September 2024

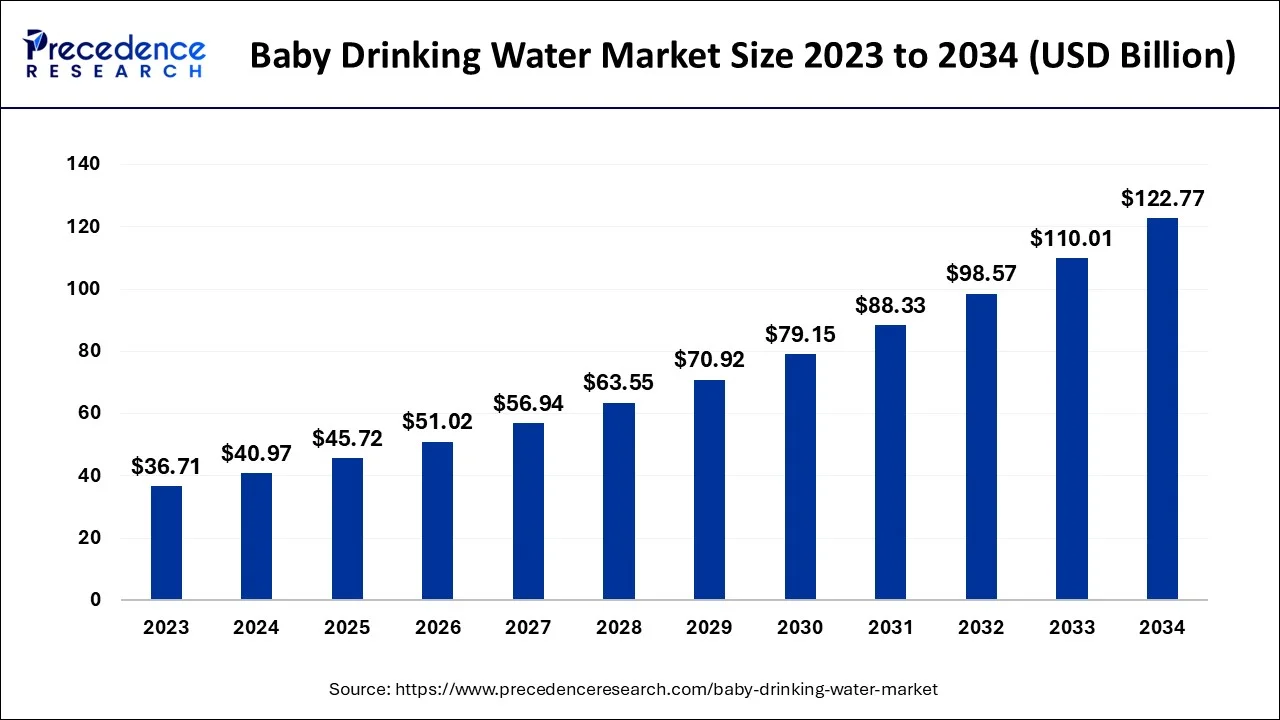

The global baby drinking water market size is estimated at USD 40.97 billion in 2024, grew to USD 45.72 billion in 2025 and is predicted to surpass around USD 122.77 billion by 2034, expanding at a CAGR of 11.60% between 2024 and 2034.

The global baby drinking water market size accounted for USD 40.97 billion in 2024 and is anticipated to reach around USD 122.77 billion by 2034, expanding at a CAGR of 11.60% between 2024 and 2034.

The baby drinking water market is primarily driven by the lack of drinkable and suitable water for babies. The immune system of babies is weaker. The presence of fluoride and sodium at higher levels in some regions may negatively impact the health of the babies and can harm the body growth and development of the baby. The rising disposable income, the rise of the middle class, and increasing awareness regarding the availability of baby drinking water are propelling the growth of the global baby drinking water market. The rising birth rate is another factor fostering the growth of this market. According to the World Bank, the fertility rate of women was recorded at 2.403 births per woman in 2019. Further, the global population is growing at a rate of 1.036%, as per the World Bank data. The rising global population along with the rising birth rate across the globe is expected to boost the growth of the global baby drinking water during the forecast period.

The lack of suitable drinking water for infants is driving the market growth. The growing need for drinkable water for babies is compelling parents to opt for specially produced water for babies that have the correct amount of minerals and are produced by the purification process. The baby's drinking water has no negative health impacts on the baby. Hence, parents are now adopting the use of baby drinking water for their babies. Further, rising women's participation in the labor force is significantly contributing to the rising disposable income of the household which positively impacts the growth of the global baby drinking water market. The increased risks of getting ill by the consumption of contaminated water had made the parents more conscious about their baby's health and increased their expenditure on the health and wellness products of the babies. Therefore the rising awareness regarding the ill effects of drinking contaminated water and the shortage of suitable drinking water is propelling the demand for baby drinking water across the globe.

| Report Coverage | Details |

| Market Size in 2024 | USD 40.97 Billion |

| Market Size by 2034 | USD 122.77 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 11.6% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Companies Mentioned | NongfuSpring, Sant' Anna, Eva Water, MAHAC, Nursery, Waiwera |

Based on type, the pure water segment dominated the global baby drinking water market in 2023, in terms of revenue and is estimated to sustain its dominance during the forecast period. Pure water has low sodium, low sulfate, and low fluoride that does not impact the immune system of the babies adversely. Due to the weaker immune systems, the consumption of regular water may impact the nutrition-absorbing capabilities of the infants and may hamper the development of the infants. Therefore, rising awareness regarding the negative health impact of regular water on infants has fostered the growth of this segment significantly and is expected to sustain its significance during the forecast period.

On the other hand, the mineral water segment is expected to grow at a significant rate during the forecast period. The major consumer of this water is the infants between 12-24 months of age. This is attributable to the increased awareness among the population regarding mineral water for babies and the need for clean and drinkable water for babies.

Based on age, the 12-24 months segment dominated the global baby drinking water market in 2023, in terms of revenue and is estimated to sustain its dominance during the forecast period. According to the World Health Organization, infants must be fed only their mother’s milk for the first 6 months after birth. Therefore, parents generally feed water to their babies as later as possible. Therefore, the development of immunity after 12 months enhances the baby’s ability to digest the water. Further the low sodium and fluoride content of the baby drinking water is best suitable for the babies of age 12 to 24 months or older.

On the other hand, the 7-12 months segment is expected to register a significant growth rate during the forecast period. This can be simply attributed to the rising birth rate, rising awareness regarding baby health, and rising disposable income.

Based on region, North America dominated the global baby drinking water market in 2023, in terms of revenue, and is estimated to sustain its dominance during the forecast period. The increased preferences for baby specialty products, increased expenditure on baby health, increased disposable income, and increased awareness regarding the availability of baby drinking water across the region are the major drivers of the baby drinking water market in North America. Europe is the second largest market for baby drinking water, just after North America owing to the similar macroeconomic factors as North America.

On the other hand, Asia Pacific is estimated to be the most opportunistic market during the forecast period. This can be attributed to the presence of huge population, rising birth rates, rising disposable income, and rising awareness regarding the availability of baby drinking water. The rising expenditure on baby care products is a major factor that is expected to foster the growth of the market in Asia Pacific during the forecast period.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

The various developmental strategies adopted by the key market players include acquisition and mergers, partnerships, joint ventures, and product launches that paves the way for the development of growth avenues in the upcoming future.

Segments Covered in the Report

By Type

By Age

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

October 2023

June 2024

November 2024