January 2025

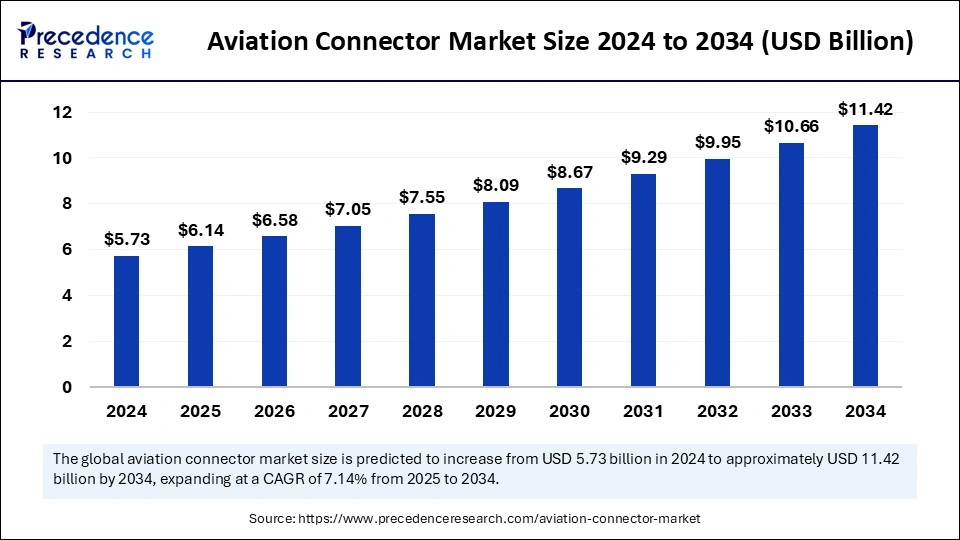

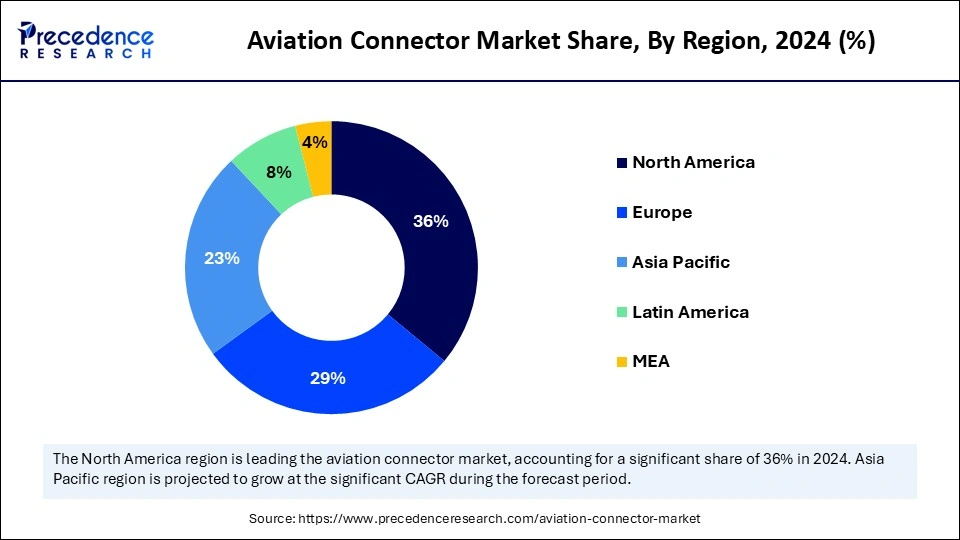

The global aviation connector market size is calculated at USD 6.14 billion in 2025 and is forecasted to reach around USD 11.42 billion by 2034, accelerating at a CAGR of 7.14% from 2025 to 2034. The North America market size surpassed USD 2.06 billion in 2024 and is expanding at a CAGR of 7.30% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global aviation connector market size accounted for USD 5.73 billion in 2024 and is predicted to increase from USD 6.14 billion in 2025 to approximately USD 11.42 billion by 2034, expanding at a CAGR of 7.14% from 2025 to 2034. Continuous advancements in military aircraft and related technologies, rising air travel, and the increasing production of aircraft are boosting the growth of the aviation connector market.

Artificial Intelligence is significantly transforming the aviation sector, influencing various aspects, from the design and manufacturing of aircraft and related products to the maintenance of the fleets. AI-powered aviation connectors can potentially renovate the aviation sector in various ways, enhancing energy efficiency and safety. AI integration can improve manufacturing processes, leading to increased production efficiency, reduced errors, and improved product quality. AI algorithms optimize flight operations and fuel efficiency and adapt to changing environmental conditions. AI-powered connectors can have the efficiency to help airlines and operators lower their operating expenses by enhancing their fleets and operations.

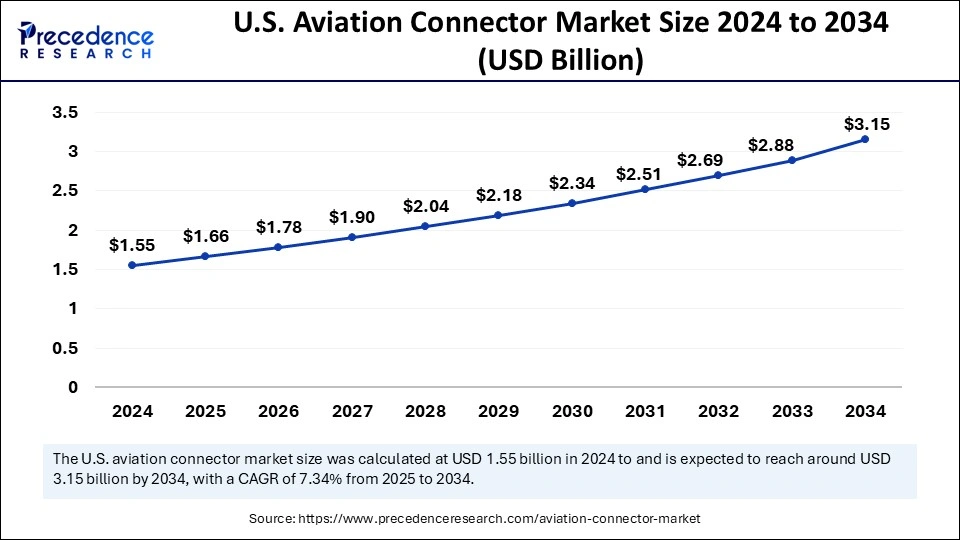

The global aviation connector market size accounted for USD 1.55 billion in 2024 and is predicted to increase from USD 1.66 billion in 2025 to approximately USD 3.15 billion by 2034, expanding at a CAGR of 7.34% from 2025 to 2034.

North America’s Sustained Dominance in the Market

North America registered dominance in the aviation connector market by capturing the largest share in 2024 and is expected to sustain its position throughout the forecast period. This is mainly due to the strong presence of leading aircraft manufacturing companies such as Airbus SE, Boeing Company, General Dynamics Corporation, Lockheed Martin Corporation, and Textron Inc. North America spends a lot on military aircraft. With the increasing production of commercial and military aircraft, the demand for aviation connectors is rising, supporting regional market growth.

The U.S. is a major contributor to the North American aviation connector market. The rising fleet modernization and increasing number of air passengers significantly boost the demand for aviation connectors. The increasing defense spending further contributes to market expansion.

Asia Pacific: The Fastest-Growing Region

Asia Pacific is expected to witness the fastest growth in the coming years. The regional market growth can be attributed to the increasing air travel and the rapid expansion of the aviation sector. In November 2024, Asia Pacific Airlines carried 31.0 million international consumers, marking a 19.8% rise compared to November 2023. Moreover, rapid growth in e-commerce has spurred demand for air cargo. The adoption of advanced technologies in aerospace also plays a critical role in enhancing passenger experience and streamlining operations, boosting the demand for aviation connectors. The expanding air transport network further supports regional market growth.

China is expected to have a stronghold on the Asia Pacific aviation connector market. The rapid expansion of the aviation sector and the rising number of domestic aircraft manufacturers support market growth. The increasing adoption of advanced technologies, including infotainment systems, to enhance the passenger experience is boosting the demand for aviation connectors. The country has increased its defense budget to procure new military aircraft and modernize existing ones, which further contributes to market growth.

In India, the aerospace sector is expanding rapidly with the increasing air travel demand. The presence of well-known airlines like Indigo, Air India, and SpiceJet further influences the market. Moreover, the Indian government initiatives, such as the Regional Connectivity Scheme – Ude Desh ka Aam Nagrik, to expand connectivity contribute to market growth.

Europe to Witness Notable Growth

Europe is observed to grow at a notable growth rate in the upcoming period. The European Commission’s strong emphasis on strengthening Europe’s defense capabilities is expected to boost the demand for aviation connectors for military aircraft. The region also boasts a robust aircraft manufacturing sector. The rising demand for enhanced connectivity solutions in commercial aircraft further supports the growth of the European aviation connector market.

Aviation connectors can be easily connected to power sources to transmit power, signals, and other data between various aircraft components. They ensure safe operation in aircraft and aerospace applications. The aviation connector market is growing rapidly due to the increasing production of aircraft, fleet expansion, advancements in avionics and communication systems, and the rising use of UAVs. These connectors are widely used in navigation, aviation, electric power, and many other fields. Accurate use of these connectors ensures the reliability of aircraft operation, reducing accidents and increasing safety. Advancements in manufacturing technologies lead to the development of high-quality aircraft components, including aviation connectors. The application of these connectors is not only limited to military and aviation sectors but also spans healthcare, railway, transportation, and automotive sectors.

| Report Coverage | Details |

| Market Size by 2034 | USD 11.42 Billion |

| Market Size in 2025 | USD 6.14 Billion |

| Market Size in 2024 | USD 5.73 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.14% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application , Aircraft, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Integration of Fly-by-wire System

The increasing integration of fly-by-wire (FBW) systems in modern aviation is driving the growth of the aviation connector market. FBW system replaces the traditional mechanical control with an electronic interface. This improves fuel efficiency, increases payload capacity, and improves aircraft design. As a lightweight alternative to mechanical controls, FBW reduces operational expenses while ensuring flight security. FBW system requires more sophisticated connectors for high-speed data transmission and power delivery, boosting the market’s growth.

Rising Usage of Miniature Circular Connectors

The rising usage of miniature circular connectors is driving the growth of the market. Since these connectors are compact and lightweight, they are commonly used in applications where space is limited. They are suitable for high-density connectivity needs. They ensure safe connections for transmitting data, power, and signals in compact systems. These connectors are frequently used in advanced electronics, healthcare equipment, and aerospace. Moreover, they are designed to withstand extreme conditions, such as electromagnetic interference (EMI), varying temperatures, and high vibrations.

Environmental Challenges and High Cost

The performance of aviation connectors depends on environmental factors. The performance and longevity of these connectors are limited by exposure to humidity, moisture, vibrations, and mechanical shocks. Loss of connectivity, short circuits, and corrosion due to moisture infiltration damage these connectors. Mechanical stress and extreme temperature lead to issues like insulation failure. Moreover, manufacturing these connectors require specialized materials, which leads to high production costs, restraining the growth of the aviation connector market.

Increasing Applications in UAVs

Increasing electrical complexity in unmanned aerial vehicles (UAVs) creates immense opportunities in the market. UAVs require compact and lightweight components to increase efficiency and flight time, demanding miniature aviation connectors. The incorporation of supplementary operational systems within the aviation and military sectors for surveillance and data collection further supports market expansion. In addition, the rising popularity of electric aircraft and autonomous flight systems and the rapid expansion of aviation in emerging markets present lucrative opportunities for aviation connectors.

The fiber optic connectors segment held the largest share of the aviation connector market in 2024. This is mainly due to their greater bandwidth compared to connector cable options, making them suitable for applications requiring high-speed data transmission. Fiber optic connectors are lightweight and resistant to electromagnetic interference, making them a preferred choice in military applications. These connectors are widely used in modern aviation systems where enhanced communication is required.

The high-power connectors segment is expected to grow at the fastest rate in the coming years due to their rising usage in military and commercial aircraft. These connectors are easy to connect to power sources and transmit signals at the same time. They are essential in power distribution and high-efficiency electrical systems due to their ability to withstand high temperatures. High-power connectors are suitable for robotics, autonomous aircraft, and military aircraft.

The commercial aircraft segment led the aviation connector market in 2024. This aircraft uses various types of connectors to support operations. With the increased number of air passengers, the production of commercial aircraft has increased. As these aircraft are often embedded with in-flight entertainment and supplementary operational systems to enhance the passenger experience, they require specialized aviation connectors to support power distribution.

The business and general aviation aircraft segment is projected to register a notable growth rate over the forecast period. These aircraft often incorporate advanced systems, such as FBW and sophisticated avionics, to enhance flight experience. These systems require more electrical connectors. The increasing production and usage of private jets support segmental growth.

The engines segment accounted for the dominant market share in 2024, as aviation connectors play a crucial role in engine operation by providing reliable power. These connectors generally have metal or plastic housings, which are surrounded by insulation. The increasing focus on fuel efficiency leads to the development of advanced engines, requiring more electrical connection. This, in turn, boosts the demand for high-performance connectors.

The in-flight entertainment (IFE) systems segment is expected to expand at the fastest rate during the projection period. Airlines are increasingly incorporating in-flight entertainment systems to enhance passenger experience. These systems require reliable aviation connectors for greater performance and seamless data transmission. The rising adoption of advanced infotainment systems further boosts the demand for sophisticated aviation connectors.

By Type

By Aircraft

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024