January 2025

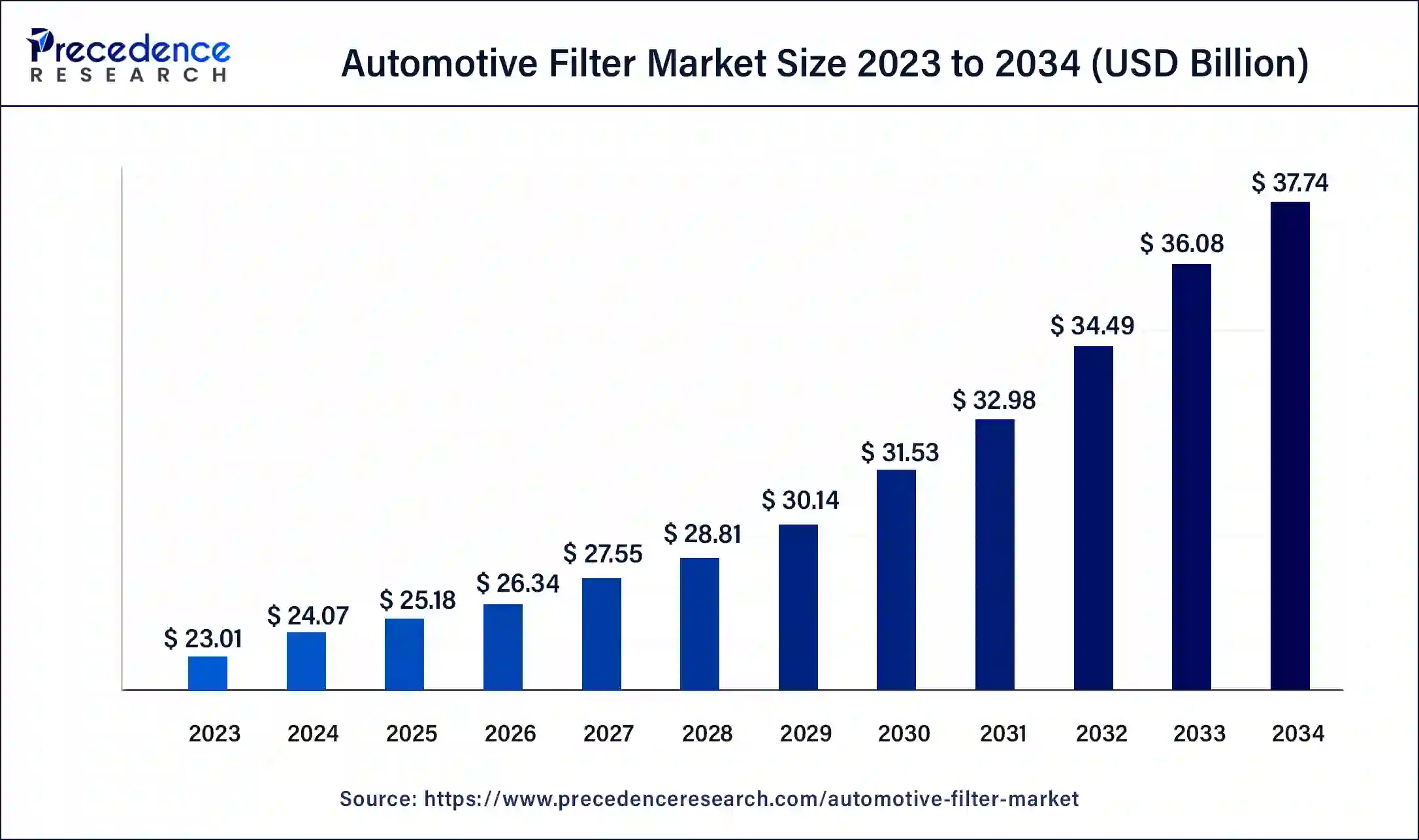

The global automotive filter market size was USD 23.01 billion in 2023, calculated at USD 24.07 billion in 2024 and is projected to surpass around USD 37.74 billion by 2034, expanding at a CAGR of 4.6% from 2024 to 2034.

The global automotive filter market size accounted for USD 24.07 billion in 2024 and is expected to be worth around USD 37.74 billion by 2034, at a CAGR of 4.6% from 2024 to 2034. The North America automotive filter market size reached USD 8.05 billion in 2023.

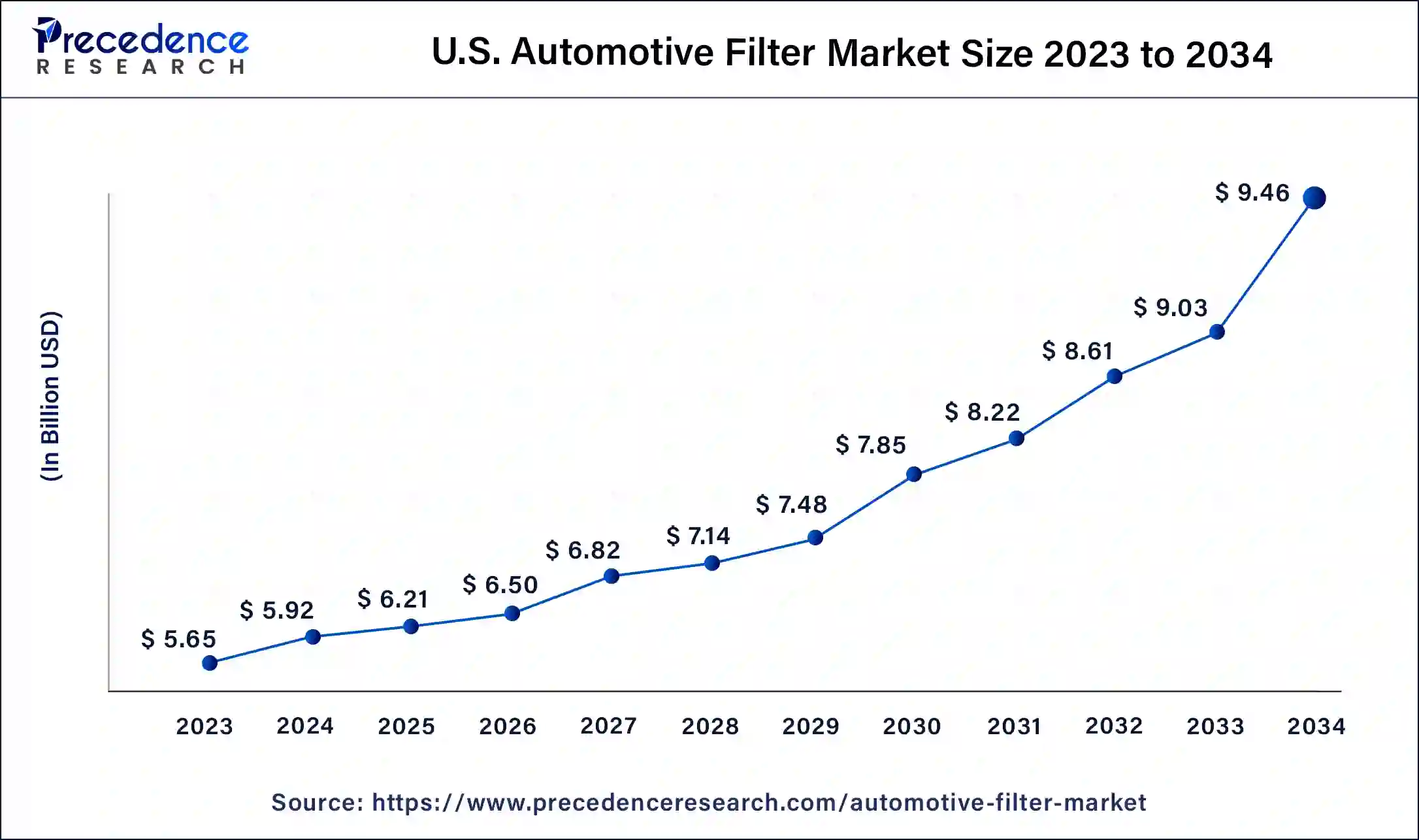

The U.S. automotive filter market size was estimated at USD 5.65 billion in 2023 and is predicted to be worth around USD 9.46 billion by 2034, at a CAGR of 4.8% from 2024 to 2034.

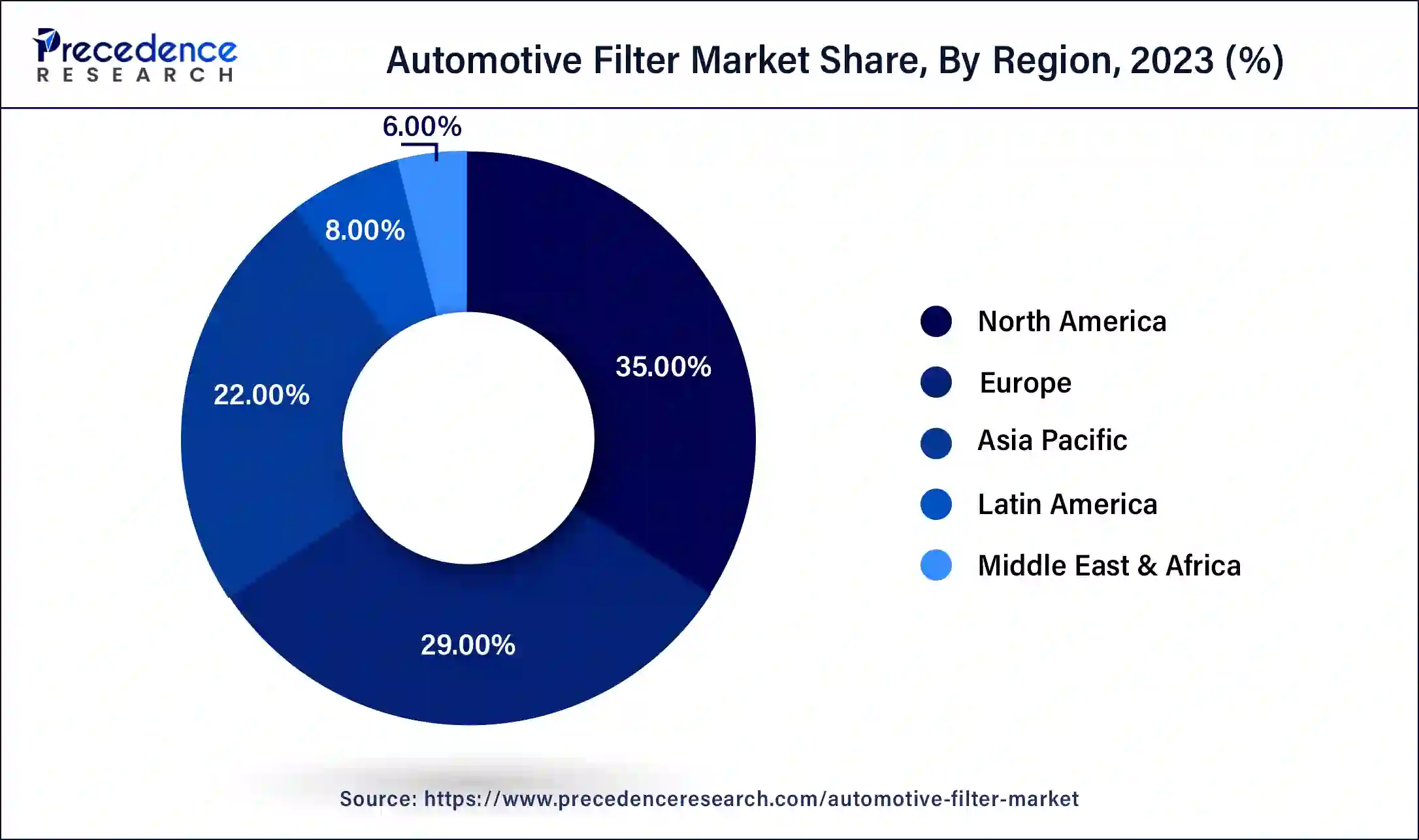

North America dominated the automotive filter market and accounted for the largest revenue share of 35% in 2023. This is attributed to the increased demand for the automotive vehicles in the nations like US and Canada. Furthermore, rising investment by the vehicle manufacturing companies for the production of automotive vehicles is augmenting the market growth. The presence of top aftermarket suppliers such as K & N Engineering and Donaldson in the region has significantly boosted the demand for the automotive filter.

On the other hand, Asia Pacific is anticipated to witness significant growth in the upcoming years owing to the factors such as rapid urbanization, huge investments in the growth of infrastructure and connectivity, rapid industrialization, and growing demand for the passenger vehicles. Countries like China and India offers the most lucrative growth opportunities to the key players in the automotive market. Moreover, China and India are on their way to be the global manufacturing hub due to the availability of cheap raw materials and labors coupled with growing government initiatives to attract investments.

The growing concerns regarding environment, pollution, and global warming has forced the government to lay down certain regulations and emission norms for the automotive sector. These regulations and standards regarding the emission is one of the primary drivers of the automotive filter market growth. Hence, the consumers are shifting their preferences towards diesel engines that promotes fuel-efficiency. Moreover, the automotive filters helps to reduce fuel consumption and facilitates in the smooth functioning of the engine. Consumers’ desire to save fuel costs by consuming less fuel is driving the growth of the automotive filter market.

The global automotive filter market is expected to witness a rapid growth owing to the increasing sales of luxury cars. The rising disposable income, rise of middle class in the developing nations, increased awareness regarding the harmful effects of carbon emission, and increased demand for premium and luxury vehicles in developed market are the various factors that are expected to augment the growth of the automotive filter market during the forecast period. Moreover, increasing investments on research & development by the manufacturers for developing advanced technologies to gain competitive edge is positively contributing towards the growth of the market.

| Report Coverage | Details |

| Market Size in 2023 | USD 23.01 Billion |

| Market Size in 2024 | USD 24.07 Billion |

| Market Size by 2034 | USD 37.74 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 4.6% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Filter, Vehicle, Distribution Channel, and Region |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

By filter type, in 2023, the cabin air filter dominated the largest market share in terms of revenue of the total market. The cabin air filters help to remove pollutants like dust and pollens from the air and provides safe breathing to the passengers. The growing health consciousness among the consumers coupled with rising investments by the automotive filter market players to improve the efficiency of the cabin air filters has fostered the growth of the cabin air filter segment in the recent years.

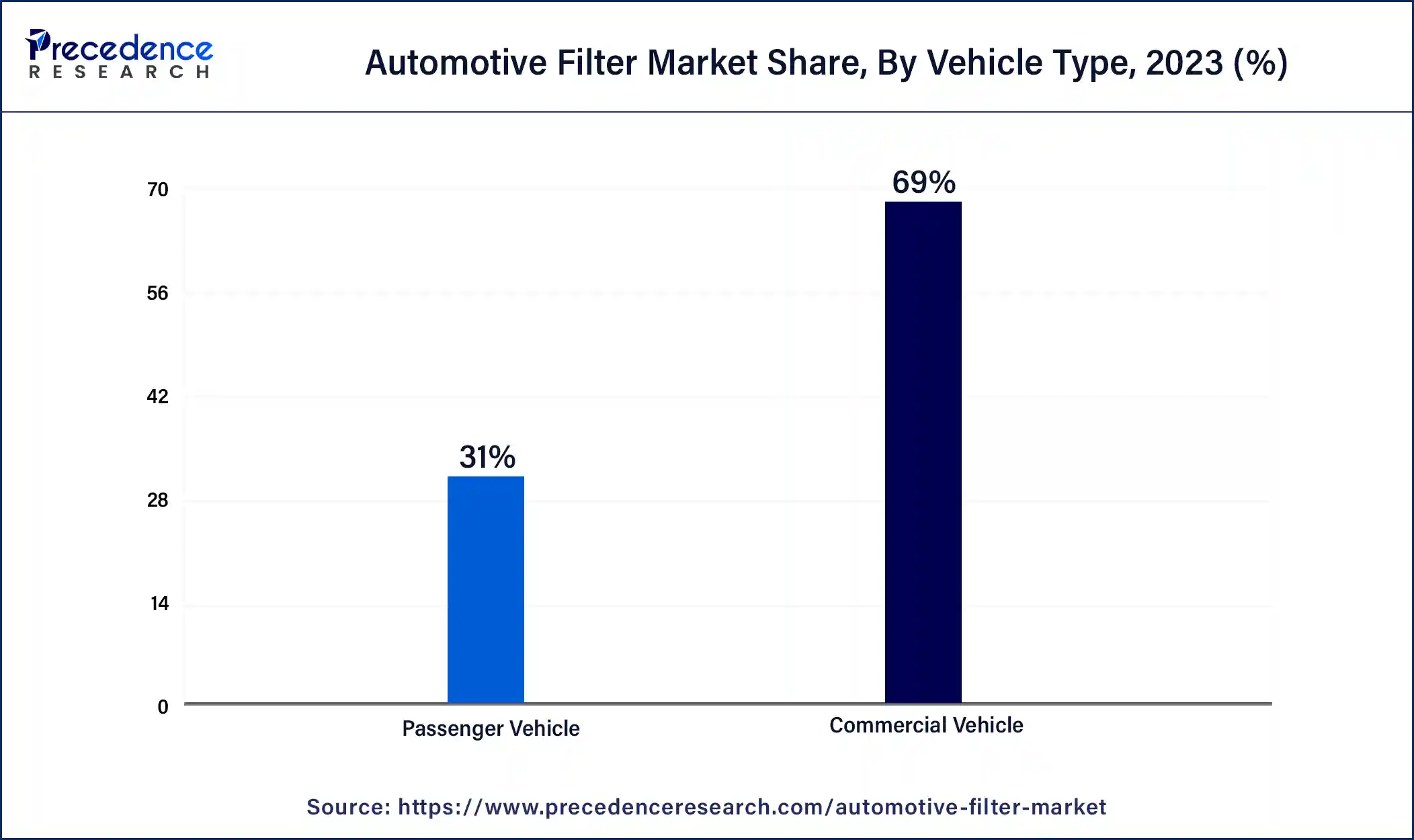

By vehicle type, in 2023, the commercial vehicle dominated the market with around 69% share in terms of revenue of the total market. The rapid expansion of infrastructure and industries in the developing economies has exponentially contributed to the sale of the commercial vehicle. Moreover, tourism industry has played a significant role in the growth of the commercial vehicles in the past few decades. The rising number of e-commerce and real estate activities are projected to fuel the demand for the commercial vehicles in the forthcoming years. Therefore, the commercial vehicle segment is anticipated to remain the dominating segment throughout the forecast period.

On the other hand, the passenger vehicles is projected to be the most opportunistic segment during the forecast period. The rising disposable income, growth of the middle class, and demand for the luxury cars is augmenting the demand for the passenger vehicles across the globe. Passenger vehicle have higher penetration in the developed markets of North America and Europe. However, the passenger vehicles demand is rapidly growing in the developing markets due to rising disposable income, easy availability of car loans, and growing demand for quality life.

By Distribution Channel, in 2020, the aftermarket dominated the market with around 75% share in terms of revenue of the total market.The automotive filter market is dominated by the aftermarket segment due to the presence of large number of Japanese, European, and American manufacturers. Moreover, the developed market like US is dominated by the aftermarket channel due to the higher penetrationof the passenger vehicles.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved and efficient automotive filter solutions. Moreover, they are also focusing on maintaining competitive pricing.

In 2019, DENSO announced to build a new manufacturing plant of around 100,000 sq. meters, in China, to ramp up its automotive parts production and also for warehousing and distributing activities. This development will play a significant role in the growth of the global automotive filter market.

Segments Covered in the Report

By Filter Type

By Vehicle Type

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025