March 2025

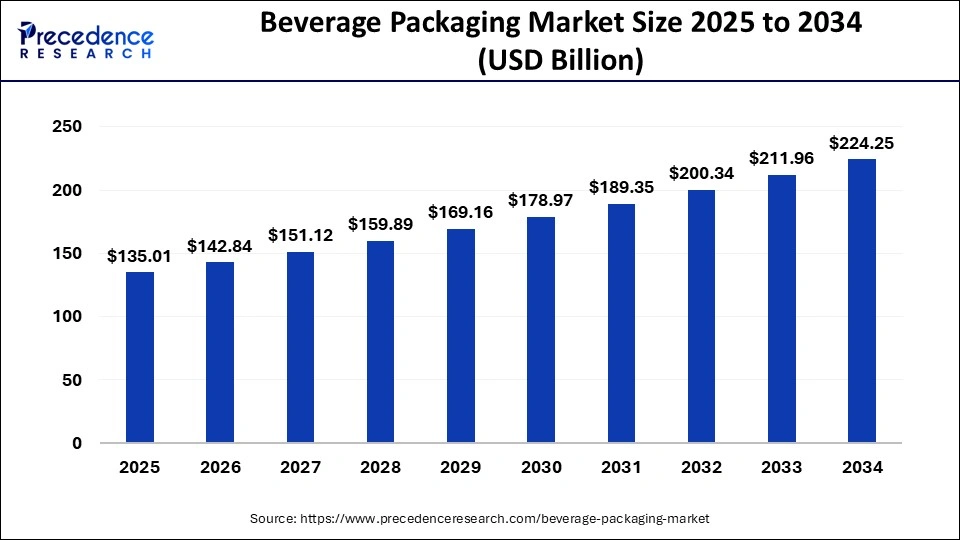

The global beverage packaging market size was estimated at USD 127.61 billion in 2024 and is predicted to increase from USD 135.01 billion in 2025 to approximately USD 224.25 billion by 2034, expanding at a CAGR of 5.80% from 2025 to 2034. The beverage packaging market is driven by the rise in need for sustainable products along with knowledge regarding the environment, combined with increasing requirement for convenient packaging.

The beverage packaging industry is undergoing a dramatic transformation, driven by the rise of artificial intelligence (AI). Among the many elements of packaging, bottle caps, small yet vital elements - are part of this change. The beverage industry is utilizing AI to advance new products. With data-driven insights, AI systems can determine consumer trends more accurately from sources such as social media, sales, and reviews. This makes it easier to understand what users want in a brand’s products, assisting R&D teams hone in on innovative goods while managing the data analysis.

Sustainability is a priority for the beverage industry, and AI is leading by improving material usage and lowering waste. For example, AI can calculate the ideal thickness as well as weight of caps to minimize material use without compromising performance.

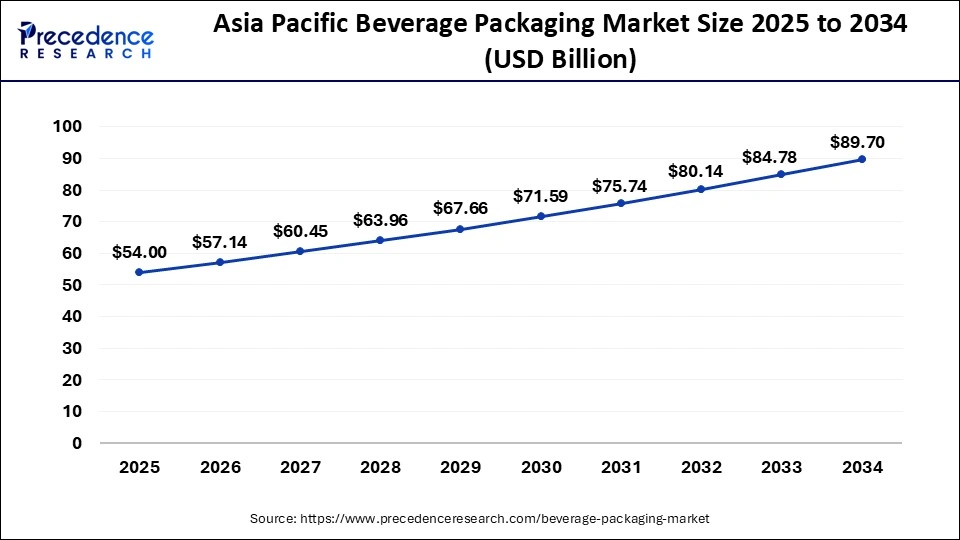

The Asia Pacific beverage packaging market size was estimated at USD 51.04 billion in 2024 and is predicted to be worth around USD 89.70 billion by 2034, at a CAGR of 6% from 2025 to 2034.

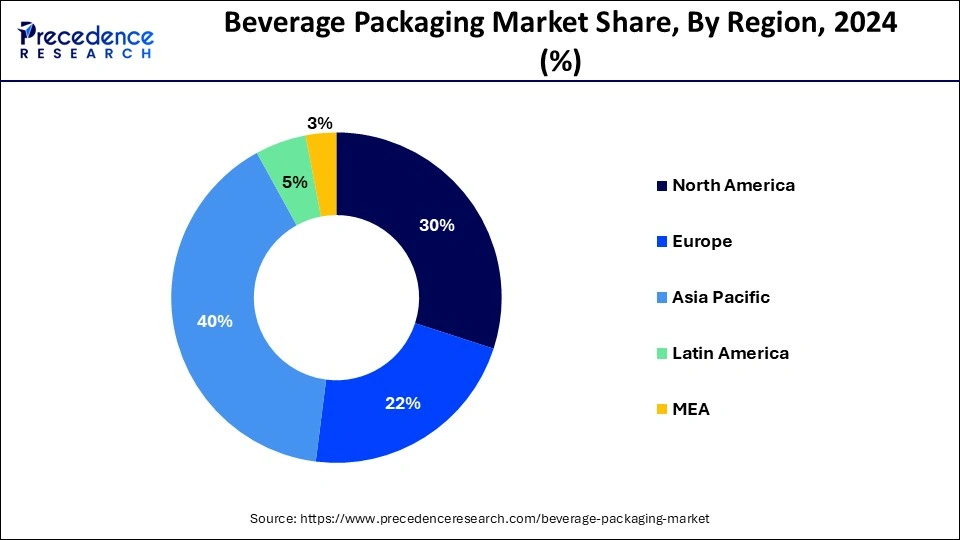

Based on the region, the Asia Pacific dominated the global beverage packaging market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. This is attributable to the higher volume of consumption of beverages due to the presence of large population in the region. Further, the PET bottles and cans are witnessing increased demand in the region owing to the various benefits it offers such as cheap price, safe packaging solution, lightweight, durability, and ease of transportation. Further, the growing penetration of fast-food chains that offer various beverages in their affordable meal packs are boosting the consumption of juices and soft drinks, thereby propelling the consumption of beverage packaging in the region.

China is leading the beverage packaging market in the Asia Pacific region owing to the factors such as huge population base, increased beverage consumption rates, rapid urbanization, ongoing technological advancements in developing advanced manufacturing solutions as well as growing emphasis on sustainable packaging.

India and Japan are emerging key market players significantly contributing to the growth of the beverage packaging market. Indian government’s initiative for using recycled materials and banning plastic for beverage packaging, rise in middle class population and increased health consciousness are driving the market growth. Whereas, Japan’s focus on innovation, well-established beverage industry and increased sustainability concerns are boosting the market expansion.

For instance, in February 2025, Tetra Pak, a globally leading food processing and packaging solutions company, announced the incorporation of certified recycle polymers in their packaging materials in India. The new carton packages with 5% certified recycled polymers will be implemented from 1 April 2025, aligning with the Indian Government’s Plastic Waste Management (Amendment) Rules 2022 set by the Ministry of Environment, Forests & Climate Change.

On the other hand, North America is anticipated to be the most opportunistic market during the forecast period. North America is the home to the top beverages companies such as The Coca Cola Company, JBS, PepsiCo, Nestle, and Kraft Heinz Co. These companies consumes huge amount of packaging products in the region. Furthermore, the introduction of the eco-friendly packaging solutions such as bio-degradable plastic, compostable plastic, and water soluble grade plastic is attracting the consumers and various beverage industry players that is expected to boost the growth of the beverage packaging market in North America.

Why is the European beverage Packaging Market Experiencing Significant Growth?

The European beverage packaging market is expected to witness significant growth over the forecast period, due to the changing consumer tastes, technological innovations, and rising focus on sustainability. These companies are continuously coming up with changes in the design of the packaging to match the trends in marketing strategy and the changing environmental laws. Also, the strict sustainability policies and regulating code of the European market are encouraging manufacturers to use recyclable, light, and biodegradable packaging materials.

The growing consumer preference for sustainable packaging solutions, or eco-friendly equivalents, as well as the intense R&D activities on innovative materials and packaging forms, further add to growth. The beverage packaging industry in the United Kingdom is experiencing dynamic development changes, most of which are a result of changing consumer lifestyles and rising health concerns. The youthful drinkers are opting more to a greater variety of alcoholic products, more frequently sold in intensive, designer, modern, and eco-friendly packages.

The beverage packaging market is significant because it's vital for preserving, protecting, and marketing beverages, while also accepting evolving consumer choices and sustainability trends. The market is adapting to trends such as on-the-go consumption with convenient packaging formats such as pouches along with single-serve bottles. There is an increasing need for sustainable and eco-friendly packaging alternatives, pushing innovation in materials along with designs.

The global beverage packaging market is primarily driven by the growing demand for the various alcoholic and non-alcoholic beverages across the globe. The beverage packaging plays a crucial role in the overall growth of the beverages industry. There are numerous types of beverages each are packaged using varied materials and in different sizes. This is a key factor responsible for the growth of the beverage packaging market across the globe. The increased consumption of carbonated beverages, sports drinks, fruit juices, and other various beverages have played a significant role in the increased utilization of the beverage packaging materials across the globe. Packaging has also become a tool for the marketing of products. Innovative packaging solutions are also used to attract the customers to make a purchase.

The demand for the sustainable packaging solutions is rising across various industries. The growing popularity of compostable, recyclable, and bio-degradable packaging is expected to boost the market growth during the forecast period. The rising environmental concerns owing to the extensive use of conventional plastics in the past have led to a serious threat to the global environment as a huge amount of plastic wastes have already been generated that would take thousands of years to decompose. Hence, growing government initiatives to reduce the usage of plastic is expected to foster the adoption rate of biodegradable and recyclable plastics across the globe. Moreover, several nations have banned the use of petroleum based plastic to reduce the carbon footprint. Hence, the rising support from the government will drive the growth of the sustainable packaging solutions in the global beverage industry.

| Report Highlights | Details |

| Market Size in 2024 | USD 127.61 billion |

| Market Size in 2025 | USD 135.01 billion |

| Market Size by 2034 | USD 224.25 billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.80% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application Type, Material Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising consumption of packaged beverages

The increasing consumption of packaged beverages is a primary driver for the beverage packaging market, boosted by urbanization, changing lifestyles, and an increasing need for convenience and on-the-go options. Increased urbanization along with the prevalence of dual-income households with busy schedules have contributed to a greater reliance on packaged beverages for hydration as well as convenience. Consumers in urban areas are seeking portable, resealable packaging options, easy-to-consume, for beverages. The expansion of online retail and food delivery services has raised the need for packaging that can withstand transportation as well as maintain product integrity.

Regulatory challenges

Regulatory challenges around waste management significantly restrain the beverage packaging market by increasing expenses, limiting material choices, and hampering innovation. Stringent regulations, such as those focused on extended producer responsibility (EPR), need companies to handle the end-of-life of their packaging, contributing to increased expenses for collection, recycling, and disposal.

Increased costs linked with more sustainable packaging can be passed on to users, making beverages more expensive. This can contribute to reduced demand, mainly in price-sensitive markets, impacting the overall expansion of the beverage packaging market.

Emergence of Innovative Packaging Solutions

Innovative beverage packaging solutions offer significant opportunities for market growth by addressing consumer need for sustainability, convenience, and improved product experience. The industry is shifting towards biodegradable as well as compostable materials such as seaweed-derived films, plant-based bioplastics, mushroom-based packaging. Emerging technologies such as AI-driven packaging solutions are redefining how beverages are transported, stored, and consumed.

By material, the glass segment led the global beverage packaging market with a remarkable revenue share in 2024 and is anticipated to retain its dominance throughout the forecast period. This is attributed to the increased production of soft drinks and increased usage of glass for packaging. Further the usage of glass materials for packaging of various products such as wine, oil, sauces, beers, and juices have significant contribution in the growth of the segment.

On the other hand, the plastic is estimated to be the most opportunistic segment during the forecast period. The low cost of plastic and higher demand for PET bottles among the consumers is expected to drive the segment growth in the foreseeable future. The growth in the demand for the eco-friendly packaging plastics is expected to boost the segment growth in the upcoming future.

By product, the bottles segment led the global beverage packaging market with remarkable revenue share in 2024 and is anticipated to retain its dominance throughout the forecast period. The extensive demand for the glass bottle from the alcoholic beverages industry has augmented the segment growth. The reusability is a major factor propelling the growth of this segment by providing sustainable packaging solutions to the global beverage industry.

On the other hand, the carton segment is estimated to be the fastest growing segment during the forecast period. Cartons are generally made up of paperboard that helps in the packaging of various beverages. It also facilitates transportation of numerous products such as milk, juices, and various other non-alcoholic beverages.

By application, the alcoholic segment led the global beverage packaging market with remarkable revenue share in 2024 and is anticipated to retain its dominance throughout the forecast period. The growth of the beverage packaging segment has been extensively influenced by the growth of the alcoholic beverage industry. The alcohol beverages are mainly packaged to preserve it for a longer period of time. Therefore, the usage of glass bottles is extensive in the alcoholic beverage industry.

On the other hand, the non-alcoholic beverage segment is expected to be the most opportunistic segment during the forecast period. The increased consumption of various non-alcoholic drinks such as soft drinks, water, juices, seltzer, and sports and energy drinks are expected to augment the segment growth in the upcoming years.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improvedsolutions. Moreover, they are also focusing on maintaining competitive pricing.

In July 2021, the parent company of Johnnie Walker and Smirnoff announced to develop 100% paper-based bottles for the spirits packaging. The source of this paper based packaging would be sourced from the sustainable wood.

The various development strategies adopted by the packaging industry players in today’s time is majorly associated with the development of innovative sustainable packaging solutions that would create growth opportunities during the forecast period.

By Material

By Product

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

July 2025

June 2025

January 2025