August 2024

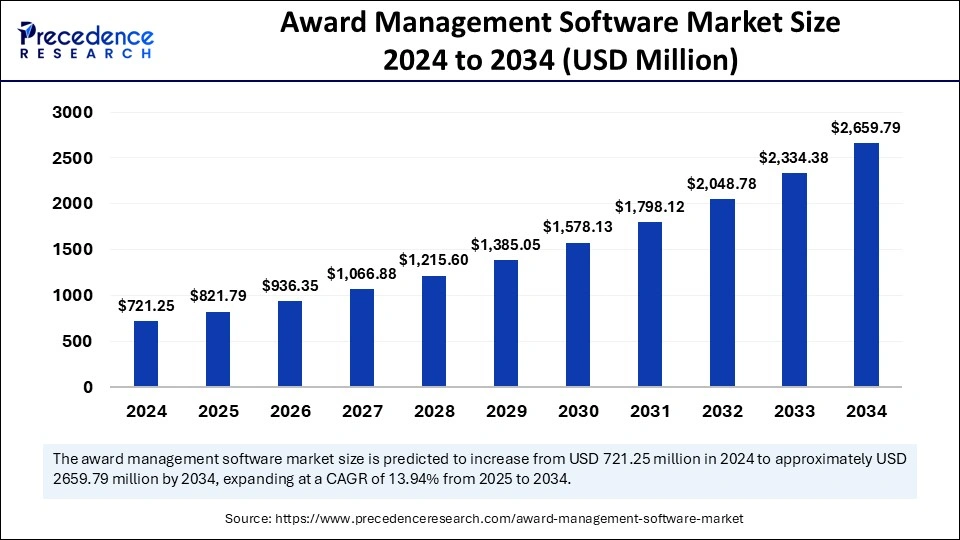

The global award management software market size is calculated at USD 821.79 million in 2025 and is forecasted to reach around USD 2,659.79 million by 2034, accelerating at a CAGR of 13.94% from 2025 to 2034. The North America market size surpassed USD 238.01 million in 2024 and is expanding at a CAGR of 14.11% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global award management software market size accounted for USD 721.25 million in 2024 and is predicted to increase from USD 821.79 million in 2025 to approximately USD 2,659.79 million by 2034, expanding at a CAGR of 13.94% from 2025 to 2034. The market growth is attributed to the rising need for streamlined, transparent, and automated management of grants, scholarships, and funding programs.

Artificial Intelligence significantly impacts the market. AI has the ability to streamline application review processes by detecting fraudulent applications. Award organizations depend on AI to evaluate extensive data quantities speedily for maximizing resource distribution. Additionally, AI-powered solutions empower institutions to operate grants and awards at higher levels of efficiency in a data-led dynamic system.

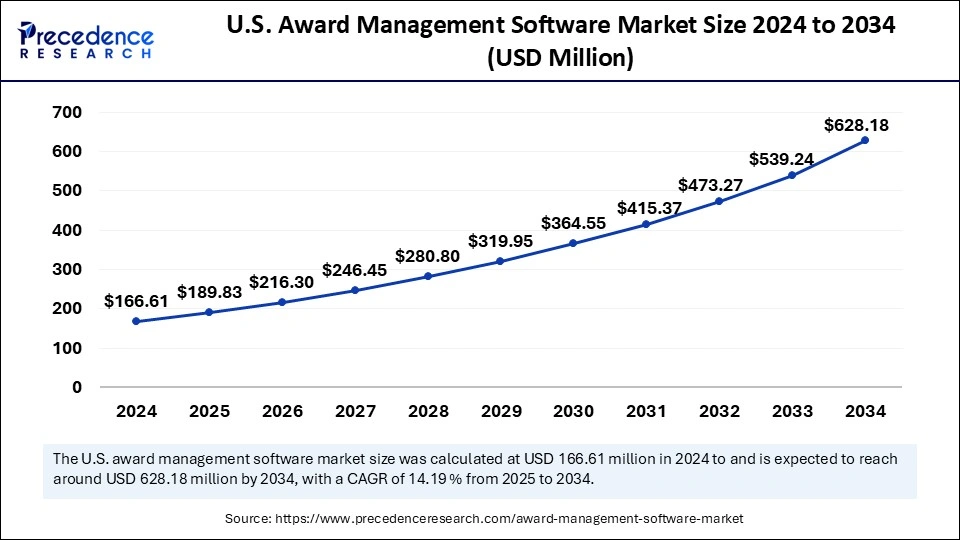

The U.S. award management software market size was exhibited at USD 166.61 million in 2024 and is projected to be worth around USD 628.18 million by 2034, growing at a CAGR of 14.19% from 2025 to 2034.

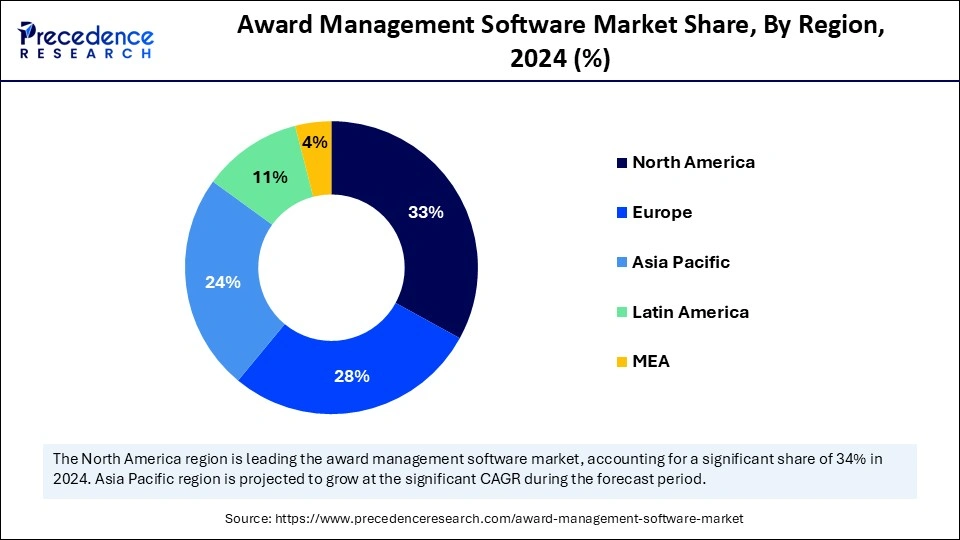

North America led the award management software market by capturing the largest share in 2024. This is mainly due to its advanced digital infrastructure and well-established public grant systems. The U.S. Department of Health and Human Services (HHS) managed over 95,000 grants through digital systems in 2023, highlighting the need for award management software. Multiple institutions, universities, and non-profit organizations in the U.S. and Canada chose cloud-based tools for managing grant programs. Furthermore, academic institutions, healthcare facilities, and philanthropic organizations continued their transition to real-time reporting systems due to strict regulatory requirements. The region has a large funding landscape, boosting the adoption of award management software solutions.

Asia Pacific is anticipated to grow at the fastest rate during the forecast period. The regional market growth can be attributed to the growing government funding programs and the rising number of academic research programs. With the rising research activities, there is a high demand for efficient award management software to streamline research grant management. The governments of India, China, and Vietnam joined forces in 2024 to unite their award platforms to enhance funding and reporting operations. Furthermore, the increasing digitization in every sector significantly influences the market.

The European award management software market is expected to grow at a notable rate in the foreseeable future. This is mainly due to the rising research grants in the region. Several public institutions across Germany, France, and Sweden are adopting cloud solutions for streamlining workflows. Furthermore, in 2023, the WHO’s Regional Office for Europe, together with health ministries in Spain and Poland, established grant tracking systems designed for disease surveillance and health equity projects. In addition, the increasing government investments in R&D activities contribute to regional market growth.

The growing need for transparent award management systems with digital components and regulatory compliance encourages organizations to adopt award management software. Award management software lets organizations automatically complete the award cycle, including application receiving and evaluation before disbursement. They also help in record-keeping while achieving regulatory requirements and compliance for audits. These platforms help educational and government institutions handle public funds. The rising demand for safe digital award management solutions with user-friendly capabilities fuels the growth of the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 2,659.79 Million |

| Market Size in 2025 | USD 821.79 Million |

| Market Size in 2024 | USD 721.25 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.94% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment, Organization Size, Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing Demand for Transparent and Accountable Award Distribution

Increasing demand for transparent and accountable award distribution technology is expected to boost the growth of the award management software market. Every step of award distribution requires tracking and auditing, as government agencies, academic institutions, and non-profits focus on fund allocation transparency. Digital award platforms integrate automated compliance capabilities. This matches regulatory specifications and generates instantaneous documentation that satisfies audit standards. Implementing these systems helps businesses prevent errors in monetary allocations while strengthening their reputation. The CDC deployed new digital grant management systems in 2024 while promoting uniform distribution of funds for transparent funding processes during health crises. Moreover, the global community speeds up its adoption of accountable grants for safer distribution of grants and awards, further fuelling the market.

High Implementation Costs

High implementation costs limit the adoption of award management software across small and medium-sized organizations, which is anticipated to restrain the growth of the award management software market. Small, non-profit educational institutions and local government agencies generally work with limited budgets, which obstruct their ability to invest in award management systems. Award management platforms come with higher costs because they need licensing payments, integration support, and worker training services. Additionally, the restricted financial resources available to small entities block their path to implementing expandable digital solutions, thus hindering the market.

Expansion of Funding Programs

The rising number of funding initiatives among government entities and private companies is likely to create immense opportunities for key players competing in the market. Businesses and governments worldwide are focusing on social responsibility programs and funding initiatives, necessitating flexible solutions for managing awards. Funding bodies require platforms that effectively handle many award programs while simplifying their review procedures. Award management systems serve grant needs by creating flexible modules. Furthermore, the current funding programs benefit from digital platforms, which demonstrates increasing dependence on such technology to support growing program needs and complexity.

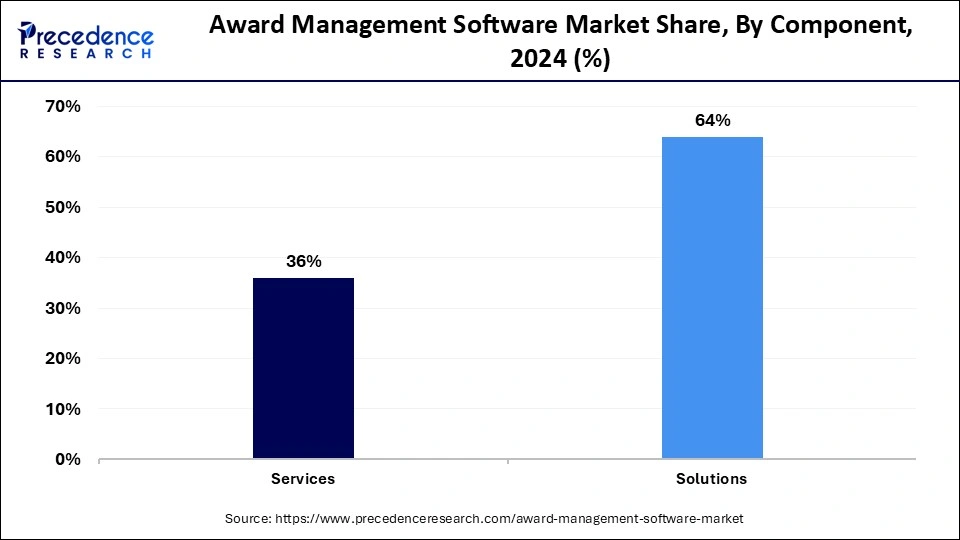

The solutions segment dominated the award management software market with the largest share in 2024. This is mainly due to the rise in the number of grant applications in educational institutions, government entities, and philanthropic organizations. This caused stakeholders to select configurable solution systems designed for their individual workflows. These solutions improved monitoring procedures and automation to follow funding agency protocols. In 2024, the CDC launched its digital transformation initiative to establish integrated platforms that reduced manual processing time.

The services segment is expected to grow at the fastest rate during the forecast period, owing to an increase in the requirement for implementation assistance and continuous system optimization. Enterprise award management systems are becoming smarter through AI analytics, multilingual features, and cloud deployment. This drives organizations to work with expert service providers to sustain proper system operations, which further fuels the segment growth in the coming years.

The cloud segment held the largest share of the award management software market in 2024. The growth of the segment is driven by the increased adoption of scalable remote platforms for maintenance-free operations with real-time collaboration. Organizations are increasingly shifting toward solutions that provide cost-efficient deployment. Cloud-based platforms enable remote control as well as better disaster recovery capabilities. The high flexibility, scalability, and cost-effectiveness of cloud-based solutions further bolstered the segmental growth. In 2024, the NIH transitioned multiple grant evaluation platforms to the cloud to achieve secure cross-site collaboration for its different teams.

The on-premises segment is anticipated to grow at the highest CAGR over the studied years, owing to the growing focus on the protection of application and funding information across government or large-scale agencies. On-premises deployment enables institutions to keep their data on in-house servers to maintain complete authority for user privileges. Moreover, the high security provided by this deployment contributes to segmental growth.

The large enterprises segment dominated the award management software market in 2024. These organizations handle numerous grant programs at once, requiring automation solutions to reduce the burden. This, in turn, boosts the need for award management software. Major large institutions, including government agencies, international companies, and research universities, focused on getting scalable solutions backed by advanced analytics and audit tracking capabilities, thus propelling the segment.

The SMEs segment is projected to expand rapidly in the coming years owing to the rising demand for affordable cloud-based award management solutions. More businesses with smaller structures now need efficient software systems designed to handle administrative workloads. The rising demand for automation solutions among SMEs to streamline operations and boost productivity further propels market growth.

The corporation segment held the largest share of the award management software market in 2024. This is mainly due to the increased number of programs for employee recognition and funding initiatives. Many corporations have integrated award management software to automate the tracking of grants. Furthermore, corporations often obtain platforms with multilingual features that enable consistent transparency between their different regional operations.

The education institutes segment is projected to grow at the fastest rate in the near future. The segmental growth can be attributed to the growing academic research grants and international academic partnerships focused on innovation. Educational institutions across India, Canada, and Germany started utilizing award platforms to oversee fellowships and institutional endowments, thus creating the demand for this type of software solution.

By Component

By Deployment

By Organization Size

By Vertical

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

April 2025

September 2024

November 2024