September 2024

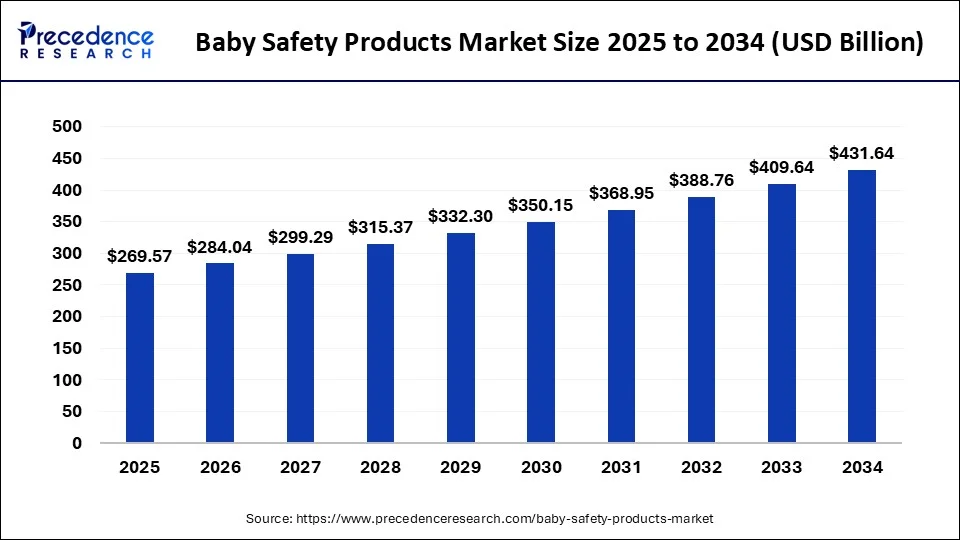

The global baby safety products market size accounted for USD 255.83 billion in 2024, grew to USD 269.57 billion in 2025 and is projected to surpass around USD 431.64 billion by 2034, representing a healthy CAGR of 5.37% between 2024 and 2034. The North America baby safety products market size is calculated at USD 84.42 billion in 2024 and is expected to grow at a fastest CAGR of 5.51% during the forecast year.

The global baby safety products market size is estimated at USD 255.83 billion in 2024 and is anticipated to reach around USD 431.64 billion by 2034, expanding at a CAGR of 5.37% from 2024 to 2034..

A baby safety product is a device or an appliance that helps to protect babies from potential injuries. There are various kinds of infant safety goods available, including baby monitors, baby gates, corner guards, outlet protectors, and others.

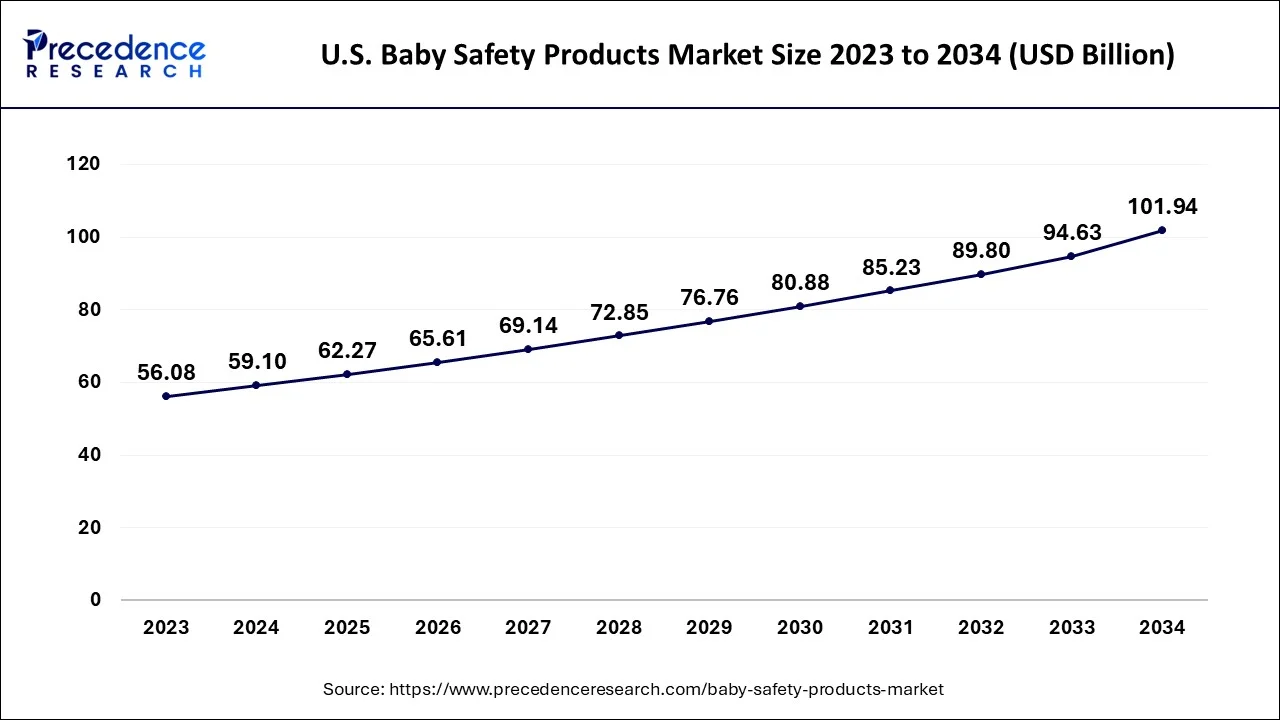

The U.S. baby safety products market size accounted forUSD 59.10 billion in 2024 and is expected to be worth around USD 101.94 billion by 2034, expanding at a CAGR of 5.58% from 2024 to 2034.

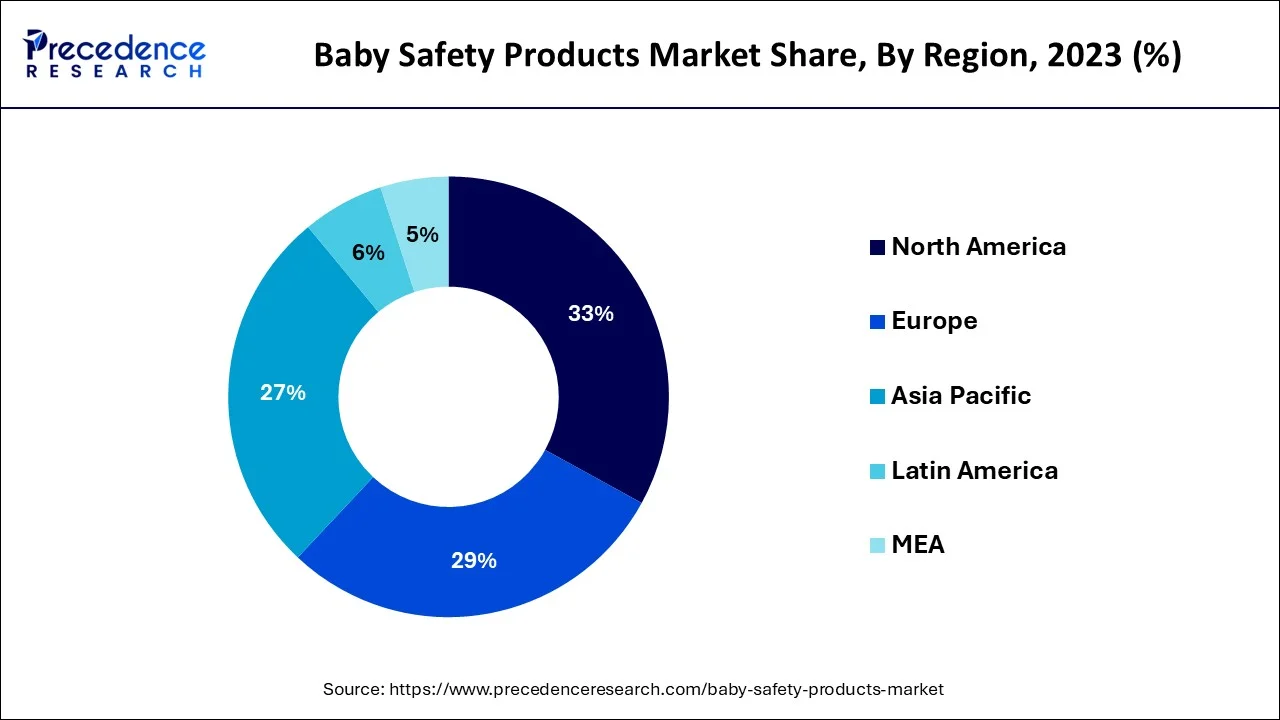

In 2022, North America had the biggest portion with 33%. The market has expanded in North America as a result of factors including high purchasing power, technical developments, working parents, and government efforts regarding infant protection. Consumers with incomes over USD 150,000 demonstrated increased penetration for infant goods, according to the TABS Industry Report.

Sudden Infant Death Syndrome (SIDS), which accounts for about 1400 fatalities annually, caused 38% of the 3,600 Sudden Unexpected Death Syndrome (SUID) deaths in the United States in 2017. The Centers for Disease Control and Prevention (CDC) started a campaign called Protect the Ones You Love to educate parents about the causes of infant harm, SIDS, and SUID and how they can be avoided in order to reduce these fatalities.

From 2024 to 2034, Asia Pacific is anticipated to have the greatest CAGR, at 6.4%. A rise in the birth rate and the number of working mothers in nations like China and India are the main factors driving this industry. The improvement in living conditions and the increase in discretionary money are two additional major drivers of market expansion in this area. The female labor involvement rate has grown by 4.5% over the past three decades, according to EPRA International Journal of Economic and Business Review. This is anticipated to increase demand for infant safety goods like baby monitors and support market expansion.

The market has been driven by an increase in government efforts to stop the growing rate of infant deaths. The key elements propelling the worldwide market are an apparent preference for nuclear families, rising customer buying power, growing requirements and knowledge about baby safety, and rising infant mortality rates. Furthermore, customers are buying more baby monitors thanks to the growing popularity of internet shopping platforms.

Babies and their parents can now communicate in real-time thanks to gadgets like infant monitors that have been made possible by technological development. The market is anticipated to grow in popularity as working professionals embrace these gadgets more and more. Security issues related to such devices have been acknowledged as a difficult business element. The government is implementing new regulations and safety standards as a result of a rise in the number of minor fatalities.

For instance, in Europe, all infant car seats must comply with regulations No. 44 and 129 of the United Nations Economic Commission for Europe (UNECE), which establishes the requirements for child safety systems. For the majority of infant safety goods, including beds, cribs, and strollers, European governments have established guidelines.

The introduction of novel and creative products is fueling the expansion of the market and generating a desire among customers to buy safety products for infants. Baby Jogger, for example, released its City Tour 2 Double Stroller in May 2019, designed for twin babies. Additionally, the Halo DreamNest is a versatile sleep system that can be utilized as a bassinet, travel cot, and travel crib.

The market is expanding as a result of the availability of a broad range of goods to satisfy particular needs related to baby weight and age standards as well as the rising appeal of the online channel. Due to its advantages in offering a thorough description of the product, the internet channel has given vendors an option to the conventional brick-and-mortar shop.

| Report Coverage | Details |

| Market Size in 2024 | USD 255.83 Billion |

| Market Size by 2034 | USD 431.64 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.37% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product Type and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Customized baby protection goods are accessible

To guarantee their children's protection, parents must use baby safety products. Some parents struggle to discover newborn safety items that are appropriate for their infants. Vendors concentrate on providing customized versions of infant safety goods as a result. Customization enables parents to cater to the specific needs of their infants. Products for baby protection can be modified based on the components, extra attachments, and extras. Parents can choose the preferred extras, with options for back or forward sitting. Baby carriages with unique feature combos are also available from vendors.

Additionally, a number of suppliers provide infant car seats with customizable choices. For instance, Dorel Industries' Maxi-Cosi name sells infant car seats that can be personalized. The Mico Max 30 variant offered by the business is adaptable. Adjusting the frames, pillows, and canopy hues, helps parents increase their infants' security and comfort. Additionally, the device has common safety measures installed. Thus, during the projection period, these factors will fuel the global market's development.

The existence of fake goods

The abundance of fake goods is a significant obstacle to the market's expansion. The market for counterfeit goods is expanding in both established and emerging nations as a result of the growing market potential for baby safety items and their rising demand. The introduction and expanding use of e-commerce has fueled the market for fake infant safety goods worldwide. Customers find it challenging to differentiate between real and fake baby safety goods because they look identical. During the forecast period, the supply of counterfeit goods will increase, which will have an impact on the sales and selling tactics of legitimate sellers.

A rising need for innovative baby protection goods

Convenient infant safety items are preferred by parents. Hence, different vendors are concentrating on creating smart variants of baby safety goods. Numerous automatic control systems are found in smart infant safety goods, which improve newborn safety. Smart versions come with extra features like automated power folding, anti-theft sensors, software that connects to cellphones, emergency stop controls, and remote security tracking systems. They also have electronic climate control systems. These characteristics make sure that parents and their children are always in contact.

There are also sophisticated versions of infant car carriers and cots on the market. Smart baby car seats assist in preventing the unintentional securing of infants in vehicles, which can result in infant fatalities. The Sirona M smart infant car seats from good baby come with an incorporated hot vehicle sensor that notifies parents when their children are in danger. Additionally, they notify the program if a child unbuckles themselves in a moving vehicle. These attributes of smart infant safety goods may encourage more vendors to sell them, which would boost sales and propel the global market's expansion over the course of the projection period.

Car seats, strollers, sensors, and other infant protection items are included in the product category. In 2022, the baby car seat market had the biggest proportion with 72%. The demand for infant car seats has been driven by an increase in traffic incidents. For example, the Britax Convertible Car Seat has three levels of safety, anti-rebound bars, and a click-tight fitting method to guarantee the kid is safely buckled in.

From 2024 to 2034, the market for monitors is anticipated to grow at the fastest CAGR of 6.9%. The demand for this product is being driven by the rising number of working parents and the need to monitor the activities of the infants. These monitors can be used to communicate with and keep an eye on the infant and can be linked to smart gadgets using wireless technology like WiFi. For instance, the willcare newborn baby Monitor includes features like lullaby recordings, temperature sensors, and a calendar along with a long-range monitor and night vision. In the coming years, demand for baby monitors is anticipated to increase significantly as a result of technical developments and their simplicity of use.

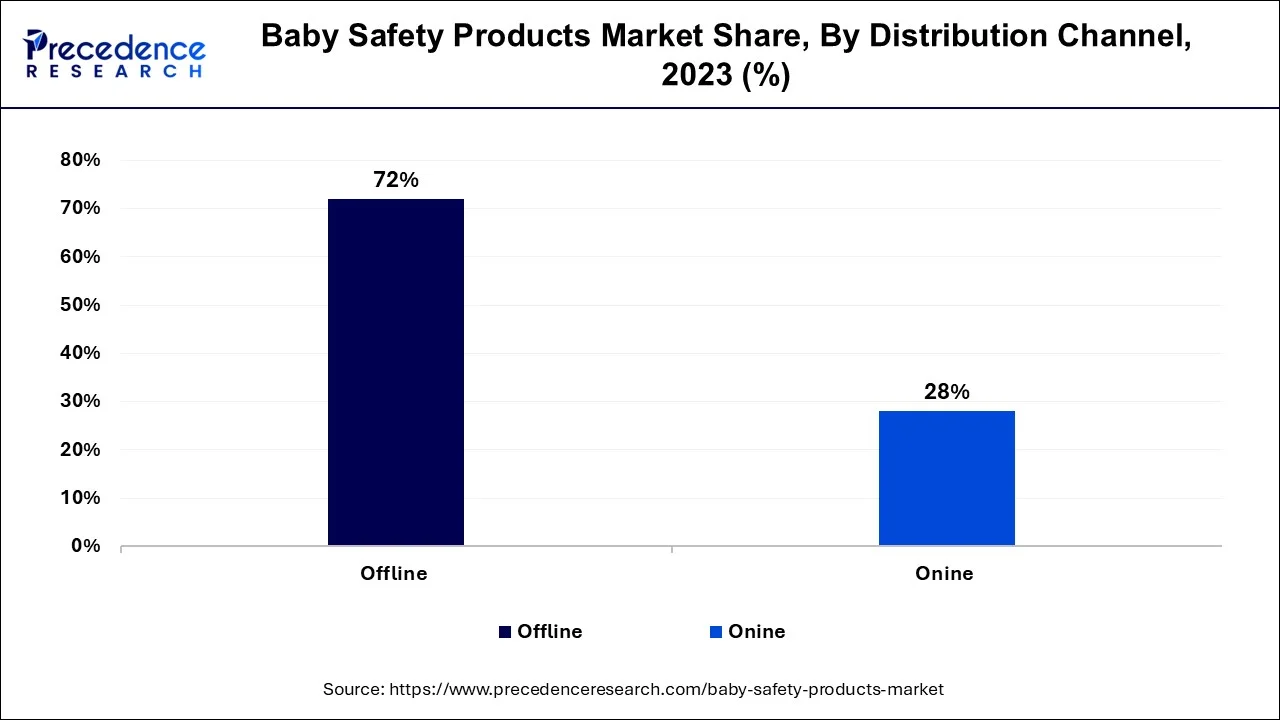

In 2023, the offline sales route had a stake of over 72.0%. The main market participants for baby safety goods derive the majority of their income from offline transactions. The substantial increase is mainly attributable to the advantages provided to the customers, including the ability to scan the product before purchase, the availability of a wide range of choices, free demonstrations, and advice from sales representatives on selecting the best product. Local shops, grocers, hypermarkets, and convenience stores are all part of the offline route. For instance, First Cry has more than 400 shops in India, making it the biggest retailer in Asia.

The quickest CAGR is anticipated to be 5.5% for the online market between 2024 and 2034. The development of the sector is expected to be boosted by elements like an increase in internet users, a fast-paced lifestyle, smartphones, and the adoption of e-commerce platforms. Customers are becoming more at ease with online purchasing thanks to features like product comparison, thorough product descriptions, and simple swap and reimbursement options, which is boosting sales. For instance, BabyHaven.com increased by 65% to 53.1 million USD, The Honest Company Inc. increased by 5% to 21.3 million USD, and Albee Baby increased by 5% to 261.1 million USD.

Segments Covered in the Report:

By Product Type

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

October 2024

October 2023

June 2024