January 2025

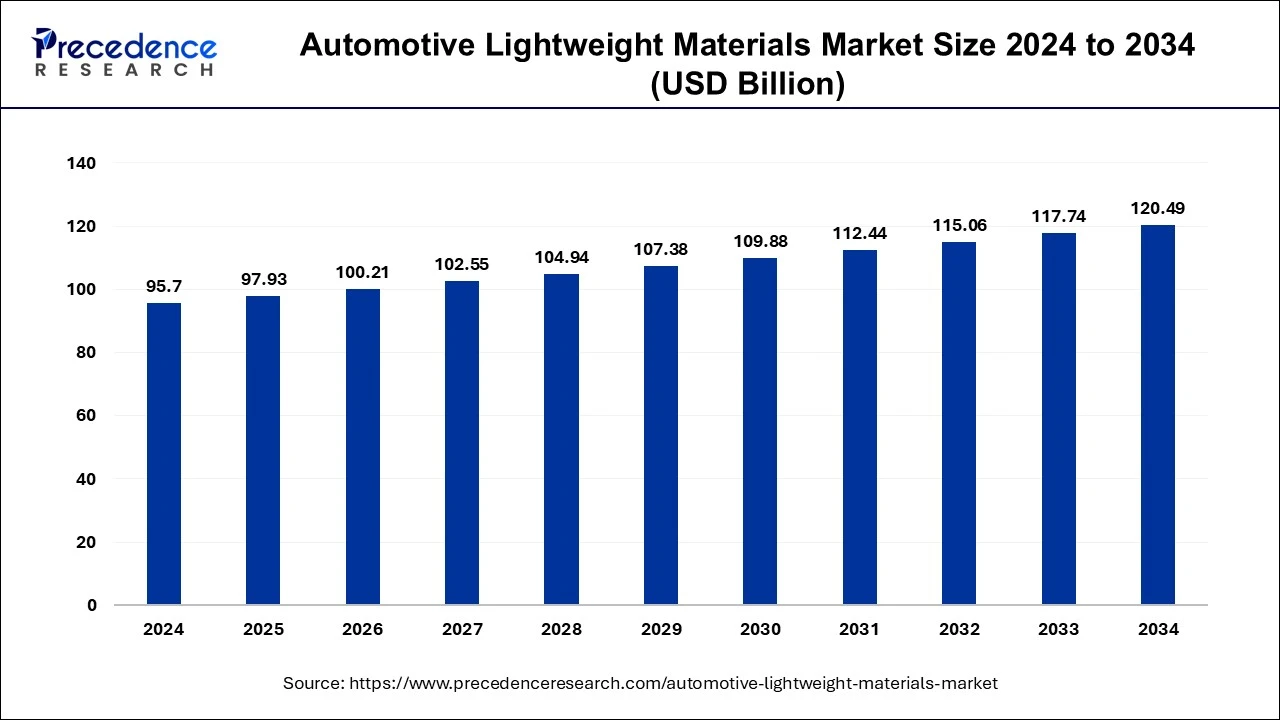

The global automotive lightweight materials market size accounted for USD 95.70 billion in 2024, grew to USD 97.93 billion in 2025 and is predicted to surpass around USD 120.49 billion by 2034, representing a healthy CAGR of 2.33% between 2025 and 2034.

The global automotive lightweight materials market size was estimated at USD 95.70 billion in 2024 and is anticipated to reach around USD 120.49 billion by 2034, expanding at a CAGR of 2.33% from 2025 to 2034. There is a growing demand for automative lightweight materials market as the sector needs materials that can increase fuel efficiency of the vehicles.

Artificial Intelligence (AI) has been slowly integrated in automobile industry. AI and machine learning (ML) algorithms are rapidly transforming technology in the sector with integrated driving systems, autonomous vehicles etc. AI can help manufacturing process, streamlining operations and improved efficiency in manufacturing in automobile manufacturing. AI technology can power autonomous vehicles that can help the vehicle navigate and operation without any human intervention. With AI technology, design and engineering can utilize new tools and methodologies to design vehicles are lighter, and durable. AI can optimize engine design increased efficiency in power and minimize fuel emissions. AI can help in personalizing customer experiences by analyzing consumer data, purchase history, and social media interactions. It can also help optimize supply chains. AI can help change the landscape of the automotive lightweight materials market during the forecast period.

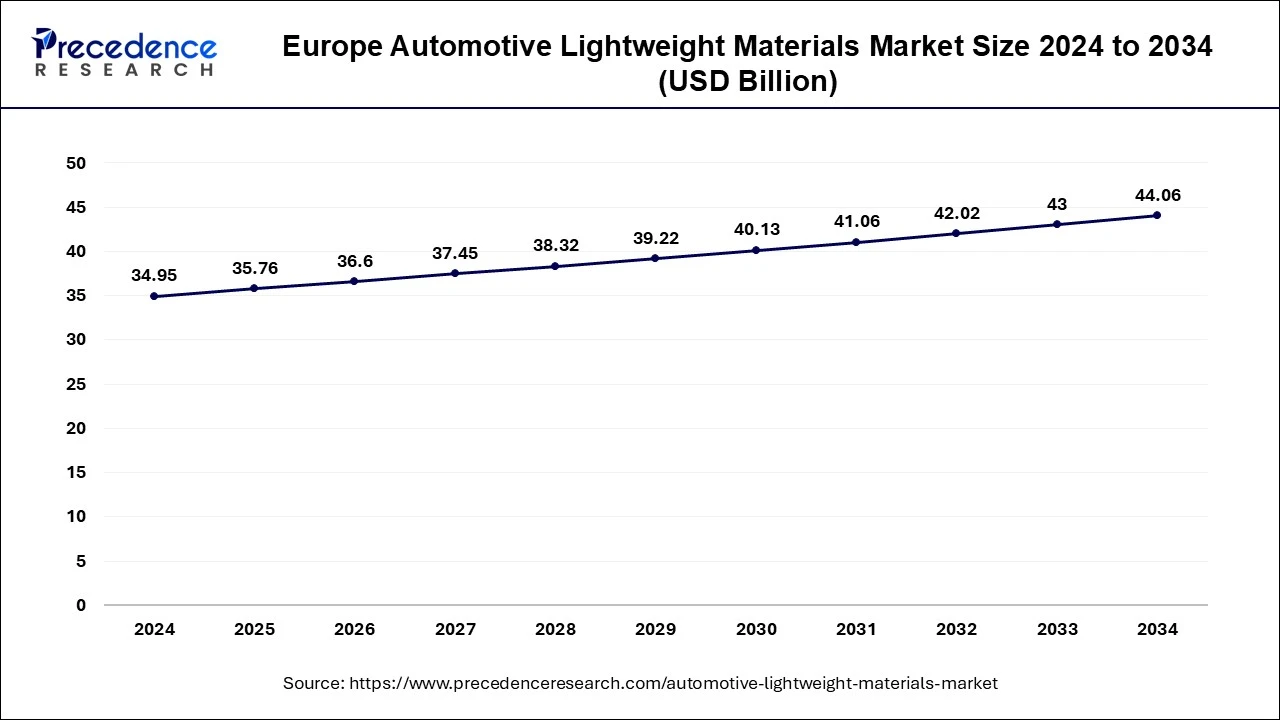

The Europe automotive lightweight materials market size was evaluated at USD 34.95 billion in 2024 and is predicted to be worth around USD 44.06 billion by 2034, rising at a CAGR of 2.34% from 2025 to 2034.

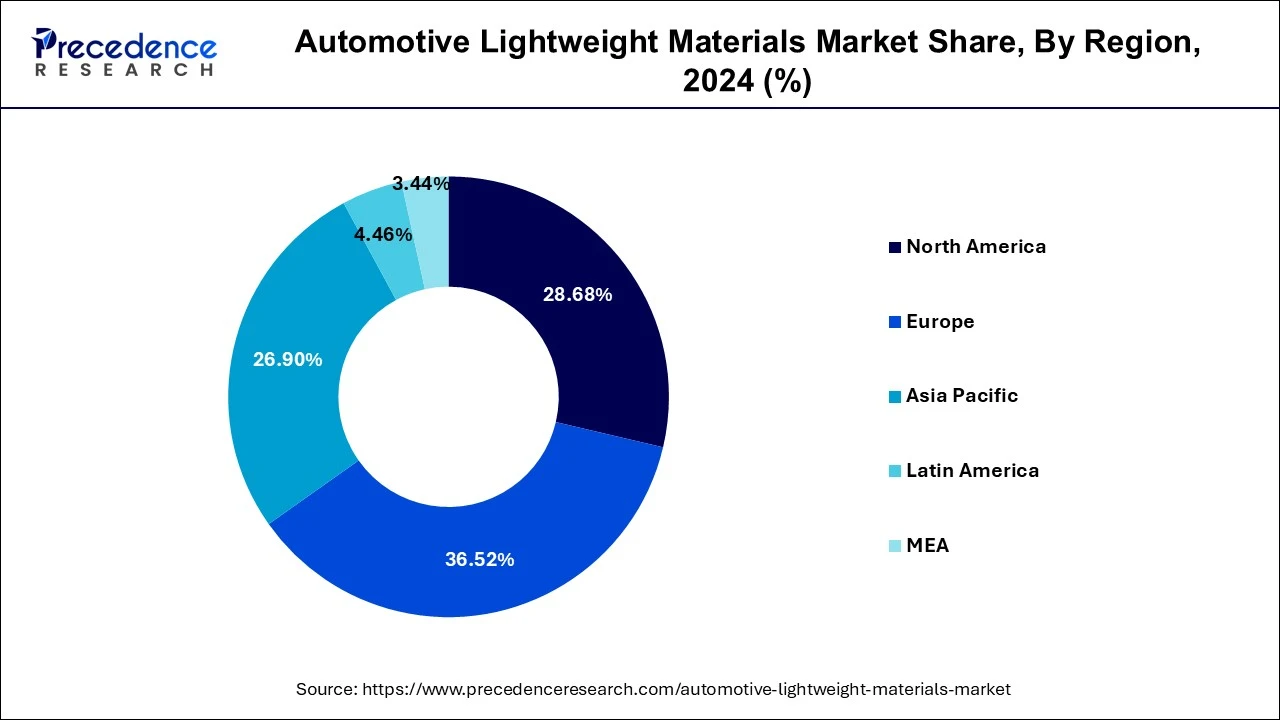

The Asia Pacific was projected as the front-runner in terms of consumption for the year 2024, owing to rapid growth in the adoption of electric and hybrid electric vehicles in the region. Some Asian countries such as China, India, Japan, and Korea have announced their plan to transform their public transportation sector with electric and advanced vehicle. In addition, these countries have stringent emission norms for automobiles because of increasing carbon percent in the environment at an alarming rate in these areas. To curb these adverse environmental impacts the region has set stringent emission standards for various industries that contribute to the carbon share, automotive is one of them.

Europe dominated the global automotive lightweight market with the largest market share of 36.52% in 2024. The EU has set definitive targets to reduce carbon emissions, which has pushed automobile manufacturers seek solutions that will improve fuel efficiency. In Europe, Germany is a frontrunner for the adoption of the lightweight materials like carbon fiber reinforced polymers, aluminum etc. These materials will be help enhancing vehicle performance that will meet stringent regulation in the region. This will continue helping the growth of automotive lightweight materials market in the European region during the forecast period.

Automotive lightweight materials market is growing because there is a necessity for vehicles that are lighter and more fuel efficient. Lightweight materials can help manufacturers optimize their production process with these advanced materials which reduces manufacturing costs. Some of these materials may be slightly expensive, but there have proven to be beneficial in the long run. The automakers need to accommodate costs pressures, making investments in lightweight materials can benefit in fuel consumption and maintenance of a vehicle during its lifecycle. These materials go a long way in improving fuel efficiency of car and also, reduce operational costs.

With new developments like the Electric Vehicles (EVs), there is a necessity for efficient energy use which will maximize battery life and improve range; the weight of the vehicle becomes a crucial aspect. Lightweight materials like carbon fibers, aluminum, high strength steel etc. are being widely used in making EVs. Lightweight materials help in bettering vehicle dynamics, acceleration, and handling while maintaining structural foundation during mishaps. Lightweight materials for manufacturers are a way to meet evolving consumer demands as these improve performance as well as safety of a vehicle which will aid market growth of the automotive lightweight materials market.

The global automotive lightweight materials market seeks intense competition among the industry participants. This is mainly because of high rate of partnership, merger & acquisition, collaboration, and joint venture agreements between the manufacturers and automotive players in the recent past. Further, the industry players also invest significantly in the research & development (R&D) for new product development and enhancement. For instance, in May 2019, BASF SE planned to build a Thermoplastic Polyurethane (TPU) plant and an engineering plastics compounding plant at the proposed integrated chemical production (“Verbund”) site of the company in Zhanjiang, China.

| Report Highlights | Details |

| Market Size in 2024 | USD 95.70 Billion |

| Market Size in 2025 | USD 97.93 Billion |

| Market Size by 2034 | USD 120.49 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 2.33% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vehicle, Material, Application, Region |

Advancement in technology and manufacturing methods

There have been many advancements in technology and manufacturing process of vehicles in the last few years. These technologies slowly but surely are replacing traditional manufacturing methods. New technologies help manufacturers integrate innovative designs and features that align with consumer demands. Additive manufacturing, resin transfer, micro injection molding etc. are some new technologies that are utilized to manufacture new materials that are lighter and durable. The advanced technologies help in minimizing material wastage.

These new processes and technological advancements have helped the automotive industry to keep up with growing demands for lightweight materials. Many key players are developing vehicles are more fuel efficient and better in performance due to advancements. These techniques have enabled substitution of materials that has resulted in cost and weight reduction of the vehicle. This will help boost the demand for the automotive lightweight materials market in the forecast period.

Integrating dissimilar materials together

The mixed material design (MMD) has helped enable lightweight automotive by designing components and parts from two different materials. This has become a bit of issue because it it is difficult to weld or join two different materials. The MMD’s is not being utilized to its full advantage because of such issues. The physical properties of two materials are different which means difference in welding temperatures and density. These materials need to joined correctly for maintaining structural integrity of a vehicle. The MMD has helped the manufacturers in using automotive lightweight materials, however it hasn’t been without its challenges. The process of welding or join two different materials seamlessly needs to worked on. The proper application of MMDs can make a huge difference in the weight, interior and exterior of the vehicle, making it stronger.

Electric and autonomous vehicles

The electric and autonomous vehicles are touted as the future of automobile industry. There has been lot of research and development activities ongoing for improvement and implementation of these vehicles on a wider scale. Electric Vehicle run on batteries; they need to have enough range and be energy efficient. The weight of the vehicle plays a huge part. Lightweight materials can help these vehicles becomes lighter, durable and efficient which will boost the overall performance. The growing concerns and regulations regarding caron emissions are making electric vehicles a better choice for the environment. Most of the key players are launching electric vehicles while also working on bettering them with improved battery life and innovative features.

Autonomous cars, on the other hand, are still growing at a slower pace. These vehicles can be incorporated with lightweight materials to reduce battery space and increase performance. The autonomous vehicles segment is still in its early stages in some countries is constantly being improved upon by manufacturers. The reduction in weight of these vehicles have proven to increase the driving range and vehicle efficiency. The development of electric and autonomous vehicles is an expansion opportunity for the automotive lightweight materials market.

The composites segment contributed the highest market share of 66% in 2024. This segment offers lightweight and durable features that have no impact on the design and dynamics. The composites have robust properties that make them easy to mold, making it a popular choice for vehicle manufacturers. The growing demand for electric vehicles is expected to help this segment’s growth during the forecast period.

The plastics segment is projected to grow at a CAGR of 3.83% during the forecast period. The regulations about carbon emissions are becoming stringent worldwide which has pushed the automakers to reduce vehicles weight in order to increase fuel efficiency. This will increase the demand for lightweight materials like plastics that weigh less than aluminum or steel. It can be utilized in the interiors, body panels, under the hood of a vehicle, helping manufacturers meet performance safety and compliances.

The body in white (BiW) segment accounted for the highest market share of 26% in 2024. This segment includes the structural frame of the vehicle and plays an important role in overall weight management of the vehicle. The closures segment is expected to grow at a CAGR of 2.6% during the forecast period. By integrating lightweight materials like aluminum, high strength steel, composites etc., helps the manufacturers reduce weight of the vehicles as well as increase fuel efficiency.

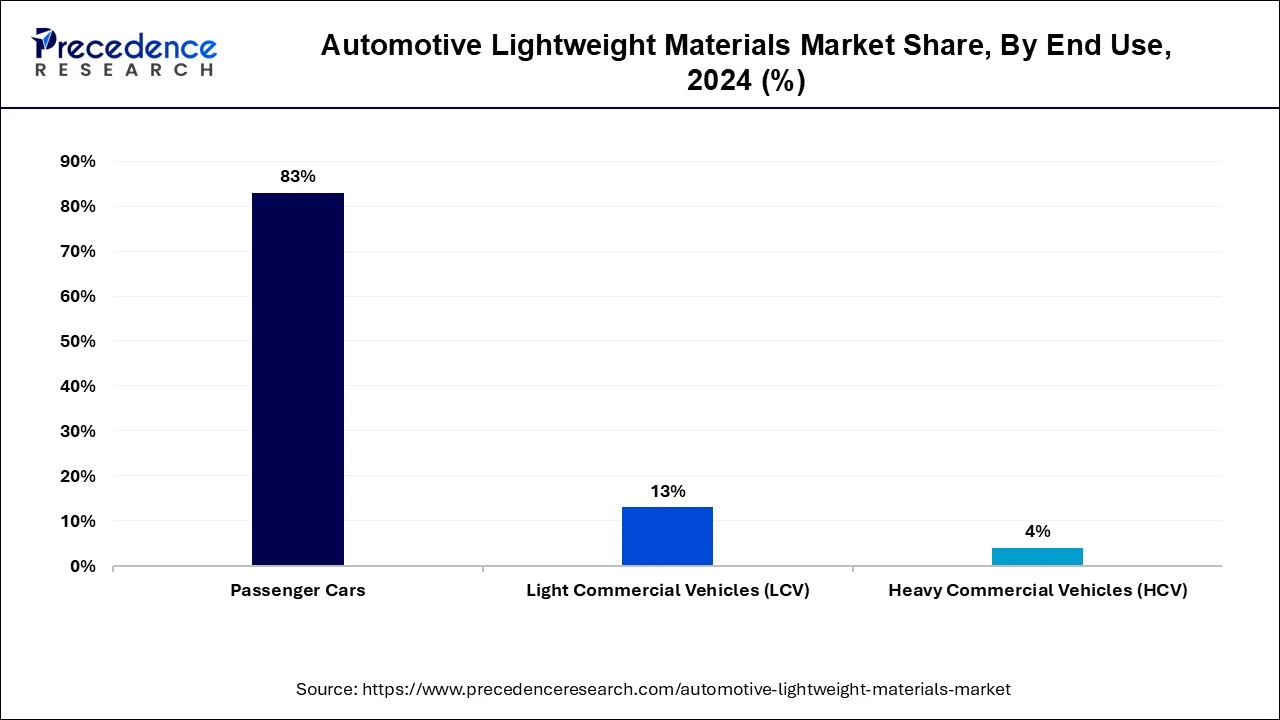

The passenger cars segment has held a major market share of 83% in 2024. The LCVs segment is expanding at a CAGR of 3.3% during the forecast period. The shifting consumer preferences towards sustainable driving practices has boosted the demand for fuel electric or hybrid vehicles which need to be fuel efficient by utilizing lightweight materials. Maximizing battery life as well as battery range require the weight of vehicle to be less. Manufacturers are focusing creating lightweight passenger cars to cater to wider consumer base that is growing conscious about environmental impact. There is an extra focus on ensuring compliances are meet that given rise to research and development activities on inclusion of innovative lightweight materials.

By Vehicle

By Material

By Application

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025