January 2025

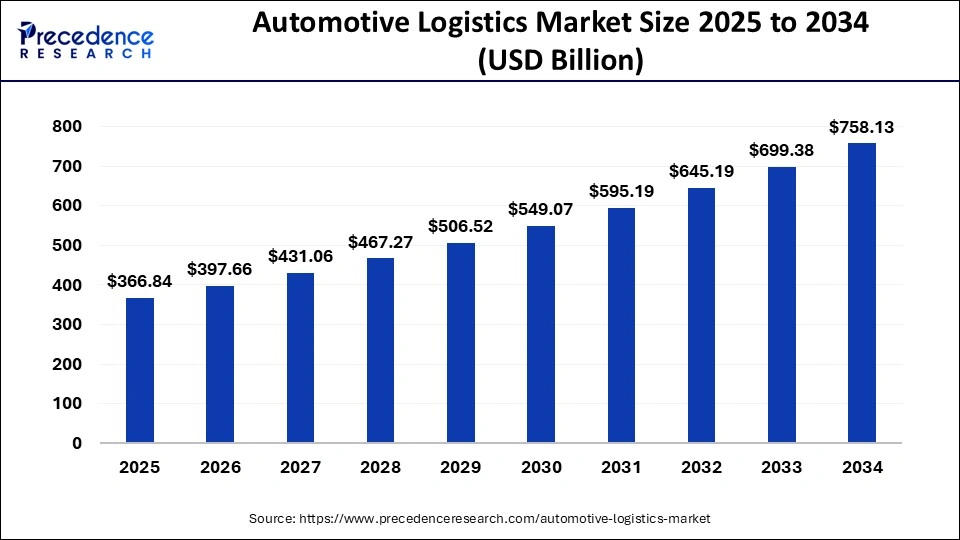

The global automotive logistics market size is calculated at USD 366.84 billion in 2025 and is expected to reach around USD 758.13 billion by 2034, expanding at a CAGR of 8.4% from 2025 to 2034. The Asia Pacific automotive logistics market size was estimated at USD 172.41 billion in 2025 and is expanding at a CAGR of 8.6% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive logistics market size accounted for USD 338.42 billion in 2024 and is expected to reach around USD 758.13 billion by 2034, expanding at a CAGR of 8.4% from 2025 to 2034.

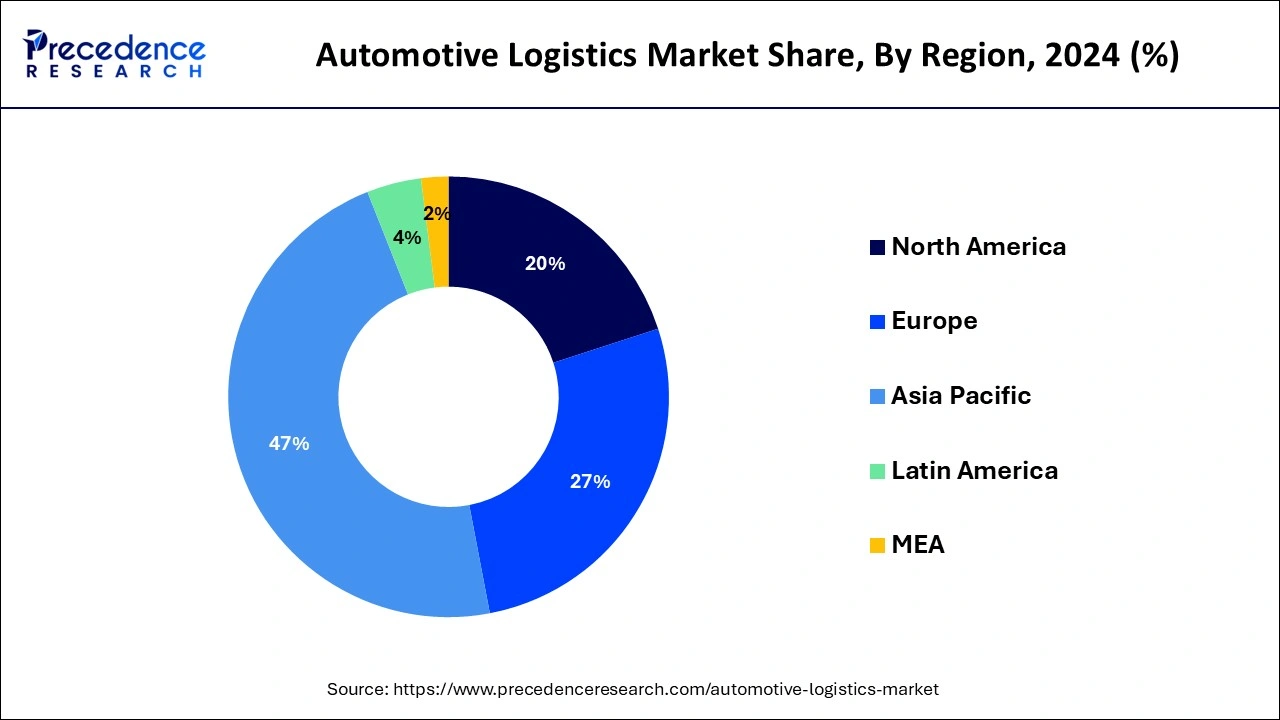

The Asia Pacific automotive logistics market size was estimated at USD 159.06 billion in 2024 and is predicted to be worth around USD 356.32 billion by 2034, at a CAGR of 8.6% from 2025 to 2034.

In terms of revenue, the Asia Pacific captured more than 47% market value share in the global automotive logistics market and expected to witness the highest growth during the forecast period. Economic growth in India and China has significantly boosted the market growth in the region. Economic revival and rising e-commerce penetration significantly contributes for the industry growth in India and China. Furthermore, increasing investments in railways, roadways, airways, and maritime trade across emerging nations, such as India, China, and Japan, are projected to bolster the demand for warehousing and logistics over the forecast period.

On the other side, Europe analyzed to witness slower growth as compared to the Asia Pacific over the next few years due to concern related to labor shortage and talent management. However, expansion of e-commerce sector and restructuring of supply chain activities is anticipated to positively influence the industry progress during forthcoming years. The region is a home for many automotive manufacturers that again triggers the market growth. In addition to this, rising demand for electric transportation in the region and favorable government initiatives significantly drive the market for automotive logistics over the forecast period.

Increasing outsourcing of automotive components, emergence of logistics services, and technological advancement are some of the prime factors that drive the market growth. Requirement of an effective and customized logistic service have established a differentiating factor among various logistic service providers and plays a crucial role in maintaining competition in the market. Logistics service providers are also incorporating disruptive technologies such as Big Data, Internet of Things (IoT), and connected ship to enhance their supply chain management system. These technologies aid in reducing the labor cost and also eliminate the delay in shipments. The aforementioned factor propels the demand of automotive logistics significantly over the coming years. Further, increasing sale of automobiles across the globe along with a significant rise in the demand for automotive spare parts positively influence the market growth. Advancement in the distribution channel and rising trend for Do it yourself (DIY) has again prominently boosted the demand for automotive aftermarkets, thereby triggers the market growth of automotive logistics.

| Report Highlights | Details |

| Market Size in 2024 | USD 338.42 Billion |

| Market Size in 2025 | USD 366.84 Billion |

| Market Size by 2034 | USD 758.13 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.4% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Logistics Solution, Distribution, Activity, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Based on type, automotive logistics market has been segregated into automobile parts and finished vehicles. Automobile parts encountered the maximum market value share in 2024. The segment includes both the revenue generated from the logistics of spare parts from both aftermarket as well as automobile manufacturers. In addition, stringent government norms for carbon emission have triggered the need for upgradation of automotive parts that again flourishes the demand for automobile parts in the coming years.

On the other hand, finished vehicles expected to register the highest growth over the forecast period due to rising demand for electric vehicles and low emission vehicles. Several government initiatives to curb the harmful emission is promoting the sale of electric and battery-powered vehicles across various regions. Additionally, governments of different regions are offering tax credits and other numerous benefits on the purchase of electric cars. Consequently, the above mentioned factors predicted to fuel the growth of finished vehicle segment during the forecast period.

Transportation segment led the global automotive logistics market with significant revenue in 2024 and analyzed to maintain its dominance over the projected years. Transportation is among the critical services in automobile manufacturing. This is mainly because of the automobile manufacturer source various parts and components of the vehicles from different companies, assemble them in their manufacturing plants and sell the finished vehicle across the globe.

Besides this, warehousing projected to exhibit the fastest growth over the analysis period. This is mainly due to increasing demand for capacity expansion in storage centers and warehouses. Furthermore, implementation of various warehouse management systems, effortless material handling, and systematic storage boost the warehouse segment growth in the coming years.

The global automotive logistics market is oligopolistic in nature and dominated by the some of the key players operating in the market. Market players are incorporating advanced technologies for route optimization, real-time tracking of shipments, and also provide technology-driven services to their customers. Collaboration, merger & acquisition of various other automotive logistics companies are the prime strategies adopted by the industry participants to capture maximum revenue share in the market. Furthermore, the market players are also focusing to improve their automation technology to achieve a competitive advantage among different end-users.

By Type

By Activity

By Logistics Solution

By Distribution

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025