January 2025

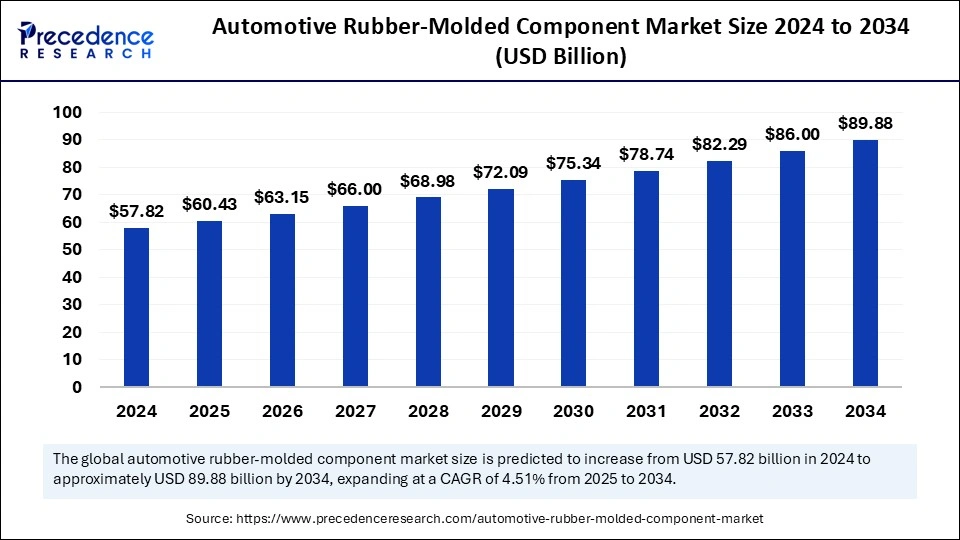

The global automotive rubber-molded component market size is calculated at USD 60.43 billion in 2025 and is forecasted to reach around USD 89.88 billion by 2034, accelerating at a CAGR of 4.51% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive rubber-molded component market size accounted for USD 57.82 billion in 2024 and is predicted to increase from USD 60.43 billion in 2025 to approximately USD 89.88 billion by 2034, expanding at a CAGR of 4.51% from 2025 to 2034. Factors such as increasing demand for lightweight and durable components, increasing production of vehicles, stringent government norms, and rising focus on reducing the overall weight of the vehicle are expected to drive the growth of the automotive rubber-molded component market throughout the forecast period.

Automotive rubber-molded components are critical vehicle parts created through heating and shaping elastomeric materials into a specific form. They are most commonly used in various parts of a vehicle, including the fuel system, engine, steering, brakes, suspension, dashboard, and other interior parts. Automotive rubber-molded components are primarily manufactured using numerous lightweight and durable materials, including styrene-butadiene rubber (SBR), natural rubber (NR), and ethylene-propylene-diene monomer (EPDM). These components help reduce damage to crucial parts, minimize the infiltration of water, dust, and dirt, dampen vibration, reduce noise, offer a cushioning effect, and prevent fluid leakage. The market is witnessing rapid growth due to the increasing utilization of robust rubber components to enhance vehicle functionality while ensuring optimal safety standards.

Artificial intelligence has emerged as a transformative force in the automotive industry, improving safety and efficiency and contributing to sustainable operations. As the industry continues to evolve with innovations such as electric vehicles and autonomous driving, the need for AI-driven solutions increases. Integrating AI technologies in the manufacturing processes of automotive rubber-molded components optimizes component design, performance, and durability. AI technologies can automate operations by enabling real-time monitoring and predictive maintenance, facilitating manufacturers to anticipate defects in components. Moreover, AI helps in supply chain optimization, enabling manufacturers to ensure timely delivery and manage inventory levels.

| Report Coverage | Details |

| Market Size by 2034 | USD 89.88 Billion |

| Market Size in 2025 | USD 60.43 Billion |

| Market Size in 2024 | USD 57.82 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.51% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, Component Type, Vehicle Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising Demand for Lightweight Vehicles

The growing demand for lightweight vehicles is boosting the growth of the automotive rubber-molded component market. Several players in the automobile industry are focusing on developing lightweight vehicles that can enhance fuel efficiency and reduce environmental emissions, which significantly boosts the demand for automotive rubber-molded components. Automakers are increasingly emphasizing rubber material advancements to develop lighter, resilient, and durable rubber-molded components. Due to their high flexibility, rubber-molded components can be molded into all shapes and sizes for different uses in the automotive industry. Using robust rubber components improves vehicle functionality while ensuring optimal safety standards. Additionally, increasing production for electric and hybrid vehicles (EVs and HEVs) significantly fuels the market's growth.

Volatility in Raw Material Prices

The fluctuation in raw material prices and shortage of raw materials hinder the growth of the global automotive rubber-molded component market. Fluctuations in raw material prices can adversely impact the final product's overall cost and hamper manufacturers' profitability. In addition, the slow adoption of electric and hybrid vehicles in middle- and lower-income countries affects the market's growth during the forecast period.

Strict Government Regulations

Stringent government policies on emission control are projected to create lucrative growth opportunities in the automotive rubber-molded component market in the coming years. Strict government regulations play a crucial role in shaping this market. Several governments worldwide have implemented stringent emission control and environmental protection regulations. Original equipment manufacturers are increasingly focusing on meeting strict emission regulations and reducing overall vehicle weight. The automotive industry's focus on reducing the impact of greenhouse emissions and achieving environmental targets is spurring the demand for these components. Moreover, rubber-molded components play a pivotal role in maintaining the integrity of critical systems. For instance, seals and gaskets are important for the proper functioning of various vehicle systems, including the braking system, engine, and transmission. The reliability of these components impacts the overall vehicle safety, and any failure can lead to severe consequences. As a result, several automakers are heavily investing in high-quality rubber components to meet stringent safety standards and reduce emissions.

The ethylene propylene diene monomer (EPDM) segment held the dominant share of the automotive rubber-molded component market in 2024. EPDM refers to the type of synthetic rubber, and it has gained significant popularity owing to its various characteristics and features, including excellent electrical insulating properties, vibration resistance, weather resistance, heat resistance, sealing properties, color stabilization, tear resistance, and durability. These attractive characteristics make EPDM the most preferred choice for automotive applications. The automotive industry is one of the largest customers for EPDM, which reduces vehicle weight to minimize vehicular emission. In addition, the increase in the production of electric vehicles and new energy vehicles contributes to segmental growth. There is a high demand for automotive components made for EPDM due to stringent emission norms and increasing electrification of vehicles.

The styrene-butadiene rubber (SBR) segment is anticipated to grow at a significant rate during the forecast period. SBR is a mostly used material in developing automotive rubber-molded components. This is mainly due to its excellent flexibility, durability, and cost-effectiveness compared to other materials. SBR also offers abrasion resistance and tensile strength, making it suitable for various automotive applications.

The seals segment held the largest share of the automotive rubber-molded component market in 2024. Rubber seals are flexible components that are widely used to prevent the leakage of gases, fluids, or contaminants in automotive systems. They ensure the smooth operation and longevity of crucial vehicle components, enhancing the overall performance of vehicles.

The gaskets segment is expected to grow at a significant rate over the studied period. Rubber gaskets are the most widely used components in the automotive industry to control and prevent leakage between the connected parts owing to their high durability, temperature resistance, color stability, and low cost. Rubber gaskets are available in various shapes and sizes and can be tailored based on the requirements of specific fittings. The rise in demand for fuel-efficient vehicles further augmented the segment as gaskets play a key role in reducing fuel consumption by preventing leakage.

The passenger cars segment accounted for the dominant share of the automotive rubber-molded component market in 2024, owing to the rise in the production of electric and hybrid vehicles. The demand for lightweight passenger vehicles has increased over the years, driven by stringent emission regulations and a strong focus on fuel efficiency. This led to a surge in the demand for lightweight rubber-molded components. Passenger cars increasingly use rubber-molded automotive components, such as gaskets, seals, hoses, bushings, dust covers, and grommets, which are integral to boosting the operational efficiency, safety, and overall performance of vehicles.

The commercial vehicles segment is likely to witness notable growth in the market in the coming years. Governments worldwide have implemented stringent regulations on controlling emissions, significantly increasing the adoption of light commercial vehicles. Stringent environmental regulations and the rising consumer preference for energy-efficient commercial vehicles are encouraging automotive manufacturers to emphasize weight reduction in vehicles without compromising performance. Rubber molded components in commercial vehicles play a vital role in driving sustainability, enhancing performance, and delivering cost savings.

Asia Pacific dominated the automotive rubber-molded component market by holding the largest share in 2024. This is mainly due to the presence of well-known automotive component manufacturers, the favorable ecosystem for emerging technologies, the easy availability of raw materials, and rapid technological improvement in rubber manufacturing technologies. Governments around the region have implemented stringent emission standards, increasing the demand for lighter and more energy-efficient vehicles and contributing to regional market growth.

China is a major contributor to the Asia Pacific automotive rubber-molded component market. China has a robust manufacturing ecosystem for electric passenger and commercial vehicles. The surge in investment in R&D by OEMs to develop cost-effective and efficient rubber-molded components is expected to accelerate the market’s growth. Factors such as increasing demand for electric vehicles, stringent emission regulations, and a growing focus on fuel efficiency are expected to propel the demand for automotive rubber-molded components. Moreover, China is the world’s largest producer of electric vehicles, contributing to about 60% of world electric car sales.

Japan also plays a major role in the market. There is a rising focus on vehicle electrification in the country. As the automotive industry continues to focus on electrification and sustainability, Japan's automotive rubber-molded component market is anticipated to grow at the fastest rate. Japan boasts some of the leading manufacturers of electric automobiles and automotive components. With the growing adoption of electric and hybrid vehicles in the country, the demand for automotive rubber-molded components to improve the overall efficiency and safety of vehicles is increasing. In addition, the increasing focus on reducing emissions and enhancing fuel efficiency supports market growth. The Japanese government is implementing several policies to reduce greenhouse gas emissions by 46ï¼… by 2030.

North America is anticipated to witness notable growth in the market in the foreseeable future. This is mainly due to the rapid expansion of the automotive sector, rising focus on developing lightweight vehicles, stringent emissions regulations, the presence of prominent automotive manufacturing companies, and rising advancements in rubber manufacturing methods. Additionally, increasing demand for electric and hybrid vehicles due to the rising concerns about environmental sustainability is anticipated to boost the regional market growth. In addition, rising government initiative to reduce greenhouse gas emissions from the automotive sector support market growth in the region.

By Material Type

By Component Type

By Vehicle Type

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025