January 2025

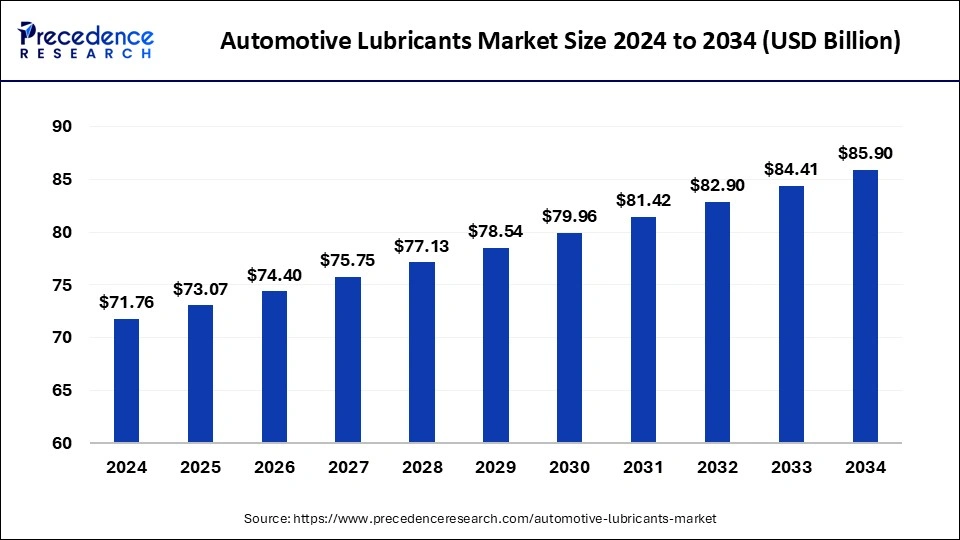

The global automotive lubricants market size is accounted at USD 73.07 billion in 2025 and is forecasted to hit around USD 85.90 billion by 2034, representing a CAGR of 1.81% from 2025 to 2034. The Asia Pacific market size was estimated at USD 30.14 billion in 2024 and is expanding at a CAGR of 1.97% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive lubricants market size was calculated at USD 71.76 billion in 2024 and is predicted to increase from USD 73.07 billion in 2025 to approximately USD 85.90 billion by 2034, expanding at a CAGR of 1.81% from 2025 to 2034. Increasing adoption of high-quality and environment-friendly automotive lubricants, which are further compatible with the technically advanced engines in the automotive market, are the major driving factors of the global automotive lubricants market.

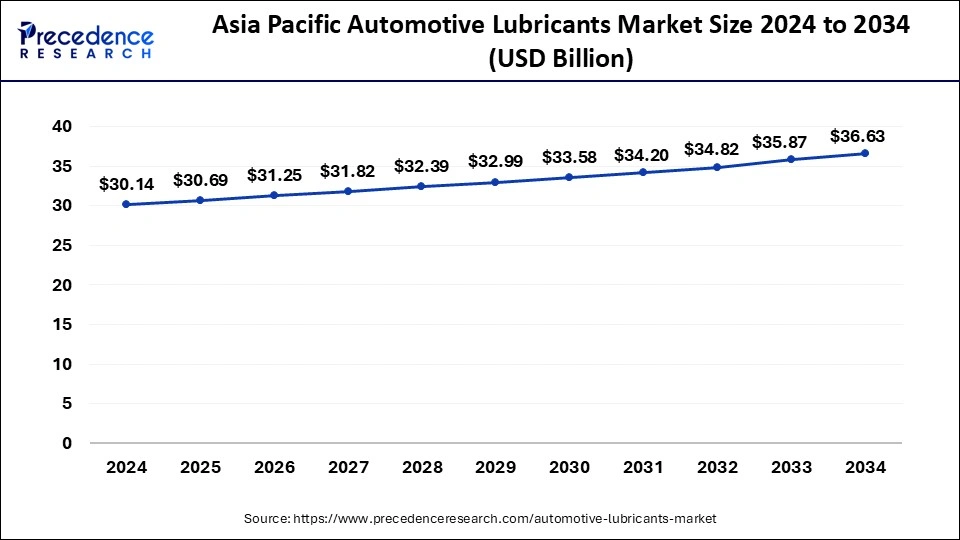

The Asia Pacific automotive lubricants market size was exhibited at USD 30.14 billion in 2024 and is projected to be worth around USD 36.63 billion by 2034, growing at a CAGR of 1.97% from 2025 to 2034.

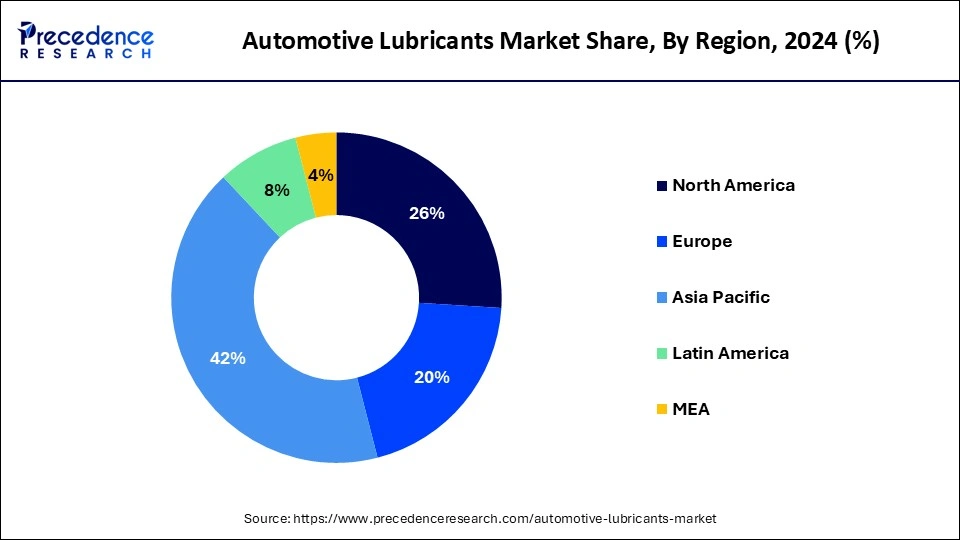

Asia Pacific accounted for a substantial share of the automotive lubricants market in 2024. The growth of this region is attributed to many factors, such as the rising automotive industry with technically advanced vehicles like EVs, which have a major contribution to the market growth. The production of automobiles is registered higher in Asian countries due to key players in the manufacturing domains established here for decades. Owing to these factors, the rising frequency of automobile servicing, including lubrication for various parts of the vehicles, has also shown a surge in the past years, helping fuel the automotive lubricants market.

Moreover, countries like China and India are the major contributors to the expansion of the automotive lubricants market due to their developing national strategy, including the establishment of robust infrastructure to support the automotive sector. Also, the automotive sector in Japan is the third largest automotive manufacturing market in the world. Again, China is considered the country with the highest revenue generator in the automotive lubricant market in the region since China has substantial lubricant consumption owing to its largest vehicle fleet in the country, which serves major organizations.

Europe is witnessing a rapid growth rate due to the increasing adoption of high-quality and sustainable automotive lubricants in the region, fuelling the market’s growth. The growth of this region is attributed to the stringent government regulations on the emission of greenhouse gases, which led marketers to come up with innovative solutions in automotive lubricants. The shift towards biodegradable and less toxic lubricants has seen a surge in the region. Moreover, the integration of digital technologies with predictive maintenance presents a lucrative opportunity in the European automotive lubricants market.

Europe has a spectrum of expanding industrial landscapes, such as manufacturing facilities, chemical plants, and several industrial processes that further fuel the European market. A number of major key players in the automotive market, like Mercedes-Benz, BMW, Volkswagen, and Audi, are established and based in Germany; Europe again presents a greater opportunity to proliferate the automotive lubricants market exponentially in Europe.

North America is expected to witness notable growth in the automotive lubricants market over the forecasted years. The region benefits from advanced manufacturing capabilities and significant investments in research and development for high-performance lubricants. Stringent environmental regulations are also pushing for the adoption of more efficient and eco-friendly lubricants. Key players like ExxonMobil and Chevron are focusing on innovative products to meet rising demand. Additionally, the presence of a large number of vehicles on the road ensures a consistent need for automotive lubricants.

The global automotive lubricants market is experiencing steady growth, driven by increasing vehicle production and ownership, especially in emerging economies. The market is segmented into engine oils, transmission fluids, and other lubricants, with engine oils dominating due to their critical role in vehicle maintenance. Advancements in lubricant technology, focusing on enhancing fuel efficiency and reducing emissions, are propelling market expansion.

Major players in the automotive lubricants market include Shell, ExxonMobil, and BP, who are investing in R&D to develop high-performance lubricants. Environmental regulations and the shift towards electric vehicles pose challenges but also open opportunities for specialized lubricants. Asia-Pacific leads the market, followed by North America and Europe, owing to high vehicle demand and manufacturing bases.

| Report Coverage | Details |

| Market Size by 2034 | USD 85.90 Billion |

| Market Size in 2025 | USD 73.07 Billion |

| Market Size in 2024 | USD 71.76 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 1.81% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Oil Type, Product Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Need to minimize energy loss due to friction in metal components of automotive

The major driver for the automotive lubricants market lies in the need to reduce the energy loss that happens during transportation due to the friction in a metal component of the vehicle, which will later develop more corrosion or rust in the equipment that plays a key role in running vehicles effortlessly. Lubricants are basically made up of specific additives and base oils, which reduce the friction between the two surfaces of components that come in contact.

Lubricants can be used in a wide range of industrial and automotive engine applications as they keep engines cool by lowering the temperature and preventing a sludge buildup in the machinery otherwise. The automotive lubricants market is fuelled by a spectrum of lubricants available in the market, like automotive engine oil, anti-rust engine oil, gear oil, automotive transmission oil, sludge prevention oil, and special fluids designed for automotive equipment. All these oils provide specific benefits that they are designed to target, such as engine oil generally used in car servicing, which boosts the performance of engines and offers superior protection for both diesel- and petrol-based engines by maintaining their longevity.

Additionally, these specialized lubricants aid in neutralizing the acidic fluids generated during the combustion of engines, which prevents corrosion and makes sure to keep the engine block thermally at a low temperature and free from residual buildup that may damage the engine further to ensure a smooth run. Under extreme pressure, machinery functioning may be affected if not prevented properly. Here, lubricants optimize functioning even under heavy loads, as they are designed to withstand extreme loads or pressure.

Works under a specific thermal range

A major challenge that can hinder the growth of the automotive lubricants market is that conventional lubricants work efficiently only under particular temperature ranges, and they do not perform optimally when the temperature gets out of range as it affects the viscosity of lubricants. The viscosity of any fluid means the ability of fluid to move easily with less resistance and provide optimal performance for which the fluid is set.

Hence, the same logic applies to conventional fluids like lubricants in automotive, which would not perform well in extreme temperatures, either high or cold temperatures, hindering startup lubrication. These lubricants tend to break down easily in hot climatic conditions or due to exposure to contaminations; hence, it is required to change oil after a regular interval of time, which increases the maintenance burden on the vehicle.

Moreover, lubrication oil is extracted from non-renewable sources that are basically mineral-based oils. After disposal, these mineral oils can have serious side effects on environmental health as they are not able to degrade easily in the soil or by any of the natural methods without leaving a hazardous footprint behind. Also, many lubricants are made one size fits all, which creates compatibility issues for newly developed automotive engines such as EVs and hybrid vehicles.

Innovations like biodegradable lubricants and nanotechnology

The major opportunity that the automotive lubricants market holds is an innovation in lubrication, such as the development of biodegradable lubricants instead of conventional ones. Growing climatic concerns due to the automotive market are not a new subject to work on. Hence, biodegradable lubricants could solve the issue by providing degradable components in the oils, which are mainly derived from renewable energy sources.

It reduces the ecological impacts since they can break down easily in nature, protecting the soil and water from pollution. Such a health approach from the automotive market will not only help reduce the harmful effect of conventional lubricants on the environment but also compel stringent environmental regulations set by authorities to protect an overall healthy climate for better survival.

On the other hand, nanotechnology is set to play a huge role in the development of innovative lubricants in the automotive market by manipulating minute particles on a nanoscale so as to utilize it effectively to revolutionize the performance of lubricants made up of nanoparticles. Nanoparticles are basically particles less than 100 nanometres as per measurement. These tiny particles can intellectually work as an additive in the lubricants by forming a thin protective layer between the working parts within the engine block to reduce friction to a nearly microscopic level, boosting its performance at the highest. Hence, nanotechnology presents an excellent opportunity to propel the automotive lubricant market globally by offering demanding tailored needs of advanced automotive engines and other equipment.

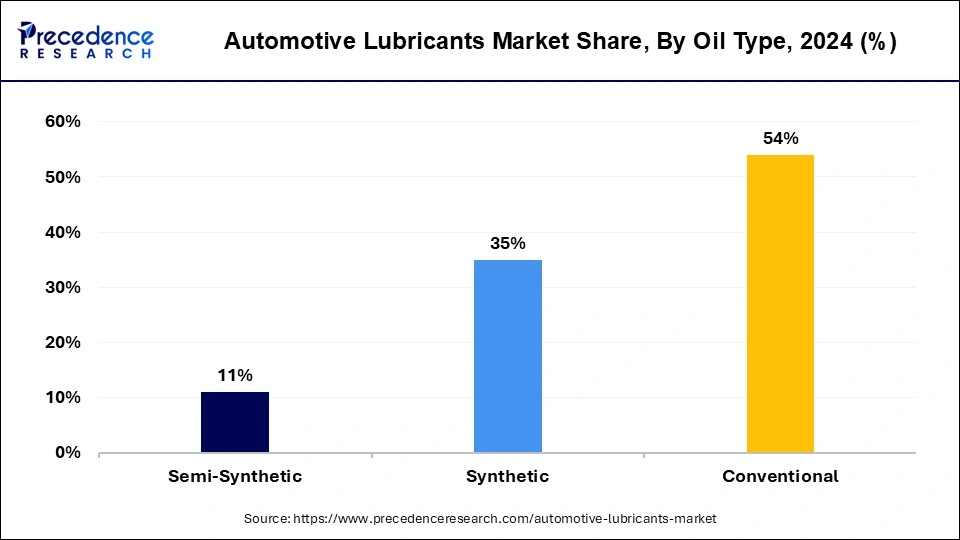

The conventional segment accounted for the largest automotive lubricants market share in 2024. Conventional oils, derived from crude oil, are preferred for their affordability and availability. They provide reliable performance for a wide range of vehicles, making them a popular choice among consumers and automotive manufacturers. Despite the rising interest in synthetic and semi-synthetic oils, conventional oils continue to hold a significant market share due to their adequate protection and lubrication in standard driving conditions. Key players are enhancing the quality of conventional oils to meet evolving performance standards and environmental regulations, ensuring their continued dominance in the market.

The synthetic segment is expected to witness considerable growth in the global automotive lubricants market over the studied period. Synthetic oils offer enhanced protection, improved fuel efficiency, and better performance in extreme temperatures. Increasing consumer awareness about these benefits, coupled with advancements in automotive technology, is driving demand. This segment is attracting significant investments from key players aiming to develop high-performance, eco-friendly lubricant solutions.

The engine oil segment dominated the global automotive lubricants market in 2024 and is expected to maintain its position in the upcoming period. Engine oils are essential for lubricating engine components, reducing friction, and preventing wear and tear. They also help cool the engine and keep it clean by suspending contaminants. Given the high frequency of oil changes required to maintain optimal engine performance, this segment sees consistent demand. Additionally, the proliferation of internal combustion engines across various vehicle types further reinforces the dominance of the engine oil segment.

The gear oil segment is projected to gain a notable share of the automotive lubricants market over the forecast period. Gear oils are essential for reducing friction and wear in gear systems, ensuring smooth and efficient operation. The rise in automatic and high-performance vehicles, which require specialized lubricants, is also driving growth. Additionally, advancements in gear oil formulations that enhance fuel efficiency and meet stringent environmental standards are contributing to the segment's expansion.

By Oil Type

By Product Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

April 2025

January 2025