February 2025

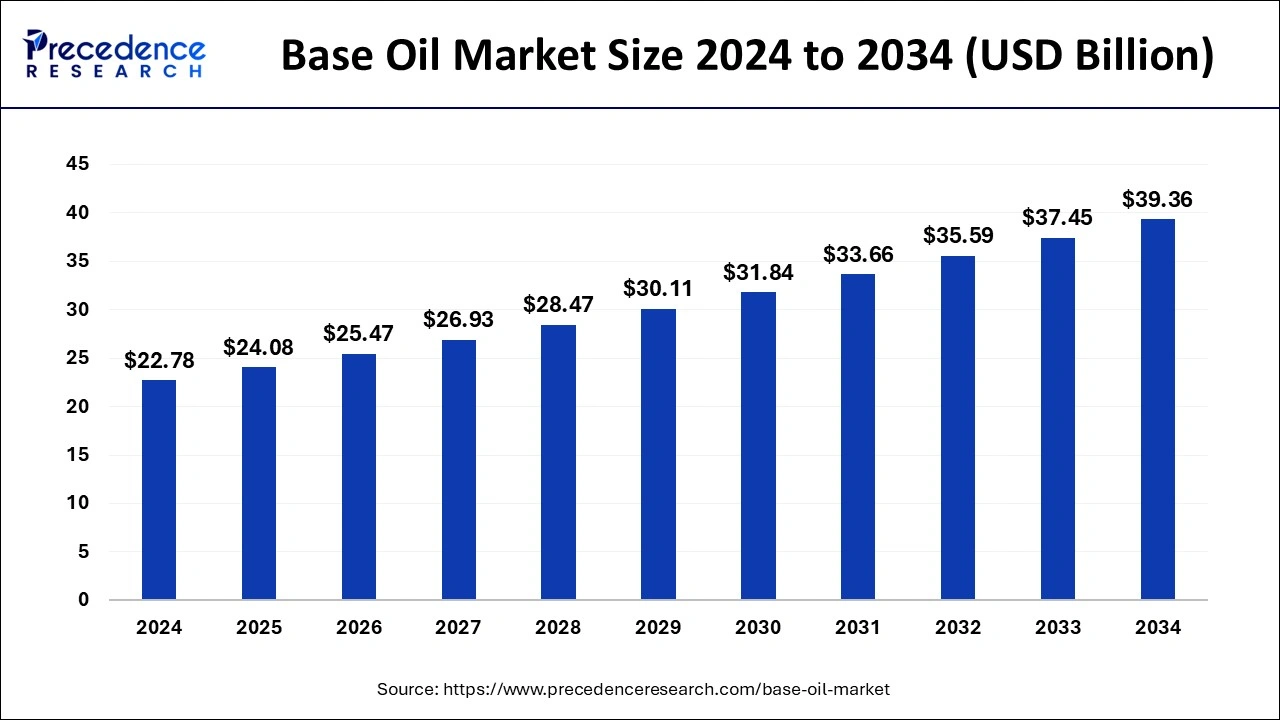

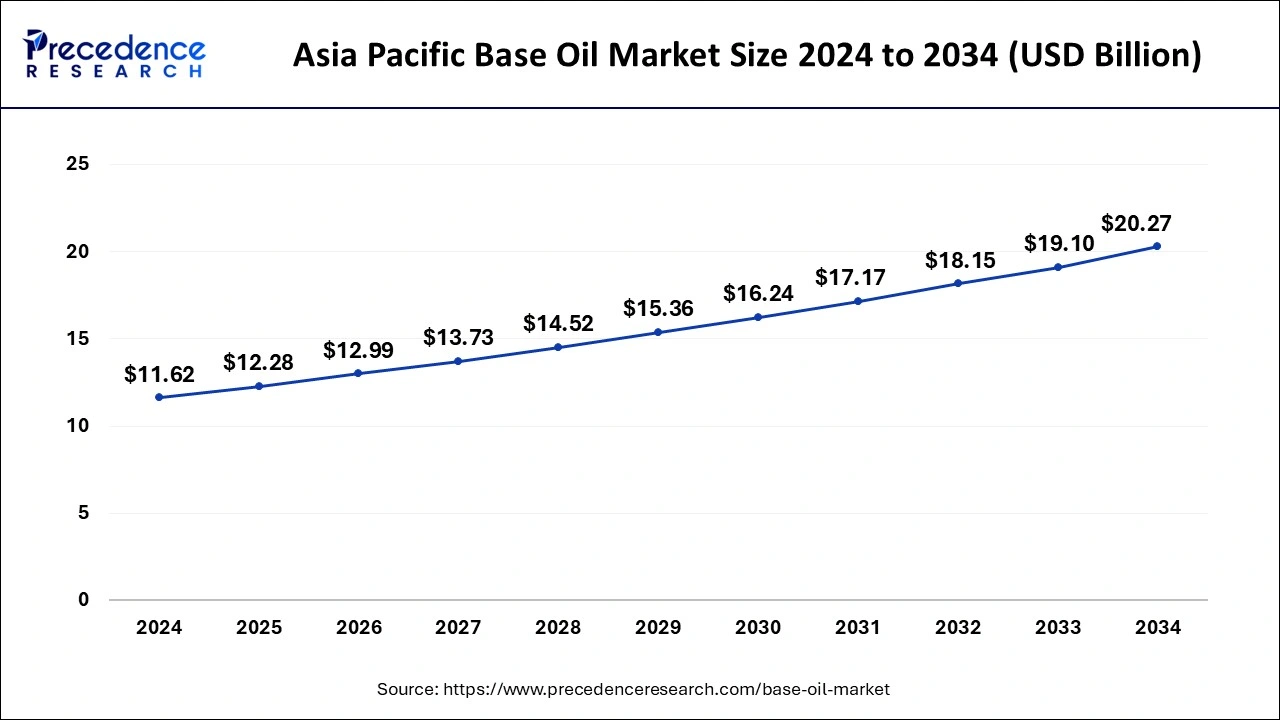

The global base oil market size is calculated at USD 24.08 billion in 2025 and is forecasted to reach around USD 39.36 billion by 2034, accelerating at a CAGR of 5.62% from 2025 to 2034. The Asia Pacific market size surpassed USD 11.62 billion in 2024 and is expanding at a CAGR of 5.72% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global base oil market size accounted for USD 22.78 billion in 2024 and is expected to exceed around USD 39.36 billion by 2034, growing at a CAGR of 5.62% from 2025 to 2034.

The Asia Pacific base oil market size was evaluated at USD 11.62 billion in 2024 and is projected to be worth around USD 20.27 billion by 2034, growing at a CAGR of 5.72% from 2025 to 2034.

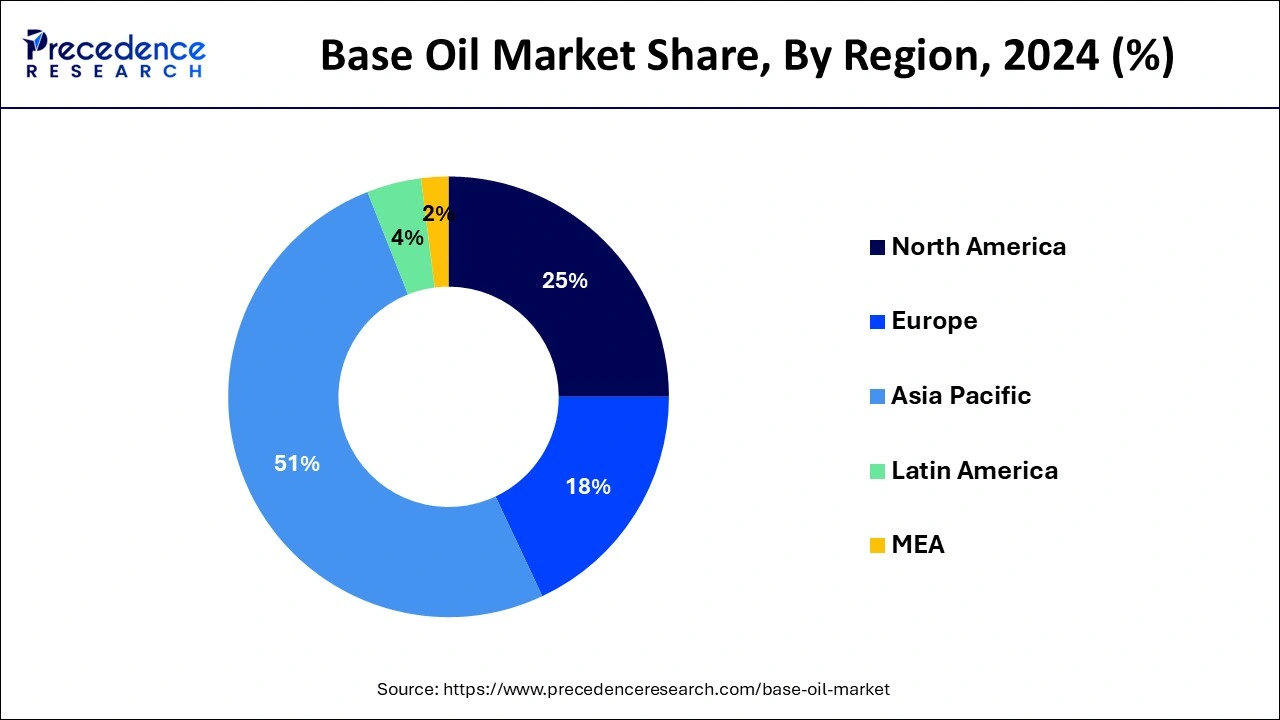

Asia Pacific dominated the market. This is due to the region's presence of emerging economies and rising disposable income, making it an appealing market for lubricant manufacturers. Asia Pacific is one of the world's largest markets for base oil, with China dominating the region. Over the forecast period, China is expected to lead the Asia Pacific base oil market. The country's dominance is attributed to the increased use of automobiles and the rapid growth of its manufacturing industry. Access to raw materials, increased foreign investment, rapid industrialization, and a growing population all help the Chinese market.

Similarly, the Indian market is expected to grow rapidly due to the strong presence of several base oil producers and the government of India's rapid infrastructure development. Europe is expected to have the world's second-largest revenue share in 2023. Lubricant consumption is a key driver for market growth in Europe, as lubricants are primarily composed of base oil. The increased consumption of base oil is closely related to the expansion of the transportation and industrial sectors. Furthermore, between 2005 and 2015, the total number of passenger vehicles in use increased by 3.8%, while commercial vehicles increased by 3.7%.

As one of its specialty products, a refinery can produce base oil. Base oil is a refined petroleum mineral or synthetic material produced to a set of specifications by a refinery, typically lubricant base stock. The extraction and processing of high-viscosity material from vacuum gasoil or vacuum reside distillation cuttings results in the production of base oils. This necessitates one-of-a-kind processing through a variety of lubes plant units. The type of base oil used for refining and/or the production method used to produce the base oil can affect the quality of a lubricant. It is critical in terms of lubricant grade because base oils typically account for 70-97% of lubricant formulation.

Base Oil is critically utilized in the lubricant oil formulation globally with widespread application across a multitude of industries. Group, I base oils are majorly utilized in marine lubricants which are widely utilized in the shipping industry to protect and enhance the efficiency of engines and equipment. These are high-performance marine lubricants that require high viscosity base oils, specially designed to enable optimal performance in operations.

Currently, the automotive industry is a major contributor to global base oil production. The demand for lubricants in vehicle manufacturing is expected to remain stable; however, the trend towards electric vehicles has reduced after-sales growth for certain lubricants. Consumers want standard and specialized products to meet specific needs, so lubricant manufacturers are investing in new product development, particularly for the automotive industry.

The rising consumption of lubricant manufacturers is expected to drive base oil demand over the forecast period. Developing economies such as China, India, and Indonesia, among others, are driving the global manufacturing sector. The availability of raw materials, lower infrastructure costs, and lower labor costs all contribute to growth. Base oil producers are shifting and expanding their production units in developing countries owing to the aforementioned factors.

The global base oil market is growing due to increased demand for oils in the automotive industry, particularly from developing countries, as well as stringent environmental legislation resulting in strict performance standards. Furthermore, the growing demand for hydraulic oil in the automobile industry propels the growth of the oil base market. However, fluctuating crude oil prices and regulations governing emission standards stymie market growth. The global shift from group I base oils to groups II and III base oils presents numerous growth opportunities for market participants.

| Report Coverage | Details |

| Market Size in 2025 | USD 24.08 Billion |

| Market Size by 2034 | USD 39.36 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.62% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Key Market Challenges:

There are the following factors which can restrain the market from growing

Reduced demand for group I base oil - Group I has dominated base oil production since the early twentieth century. However, at the moment, demand for Group I base oil is expected to fall significantly, particularly in Europe and North America. This downsizing is primarily due to a growing preference for cleaner and higher-quality base oil, as Group I base oil contains a high concentration of impurities such as sulfur, nitrogen, olefins, and PCNA (Poly-Cyclic Nuclear Aromatics). Group I base oil's high sulphur content makes it difficult to meet mid-SAPS (Sulfated Ash, Phosphorous, and Sulfur) specifications or match the high performance of lighter viscosity grade oils.

Crude oil prices fluctuate - The variation in the crude oil market has a significant impact on the base oil market. Between 2008 and 2014, the crude oil market was profitable, with prices reaching USD 100 per barrel and beyond. Brent crude was trading at USD 140 per barrel, while WTI was trading at USD 120 per barrel. Crude oil prices hit all-time lows in 2015. Price volatility has an impact on the profit margins of manufacturers.

Key Market Opportunities:

The base oil market presents several opportunities for growth and expansion in the coming years. Here are some of the key opportunities:

BRIC countries have lucrative market opportunities - During the forecast period, the BRIC countries are expected to be lucrative markets for lubricants. According to World Bank estimates, the BRIC countries account for approximately 41% of the global population, and this population is expected to grow further. Governments in these countries are heavily focused on industrial development in order to meet the demands of their massive populations. Foreign and domestic investments are expected to increase exponentially in these countries over the next five years as financial infrastructure is strengthened. This will benefit all associated sectors, accelerating the growth of related industries such as base oil and lubricants.

In 2024, the group I product segment dominated the market, accounting for 43% of total revenue. This is due to their increasing use in automotive, marine, and rail lubricants due to their low volatility, high viscosity index, and lubrication properties. Group I products contain more than 0.03% sulphur, less than 90% saturates, and have viscosities ranging from 80 to 120. This group is distinguished by its lack of aromatic compounds and paraffinic nature. Temperatures range from 32°F to 150°F. Group I is less refined than the other groups and is a mixture of different hydrocarbon chains with little uniformity.

In 2024, the group II product segment accounted for the second-largest revenue share. This is due to its easy availability and new capacity additions near Asia Pacific and Middle Eastern countries, as well as competitive prices. Over 90% of all lubricants can be formulated from group II type. Because the prices of Group II are comparable to those of Group I, they have gained popularity in the market.

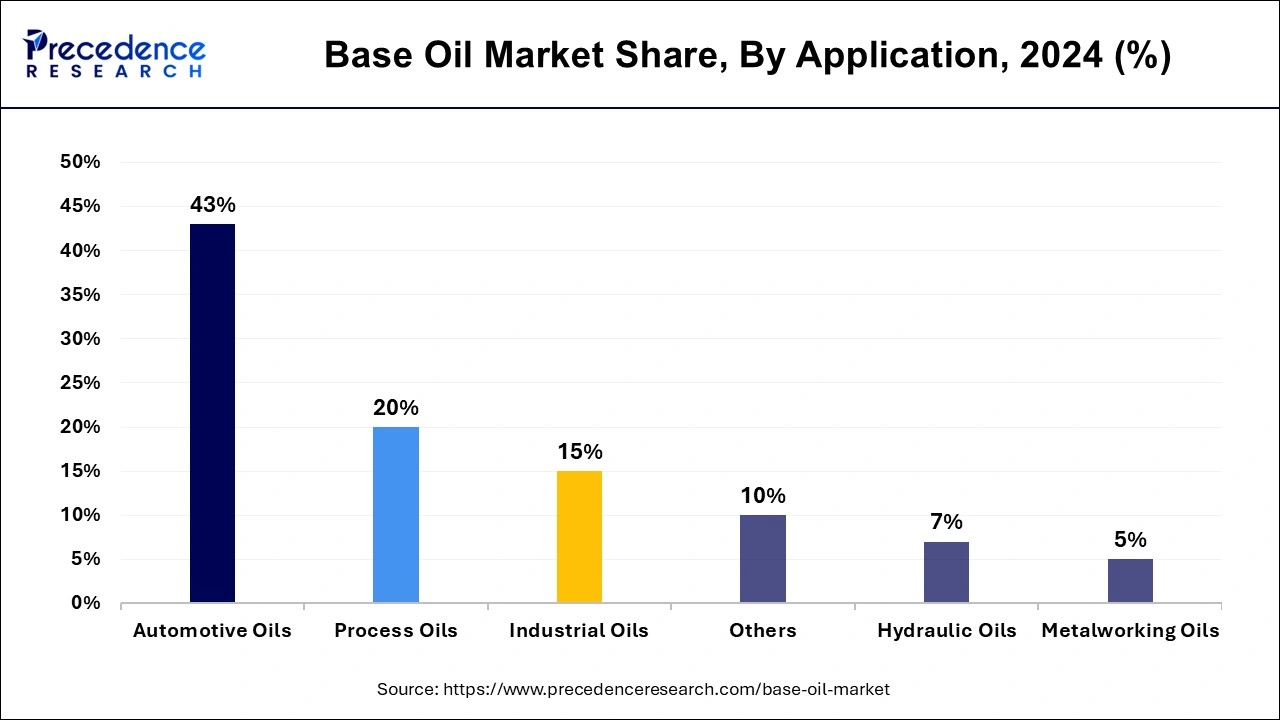

In 2024, the automotive oils application segment dominated the market, accounting for 43% of total revenue. Its high share is due to the rising demand for greases, gear oil, engine oil, and other lubricants used in automobiles. Automobile and truck engines are the largest consumers globally, consuming over 20 million tonnes of lubricants per year, accounting for roughly half of total lubricant use. The automobile market is expected to prompt oil companies to produce base oils as vehicle manufacturers strive to meet pollution standards.

The rising popularity of fragrance products for homes in developed economies such as Canada, the United States, the United Kingdom, and Germany is expected to drive demand for automobile oils over the forecast period. The most commonly purchased automobile oils on the market are blended, paraffin, bees base, palm, and soy base oils. Process oil accounted for the second-largest revenue share globally due to its use in a wide range of technical and chemical industries as a processing aid or as a raw material. They are essential in a variety of applications, including the polymer industry, foam control, agriculture, sealants, leather goods manufacturing, textile production, civil explosive production, and others.

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

January 2025

February 2025

April 2025