January 2025

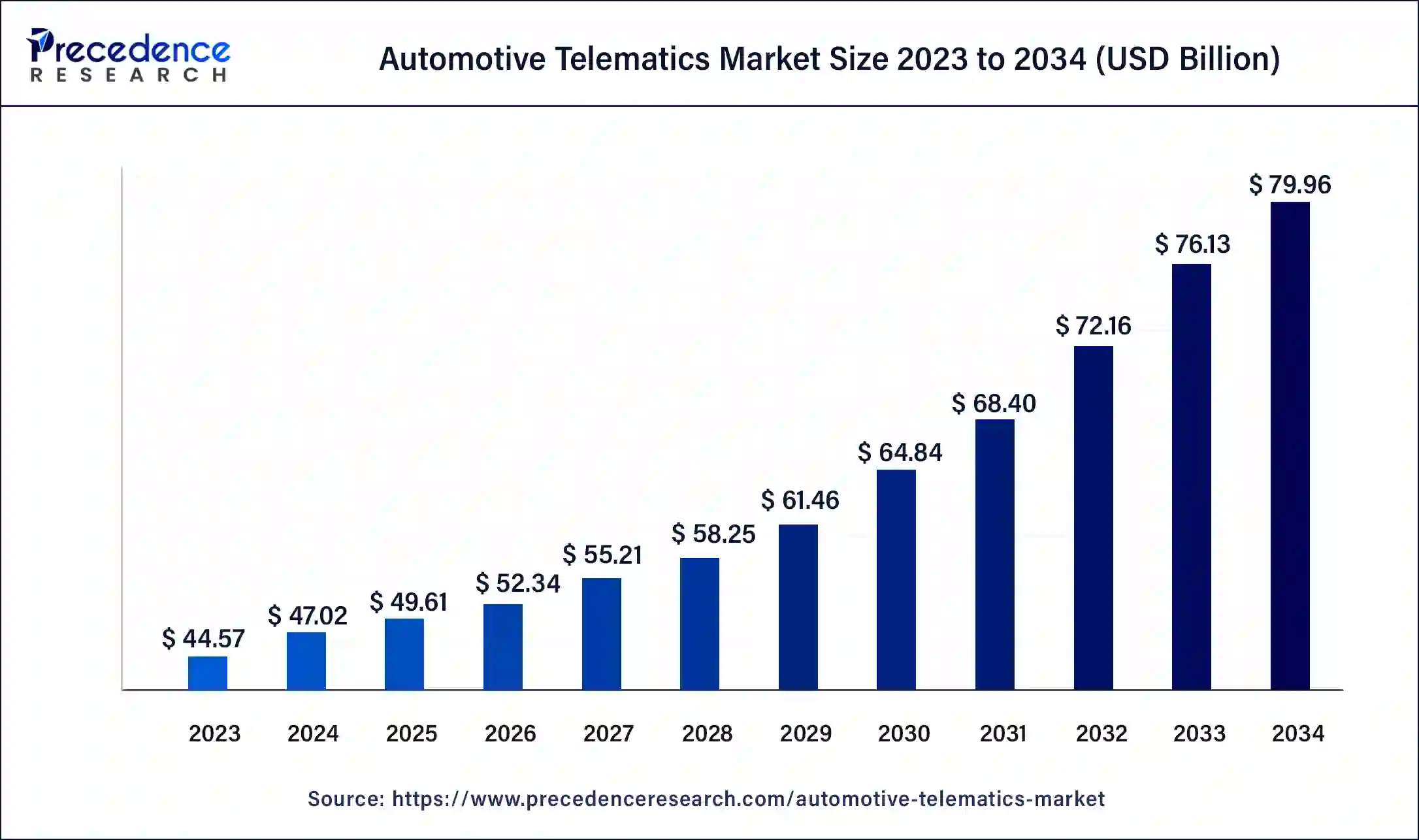

The global automotive telematics market size was USD 60.53 billion in 2023, estimated at USD 70.45 billion in 2024 and is anticipated to reach around USD 300.14 billion by 2034, expanding at a CAGR of 15.60% from 2024 to 2034.

The global automotive telematics market size accounted for USD 70.45 billion in 2024 and is predicted to reach around USD 300.14 billion by 2034, growing at a CAGR of 15.60% from 2024 to 2034.

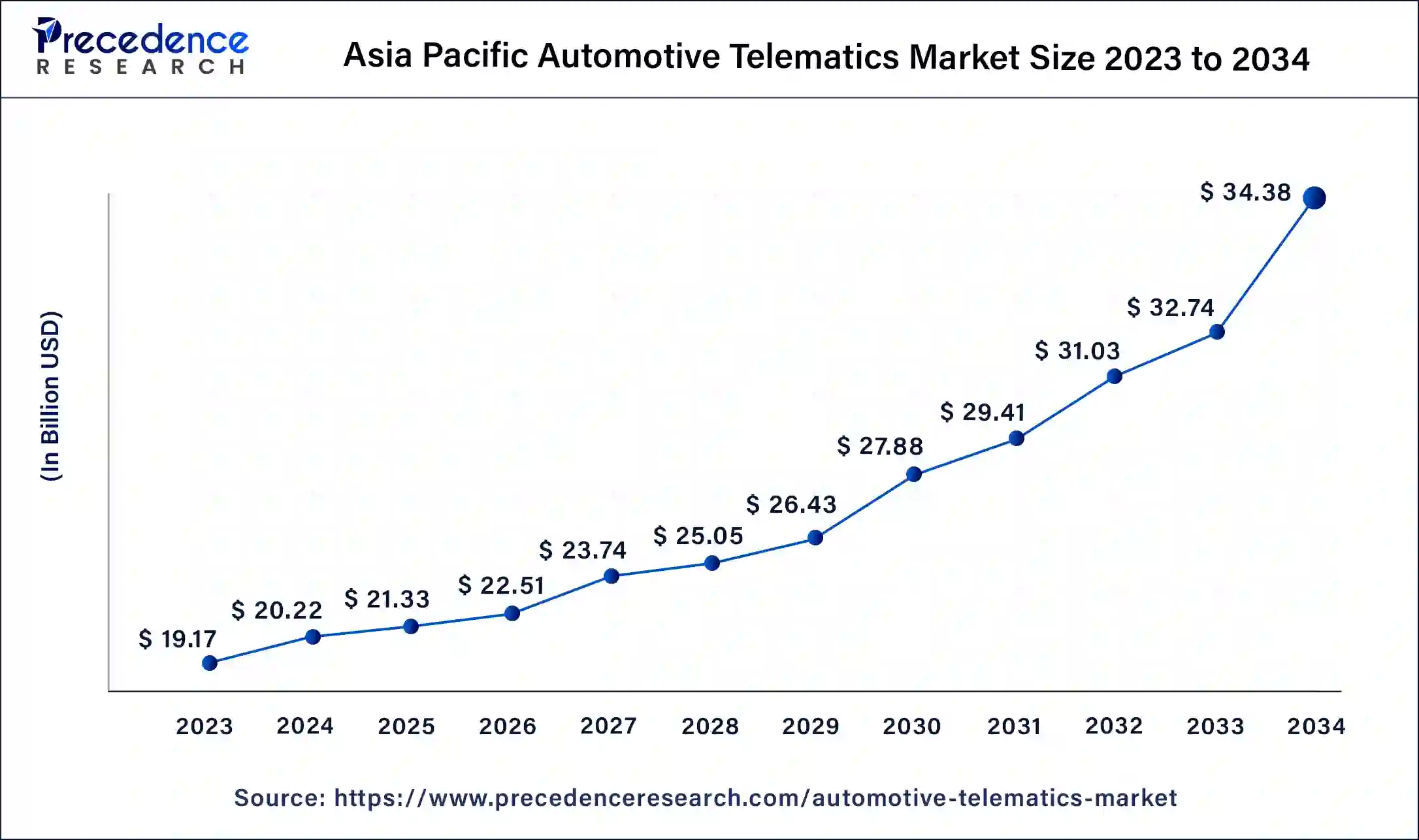

The Asia Pacific automotive telematics market was valued at USD 35.71 billion in 2023 and is projected to be worth USD 177.08 billion by 2034, at a CAGR of 16% from 2024 to 2034.

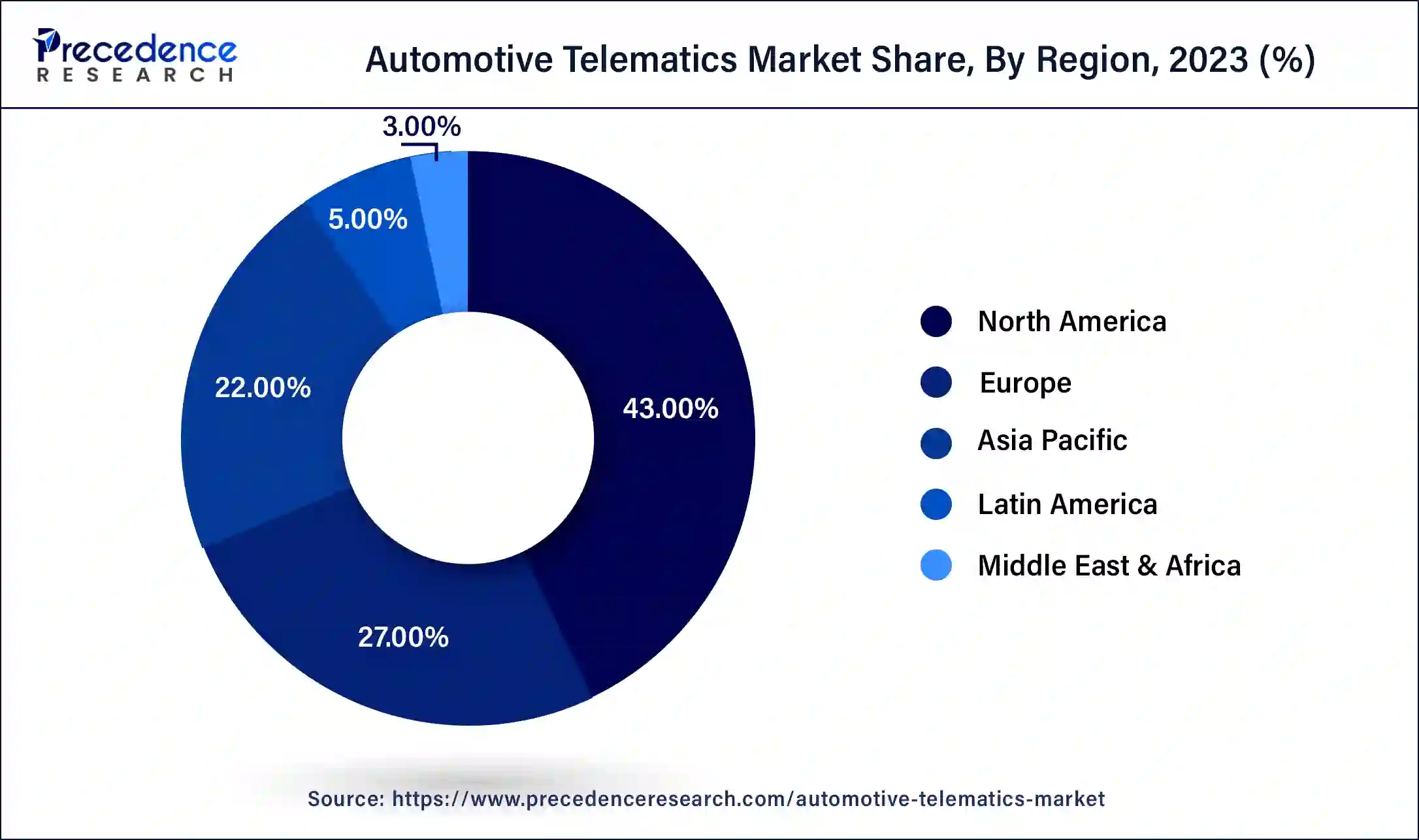

Based on the region, the North America segment dominated the market in 2023. The U.S. dominates the North America automotive telematics market during the forecast period. The North America automotive telematics market is being driven due to increased demand for fuel-efficient vehicles, as well as the add on feature such as Global Positioning System (GPS) as a standard option to address concerns such as an increase in number of road accidents and rising fuel prices.

On the other hand, the Europe is estimated to be the most opportunistic segment during the forecast period. This is attributed to rising concerns for road safety. The European Union and European Transport Safety Council has embedded major laws against road accidents in favor of road and passenger safety. These policies and laws enacted by European organizations will drive the growth of the Europe automotive telematics market growth during the forecast period.

Telecommunications, electrical engineering, wireless communications, road transportation, computer science, and vehicular technologies are all interlinked with the help of automotive telematics. Automotive telematics systems are being intricately linked with mobile phones and tablets, allowing users to monitor and manage parameters from the same and distant places using portable devices. It’s now easier to diagnose all data with the help of location tracking. The automotive telematics system had helped fleet managers to take accurate decisions by tracking the vehicle for 24 hours. It had also helped in improving fleet efficiency while lowering expenses and redundancies.

The automotive telematics is used for tracking vehicles and fleet with the help of Global Positioning System (GPS). The global automotive telematics market encompasses the services used to monitor and manage a vehicle via communication devices. Furthermore, the rise in popularity of ride-sharing services for daily transportation has been aided by the introduction of telematics systems. Both ride-sharing firms and passengers can use automotive telematics technology to keep a watch on movements of drivers and also track vehicle movement.

The government rules and regulations for vehicle telematics, as well as a rise in the popularity of connectivity options, are propelling the market growth of automotive telematics. Moreover, the automotive telematics industry is growing due to the simplicity with which vehicles can be diagnosed due to telematics systems. However, the automotive telematics market growth is hampered by the risk of the data hacking, high cost of installation, and lack of good internet connectivity. In addition, the market has a significant development opportunity due to increased automobile and vehicle performance and smart transportation systems.

| Report Coverage | Details |

| Market Size by 2034 | USD 300.14 Billion |

| Market Size in 2023 | USD 60.53 Billion |

| Market Size in 2024 | USD 70.45 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 15.60% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Services, Sales Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Based on the services, the safety and security automotive telematics segment dominated the global automotive telematics market in 2023, in terms of revenue. Safety and security automotive telematics is responsible for communicating, transferring data, assessing machine codes created by the vehicle’s onboard system. This kind of telematics can transfer data with utmost security and safety.

On the other hand, the information and technology automotive telematics segmentis estimated to be the most opportunistic segment during the forecast period. The information and technology automotive telematics is combined with Wi-Fi, 3G and 4G network, and various types of sensors. This helps telematics to transfer data effectively and efficiently without wasting time. The information and technology automotive telematics is widely used nowadays due to upcoming 5G network.

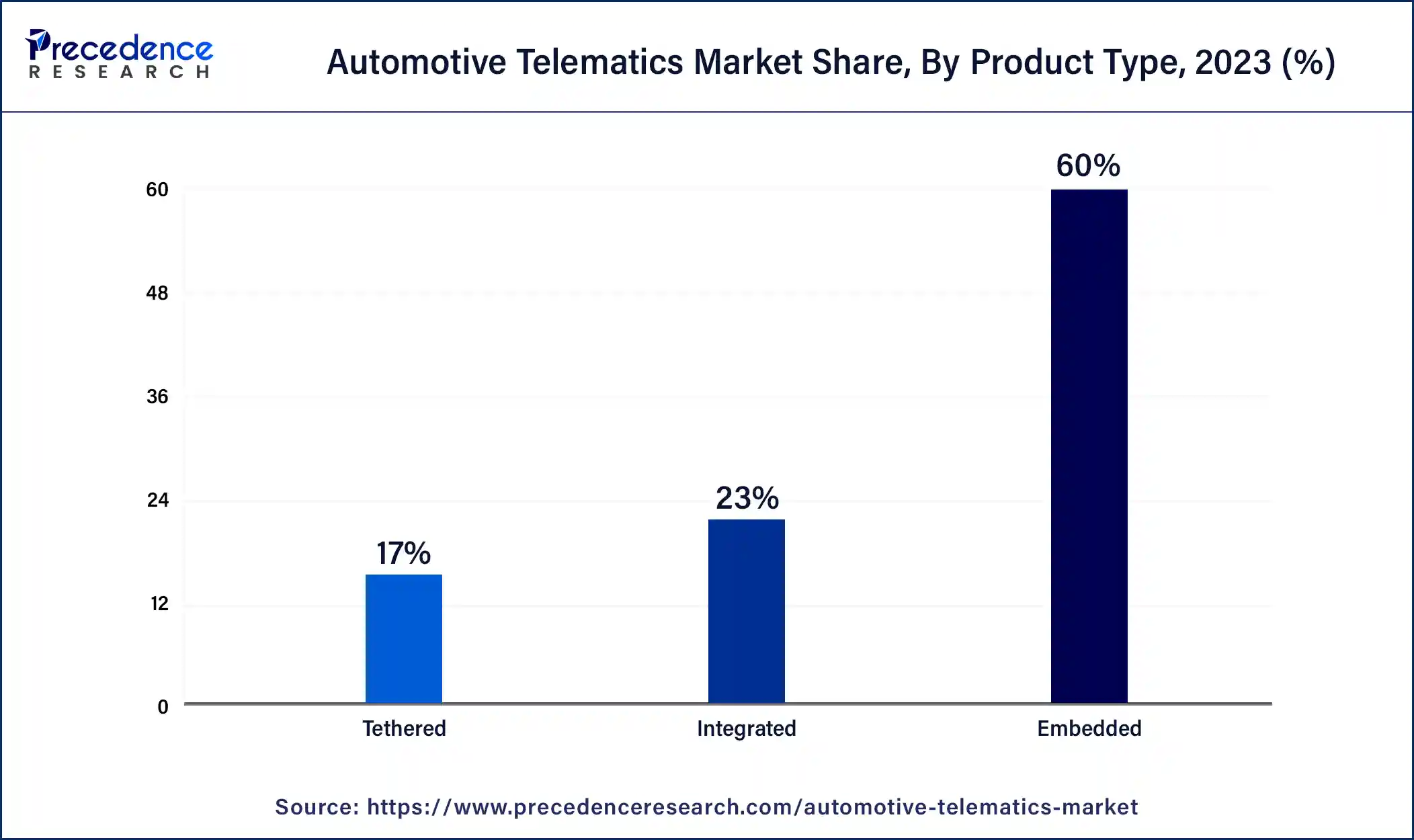

Based on the product type, the embedded segment accounted revenue share of around 60% in 2023. With the help of telecommunication devices, embedded automotive telematics sends and receives data. The GPS navigation, a safety communications and emergency system, automatic driving assistance, and other features are all available with embedded automotive telematics system. Moreover, the embedded automotive telematics segment is expected to develop due to an increase in demand for fleet management systems.

On the other hand, the integrated automotive telematics segment is estimated to be the most opportunistic segment during the forecast period. The information from integrated automotive telematics is presented via smartphone application. It links the vehicle and equipment to the internet of things.

Based on the sales channel, the original equipment manufacturer (OEM) segment dominated the global automotive telematics market in 2023, in terms of revenue. OEM products have a lower cost of production because of economies of scale. Furthermore, the firm that purchases these kinds of products can use them to develop systems without managing their own manufacturing facilities.

On the other hand, the aftermarket segment is estimated to be the most opportunistic segment during the forecast period. The aftermarket products are much similar to OEM products. The aftermarket products are low in price as compared to original equipment manufacturer (OEM) products.

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting different marketing strategies, such as new product launch, investments, partnerships, and mergers & acquisitions. The companies are also spending on the development of improved products. Moreover, they are also focusing on competitive pricing.

In January 2021, the Harman International Industries Inc.launched new product in the market known as HARMAN Turbo Connect (TBOT).

The various developmental strategies such as new product launches, acquisition, partnerships,business expansion, investments, joint venture, and mergers fosters market growth and offers lucrative growth opportunities to the market players.

Segments Covered in the Report

By Product Type

By Services

By Sales Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025