January 2025

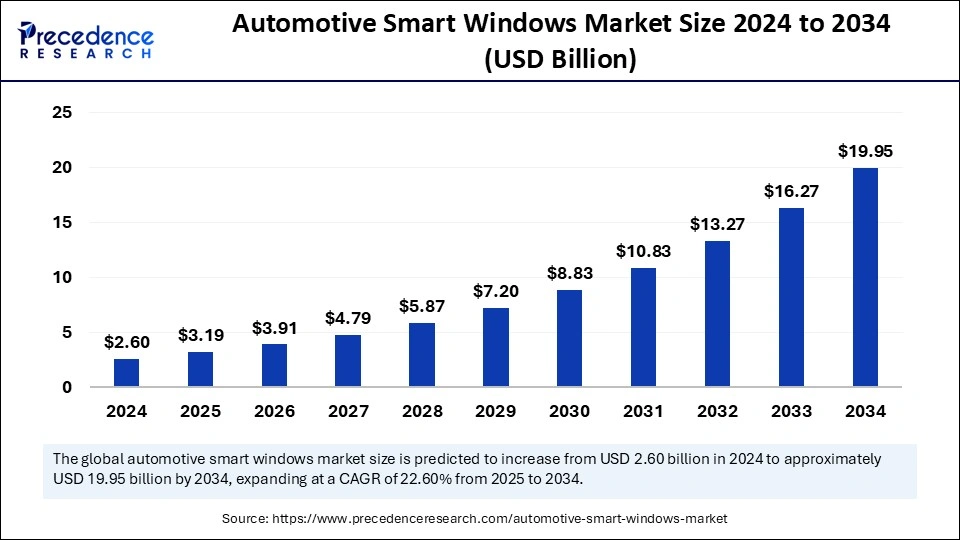

The global automotive smart windows market size is calculated at USD 3.19 billion in 2025 and is forecasted to reach around USD 19.95 billion by 2034, accelerating at a CAGR of 22.60% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive smart windows market size was estimated at USD 2.60 billion in 2024 and is predicted to increase from USD 3.19 billion in 2025 to approximately USD 19.95 billion by 2034, expanding at a CAGR of 22.60% from 2025 to 2034. The growth of the market is driven by the increasing demand from the transportation sector. These windows are essential for lowering costs associated with heating, air conditioning, and lighting, which fosters market growth. Additionally, smart windows effectively block ultraviolet rays, further driving product demand and contributing to the overall growth of the market.

The integration of artificial intelligence in the automotive smart windows market is fundamentally transforming automotive smart windows, changing them from passive elements to active, intelligent interfaces. By carefully analyzing real-time sensor data, including light, temperature, and location, AI makes autonomous adjustments to the tint and clarity of the windows. This proactive approach enhances passenger comfort by reducing glare, controlling cabin temperatures, and improving energy efficiency.

Artificial intelligence contributes to vehicle safety by seamlessly connecting with advanced driver assistance systems, offering vital alerts, and improving visibility in emergency situations. It also tailors the in-vehicle experience by adapting to user preferences, providing personalized Augmented Reality overlays, situational information, and customized climate settings.

The advancements in AI-driven environmental adjustments, enhanced safety functions, and personalized interfaces are not only fueling market growth but also transforming the automotive interior. Smart windows are becoming interactive systems that improve the overall driving and passenger experience, resulting in a more comfortable, secure, and interactive environment. This evolution aligns with the wider trend toward software-defined vehicles, where AI is crucial in building intelligent and responsive automotive ecosystems.

The automotive smart windows market is experiencing rapid growth as various industries require precise timing solutions. The primary factor for this increase is the growing adoption of advanced technologies such as 5G, the Internet of Things, and autonomous vehicles, all of which necessitate highly accurate and synchronized automotive smart windows. Significant advancements in various timing technologies, including atomic clocks, quartz crystal oscillators, and micro-electro-mechanical Systems solutions, are being adopted in the automotive smart window sector.

The automotive smart window industry has witnessed a rise in applications, with the incorporation of innovative technologies like smart car windshields and intelligent glass. These cutting-edge solutions go beyond traditional auto glass features, providing dynamic modifications to light transmission properties. As the automotive sector continues to emphasize technological innovation, the diverse applications of automotive smart windows are setting new benchmarks for performance and innovation within the industry.

The automotive, aerospace, and telecommunications industries are leading the way in technological advancement, establishing high standards for various applications. The development of automotive smart windows is intricately tied to the demand for meeting and surpassing these rigorous standards. The market for automotive smart windows is projected to grow consistently and significantly as technological innovations continue to emerge. Beyond just innovation, automotive smart windows are vital for ensuring temporal precision, which is essential for the seamless functioning of numerous technology applications across various sectors.

| Report Coverage | Details |

| Market Size by 2034 | USD 19.95 Billion |

| Market Size in 2025 | USD 3.19 Billion |

| Market Size in 2024 | USD 2.60 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 22.60% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Type, Vehicle Type and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for greater comfort and safety

Modern automotive consumers, especially in the premium and luxury markets, focus on more than just basic transportation. A significant transformation has taken place, prioritizing the in-vehicle experience. This shift emphasizes features that improve both comfort and safety. Smart windows are set to become an essential part of this enhanced experience. Their ability to automatically adjust tinting based on changing environmental conditions is a vital feature. This function helps reduce glare, which often contributes to driver fatigue and impairments in visibility.

The smart control of interior temperature by blocking harmful UV rays and solar heat gain ensures a consistently pleasant atmosphere, irrespective of external weather conditions. This is especially beneficial in areas with extreme climates. Beyond comfort, the assimilation of smart windows with Advanced Driver-Assistance Systems is a significant safety advantage. Picture visual alerts are displayed directly on the window surface, offering immediate warnings for lane changes, blind spots, or potential collisions. This seamless merging improves driver situational awareness and fosters a safer driving environment.

High initial costs and technological complexity

The main obstacle to the widespread use of automotive smart windows is the considerable initial investment required for their production and integration. The sophisticated materials and complex electronic components necessary for smart window operation contribute to this financial hurdle. Manufacturing electrochromic or PDLC films, which are vital components of smart windows, involves intricate production processes and specific materials, resulting in elevated production costs. The incorporation of sensors, control units, and wiring harnesses further escalates total expenses.

The technological intricacy of smart window systems also poses challenges for large-scale manufacturing scalability and reliability. Ensuring uniform quality and durability across extensive production runs necessitates significant investments in research, development, and quality assurance. Additionally, incorporating these systems into existing vehicle designs can be expensive, with adjustments to electrical systems and the controlling software significantly increasing system costs. This high expense serves as a major barrier to entry for average consumers.

Integration with augmented reality and connectivity

The merging of smart window technology with augmented reality and widespread connectivity offers a revolutionary chance to transform the automotive user experience. Smart windows can move beyond their conventional function as passive glass and transform into engaging interactive displays. Picture AR overlays effortlessly integrated into the windshield or side windows, offering drivers real-time navigation directions, points of interest, and contextual details.

Passengers could experience immersive entertainment or access customized information displays. With the growing presence of vehicle connectivity, smart windows can integrate smoothly with external data sources, delivering live traffic updates, weather forecasts, and personalized suggestions. The automotive smart windows market results in a far more dynamic and advantageous user experience. Smart windows will become an essential component of the human-machine interface, enabling drivers and passengers to engage with the vehicle in fresh and intuitive ways. The expansion of the connected vehicle market and the shift towards software-defined vehicles allow smart windows to be a more valuable and cohesive element of the automobile.

The electrochromic segment dominated the automotive smart windows market with the largest share in 2024 and continues to be a crucial player in the market, mainly in premium and luxury vehicle applications. This technology provides advanced light control features and has been widely accepted in high-end vehicles for applications like smart windows. The ability of this technology to offer gradual tinting control and its demonstrated reliability in automotive settings have made it a preferred option for numerous vehicle manufacturers. Electrochromic technology has also proven its potential for integration with advanced driver assistance systems and other intelligent vehicle functionalities, making it particularly relevant in the developing autonomous vehicle sector.

The suspended particle device segment is anticipated to grow with the highest CAGR during the studied years. SPD technology has gained considerable momentum due to its exceptional efficiency, using only an average of 1.5 watts per square meter compared to other smart window technologies. Leading automotive manufacturers are increasingly adopting SPD technology for their premium vehicle models, especially in applications such as panoramic sunroofs and windows, as it effectively lowers interior heat by up to 10° Celsius and enhances driving range by about 5.5% in electric vehicles. The ability of the technology to provide immediate light control, improved UV protection, and a substantial decrease in CO2 emissions has made it especially appealing to luxury vehicle manufacturers and electric vehicle creators who are focusing on both comfort and sustainability.

The OLED glass segment dominated the automotive smart windows market, accounting for the largest share in 2024. OLED glass stands out for its superb visual clarity, vibrant color representation, and outstanding contrast ratios. These qualities are essential for situations where displaying visual information is critical, such as AR overlays, interactive dashboards, and tailored infotainment systems. Moreover, the natural flexibility of OLED technology enables the production of curved and uniquely shaped smart windows, allowing for seamless integration with the increasingly intricate and aesthetically designed vehicles of today. This design adaptability is a notable advantage over traditional liquid crystal or electrochromic technologies.

The self-repairing segment is expected to grow at the fastest rate during the forecast period of 2025 to 2034. This significant growth is fueled by the rising demand for automotive glazing solutions that are durable, resilient, and require minimal maintenance. Self-repairing smart windows employ cutting-edge materials and technologies that allow them to autonomously repair minor scratches, cracks, and other types of damage. This feature greatly enhances the lifespan and durability of smart windows, minimizing the necessity for expensive repairs or replacements. As technology advances and costs decrease, the rate of adoption is expected to rise dramatically. Additionally, the increasing presence of autonomous vehicles will boost the need for self-repairing windows.

The passenger cars segment dominated the global automotive smart windows market in 2024. This segment's dominance can be attributed to the growing integration of smart window technologies in premium and luxury vehicle models, especially in SUVs and high-end sedans. Demand from consumers for improved comfort features, alongside strict safety regulations and the rising prevalence of electric vehicles, has significantly advanced the implementation of smart window solutions in passenger cars. Leading automotive manufacturers are progressively including innovative features like electrochromic sunroofs, switchable privacy glasses, and heads-up display windshields in their premium offerings. Moreover, technological innovations in glass manufacturing processes have contributed to making smart window solutions more reliable and affordable for widespread market use.

The light commercial vehicles segment is projected to expand rapidly in the coming years. This increase is driven by the specific operational needs and fleet optimization practices commonly found in the commercial vehicle segment. LCVs, such as delivery vans, service vehicles, and utility trucks, operate under demanding conditions, often involving frequent stops, heavy loads, and exposure to harsh environments. Smart windows can significantly improve the efficiency and safety of LCV operations. They help manage the interior temperature of LCVs, alleviating the burden on air conditioning systems and enhancing fuel efficiency. This is especially vital for delivery vehicles that function in hot climates. The rise in online shopping and delivery services will continue to propel growth in this market segment.

North America dominated the automotive smart windows market in 2024. Consumers in North America, particularly those in the United States and Canada, demonstrate a preference for high-end vehicles that feature state-of-the-art attributes. This growing trend for technological advancement has fostered a favorable environment for the uptake of smart windows, which are regarded as a beneficial addition to vehicle comfort, safety, and design. The region's well-developed automotive manufacturing network, along with the presence of major tech firms and research institutions, has supported the advancement and rollout of smart window technologies.

Strict safety regulations in North America have compelled car manufacturers to integrate sophisticated safety features into their vehicles, including those enabled by smart windows, like ADAS integration and improved visibility. The significant sales of luxury vehicles in North America have accelerated the rate of smart window adoption compared to other regions globally. An established culture of vehicle customization and personalization in North America has also fueled the demand for smart windows as drivers look to set their vehicles apart with unique and innovative options.

Asia Pacific will host the fastest-growing automotive smart windows market, expanding at a CAGR from 2025 to 2034. This rapid growth is influenced by a combination of factors such as swift economic expansion, increased disposable incomes, and a thriving automotive sector in nations like China, India, and South Korea. The region is experiencing a rise in vehicle ownership, particularly in urban areas, fueled by growing wealth and enhanced infrastructure. This escalating demand for vehicles has opened up a substantial market for automotive technologies, which includes smart windows. Moreover, the area has a swiftly growing middle class that is increasingly inclined towards premium and technologically advanced vehicles.

The presence of significant automotive producers and tech companies in the Asia Pacific has cultivated a dynamic ecosystem for the development and manufacturing of smart window technologies. Governments in the region actively advocate for the adoption of electric vehicles and connected cars, typically featuring advanced functionalities like smart windows. The vast population of the Asia Pacific, alongside rapid urbanization, represents a significant market opportunity for manufacturers of automotive smart windows. An increase in manufacturing within the region will also contribute to cost reduction, thereby enhancing the adoption rate of this technology.

By Technology

By Type

By Vehicle Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025