January 2025

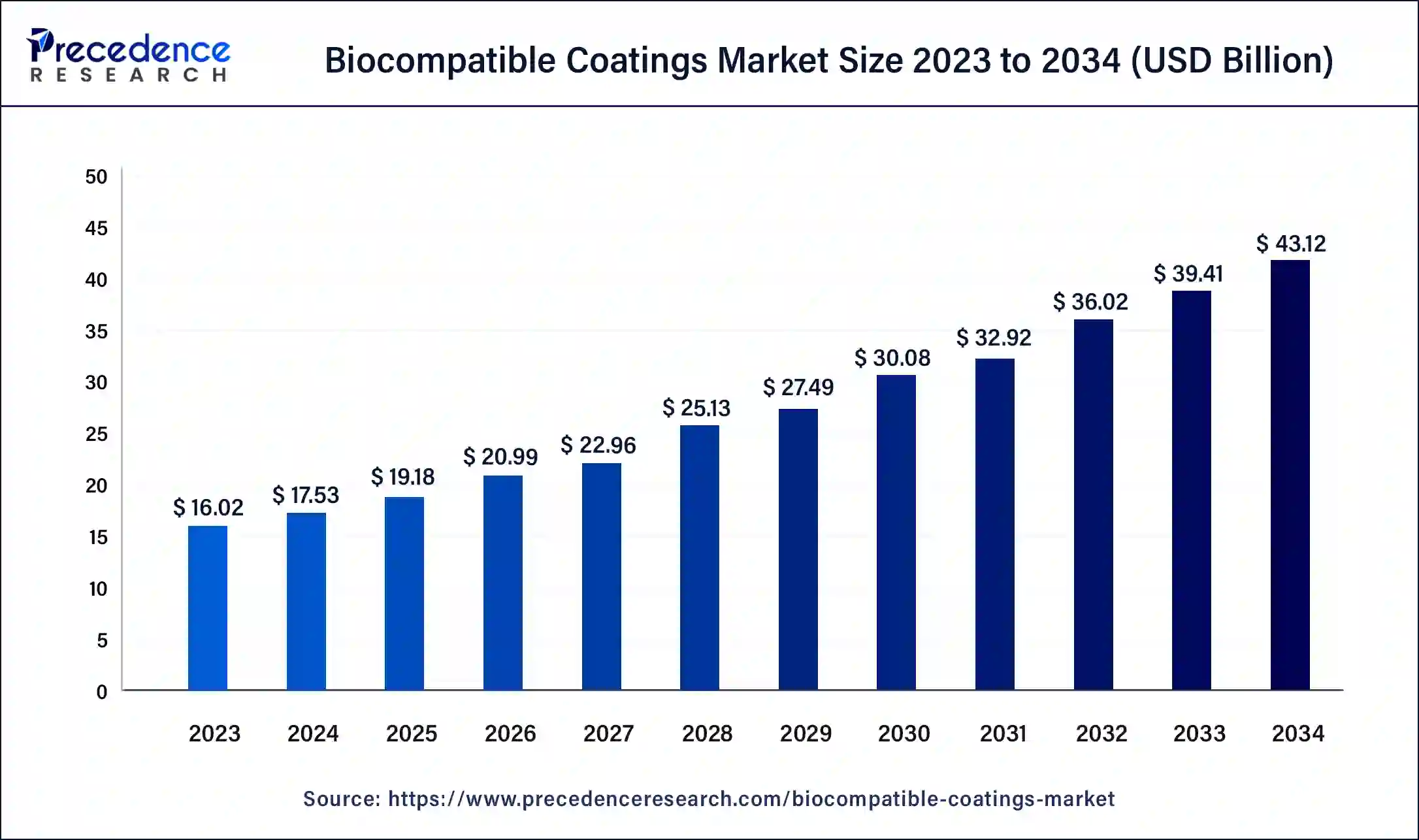

The global biocompatible coatings market size surpassed USD 16.02 billion in 2023 and is estimated to increase from USD 17.53 billion in 2024 to approximately USD 43.12 billion by 2034. It is projected to grow at a CAGR of 9.42% from 2024 to 2034.

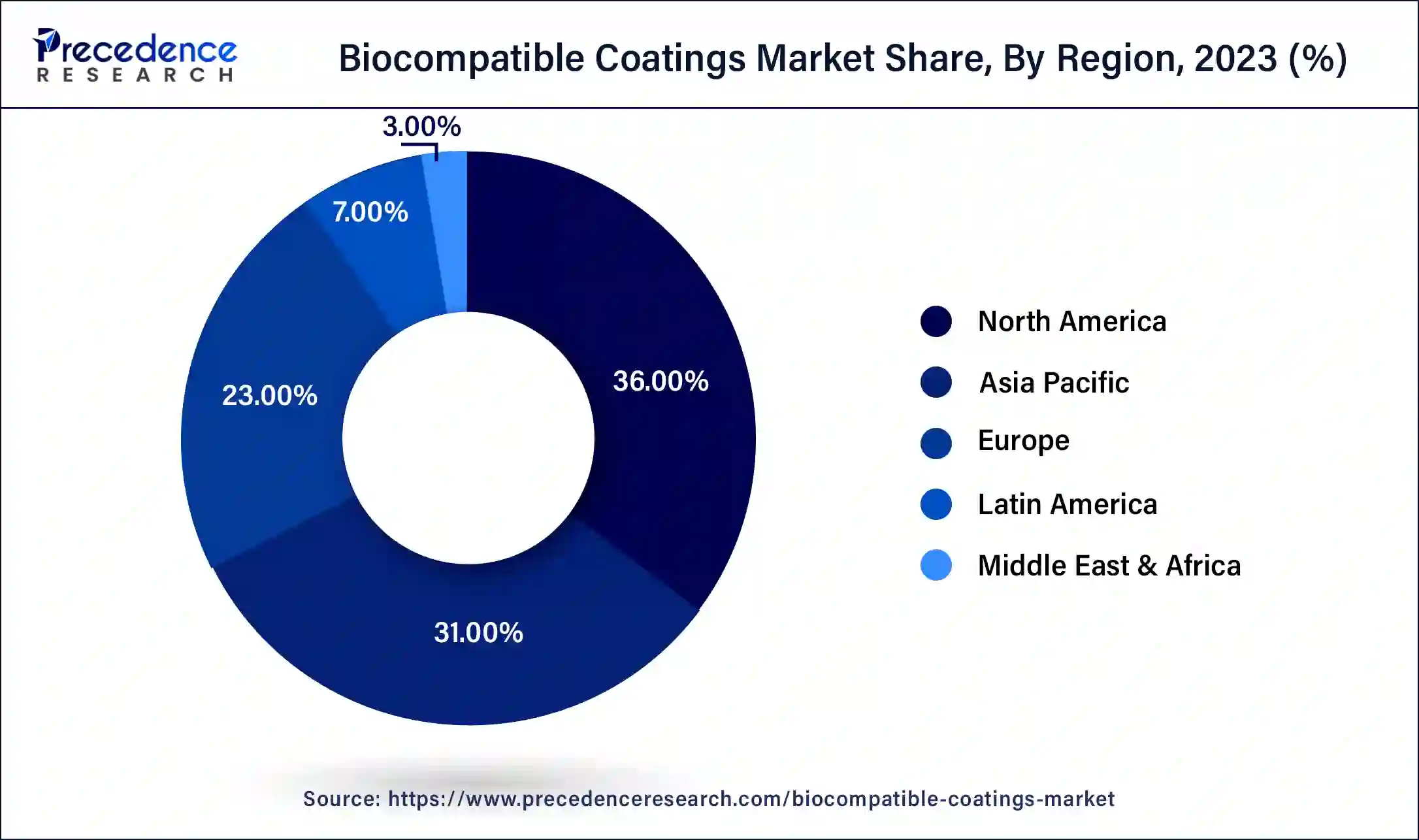

The global biocompatible coatings market size is worth around USD 17.53 billion in 2024 and is anticipated to reach around USD 43.12 billion by 2034, growing at a solid CAGR of 9.42% over the forecast period 2024 to 2034. The North America biocompatible coatings market size reached USD 5.77 billion in 2023. The biocompatible coatings market growth is attributed to increasing investment in research and development for innovative coating technologies.

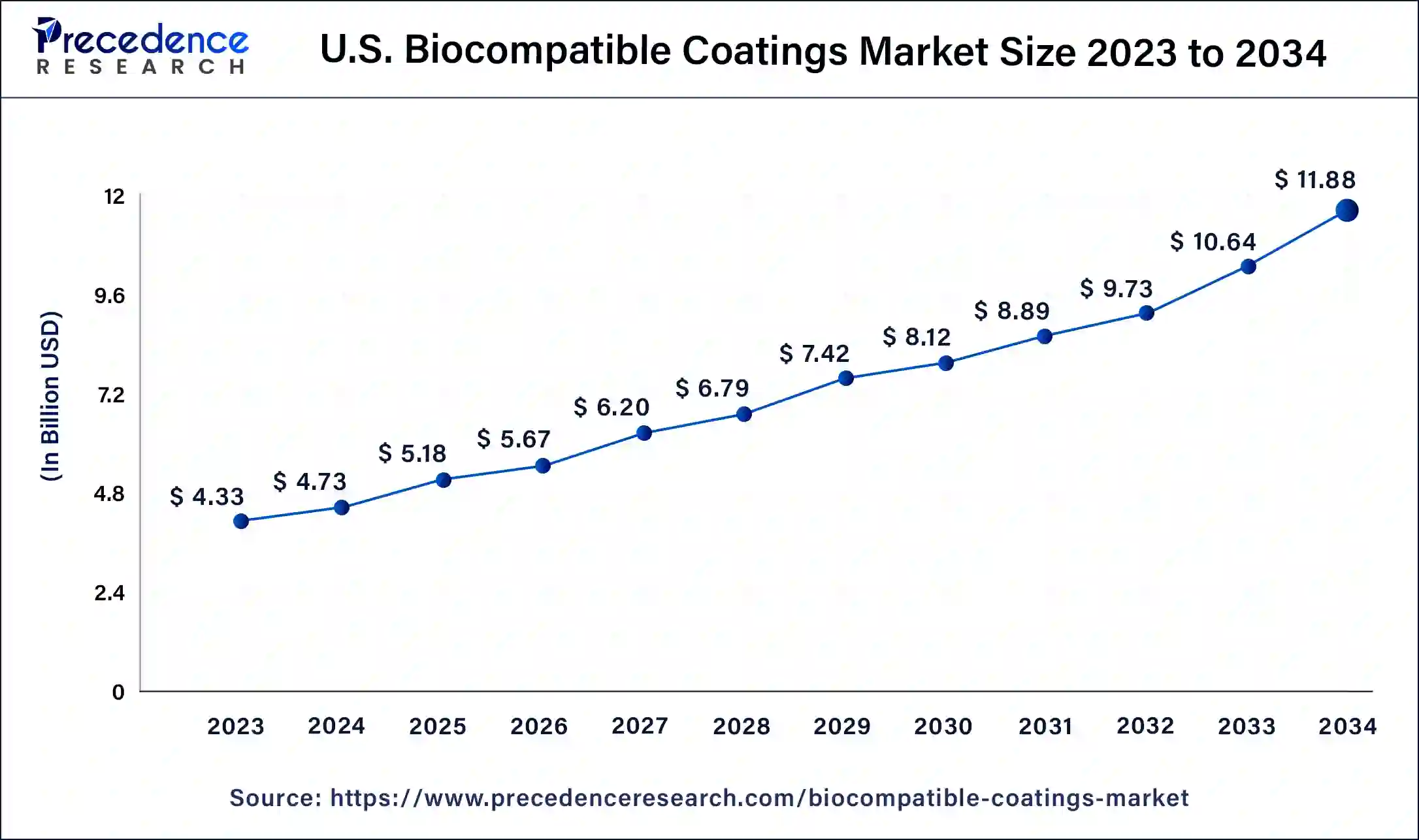

The U.S. biocompatible coatings market size was exhibited at USD 4.33 billion in 2023 and is projected to be worth around USD 11.88 billion by 2034, poised to grow at a CAGR of 9.60% from 2024 to 2034.

North America dominated the global biocompatible coatings market in 2023 due to the well-developed healthcare systems and the increasing focus on developments in medical instruments. The increasing geriatric population is driving the need for high-quality medical implants and devices. There is an economic burden that catalyzes the need for high-performance coatings in applications such as medical devices.

Asia Pacific is anticipated to grow at the fastest rate in the biocompatible coatings market during the forecast period, owing to the increased economic growth along with growing investments in healthcare. Improvements in regulatory standards for medical devices are encouraging the development and use of advanced biocompatible coatings. Furthermore, this supports the enhanced importance of the region and its further predicted dominance in the biocompatible coatings market.

The growing incidence of chronic diseases is also the major factor fuelling the global biocompatible coatings market, as these coatings prove to be highly beneficial in medical device procedures. Biocompatible coatings are smart coatings that are safe for biological use and minimize the chances of a biological response. Furthermore, the rising demand due to technological development in coating practices will further fuel the market in the coming years.

Impact of Artificial Intelligence on the biocompatible coatings market

Artificial intelligence improves decision-making in material selection and design, hence cutting the time taken to develop new solutions. Complex ML algorithms improve predictive capabilities, which helps the company foresee performance statistics or durability of the coatings to develop stable and efficient coatings.

AI improves the quality aspect, where the system is able to detect flaws and variability in production lines, hence cutting down on manufacturing and operations costs. This removes barriers to the creation of brand-new coatings that fit biomedical or industrial requirements. These are the imperative factors that make the integration of AI in manufacturing processes proactive, enabling the development of technologies and competition in the biocompatible coatings market.

| Report Coverage | Details |

| Market Size by 2034 | USD 43.12 Billion |

| Market Size in 2024 | USD 17.53 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.42% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Material, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

High demand for antimicrobial coatings

High demand for antimicrobial coatings is projected to propel biocompatible coatings market growth. Due to increased cases of HAIs, many hospitals and healthcare centers use antimicrobial technologies to enhance the outcomes of the patients. Antibacterial coatings with biocompatibility characteristics protect against bacterial infestations on medical equipment, operation instruments, hospital floors, walls, and other surfaces.

Additionally, key regulatory authorities such as the U.S. FDA and EMA have increased the standards for approvals, introducing more pressure towards the growth of the biocompatible coatings market. The increasing concern for infections has necessitated increased use of antimicrobial biocompatible coatings, especially in the healthcare systems where there are stringent regulations on product use.

| Metric | Data/Value | Source |

| Global Antimicrobial Coatings Market Size (2020) | USD 2.1 billion | U.S. Environmental Protection Agency (EPA) |

| Projected Market Size (2026) | USD 4.5 billion | U.S. Environmental Protection Agency (EPA) |

| Healthcare-Associated Infections (HAIs) in Developed Countries | 7% of hospitalized patients | World Health Organization (WHO) |

| Healthcare-Associated Infections (HAIs) in Developing Countries | 10% of hospitalized patients | World Health Organization (WHO) |

| Infection Rate Reduction Due to Antimicrobial Coatings | Up to 50% | Centers for Disease Control and Prevention (CDC) |

| Regulatory Bodies Driving Market Growth | FDA, EMA, WHO | U.S. FDA, EMA, WHO |

| Projected Annual Growth Rate (CAGR) of Antimicrobial Coatings Market (2020-2026) | 10.2% | U.S. Environmental Protection Agency (EPA) |

High production costs

High production costs are expected to hamper the growth of the biocompatible coatings market. Advanced coatings are established using costly basic materials and time-consuming production techniques, which pose a great challenge for producers. Another cost rise is observed in expenses on equipment and highly professional personnel since manufacturing these coatings entails the use of special tools and appropriate expertise.

Moreover, the cost of quality control measures is also high, mainly due to the quality condition of the biocompatible coatings market product's intended candidate material, which requires regular testing for biocompatibility. Small manufacturers, especially those from developing countries, are at a disadvantage because of these high initial costs. Price-sensitive markets slow the rate of growth as manufacturers opt for cheaper models.

Growing investment in R&D

Growing investment in research and development for advanced coating technologies is anticipated to create immense opportunities for the players competing in the biocompatible coatings market. Current strategies and challenges for advanced biocompatible coatings for medical applications are leading companies and research organizations’ innovations. This trend is in favor of the next generation of coatings for drug delivery systems, wound healing, and implantable devices.

Large-scale investment, especially in North America and Europe, is the constant development of biocompatible coatings, which is opening new demand in medical use and material science. The U.S. government’s Biomedical Advanced Research and Development Authority (BARDA) supported funding from companies engaged in the manufacturing of antimicrobial biocompatible coatings for HAIs. The European Commission has also urged for more sustainable and advanced material research.

The hydrophilic leather segment held a dominant presence in the biocompatible coatings market in 2023. These coatings are preferred for their effectiveness in increasing the wettability of different surfaces by promoting the interaction between materials and biological tissues. Hydrophilic coatings are applied in medical devices, including catheters, stents, and implants, among others. This adoption has been propelled by the need for sophisticated, advanced, and small invasive surgeries and the growing need for enhanced, high-performing medical devices. These coatings are expected to contribute to the majority of the market share due to features such as lowering the possibility of contracting infections and improving the durability of the implements. Moreover, their capability to act as carriers in drug delivery and the wound healing process has been very crucial in their application.

The antibacterial segment is expected to grow at the fastest rate in the biocompatible coatings market during the forecast period of 2024 to 2034. These coatings can inhibit microbial adhesion on a surface, which is very important in hospitals or other areas where an individual is vulnerable to infections. The growing incidence of HAIs and the shift towards infection control are the main factors that create demand for antibacterial coatings. Antibacterial and antimicrobial coatings are expected to have significant growth as they are implemented proactively to decrease infection levels and are utilized in surgery tools, implantable, and hospital surfaces. Government health regulatory organizations like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are beginning to support the use of antibacterial coatings in the prevention of infections. Furthermore, constant innovation and research are likely to improve the effectiveness of these coatings.

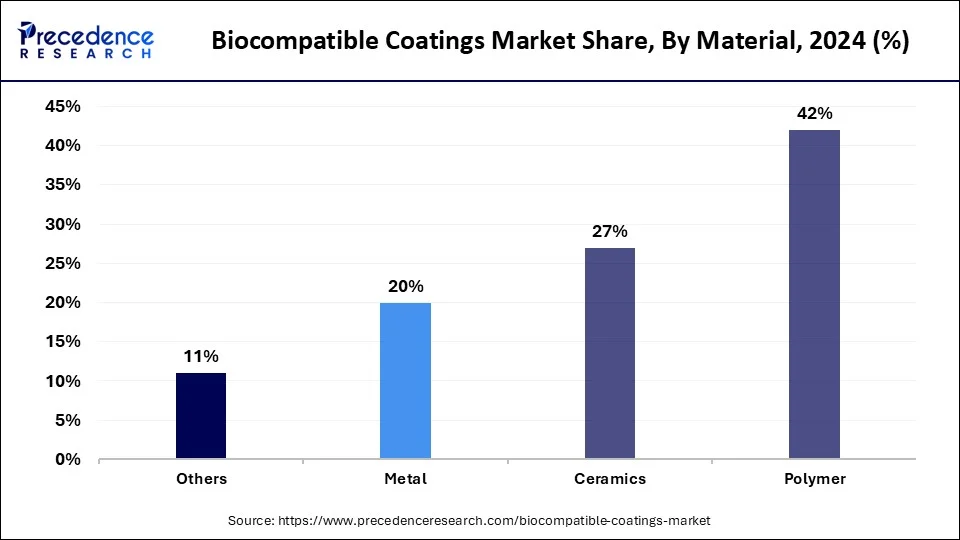

The polymers segment accounted for a considerable share of the biocompatible coatings market in 2023 due to their flexibility and numerous beneficial characteristics. There are vast numbers of polymers used in medical applications, including synthetic polymers and natural polymers. They are flexible, easy to process, and biocompatible. Both solvent and aqueous-based formulations of these coatings are employed or are under consideration in a broad spectrum of medical applications, including implants, stents, wound dressings, and drug delivery systems. The usage of polymers has increased due to the provision of polymers that can be customized based on application requirements, such as controlling the release rate of the drug or surface characteristics. Additionally, their utilization of medical technologies is due to their cheaper cost of production and the endless technological improvements in polymer science.

The ceramics segment is anticipated to grow with the highest CAGR in the biocompatible coatings market during the studied years, owing to the rising number of orthopedic surgeries and the need to use implants that are durable and longer to last. New developments in the technologies of ceramic coatings, which also seek better adhesion and versatility, add to the case. Legal backing coupled with increasing interest by key stakeholders to boost the performance and durability of medical implants is seen as a boost to ceramic coatings. Furthermore, the high, especially due to the increase in application and adoption of the segment in healthcare.

The healthcare segment led the global biocompatible coatings market. Biocompatible coatings are used in products such as medical implants, surgical instruments, and diagnostic equipment. These coatings increase the functionality of the devices, benefit the patient, and minimize the chance of infections and future complications. Rising incidence of lifestyle-related diseases and ageing population worldwide are therefore fuelling the need for improved medical devices hence buttressing the dominance of the healthcare segment. Additionally, the growing expenditure on healthcare facilities and improving technologies in the medical devices industry enhance this segment’s market growth.

The medical devices segment is projected to expand rapidly in the biocompatible coatings market in the coming years, owing to the increased number of applications of biocompatibility coatings for stents, catheters, and prostheses. This increase in the demand for less invasive procedures and improvements in device technology are likely to drive the need for coatings that increase biocompatibility and functionality. Various governing bodies, including the FDA and EMA, are also shifting their attention towards strict regulatory policies for medical device quality, safety, and efficacy which in turn has prompted the demand for superior quality biocompatible coatings. The segment is expected to be largely dynamic with advancements in the coating technique and the rising demand for advanced medical applications.

Segments Covered in the Report

By Type

By Material

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

January 2025

January 2025