March 2025

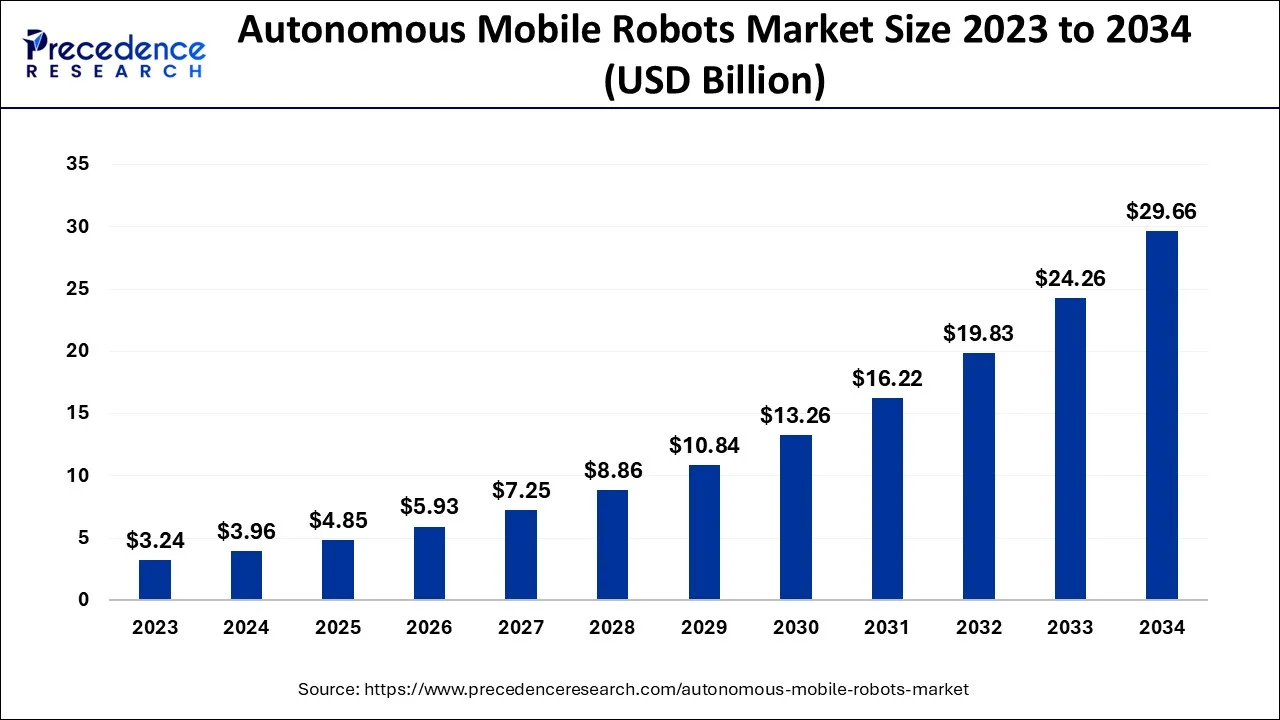

The global autonomous mobile robots market size accounted for USD 3.96 billion in 2024, grew to USD 4.85 billion in 2025 and is predicted to surpass around USD 29.66 billion by 2034, representing a healthy CAGR of 22.30% between 2024 and 2034.

The global autonomous mobile robots market size is exhibited at USD 3.96 billion in 2024 and is predicted to surpass around USD 29.66 billion by 2034, growing at a CAGR of 22.30% from 2024 to 2034. An autonomous mobile robot is a kind of robot that can understand and explore its environment on its own. AMRs differ from autonomous guided vehicles (AGVs), which are typically supervised by humans and depend on tracks or predefined trajectories.

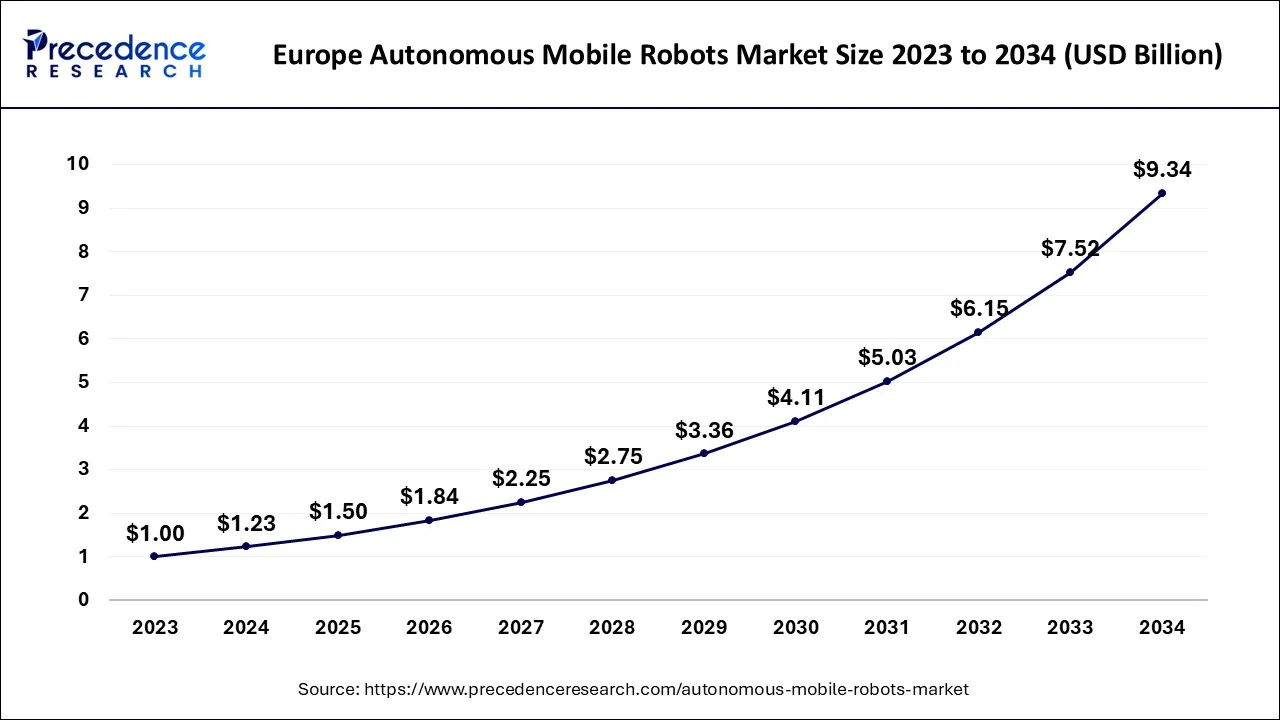

The Europe autonomous mobile robots market size is estimated at USD 1.23 billion in 2024 and is expected to be worth around USD 9.34 billion by 2034, rising at a CAGR of 22.52% from 2024 to 2034.

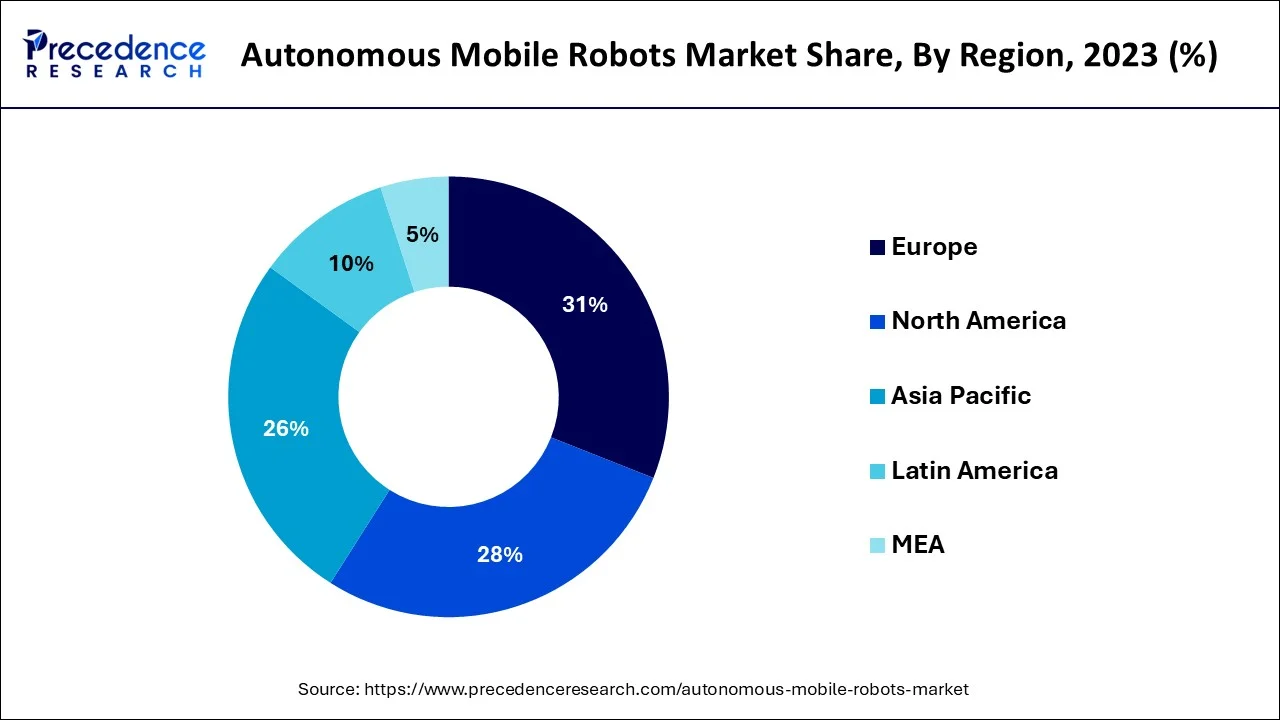

With a market share of almost 31%, Europe dominated the market in 2023. This might be linked to the incumbents in the manufacturing industry's increasing need for material-handling tools. Growth is also being fueled by ongoing process automation in other industry verticals and sectors.

Over the projection period, Asia Pacific is predicted to experience a considerable CAGR. The use of autonomous mobile robots for warehouse inventory management is being encouraged by the expanding electronic commerce sector in Asia Pacific's rising nations. Due to the fierce rivalry that exists within the e-commerce sector as e-commerce businesses attempt to differentiate themselves by slashing the time it takes to deliver items, the adoption of AMRs is also gaining momentum.

AMRs are being used by e-commerce businesses to automate intra-logistics processes including sorting, picking, and palletizing. For instance, Hai Robotics, a producer of ACRs located in Shenzhen, raised $200M in two stock transactions in September 2021. The money will be used to modernize the robot fleet and enable it to compete on a global scale, as well as to assist supply chain management and hire new personnel.

One of the key elements that are anticipated to assist the market's growth is the expanding use of robots in numerous industrial sectors. Some of the reasons that are projected to fuel the expansion of the market include technical advancement, increasing awareness of the advantages of autonomous robots in emerging economies, and expanding application areas for autonomous robots. However, some of the key restraints that may have an impact on the market's expansion are the slow pace at which robots move and the malfunction of robots. Additionally, the industry has a chance to expand due to the growing use of mobile robots for patrolling.

The market is growing as a result of factors including the increased demand for smart devices in automobiles and the increasing use of advanced driver assistance technologies. The government's enforcement of stringent telematics regulations has also accelerated the market's growth. Real-time traffic and event notifications are also necessary, and this is helping the industry grow. However, market development is being hampered by the high cost of implementation and the unequal distribution of internet access.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.96 Billion |

| Market Size by 2034 | USD 29.66 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 22.30% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

Growth of the e-commerce sector

In 2023, the hardware sector had the highest revenue share at over 68.40%. The section discusses the components that go into making the AMRs, including the controllers, encoders, wheels, brakes, motors, sensors, actuators, batteries, and power systems.

Over the projection period, the software category is anticipated to have the greatest CAGR. The section discusses the tools used to create the AMRs. Software for autonomous mobile robots comprises, among other things, motion planning, safety systems, navigation systems, control systems, fleet management systems, payload, and software for scanning and visual processing.

In 2023, the category for goods-to-person picking robots was responsible for more than 50 percent of the revenue share. The ongoing use of autonomous robots to replace manual picking techniques is responsible for the high share. Robots that pick up items for people can also be programmed to push carts and take a variety of paths to get the commodities from one station to another.

Autonomous mobile robotic picking systems are provided by a number of robotics firms, such as Blum, and IAM Robotics, and they may be able to bring new levels of efficiency to warehouse and industrial processes. For example, Locus Robotics, a business that automates robotic processes, asserts that their picking robots may boost production by 3 to 5 times by cutting personnel costs associated with overtime, travel time, and training expenses.

Over the course of the projection period, a noticeable shift in demand is anticipated in the self-driving forklift market. Forklifts which are self-driven are perfect for routine cargo handling tasks that frequently require traveling great distances. Automated forklifts are available from Linde Material Handling, a German producer of warehouse equipment and forklift trucks, and they come with the front as well as rear scanners, navigation lasers, auditory and visual warning signs, and 3D camera vision.

The lead battery market sector kept the top rank in 2023 with a revenue share of more than 50%. The high percentage can be attributed to lead batteries' low-cost advantages over other battery types. Because they ensure stable voltage, high reversibility, and long useful life, lead batteries are appropriate for a range of industrial applications.

The lithium-ion battery category is predicted to have substantial growth throughout the forecast period. Compared to lead batteries, lithium-ion batteries frequently cost more. However, lithium-ion batteries deliver high-power charge and discharge while also satisfying a variety of industrial requirements, such as high energy density, exceptional temperature tolerance, and prolonged cycle life.

It is anticipated that certain advantages associated with lithium-ion batteries would persuade manufacturers of AMR to utilize them as a power source. For instance, Tennant Company, a supplier of automated floor cleaning tools, declared in April 2022 that lithium-ion batteries will be made available in its AMRs. Two benefits of the advanced battery technology employed in its autonomous mobile robots are long run times and easy maintenance. Long run times will improve cleaning effectiveness and make the most use of staff resources.

In 2023, the manufacturing sector had the highest revenue share at almost 77%. The substantial proportion can be attributable to the global manufacturing industry's ongoing process automation. The market is further divided into the following subsectors: FMCG, automotive, aerospace, electronics, chemicals, medicines, and plastics.

The automotive industry also had a sizable market share as a result of the aggressive adoption of AMRs for a variety of operations, including assembly, sealing, machine tending & part transfer, painting, coating, materials removal, as well as internal logistics related to automotive manufacture.

Over the projection period, it is predicted that the aerospace and military industries would display a significant CAGR. Due to the necessity to handle large-sized components like fuselages, nacelles, engine pods, and wings, production facilities related to the aerospace and military sector verticals are sometimes enormous. However, the lanes that these parts must go through to get to the production plant are frequently rather small. Aerospace and defense businesses are rapidly implementing AMRs to move bulky components inside the facility on predetermined or changing routes in order to prevent any potential accidents and mishaps resulting from human mistakes when transferring large parts through constrained spaces.

By Component

By Type

By Battery Type

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

October 2024

October 2024

October 2024