March 2025

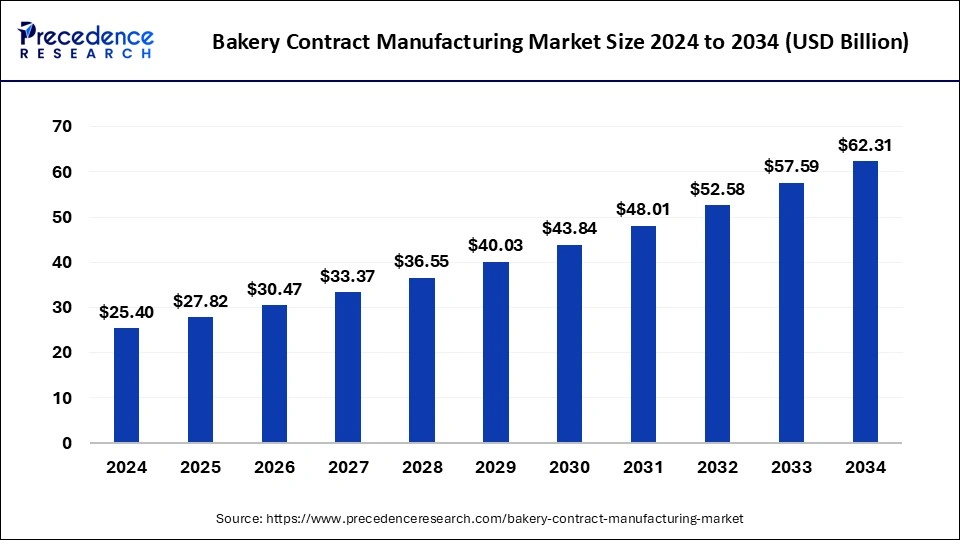

The global bakery contract manufacturing market size is calculated at USD 27.82 billion in 2025 and is forecasted to reach around USD 62.31 billion by 2034, accelerating at a CAGR of 9.39% from 2025 to 2034. The Europe bakery contract manufacturing market size surpassed USD 9.46 billion in 2025 and is expanding at a CAGR of 9.55% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global bakery contract manufacturing market size was estimated at USD 25.40 billion in 2024 and is predicted to increase from USD 27.82 billion in 2025 to approximately USD 62.31 billion by 2034, expanding at a CAGR of 9.39% from 2025 to 2034. The growing demand for bakery products significantly increases the demand for the bakery contract manufacturing market.

The Europe bakery contract manufacturing market was valued at USD 8.64 billion in 2024 and is expected to be worth around USD 21.50 billion by 2034, at a CAGR of 9.55% from 2025 to 2034.

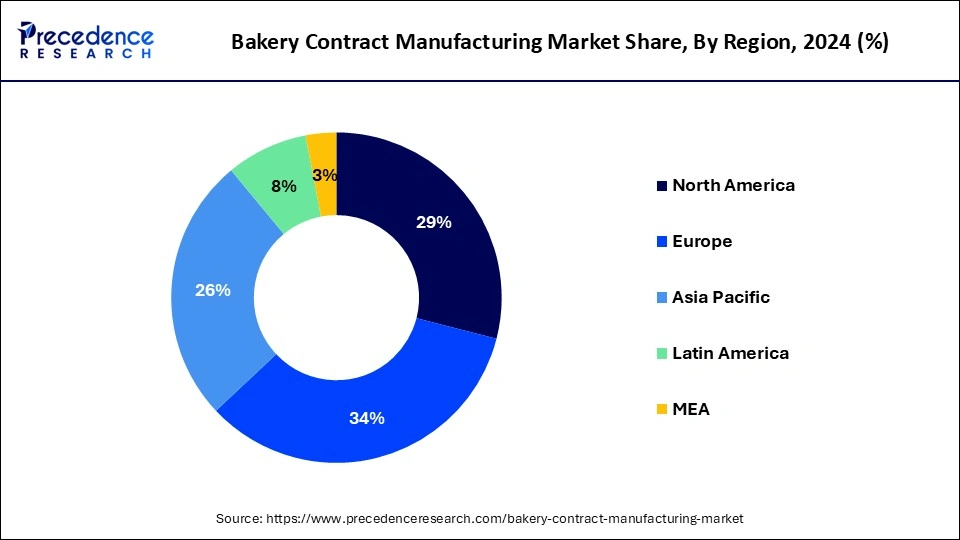

Europe held the largest share of the bakery contract manufacturing market in 2024. A rising trend among consumers is the preference for specialty bakery goods, such as those that are low-sugar, organic, gluten-free, and non-GMO. The need for specialist contract manufacturing services is driven by the need for healthier and personalized baked goods.

The bakery contract manufacturing market in Europe is very competitive and focused on innovation. The contract manufacturers help firms launch cutting-edge baked goods into the market more swiftly by providing their experience in formulating and producing new products. The private label businesses are becoming more and more popular among European retailers. To create affordable and high-quality bakery items, these brands need contract manufacturing services.

Asia Pacific is expected to grow at the fastest rate in the bakery contract manufacturing market during the forecast period. The region's urbanization has resulted in hectic lives, which has raised demand for quick-to-eat bakery goods. The demand for effective contract manufacturing-based bakery production has arisen as a result of this change. Consumers in the area now have easier access to bakery items because of the growth of supermarkets, hypermarkets, and e-commerce platforms.

Increasing middle-class populations in Southeast Asian, Indian, and Chinese countries have led to higher discretionary incomes. The spending by this generation has increased on a range of food products, particularly premium and high-quality baked goods. Asia Pacific has seen a sharp increase in the acceptance of Western cuisine, which includes baked goods like bread, cakes, and pastries. The bread business has grown as a result of this tendency, which has increased demand for the bakery contract manufacturing market.

The bakery contract manufacturing is the practice of contracting out the manufacturing of bakery goods to other producers. The bakery contract manufacturers are these specialist manufacturers who manage the full production process, freeing up bakery brands to concentrate on other business-related activities like product development, marketing, and distribution.

The bakery contract manufacturing market is fragmented with multiple small-scale and large-scale players, such as Blackfriars Bakery, Perfection Foods, Michel’s Bakery, Inc., Tradition Fine Foods Ltd, Oakhouse Bakery, Cibus Nexus, Southern Bakeries LLC, Stephano Group Ltd., Hearthside Food Solutions LLC, Richmond Baking, Adventure Bakery LLC, Bake Works, Inc., De Banketgroep B.V., PacMoore Products, Inc., HACO Holding AG.

| Report Coverage | Details |

| Market Size by 2034 | USD 62.31 Billion |

| Market Size in 2025 | USD 27.82 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.39% |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for long shelves of bakery products

The rising demand for a long shelf of bakery products can boost the growth of the bakery contract manufacturing market. The market can benefit from the growing demand for long-shelf-life bakery products in a number of ways, including increased consumer convenience, increased market reach, improved supply chain efficiency, food security, leveraging technological advancements, cost savings, assuring health and safety, offering market differentiation, and supporting economic stability. Together, these elements propel market expansion and innovation.

Higher long-term cost

The higher long-term cost may slow down the growth of the bakery contract manufacturing market. The higher long-term costs can impede the market's growth for contract manufacturing of bakery goods by raising production and operating costs, putting pressure on prices, restricting market accessibility, straining finances, complicating the supply chain, and necessitating ongoing investments in workforce training and compliance.

Technical advancement in bakery contract manufacturing

Technical advancements in bakery contract manufacturing may be an opportunity to boost the bakery contract manufacturing market. The time and personnel expenses associated with manufacturing processes can be decreased with the help of modern automated technologies. The results are higher manufacturing quantities and consistent product quality. The product quality and shelf life can be improved by innovations like fast cooling systems and precise bake ovens.

Maintaining the reputation of a brand depends on every batch of baked goods meeting the same exacting standards, which are ensured by sophisticated technology and precise control systems. Advanced sensors and monitoring systems have the ability to identify and address problems instantly, guaranteeing that the finished goods fulfill exacting standards for quality.

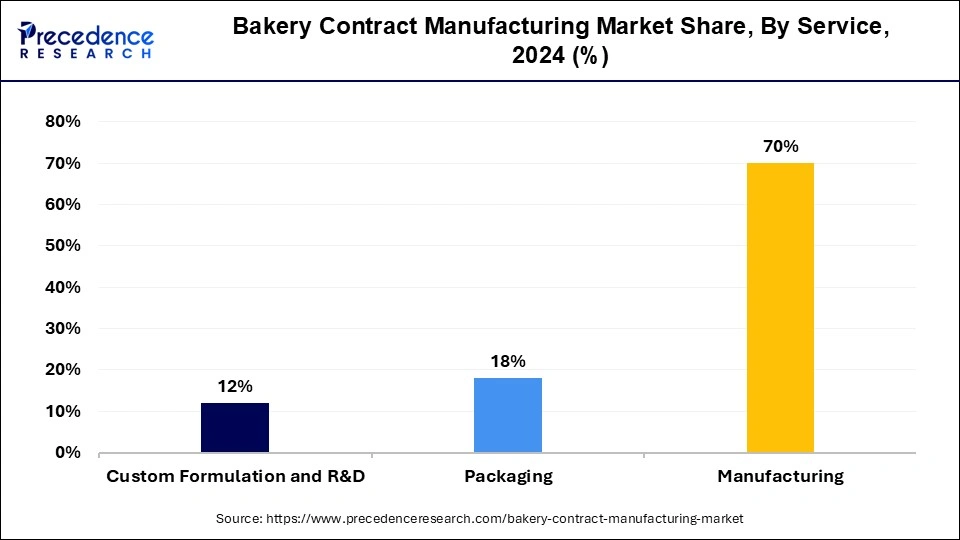

The manufacturing segment dominated the bakery contract manufacturing market in 2024. Large-scale bakery manufacturing is made possible by the advanced machinery and specialized knowledge of contract manufacturers. They can now efficiently and affordably make superior bakery goods thanks to this. The labor, raw material, and equipment maintenance expenses are decreased for bakery brands when manufacturing is outsourced to contract manufacturers. For small and medium-sized businesses (SMEs) that might lack the funding to invest in expansive manufacturing facilities, this is especially beneficial. The flexibility for bakery brands is provided by contract manufacturers, who may adjust production levels in response to demand. In the bread sector, demand might fluctuate depending on market trends or be seasonal. Therefore, this is quite important. Bakeries may concentrate on their key skills, such as product creation, marketing, and distribution, by outsourcing the production process.

The custom formulation segment is expected to grow at a significant CAGR in the bakery contract manufacturing market during the forecast period. The consumer demand for distinctive and customized baked goods that address particular preferences, dietary needs, and health issues is rising. By developing specialized goods, businesses are able to satisfy these needs thanks to custom formulas. The demand for bakery goods with particular health advantages, such as gluten-free, low-sugar, high-protein, and vegan alternatives, is being driven by growing knowledge about health and well-being. The production of these specific goods is made possible by custom formulation. The bakery businesses aim to set themselves apart in a crowded market by introducing novel items. By experimenting with different ingredients, tastes, and product forms, custom formulation enables firms to create distinctive products that stand out in the bakery contract manufacturing marketplace.

By Service

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

February 2025

June 2024

July 2024