Bamboo Flooring Market Size and Forecast 2025 to 2034

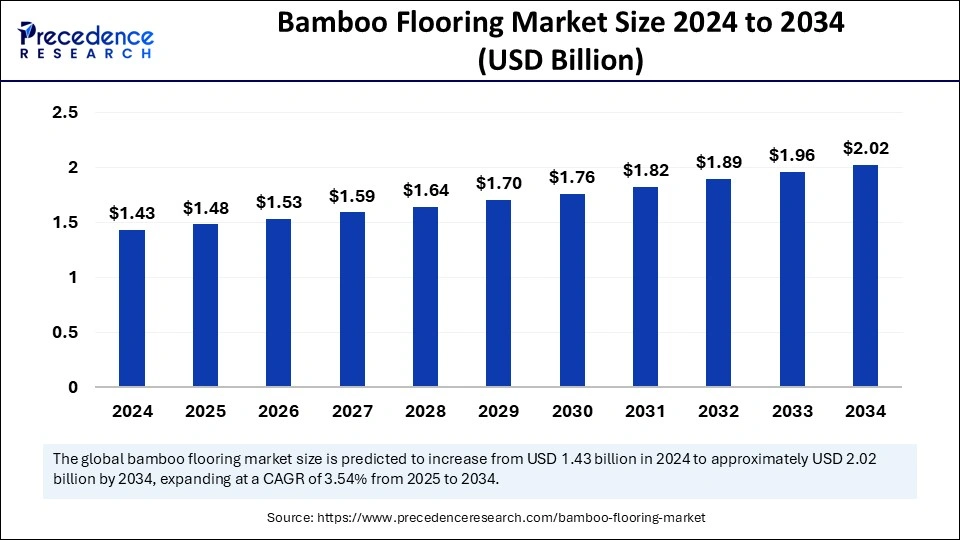

The global bamboo flooring market size accounted for USD 1.43 billion in 2024 and is predicted to increase from USD 1.48 billion in 2025 to approximately USD 2.02 billion by 2034, expanding at a CAGR of 3.54% from 2025 to 2034. The growing demand for sustainable and eco-friendly materials is the key factor driving the growth of the market. Also, innovations in bamboo flooring technology, coupled with the increasing shift toward home renovation and construction, can fuel market growth further.

Bamboo Flooring Market Key Takeaways

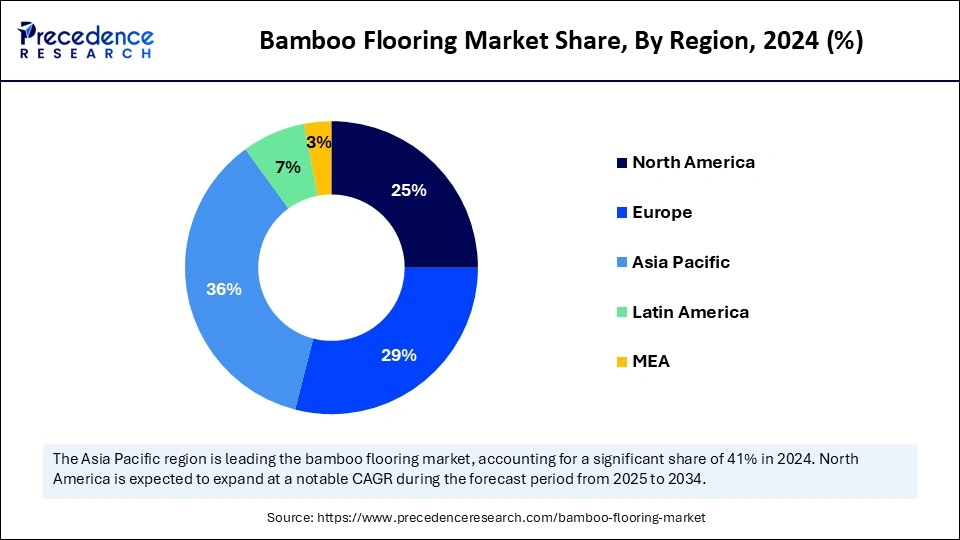

- Asia Pacific dominated the global market with the largest market share of 41% in 2024.

- North America is expected to grow at the fastest CAGR over the period studied.

- By type, the solid bamboo floor segment held the largest market share in 2024.

- By type, the engineered bamboo floor segment is expected to grow at the fastest CAGR over the forecast period.

- By application, the residential sector segment has held the largest market share in 2024.

- By application, the commercial sector segment is anticipated to grow at the fastest rate over the projected period.

Role of Artificial Intelligence (AI) in Enhancing the Bamboo Flooring Process

Artificial Intelligence plays a key role in the bamboo flooring market, influencing numerous stages from production and processing to distribution and sales. It improves production processes, enhances sustainability, and optimizes individualized customer experiences. Furthermore, AI can automate tasks such as bamboo cutting, drying, and processing, which leads to increased efficiency and decreased labor costs. AI can be utilized to combine bamboo flooring with smart home technologies, creating efficient and connected living spaces.

Asia Pacific Bamboo Flooring Market Size and Growth 2025 to 2034

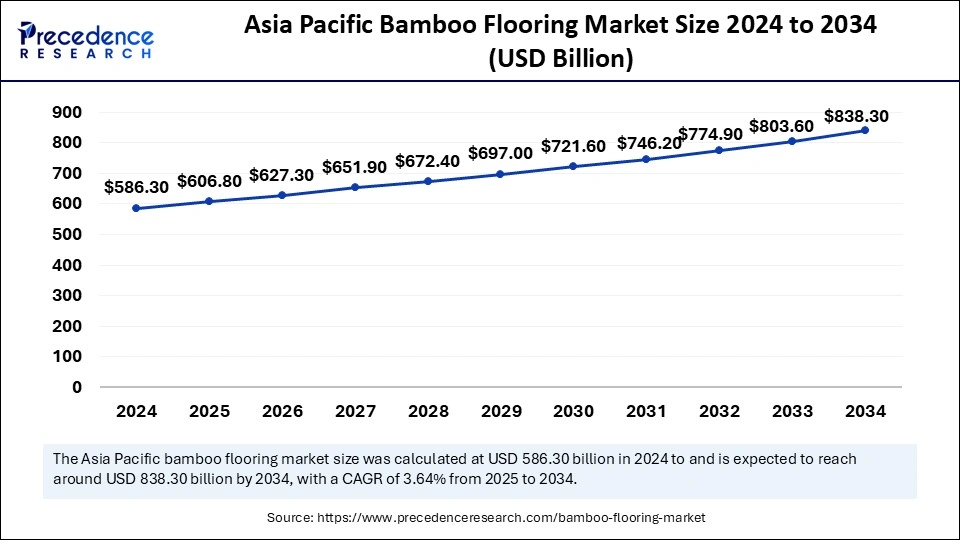

The Asia Pacific bamboo flooring market size was exhibited at USD 586.3 billion in 2024 and is projected to be worth around USD 838.3 billion by 2034, growing at a CAGR of 3.64% from 2025 to 2034.

Asia Pacific dominated the bamboo flooring market in 2024. The dominance of the region can be attributed to the presence of major market players in the region, along with the ongoing urbanization in emerging market countries such as China, Indonesia, and Vietnam. However, government measures promoting eco-friendly construction techniques and sustainable materials boost market growth. The region is also a key hub for bamboo flooring manufacturing, consumption, and innovation.

In Asia Pacific, China led the bamboo flooring market owing to the rising investments focusing on infrastructure development in the country. Most of today's bamboo flooring products come from China. Government initiatives facilitating eco-friendly and sustainable building practices can soon impact countries' growth positively.

- In November 2023, China launched a three-year plan to promote bamboo as an eco-friendly substitute for plastics. The plan aims to build an industrial system to meet the goal, including the cultivation of bamboo, deep processing, and market expansion.

North America is expected to grow at the fastest rate in the bamboo flooring market over the period studied. The growth of the region can be driven by increasing focus on environmentally friendly and sustainable construction practices, which has propelled the demand for bamboo flooring as a substitute to conventional hardwoods. Furthermore, commercial industries like retail and hospitality are using bamboo flooring because of its diversity and eco-friendly image.

In North America, the U.S. leads the bamboo flooring market. The dominance of the country is due to the rising popularity of the latest interior design trends and open-concept living spaces, which has bolstered the utilization of bamboo flooring in the country. Also, bamboo flooring is famous among U.S. consumers because of its aesthetic appeal, longevity, and environmental friendliness.

- In February 2023, Mohawk Industries, a well-known American flooring manufacturer that operates in both the residential and commercial sectors, finalized an acquisition by buying Mannington Mills, a leading firm globally in fine residential and commercial flooring.

Market Overview

Bamboo flooring is a type of flooring obtained from bamboo plants, a renewable and rapidly growing resource. It is generally made by cutting fully grown bamboo stalks into strips, which are then processed and laminated to create boards. This type of flooring has an extensive range of applications, such as bedrooms, kitchens, living rooms, and offices. Its warm tones and natural beauty add character to any room. This flooring can be installed in many ways, like nail-down, glue-down, and floating installation, which offers versatility to different projects.

Bamboo Flooring Market Growth Factors

- The healthcare sector is rapidly adopting bamboo flooring for its antimicrobial characteristics, which is expected to fuel the bamboo flooring market growth soon.

- Ongoing innovations in processing technologies, which enhance the product's versatility and durability, can propel market growth shortly.

- The growing adoption of green building standards like LEED will likely contribute to the market expansion further.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.02 Billion |

| Market Size in 2025 | USD 1.48 Billion |

| Market Size in 2024 | USD 1.43 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.54% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for aesthetic appeal

Bamboo flooring offers a crucial aesthetic appeal that integrates the beauty of real wood with certain color variations and peculiar grain patterns associated with bamboo. This versatility allows an extensive selection of finishes and styles to fit different interior design tastes, such as contemporary, rustic, modern, and classic. In addition, consumers are increasingly focusing on customization and aesthetics in their home décor selections. Hence, bamboo flooring is a primary alternative that complies with a range of interior design schemes.

In February 2025, Smith and Fong, the pioneering force in sustainable architectural bamboo products, announced the launch of Pleat&Weave™, an innovative line where dynamic, sustainable bamboo surfaces meet the craftsmanship of textiles and fashion design, shaping spaces with artful precision and fluid sophistication.

- In May 2023, the Nagaland bamboo Industry launched organic bamboo charcoal Tir Mijang. The bamboo charcoal produced by NBI has undergone testing at Faer Labs Pvt Ltd, Gurugram, Haryana, where it was deemed suitable for the market. Bamboo charcoal has various applications, including being used as household fuel for heating and cooking, as well as for purification and absorption purposes.

Restraint

Market competition and saturation

The increasing popularity of bamboo flooring makes the market more crowded with various producers and suppliers, which makes it challenging to distinguish products and leads to price differences. Moreover, competition also appears from other flooring materials such as engineered hardwood and luxury vinyl tile (LVT). Also, lack of standardization and inconsistencies in quality across different sectors can make it difficult for suppliers to build truthful bamboo product offerings.

Opportunity

Increasing demand for green building materials

Bamboo's quick growth and renewability make it a key substitute for conventional wood flooring, which aligns with the increasing demand for eco-friendly building materials. With the surging environmental concerns and rising awareness for adopting more sustainable lifestyles, there is a huge demand for green building materials. Furthermore, bamboo flooring, with its mix of durability, sustainability, and aesthetic appeal, is impacting market expansion positively.

- In July 2024, Echon, a globally recognized manufacturer of innovative building materials for home interiors, exteriors, and signage, announced its strategic expansion into the Indian market. With over 25 years of international experience and a robust global presence, Echon aims to revolutionize India's construction and home improvement sectors with eco-friendly and cutting-edge solutions.

Type Insights

The solid bamboo floor segment held the largest bamboo flooring market share in 2024. The dominance of the segment can be attributed to its natural authenticity, long history of popularity, and perceived durability among customers. The solid bamboo floors are made by compressing strips of bamboo together vertically or horizontally, creating versatile and stable planks. Additionally, these bamboo floors are famous for their hardness and high density, which makes them convenient for high-traffic areas. Also, it is suitable for an extensive range of applications, such as residential and commercial settings.

The engineered bamboo floor segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the innovations in manufacturing technology, raised acceptance in both commercial and residential settings, along with greater product performance. Also, the engineered bamboo floor construction offers exceptional moisture resistance and stability as compared to solid bamboo, which makes it suitable for diverse environments. The bamboo veneer is available in different finishes, colors, and styles, enabling more individualized design options.

Application Insights

The residential sector segment dominated the bamboo flooring market in 2024. The dominance of the segment can be credited to the bamboo flooring's extensive use in homes across the globe, fueled by its durability, eco-friendliness, and aesthetic appeal. Moreover, there is a growing demand for durable and sustainable solutions due to growing awareness regarding green building techniques. Bamboo flooring is the first choice for homeowners looking for attractive and sustainable flooring options.

- In March 2023, Armstrong Flooring, a prominent manufacturer of exceptional flooring solutions for both residential and commercial needs, announced the upcoming introduction of its luxe vinyl flooring collection. This range, dubbed Impressions, covers a whole variety of flooring types: very realistic wood designs as well as stylish stone looks.

The commercial sector segment is anticipated to grow at the fastest rate over the projected period. The growth of the segment can be linked to the growing use of bamboo flooring in commercial spaces like retail stores, offices, and hospitality organizations, which is facilitated by its sustainability performance and increasing acceptance of natural building materials. Furthermore, bamboo flooring can be a cheaper alternative compared to other flooring options, particularly in commercial settings.

Bamboo Flooring Market Companies

- Yoyu

- Dasso

- Jiangxi Feiyu

- Eco Bamboo and Wood

- Tengda

- Jiangxi Shanyou

- Sinohcon

- Tianzhen

- Kang Ti Long

- Huayu

- Kangda

- Kanger Group

- Zhutao

- Jiangxi Lvbao

- US Floors Inc

- Teragren

- Bamboo Hardwoods

Latest Announcements

- In February 2025, TRINITY International, a leader in innovative, sustainable storage and organization solutions, announced that its EcoStorage 6-Piece Bamboo Drawer Organizer Set with Dividers has been named a finalist in the prestigious 2025 IHA Global Innovation Awards (GIA) for Excellence in Product Design. This recognition places TRINITY among the most innovative brands in the home and housewares industry.

Recent Developments

- In April 2024, SITC Line released a new series of 10,000 TEU dry containers with eco-friendly materials such as bamboo flooring, waterborne paint, and MS sealant. This latest batch of containers, which is being gradually introduced by SITC Line, incorporates sustainable technology and environmentally friendly materials.

- In May 2023, Tripura's bamboo flooring and Mirzapur carpets decorated the new Parliament building. The new Parliament building represents India's cultural diversity and is created in accordance with the "Made in India" policy, as indicated by materials obtained from various sections of the nation.

- In January 2023, Tarkett, a renowned French multinational corporation specializing in floor and wall coverings, unveiled its latest innovation: the Aqua+ water-resistant laminate flooring line. These new clothes are made of the latest technology, thus they are water-resistant. Having such a characteristic, Aqua+ is an ideal flooring material to use in places with a high level of humidity, like kitchens and bathrooms.

Segments Covered in the Report

By Type

- Engineered Bamboo

- Stranded Bamboo

- Solid Bamboo

- Sustainable Bamboo

By Application

- Residential

- Commercial

- Industrial

- Outdoor

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting