March 2025

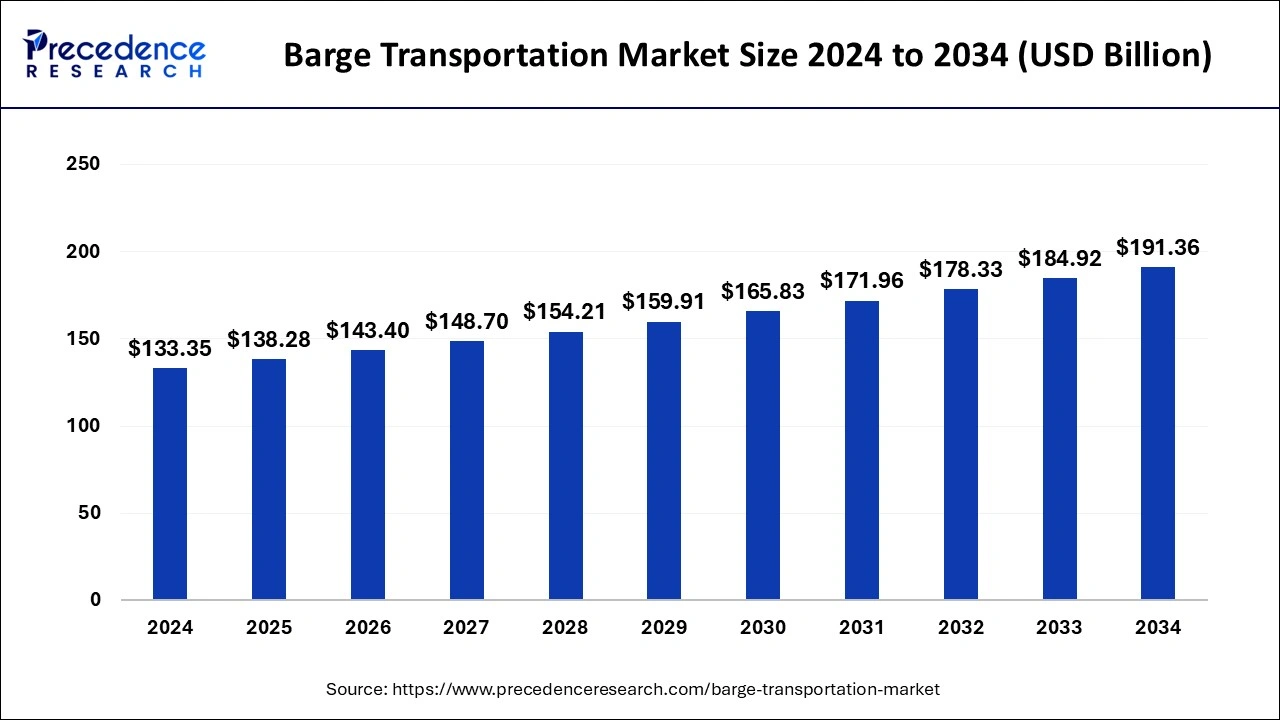

The global barge transportation market size was USD 133.35 billion in 2024, estimated at USD 133.35 billion in 2024 and is anticipated to reach around USD 191.36 billion by 2034, expanding at a CAGR of 3.68% from 2024 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global barge transportation market size accounted for USD 133.35 billion in 2024 and is predicted to reach around USD 191.36 billion by 2034, growing at a CAGR of 3.68% from 2025 to 2034. The cost-effectiveness of barge transport systems, growing intermodal transportation in several industries, favorable government initiatives, rising investments for enhancement of inland water infrastructures, growing industrialization, rising awareness of lower carbon emissions from barge transportation, and growing focus on environmental sustainability are expected to drive the growth of the barge transportation market during the forecast period.

AI is rapidly transforming every aspect of the shipping industry. With the advent of AI technologies, smart transportation has gained immense traction. AI technologies allow transportation companies to boost productivity and expedite operations. AI technologies play a crucial role in barge transportation, determining the most efficient routes by considering factors like weather conditions and traffic. They also monitor vessel performance and fuel consumption, predict maintenance, and manage cargo. This results in optimized route planning and time and fuel savings. By leveraging AI-driven navigation systems, barge transportation companies can manage their fleet effectively. AI enables real-time tracking of barges, streamlining deliveries, protecting assets, and enhancing transparency for shippers. Overall, AI technologies can improve safety, reduce operational costs, and enhance the efficiency of barge transportation.

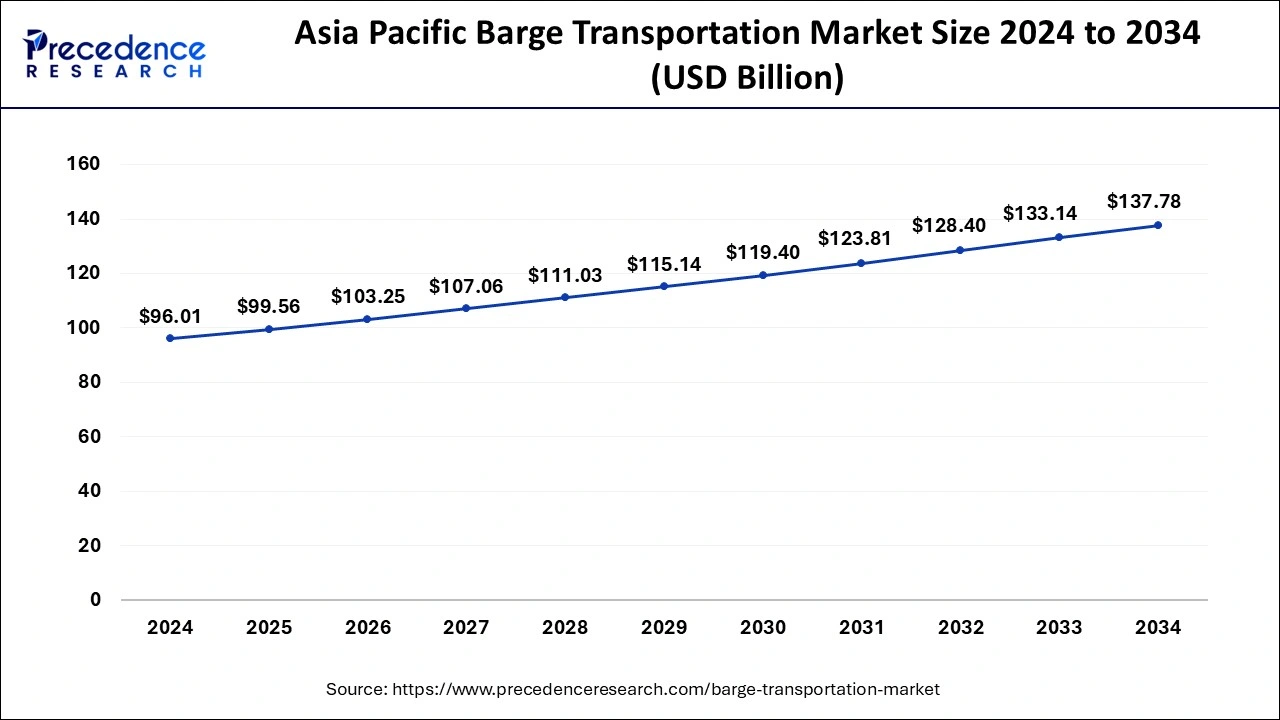

The Asia Pacific barge transportation market size was valued at USD 96.01billion in 2024 and is expected to be worth around USD 137.78 billion by 2034, growing at a CAGR of 3.70% from 2025 to 2034.

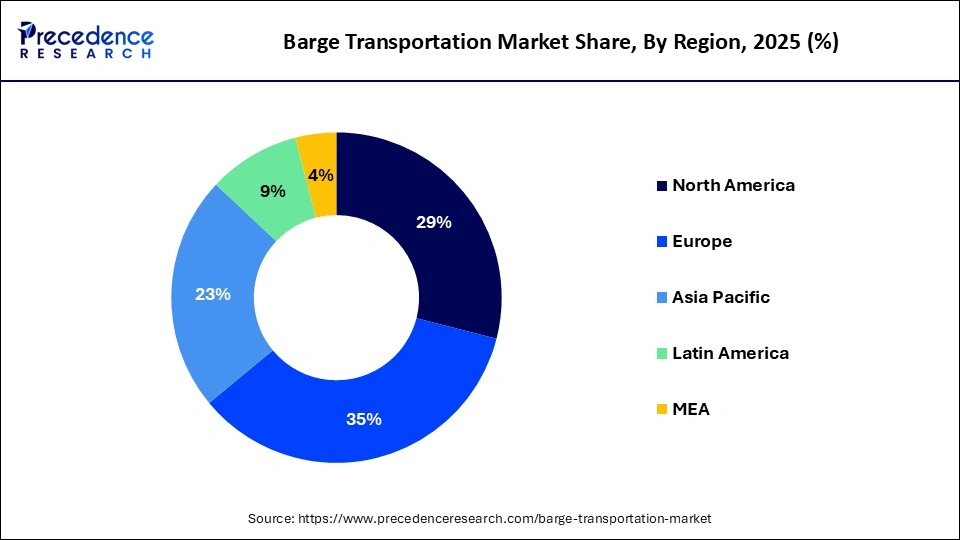

Asia Pacific held the largest share of the barge transportation market in 2024. Asia Pacific boasts some of the most extensive and navigable river networks in the world. Countries like China, India, Indonesia, and Vietnam have vast inland waterways that are highly suitable for barge transportation. The Yangtze River in China and the Ganges in India are prime examples of major rivers that facilitate large-scale barge transport, supporting the movement of bulk goods across vast distances. Barge transportation is recognized for its cost-effectiveness, particularly for transporting bulk commodities over long distances. In Asia Pacific, where infrastructure development in some areas is still in progress, barge transport offers a more affordable and fuel-efficient alternative to road and rail transport. The ability to move large quantities of goods with lower fuel consumption contributes to its popularity, particularly in countries with vast waterway systems.

Europe is observed to grow at the fastest rate during the forecast period. Rising investment for the port development has positively influenced the European barge transportation market over the years. The port development determined to intensify the oil & bulk trade, container, and work for tugboats in the nation. The presence of major ports in the region that includes Howden, Corpach, Sharpness, Caldaire, Selby, and Weston Point positively influence the market growth. Moreover, rising efforts by regional market players to promote sustainable transportation systems contribute to regional market expansion.

| Report Highlights | Details |

| Market Size in 2024 | USD 133.35 Billion |

| Market Size by 2034 | USD 191.36 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.68% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Barge Fleet, Product, Application, Region Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for cost-effective transportation

The increasing demand for cost-effective modes of transportation is boosting the growth of the barge transportation market. Due to the cost-effective nature of the barge transportation system, it is increasingly being used across several industries. Barges are suitable for heavy and large shipments. Thus, they are most commonly used to transport bulk goods, such as crude oil and petrochemicals, chemicals, coal, and agricultural products. In addition, the rising industrialization drives the market. As industries expand, import and export activities increase, requiring cost-efficient transportation.

Rising advancement in other modes of transport

The increasing advancement in other modes of transport, such as railways, roadways, and airways, is anticipated to hamper the growth of the barge transportation market. In addition, high operating costs associated with barge transportation limit the growth of the market during the forecast period.

Increasing inclination toward environmentally friendly transportation systems

The rapid shift toward environmentally friendly modes of transportation is projected to create lucrative growth opportunities for the barge transportation market. Barges use less fuel and have increased cargo volume capabilities, which results in lower carbon emissions. Electric-powered barges are increasingly becoming popular as a zero-emissions inland transport solution to achieve Net Zero Carbon and support the decarbonization of maritime activities. Several governments around the world are promoting water transport. The rising government funding for the development of port and inland waterways infrastructure. Moreover, the rising development of electric barges is expected to propel the market's growth in the coming years.

Tank barges segment emerged as a significant revenue shareholder of nearly 25% of the barge transportation in the year 2024. The significant growth of the segment is mainly attributed to the rising import and export of petrochemicals and chemicals across the world. As per the European Chemical Industry Council, the chemical industry export in European Union had reached approximately USD 175 Mn in the year 2018, this proved to be an ample opportunity for the service providers in the barge transportation market to grow prominently in the coming years.

Further, rising international and domestic trade of LNG has motivated the industry participants to invest significantly for purchasing new barge fleet. For example, in January 2020, Kirby Corporation purchased bunkering services coupled with the fleet of inland tank barges for USD 278 Mn from Savage Inland Marine. The acquisition helped Kirby to take over the Savage’s operation of 46 inland towboats along with 90 inland tank barges fleet having total capacity of nearly 2.5 Mn barrels. Such initiatives taken by the industry players to amplify their market share and also to provide enhanced customer service are expected to propel the market growth for tanked barges in the coming years.

Increasing demand for iron ore, coal, and grains especially in the Asia Pacific, Germany, and the U.S. had significantly boosted the sales for dry cargo products over the past few years. The dry cargo product segment is projected to cross the revenue of USD 22 Billion by 2034. The rising need for cost-efficient transportation of products that include ore, steel, lumber, and gravel across the world predicted to further drive the market growth. High production volume of dry cargo products triggers the competition for advanced transportation, making it a preferred choice for the end-users. Innovation in the shipping sector such as online freight platform has uplifted the barge transportation for dry commodities.

The global barge transportation market is nearly a consolidated market though offer high competition among the industry participants. The increasing competition is majorly due to significant spending by market players for the improvement of fleet operation and advancement in the technology. Several players operating in the market focus that have strong market presence primarily focuses on the inland transportation services as it offers significant opportunity to grow.

This research report includes complete assessment of the market with the help of extensive qualitative and quantitative insights, and projections regarding the market. This report offers breakdown of market into prospective and niche sectors. Further, this research study calculates market revenue and its growth trend at global, regional, and country from 2020 to 2032. This report includes market segmentation and its revenue estimation by classifying on the basis of barge fleet, product, application, and region:

By Barge Fleet

By Product

By Application

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

January 2025

March 2025