February 2025

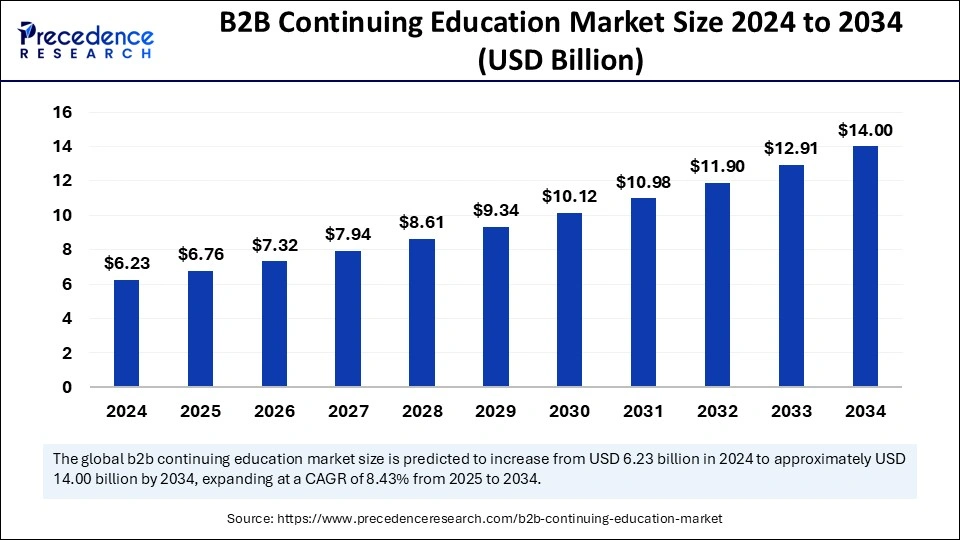

The global B2B continuing education market size is calculated at USD 6.76 billion in 2025 and is forecasted to reach around USD 14.00 billion by 2034, accelerating at a CAGR of 8.43% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global B2B continuing education market size accounted for USD 6.23 billion in 2024 and is predicted to increase from USD 6.76 billion in 2025 to approximately USD 14.00 billion by 2034, expanding at a CAGR of 8.43% from 2025 to 2034. The market is witnessing high growth because of the need for specialized skills, regulation, and current professional insights. Expansion is also driven using digital learning platforms and adaptive, on-demand training methods serving varying professional requirements across various industries such as healthcare, IT, and education.

Artificial intelligence is transforming the B2B continuing education market with personalized, automated, and accessible learning experiences. AI-based platforms use the behavior and knowledge gaps of learners to present content that is highly relevant to them, particularly in multinational industries. AI frees organizations from mundane administrative activities, enabling them to concentrate on imparting impactful education. It supports on-demand, flexible learning and resolves issues such as the widening skills gap and the necessity for current knowledge in rapidly changing industries. AI-based virtual helpers and chatbots enable around-the-clock support, enhancing accessibility and satisfaction for learners.

B2B continuing education market is a sector in education that provides professional development along with skill enhancement and upskilling for employees, organizations, and companies through business-to-business (B2B) sales. The programs are designed to increase employee productivity, comply with industry practices, and enhance the efficiency of operations.

The market has experienced rapid expansion with the emergence of technology, changing workforce realities, and rising demand for technical skills. Firms spend on ongoing education to stay competitive, meet regulatory requirements, and keep up with technological changes. Major players in this industry are online learning platforms, corporate training firms, professional development associations, and industry groups. The industry is fueled by technological innovation, changing workforce patterns, and the demand for specialized skills.

| Report Coverage | Details |

| Market Size by 2034 | USD 14.00 Billion |

| Market Size in 2025 | USD 6.76 Billion |

| Market Size in 2024 | USD 6.23 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.43% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Component, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Corporate shift toward workforce upskilling

One of the key drivers in the B2B continuing education market is the corporate shift toward workforce upskilling. Organizations are investing in training programs for employees to remain competitive and match the pace of technological progress. This trend is also visible in the legal profession, with law firms upgrading training programs to retain and hire top talent. This encompasses thorough training in business development and client relationship management skills that not only enhance revenue generation but also generate goodwill among associates, making companies more appealing to the best talent.

High Costs and Technological Limitations

The B2B continuing education market is propelled by technological innovation and regulatory needs, but it is heavily constrained by high costs and technological limitations. Although innovations such as AI and VR improve the personalized learning experience, smaller firms find it challenging to implement these technologies because of cost factors. For example, in the health industry, big hospitals can adopt VR-based training, but there are smaller health centers remaining behind because of financial and infrastructure limitations. This divide suggests that there should be affordable solutions that can level the playing field and democratize access to sophisticated learning tools so that all companies can leverage continuing education.

AI-powered personalization and immersive technology

The B2B continuing education market is set to experience tremendous growth with the incorporation of AI-powered personalization and immersive technologies such as VR and AR. These technologies allow providers to develop customized learning experiences, improve knowledge retention, and offer hands-on training in virtual settings. AI can accelerate course development and personalization, fill skill gaps, and improve employee development. This corporate training revolution is set to make it more efficient and responsive to changing business requirements.

The offline segment dominates the B2B continuing education market, with the highest revenue in 2024 by personal interaction and experiential learning opportunities. Conventional face-to-face models, including conferences, seminars, workshops, and hands-on training sessions, facilitate direct engagement, instant feedback, and interpersonal relationships that cannot easily be established through virtual mediums. Healthcare and manufacturing industries reap benefits from offline modes of training because they demand hands-on expertise and direct observation.

The All-India Council for Technical Education (AICTE) and the Society of American Gastrointestinal and Endoscopic Surgeons (SAGES) highlight the offline importance of education in the market. SAGES conducted more than 20 hands-on training courses on complex endoscopic procedures in 2022, while 500 ATAL Faculty Development Programs by AICTE seek to improve faculty training, complementing the growth of online learning platforms and catering to varied educational requirements.

The online segment is experiencing rapid growth over the forecast period of 2025 to 2034 due to its flexibility, scalability, and cost-effectiveness. Online certification and training are delivered via websites for the convenience of busy employees and geographically dispersed teams. The use of sophisticated technologies such as AI, VR, and gamification makes online education more effective, offering personalized and interactive learning experiences. The online platforms provide low-cost alternatives to businesses, avoiding expenses associated with physical premises, transportation, and hard copies, thus increasing the demand for ongoing upskilling in technology-based sectors. SWAYAM, an initiative of the Digital India program, offers free online courses for professionals across industries, illustrating the use of digital platforms by governments for cost-effective continuing education.

The acute care center segment dominated the B2B continuing education market with the highest share in 2024 because of its essential function of treating complicated and emergency medical situations. This segment includes hospitals, emergency rooms, and ICUs and demands ongoing training for specialists such as emergency medicine doctors, critical care nurses, and respiratory therapists. The growing sophistication of acute illnesses and the development of diagnostic methods and treatment protocols mandate continuous education to maintain high-quality care for patients. The need for specialized training courses specific to acute care environments has grown due to the higher incidence of chronic diseases and emergency cases. Infrastructure and public reimbursement programs funded by the U.S. government promote continuing education programs for health professionals.

The behavioral health segment will experience rapid growth over the forecast period of 2025 to 2034 because the incidence of mental health illnesses like anxiety, depression, and abuse of substances is on the rise along with growing global concern for mental illness. Organizations and governments are making mental health a priority by investing in training programs and incorporating behavioral health services into primary and acute care environments. In June 2024, SAMHSA launched a funding opportunity to educate healthcare providers in evidence-based treatment practices for mental health and substance use disorders with the goal of addressing the increased demand for comprehensive and integrated mental health care.

The training segment dominated the B2B continuing education market in 2024, offering healthcare professionals continuing education and skill development. It encompasses courses, workshops, seminars, webinars, and online modules to update them on recent practices, procedures, technologies, and developments. Demand for training is fueled by licensure maintenance, regulatory compliance, and quality patient care. The training programs are customized to include diverse specialties and professional development categories so that they can be applied to different healthcare settings.

Flexible training allows healthcare providers to remain current in practices, procedures, technology, and regulatory standards, enhancing the competence and outcomes of patients. The American Heart Association (AHA) and the U.S. Department of Health and Human Services (HHS) have underscored the significance of healthcare training. In 2024, the HHS initiated a national program to deal with emerging infectious diseases, while the AHA released revised guidelines for cardiopulmonary resuscitation and emergency cardiovascular care. Training programs play a pivotal role in tackling intricate medical issues.

The credentialing segment will witness rapid growth over the forecast period of 2025 to 2034, with the rising need for specialty credentials and certifications, especially in regulated industries. Advances in technology, such as digital badges and blockchain technology, are improving the trust and efficiency of credential verification, which could boost this growth of the segment. The larger alternative credentials market, such as digital badges and micro-credentials, is also growing rapidly with its emphasis on targeted skill building and flexibility. Credentialing is critical to career progression and upholding industry best practices, and the integration of digital platforms has further enhanced the credentialing process, making it accessible and convenient for professionals across the globe.

North America dominated the B2B continuing education market in 2024 because of its sophisticated healthcare infrastructure, rigorous regulatory environments, and high value placed on professional growth. Physicians in the US must complete continuing medical education (CME) to keep their licenses and certifications current, generating demand for accredited continuing education courses. The Accreditation Council for Continuing Medical Education regulates this requirement, ensuring excellence in continuing education. This mandate creates a high demand for accredited continuing education programs, which fuels growth in the market. The sophisticated healthcare systems, along with stringent regulatory environments and focus on the professional development of the region, are responsible for its market leadership.

The ACCME Annual Report emphasizes the dominance of North America in the international B2B continuing education market, as the initiative by the U.S. Department of Health in 2024 broadens CME programs. The report underscores the role of U.S. CME providers, such as the American Medical Association and American College of Physicians, in delivering high-quality educational content.

The U.S. dominates the B2B continuing education market on account of its sophisticated infrastructure, robust regulatory environment, and support from institutions. Institutions such as Harvard Medical School and Mayo Clinic provide high-value programs, and technological progress enhances access to learning. The competitive employment market compels professionals to seek expertise improvement, and the U.S. Department of Health and Human Services increases continuing medical education programs to keep professionals updated.

Asia Pacific will host the fastest-growing B2B continuing education market over the forecast period of 2025 to 2034, propelled by technological developments, the adoption of mobile learning, and the need for customized and flexible learning. China and India are spearheading the growth, heavily investing in e-learning platforms and mobile learning solutions. Rapid growth in the economy and increasing digital infrastructure of the region make it a favorable destination for education technology innovations. Other nations such as China, India, and Southeast Asian countries are heavily investing in healthcare education to fill the skill gaps and cater to the needs of their developing healthcare systems. The high population density and growing occurrence of chronic diseases in the region further boost the demand for qualified healthcare professionals.

Europe will grow at a considerable growth rate in the upcoming period in the B2B continuing education market, with well-developed health systems along with strong regulatory requirements and a strong focus on lifelong learning among professionals. Germany, the UK, and France have compulsory continuing education for healthcare professionals, thereby maintaining a steady demand for courses. The focus of Europe on quality assurance and accreditation also ensures high-quality continuing education. The European Union introduced the EU4Health Programme in March of 2023, which gives significant funding for improving healthcare professional training programs among its member nations, reflecting the dedication of Europe to professional enhancement.

By Type

By Component

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

February 2025

August 2024

March 2025