January 2025

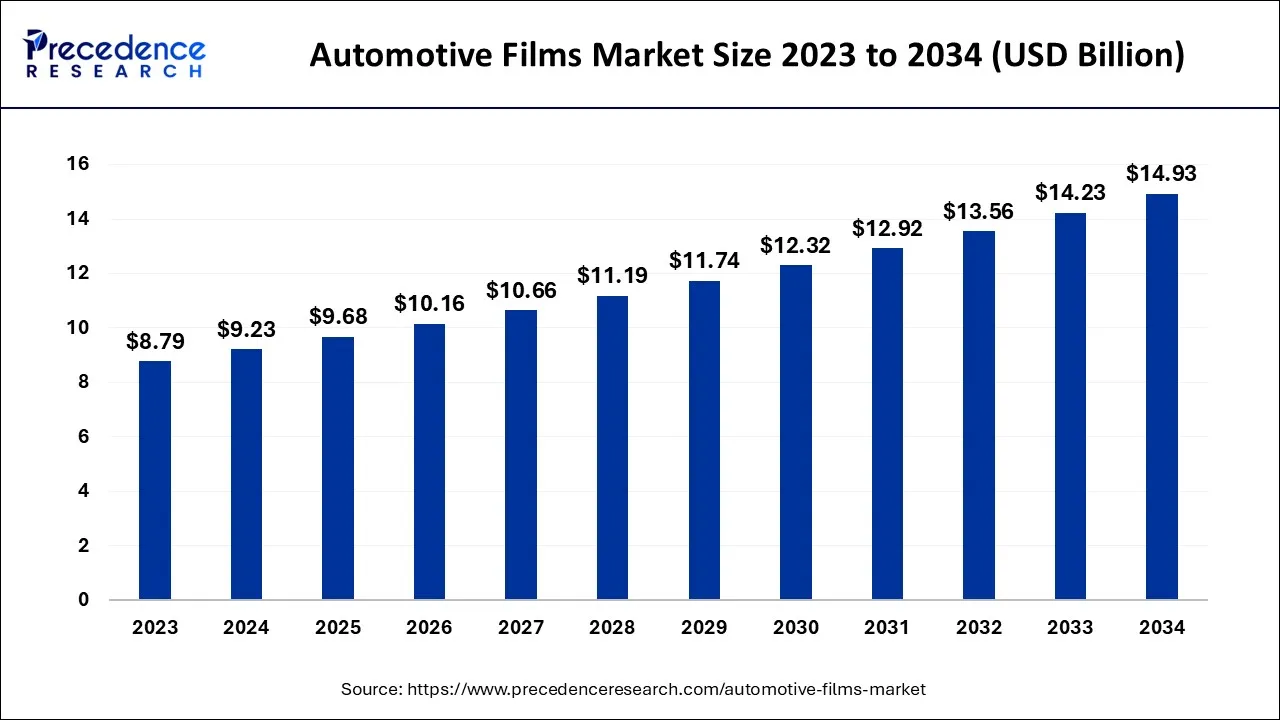

The global automotive films market size accounted for USD 9.23 billion in 2024, grew to USD 9.68 billion in 2025 and is expected to be worth around USD 14.93 billion by 2034, registering a CAGR of 4.93% between 2024 and 2034.

The global automotive films market size is calculated at USD 9.23 billion in 2024 and is projected to surpass around USD 14.93 billion by 2034, growing at a CAGR of 4.93% from 2024 to 2034.

The global automotive films market revolves around the production, innovation, and sales of automotive films that are later applied to various parts of automobiles. Automotive films are lightweight laminates used both inside and outside of automobiles. They increase the safety and privacy of the driver and passengers. Various materials, such as polycarbonate, polyester, polystyrene, polyvinyl chloride, and others, can be used to create automotive films. It is anticipated that the expansion of the automotive sector will be positively impacted by rising consumer awareness, the need for vehicle maintenance, and the rising need for paint protection as a result of higher maintenance expenses.

The rise in demand for components like adhesives, scratch-resistant coatings, alloys, UV inhibitors, release liners, polyester sheets, dyes, and metals for improving the durability and performance of window tints, along with an increase in the number of automotive films installed because they protect against harmful sun radiation and reduce energy costs, all contribute to the market's expansion. Many consumers/vehicle owners are focused on maintaining the paint coat of their car to maintain the aesthetics. Considering the rising demand for paint protection by consumers, the players in the automotive films industry have shifted their focus towards the development of advanced and sustainable automotive films. This element is expected to fuel the growth of the market during the forecast period.

In May 2023, a Germany-based material manufacturer, Covestro, announced the launch of a new production line to develop automotive paint protection films (PPF) in Changhua, Taiwan. The new production line aims to offer durable solutions to maintain the paint and coats of the cars.

The rise in demand for components like adhesives, scratch-resistant coatings, alloys, UV inhibitors, release liners, polyester sheets, dyes, and metals for improving the durability and performance of window tints, along with an increase in the number of automotive films installed because they protect against harmful sun radiation and reduce energy costs, all contribute to the market's expansion. The expanding automotive sector is anticipated to benefit market growth, as will rising consumer awareness of the need for vehicle maintenance and the rising demand for paint protection due to higher maintenance expenses.

| Report Coverage | Details |

| Market Size in 2024 | USD 9.23 Billion |

| Market Size by 2034 | USD 14.93 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.93% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product, By Application, and By Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing vehicle customization

Customers are increasingly looking for ways to customize vehicles. Owing to their many different colors, patterns, and styles, automotive films provide a simple and affordable option to accomplish this. Personalization, in which consumers desire to show their uniqueness through their vehicles, is one of several drivers that propel this market. They want their cars to reflect their personalities, values, and lifestyles. Automotive films provide a simple and affordable approach to tapping into this industry. Similar to performance, customization can boost a car's performance. This can be accomplished by improving the vehicle's engine, exhaust system, and other elements like the brakes and suspension that impact how it drives or handles on the road.

Although there are many different types of car alterations, aesthetic and cosmetic modifications are the most common. The customization might be as simple as painting your automobile a different color, investing in more powerful headlights and taillights, adding chrome wheels, or tinting the windows. Certain people embellish their interiors with even better seats. As the demand for such customization services increases, the growth of the automotive film market is expected to boost.

High installation price

Automotive film installation frequently calls for specific tools and expertise, which raises the installation cost. This may limit the market for vehicle films and make it difficult for certain buyers to justify the cost. The type of film used, the size of the vehicle, and the service provider's location are just a few of the variables that might affect how much it costs to tint car windows. For a conventional automobile, professional window tinting typically costs between $200 and $600, with larger vehicles like SUVs and vans costing more. The price can also vary depending on the type of film being used, with more expensive films like ceramic or carbon frequently costing more than standard colored films. As certain states have limitations on the amount of tint allowed on specific windows, the desired level of darkness or tint percentage might also affect the price.

Other elements that affect cost include the film's quality, with higher-grade films offering better protection and greater durability but also costing more. The size of the vehicle affects how much film is needed, which increases the cost of installation. Additionally, some installation techniques, including custom installation, can be more expensive than pre-cut kits.

Growing automobile and vehicle demand due to technological advances

The automotive film market is expanding steadily, and businesses are investing heavily in R&D, partnerships, technological advancement, and collaboration to introduce cutting-edge products and take advantage of new market opportunities. Market players are concentrating on developing unique products to meet the rising demand for automotive glasses.

An innovative, incredibly long-lasting (up to 12 years), conformable film for large-format digital printing called Ri-Jet C50 Ultimate Slide & Tack was introduced in November 2022 by the Italian manufacturer Fedrigoni S.P.A.

An announcement from 3M stated that the "3M Ceramic Coating" for plastic trim, metal, auto glass, wheels, and paint was released in April 2022. The debut of such cutting-edge and new products is anticipated to fuel the market for automotive films in the upcoming years.

The tinting films segment is expected to witness significant growth during the forecast period. Protective liner, polyester material, coating, dyes, adhesives, alloys, metals, and UV inhibitors are some of the components that increase the window’s durability and performance over time as well as its life, both of which are expected to contribute to the market growth for window tint films.

The automotive wrap segment is expected to witness an enormous demand during the forecast period. The increasing utilization of automotive wraps as they are light-weight alternative fuels the segment’s growth.

Due to the abundance of raw materials, the market for automotive NVH laminates is anticipated to expand. The market for automotive wraps is developing significantly as a result of changing consumer lifestyles and rising disposable income. Vehicles can only be painted in a limited number of colors, although manufacturers offer a vast variety of hues and textures.

The interior segment holds a significant market share and is expected to maintain its position in the market. The demand for automotive wraps is developing significantly, in large part due to changing consumer lifestyles and rising disposable income. Vehicles can have a much wider variety of colors and textures from manufacturers than paint. As a result, there should be an increase in demand for automotive wraps throughout the predicted period. Over the projected period, the product's interior application is anticipated to dominate demand. Due to rising consumer awareness, the market is being driven by interior use of the product, which includes laminates and window tints used for sun protection and, correspondingly, reducing the noise and harshness of automobiles.

On the other hand, the external application segment is expected to grow at a noticeable rate. The demand for wrap and paint protection films propels the product's external use. Consumers' growing interest in customizing their vehicles drives the need for exterior applications. Because of the rising desire for designer wraps in the automotive sector, the market for exterior films is anticipated to increase significantly. Additionally, growth is expected to be fueled by the high on-road density of LCVs. Due to the product's advantages, including protection from dirt, gravel, and dust particles, which help maintain the aesthetic value of automobiles, demand is likely to increase over the forecast period.

Over the projected period, the aftermarket is anticipated to dominate the sector as a whole. As the use of the product is directly proportional to the number of vehicles manufactured, the OEM channel dominates the sale of automotive films in the NVH film laminates product area. The primary barrier impeding market demand at the OEM level is the high installation and product cost.

However, it is anticipated that throughout the projected year, there will be an increase in the installation of protection films in high-end automobiles at the OEM level. Due to the inexpensive cost of the materials and the installation accounting for 50% of the total cost, paint protection and wraps are in high demand through aftermarket channels. In addition, it is anticipated that the propensity of consumers to install protection goods after making a purchase will support the need for the product in the aftermarket. Due to automakers' use of the product to aid in noise reduction, the demand for NVH laminates in the aftermarket is smaller than that in the OEM market. There is little demand for the product through the OEM channel because the entire application cost of paint protection or window tinting is nearly twice as high as the aftermarket cost.

North America dominates the global automotive film market. The expansion of the automobile industry's use of the most recent technologies, rising vehicle production, growing desire for opulent and exotic vehicles in production and sales, and a solid automotive infrastructure. Due to the rise in demand for wraps, paint protection, and tinting, the largest revenue share was achieved in 2023 by North America.

The United States is expected to be the most significant contributor to the market‘s development throughout the projected period. This can be attributed to the region's growing use of vehicle wraps for personalization and the low cost of vehicle maintenance for automobiles that use paint protection films. Automotive films enhance the car's overall appearance and offer protection against sun-oriented light radiation.

Due to rising consumer demand for improved aesthetics, privacy, and safety features in their vehicles, the automotive film industry is predicted to expand significantly throughout several North American areas.

On the other hand, Asia Pacific is the fastest-growing region in the automotive film market. rising product demand in the developing countries of the Asia-Pacific region is predicted to fuel market expansion. The use of automotive films is expanding across the Asia-Pacific region as auto manufacturing and sales rise in nations like China, India, Indonesia, Thailand, and Japan. China is the world's greatest producer and buyer of automobiles, according to OICA.

In April 2022, China sold about 965 thousand passenger cars and 216 thousand commercial vehicles. In the Asia-Pacific region, India is one of the biggest markets for automotive movies. According to OICA, India produced about 4.4 million vehicles in 2021, an increase of about 30% from the 3.39 million vehicles produced in 2020. By volume, India is anticipated to overtake China as the third-largest auto market by 2026, which is good news for commercial and electric vehicles. By 2025, the United States will have the youngest population, which will increase vehicle penetration and demand, as well as the number of research and development hubs.

Segments Covered in the Report

By Product

By Application

By Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

April 2025

January 2025