November 2024

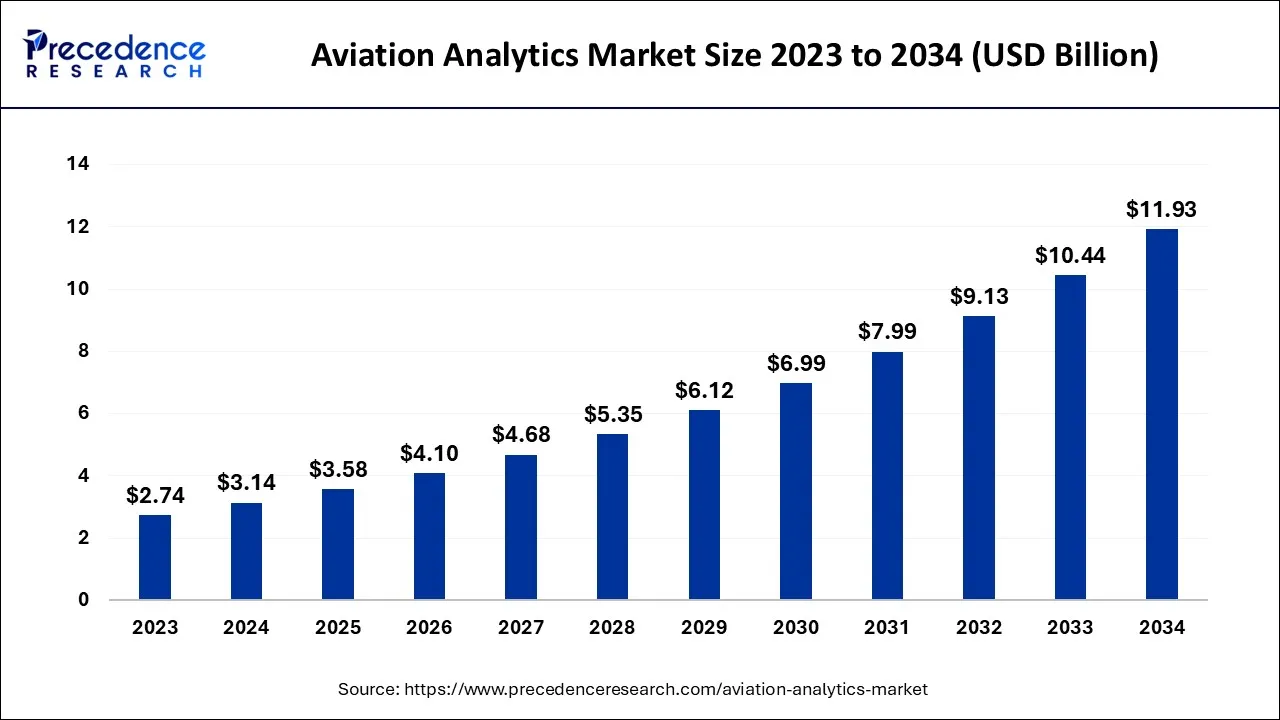

The global aviation analytics market size accounted for USD 3.14 billion in 2024, grew to USD 3.58 billion in 2025 and is expected to be worth around USD 11.93 billion by 2034, registering a CAGR of 14.28% between 2024 and 2034. The North America aviation analytics market size is calculated at USD 970 million in 2024 and is estimated to grow at a CAGR of 12.29% during the forecast period.

The global aviation analytics market size is calculated at USD 3.14 billion in 2024 and is projected to surpass around USD 11.93 billion by 2034, growing at a CAGR of 14.28% from 2024 to 2034.

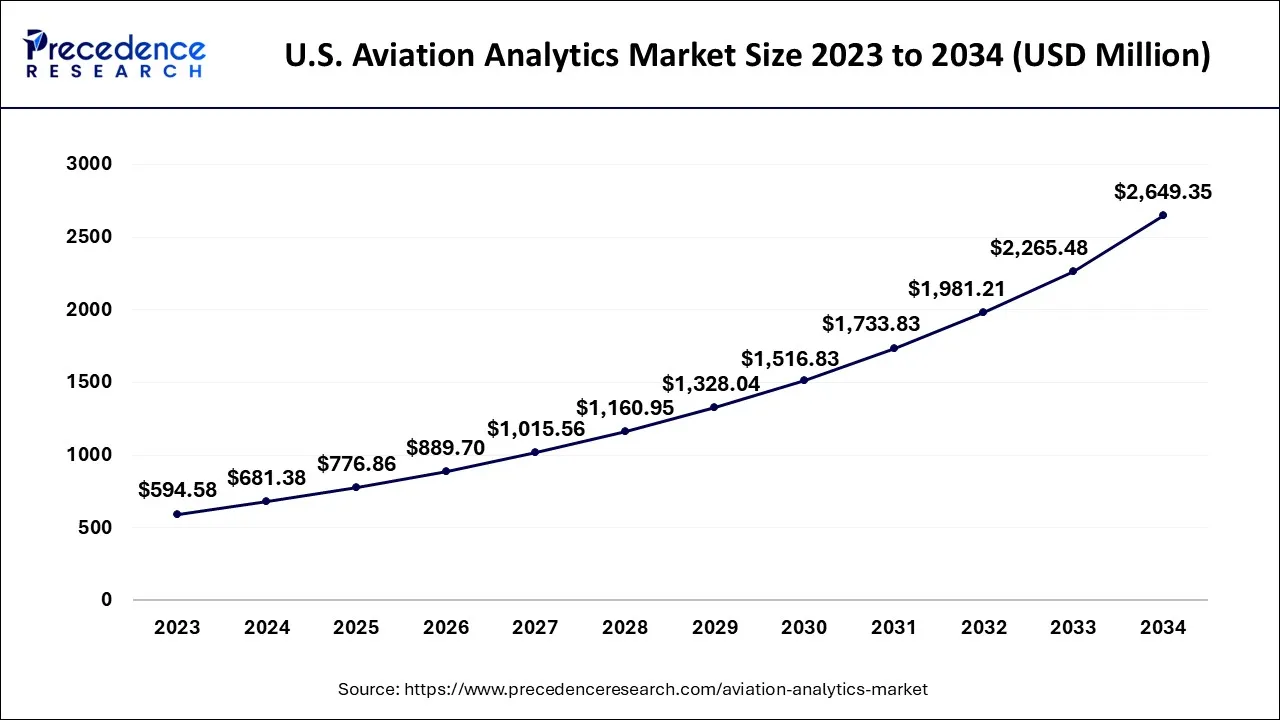

The U.S. aviation analytics market size is exhibited at USD 681.38 million in 2024 and is projected to be worth around USD 2,649.35 million by 2034, growing at a CAGR of 14.54% from 2024 to 2034.

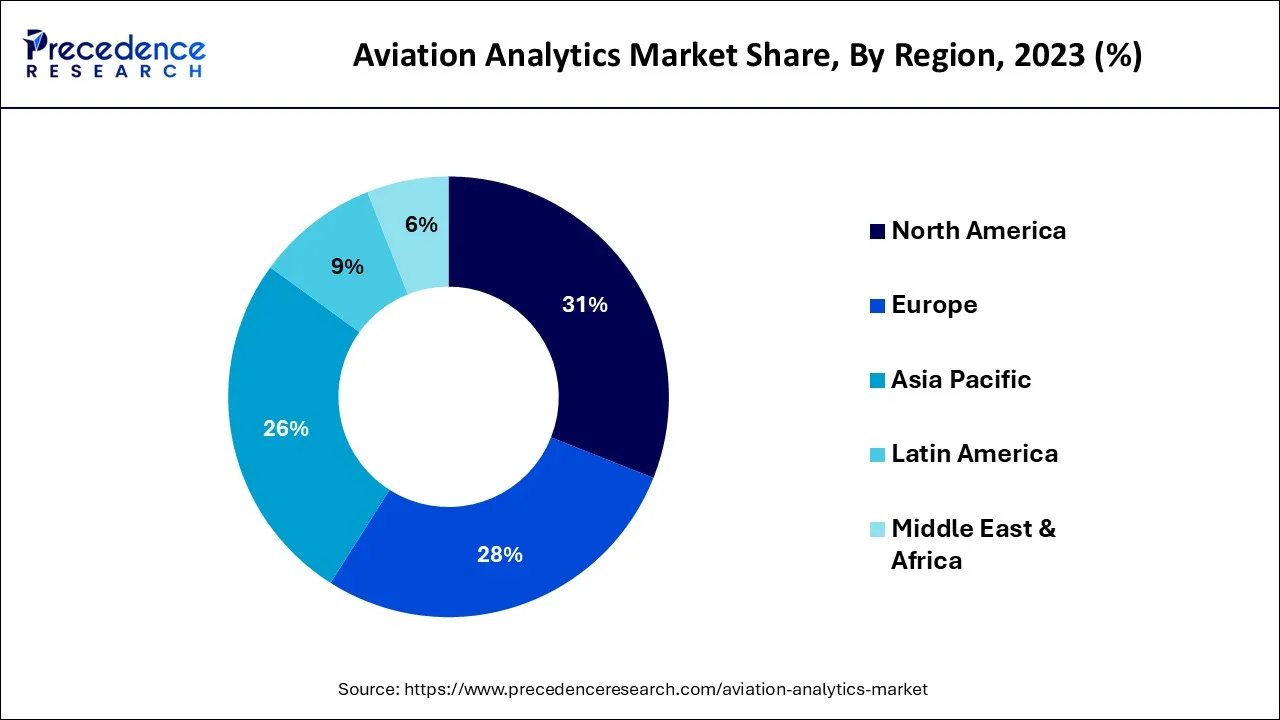

North America held the largest share of 31% in aviation analytics market in 2023 due to its established aerospace industry, high adoption of advanced technologies, strong presence of key players, and substantial investments in research and development. The region also benefits from a large number of airlines and airports, which generate vast amounts of operational data, driving demand for analytics solutions to optimize performance, enhance safety, and improve customer experience. Additionally, favorable government regulations and a competitive market environment further support North America's leadership in aviation analytics.

Over the years, Asia-Pacific has developed into an important aviation center. Due to a rise in demand for air travel, the growing economies in the area, including China and India, are seeing enormous growth in their own civil aviation businesses. As a result, a significant growth rate in Asia-Pacific sales is anticipated during the forecast period. Because to strong domestic demand, China is driving the resurgence of commercial aviation worldwide and assisting airlines in experiencing financial recovery.

Due to high demand from both civilian and military customers, it has grown to be a significant aviation industry hub throughout time. Over the years, commercial aviation has made significant contributions to China's aviation industry. Due to an increase in domestic air passenger traffic, which is predicted to grow at a pace of 4.4% by 2040, China is currently the world's largest market for aviation. The expansion of the market would also be aided by an increase in the number of airports in the area. The development of 21 new greenfield airports in India was given the nod by the Indian Aviation Ministry in March 2022.

The computational technology known as aviation analytics offers data statistics and information on operational activities, weather forecast data, and real-time flight data. It evaluates and analyses the enormous amount of data produced. Inventory, flight risk, fuel, revenue management, and customer analytics all make extensive use of it. Information can be analyzed, optimized, and managed using a variety of technologies, including monitoring and data and descriptive statistics.

It helps to improve operational strategy and execution while also promoting productivity, efficiency, transparency, maintenance, client satisfaction, and risk management. In order to give meaningful information to airports, airlines, aviation stakeholders, and other business sectors like marketing and sales, finance, maintenance, and repair, aviation analytics is frequently employed.

One of the main elements fostering a favorable outlook for the market is the considerable global growth of the aviation industry. The management of real-time data, such as navigation databases, connectivity, flight operational operations, and aircraft maintenance, is a common use of aviation analytics. Accordingly, the widespread use of products to cut operating costs and predict client preferences as a result of rising passenger traffic is promoting market expansion.

Also, a number of technical developments, such as the combination of big data and artificial intelligence (AI) to conduct mechanical analysis, boost productivity and security, and forecast unplanned failure, are fueling the market's expansion. Also, the market growth is being positively impacted by the rising need for real-time analytical solutions to boost profitability, tracking, fraud detection, and data management. In addition, it is projected that significant research and development (R&D) activities and the execution of several government initiatives to enhance aviation safety will propel the market toward expansion.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.14 Billion |

| Market Size by 2034 | USD 11.93 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 14.28% |

| Largest Market | Asia-Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Component, By Business Function, By End User, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increased demand for corporate process optimization through the application of structured analytical solutions

The rising competitiveness in the aviation industry is motivating businesses to adopt advanced data analytics in order to maintain their market share globally. By utilizing data analytics, aviation companies can achieve high sales and operational profitability. With analytical tools like forecast analysis, profitability analysis, sales analysis, competitive analytics, and dependability analytics, businesses may gather, organize, analyses, store, and retrieve enormous volumes of data about their markets and consumers.

Restrain

Absence of highly qualified personnel in the sector

As the use of real-time analytical solutions, particularly "Big Data" analytics, has recently increased, a workforce with analytical abilities is now necessary. Lack of competent labor could slow the overall aviation passenger traffic's explosive expansion. The expansion of the aviation analytics market is also restricted by a lack of experienced personnel, which is a key obstacle to current data and analytics initiatives despite the rise in data usage and consumption.

It is challenging to integrate traditional and contemporary aircraft equipment, and it takes a significant financial and technical effort. New gadgets can have various protocols that make them challenging to adopt. Due to a lack of adequate analytical capabilities, integrating old data systems with modern technology takes time and effort and may divert a company from its main business operations.

Large-scale data production in the aviation sector

The amount of data used in the aviation industry is substantial and difficult to manage and evaluate. The FAA's Air Traffic Organization (ATO) manages over 2.8 million airline passengers and more than 50,000 flights per day across more than 30 million square miles of airspace. More than 2.5 million characteristics are gathered by sensors on a single aero plane, with engine data being one of the most important. Any business decision requires access to these enormous amounts of data.

Impact of Covid-19:

The COVID-19 pandemic has forced governments and aviation-related organizations to enact a number of stringent regulations to block the virus's spread. A reduction in airport traffic and economic damage for the aviation industry globally resulted from airports and air travel almost ceasing in the second quarter of 2020. Many other countries in other regions remain susceptible to new waves of illnesses, causing their administrations to once again declare partial or complete lockdowns, even though some have started to gradually restore substantial sectors of their economy.

The aviation analytics market is divided into sales and marketing, finance, maintenance, repair & operations, and supply chain according to business function. The finance segment dominated the aviation analytics market in 2023. Airport finance analytics includes information on the airport's revenues, costs, profitability, payables and receivables, assets, and significant financial ratios. Airports are embracing and investing in this industry more and more as a result of these causes.

The aviation analytics market is segmented into Airlines, Airports, and Others based on end-user. The airline sector led the aviation analytics market in 2023. Due to the rising need for aviation analytics across a range of commercial applications, airlines all over the world are employing them. The increasing popularity of air travel and the opening of new air routes are two major factors fostering the airline industry's expansion.

The aviation analytics market is divided into two segments based on components: service and software. In 2023, the software sector gained a sizeable sales share in the aviation analytics industry. It is because businesses are investing more money in implementing cutting-edge software and solutions. The need for such upgraded items is also being fueled by the expansion of market participants. Also, such software would assist aviation businesses in enhancing their operations and increasing income.

Flight risk management, fuel management, inventory management, revenue management, customer analytics, and navigation services are the various applications in the aviation analytics sector. In 2023, the aviation analytics market's highest revenue share was attained by the customer analytics segment. It is as a result of the great demand for drones with aviation analytics to satisfy consumer needs. In addition to embracing customer-centricity by using predictive analytics to improve decision-making, the airlines are investing a lot of money in learning about customer preferences and behavior.

Segments Covered in the Report

By Component

By Business Function

By End User

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

July 2024

February 2025

July 2024