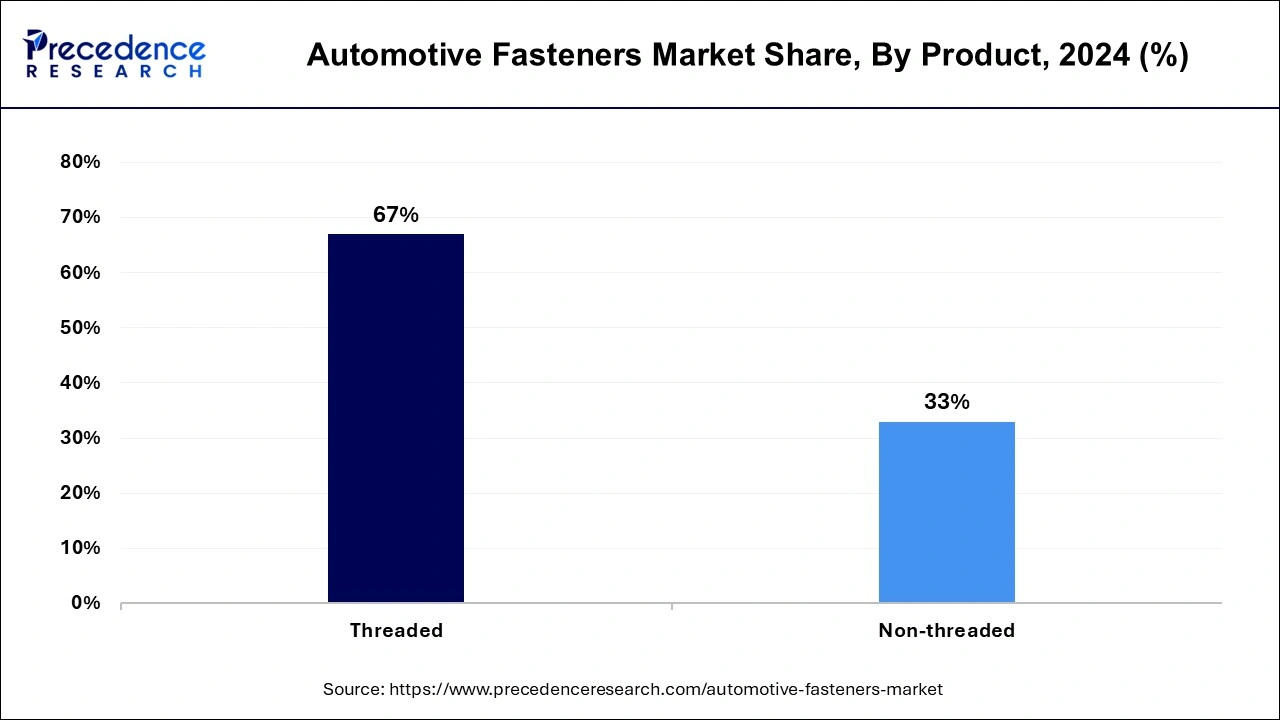

The threaded segment dominated the automotive fasteners market with revenue share of 67% in 2024. The bolts with a head on one end and a nut on the other end are known as threaded automotive fasteners. These fasteners are frequently put into a hole and attached with the help of nuts.

The non-threaded segment is fastest growing segment of the automotive fasteners market in 2024. The non-threaded fasteners lack internal threading to hold it together with other parts. The different ways for securing mechanical components are demonstrated by these fasteners.

The plastic segment dominated the automotive fasteners market in 2024. The plastic fasteners are utilized in applications that need consideration of thermal, optical, environmental, and electrical qualities during the manufacturing process.

The stainless-steel segment, on the other hand, is predicted to develop at the quickest rate in the future years. Depending on the use in the automotive sector, stainless-steel is the most commonly used material for automotive fasteners.

The removable fasteners segment dominated the automotive fasteners market in 2024. The removable automotive fasteners are used to link two parts, but they may be easily detached without causing damage to the fasteners or the part.

The semi-permanent fasteners segment is fastest growing segment of the automotive fasteners market in 2024. The semi-permanent automotive fasteners are meant to attach two parts; however, when the parts are disconnected, the fasteners or the part are frequently damaged.

Segments Covered in the Report

By Product

By Application

By Characteristics

By Material

By Electric Vehicle Type

By Vehicle Type

By Distribution

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025