January 2025

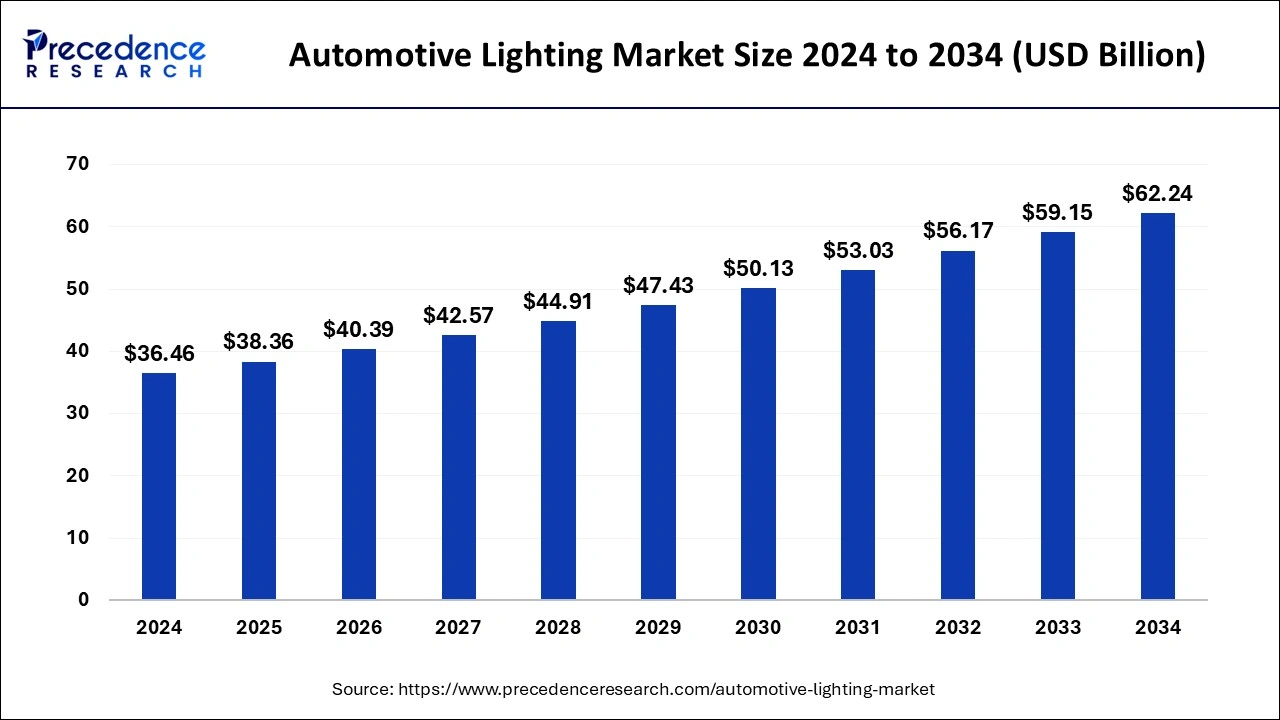

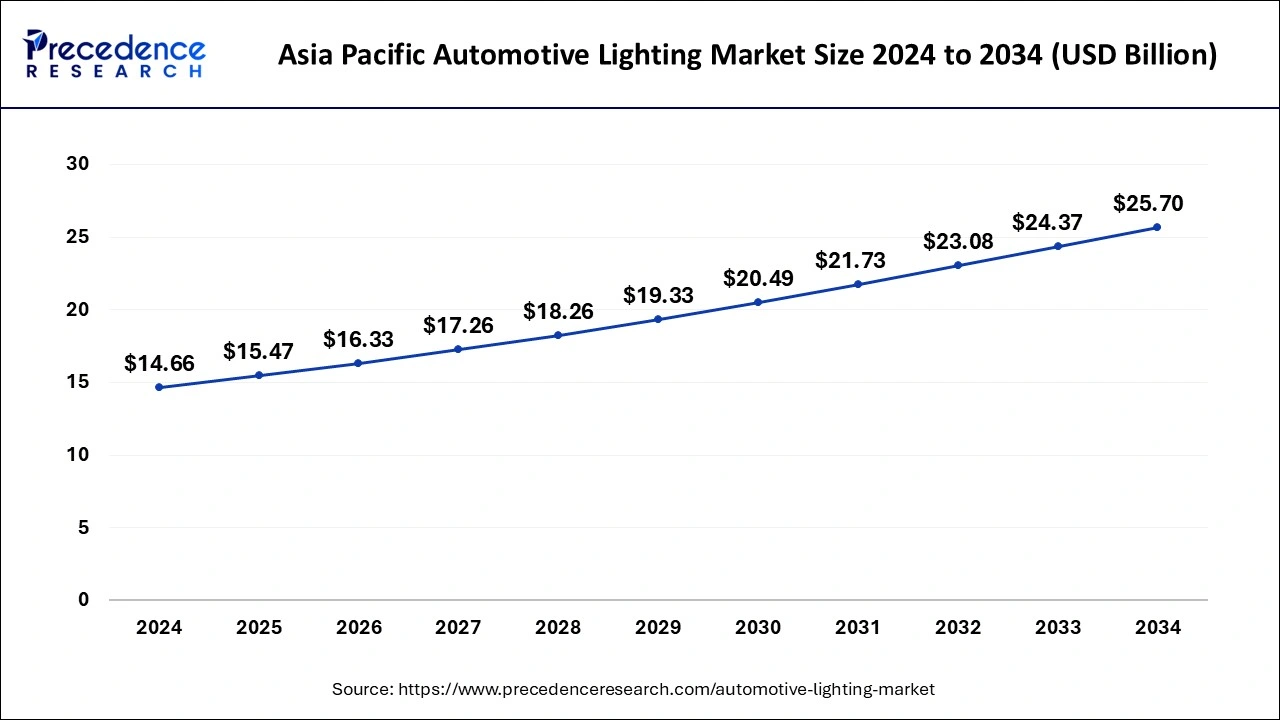

The global automotive lighting market size is calculated at USD 38.36 billion in 2025 and is forecasted to reach around USD 62.24 billion by 2034, accelerating at a CAGR of 5.49% from 2025 to 2034. The Asia Pacific automotive lighting market size surpassed USD 14.66 billion in 2024 and is expanding at a CAGR of 5.77% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive lighting market size was estimated at USD 36.46 billion in 2024 and is anticipated to reach around USD 62.24 billion by 2034, expanding at a CAGR of 5.49% from 2025 to 2034. The rising sales of automobiles worldwide is directly increasing the demand for automotive lighting market

Automobile industry is already embracing Artificial Intelligence (AI) in different processes of end product as well as manufacturing. Adopting AI in the automotive lighting industry will help further expand the market. It can be utilized in automotive exterior lighting by using AI and machine learning (ML) algorithms in combination with sensors. This can identify objects to adjust vehicle lighting improving visibility and safety of the driver. Intelligent interior lightening along with AI technology is extremely beneficial. For instance, gesture control of ambient light, an AI-driven feature, for individual lightning can add comfort for the car interior. AI technology integrated with Internet of Things (IoT) will enhance smart features of the car like location tracking, weather, real-time analysis etc. that helps the driver make informed decisions. AI is set to revolutionize the automotive lighting market in the forecast period.

The Asia Pacific automotive lighting market size was exhibited at USD 14.66 billion in 2024 and is projected to be worth around USD 25.70 billion by 2034, growing at a CAGR of 5.77% from 2025 to 2034.

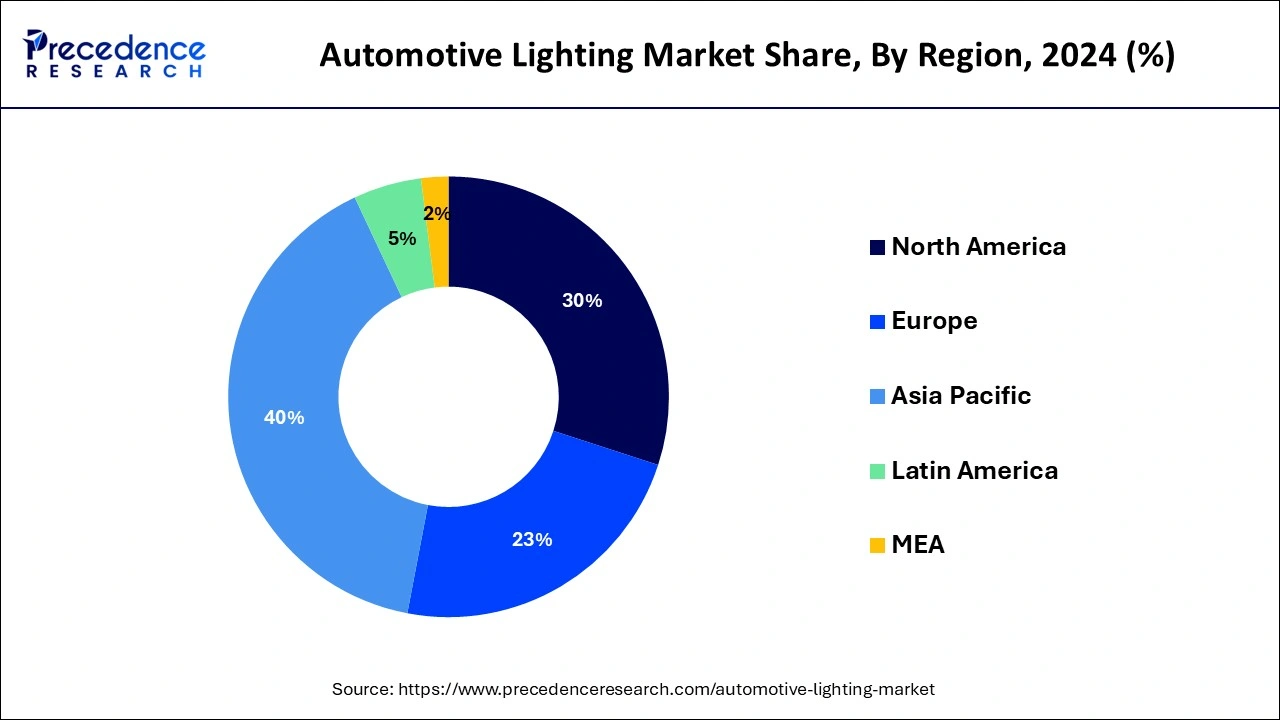

The Asia Pacific emerged as the most promising region in the global automotive lighting market with a significant revenue share of nearly 40.11% in 2023 and anticipated to witness the fastest growth over the analysis period. This is primarily due to the high production and sales of passenger vehicles in the region. Increasing purchasing power of the consumers along with rising GDP in the emerging economies attributed to the significant demand for passenger vehicle sales in the region. Further, China, India, Japan, and Taiwan are the major automotive manufacturing hub, thereby fuelling the growth of automotive lights production in the region. In addition, rising number of road accidents in the region are likely to boost the aftermarket sales of automotive lighting. Automotive lighting cover or mirror are the most critical part and easily break while collision, thus automotive lighting is one of the most replaceable part of the automotive vehicle.

Countries like India have a major role to play in the ever-evolving automobile industry for the Asia Pacific region. The country is an important market for the automobile industry which will directly help in increasing the demand for automotive lighting market. The LED segment is gaining momentum in the country as there is a noticeable shift towards advanced technologies. Halogen and LED technologies are growing in demand that will help the market growth in the forecast period.

The U.S. holds the major share of the automotive lighting market in the region. The growing demand from consumers for efficient and advanced technology integrated automobiles are driving the market in the country. The shift of customers to focus on aesthetics, comfort and safety is increasing demand for LED lighting as it an energy efficient option.

Increasing sales and production of automotive vehicle across the world expected to drive the demand for automotive lighting during the forecast period. Rising disposable income, rising need for transportation services, and improvement in lifestyle are the major factors that boost the production of automotive vehicle, thereby propelling the growth of automotive lighting. Furthermore, government regulation for automotive lighting along with rising concern for road safety are some of the prime factors that drive the automotive lighting market growth. Increased number of road accidents is the major cause to propel the demand for adaptive lighting system along with safety features in the automobile. Vehicles with advanced and adaptive lighting can detect objects on road; this prevents the upcoming accident by alerting the driver in proper time to take necessary action. Furthermore, rising demand for vehicle as well as driver safety as a concern regarding increasing accident cases eventually leads to the deployment of efficient lighting systems that provides optimum illumination on road.

| Report Highlights | Details |

| Market Size in 2025 | USD 38.36 Billion |

| Market Size by 2034 | USD 62.24 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.49% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Product, Vehicle, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

In 2024, halogen technology led the global automotive lighting market with prominent revenue share and expected to register stagnant growth over the forecast period. Easy availability along with less replacement & purchasing cost of the halogen lights are few factors that drive the growth of the segment. They are easily available at low cost and in different dimensions that make them a preferred choice for the consumers. Besides this, excessive heat loss during light radiation restricts the usage of halogen.

As a counterpart, Light Emitting Diode (LED) technology registers lucrative growth over the forecast period. This is primarily attributed to its diverse applications such as brake lights and indicators. Furthermore, their benefits such as energy saving and optimum as well as constant illumination contribute as the other major factors to drive their adoption in automotive lighting industry. Presently, LEDs have penetrated in almost every automotive lighting application along with headlamp sector.

The front/headlamps application segment estimated to register significant growth prospect over the forecast period. This is mainly attributed to the rising advancement in the headlamps along with incorporation LED technology in the front view lighting sector. In electric or battery-powered vehicles energy saving is a prominent aspect and implementation of LED fulfills the requirement for energy saving, thus flourishing demand for electric cars or vehicles expected to drive the growth for LED demand in headlamps segment. Further, adaptive lighting are the most demanded safety features in the advanced vehicles to enhance the driver’s visibility also in low lighting condition.

Rear lights are the lighting solution mounted on the back side of the vehicle that comprises indicators, tail lights, brake, and back-up lights. These lights are the most important lighting system that indicates or alerts other drivers on road about the vehicle position, direction, and movement. Presently, halogen lighting is commonly used lighting technology for rear lights in a vehicle; however, LEDs are expected to emerge as the prominent solution in vehicles during analysis period.

By Technology

By Product Sale

By Vehicle Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025