What is Biodegradable Plastic Market Size?

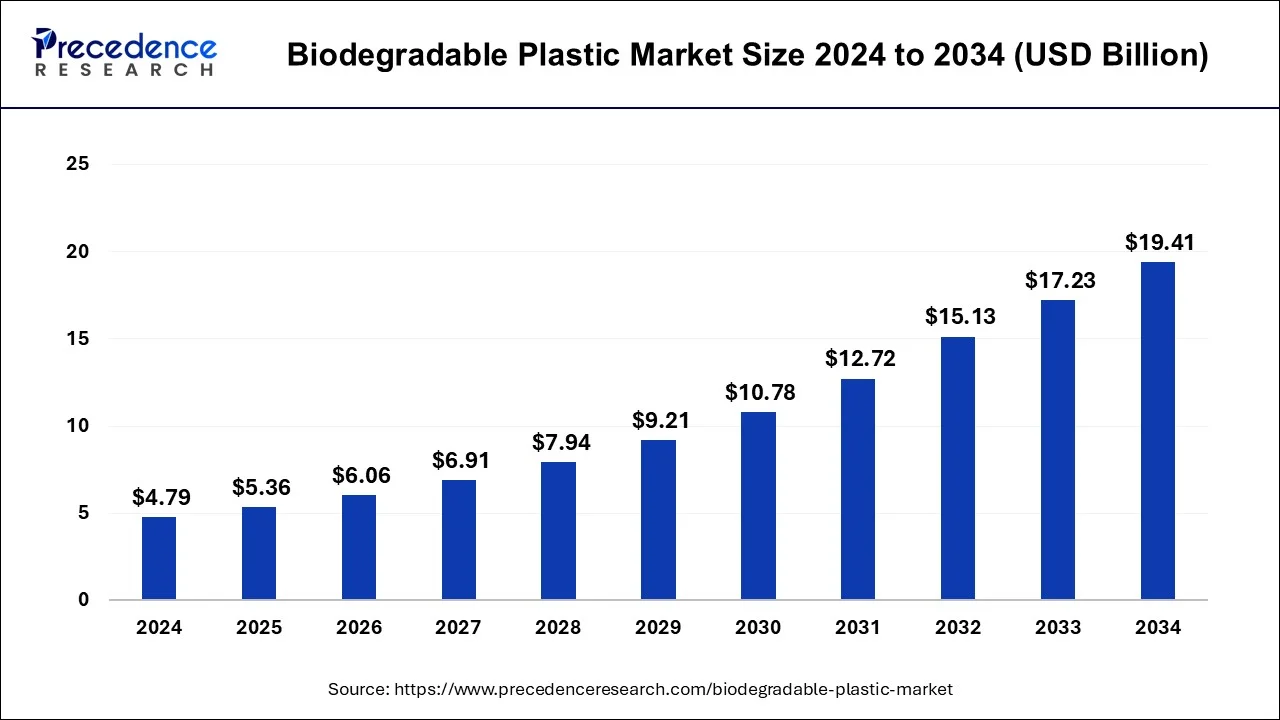

The global biodegradable plastics market size was valued at USD 5.36 billion in 2025 and is anticipated to reach around USD 19.41 billion by 2034, growing at a CAGR of 15.28% from 2025 to 2034. The demand for biodegradable plastic market is growing as governments and other agencies across the world are tightening regulations on the usage of non-biodegradable plastics to promote environmentally sustainable options.

Biodegradable Plastic Market Key Takeaways

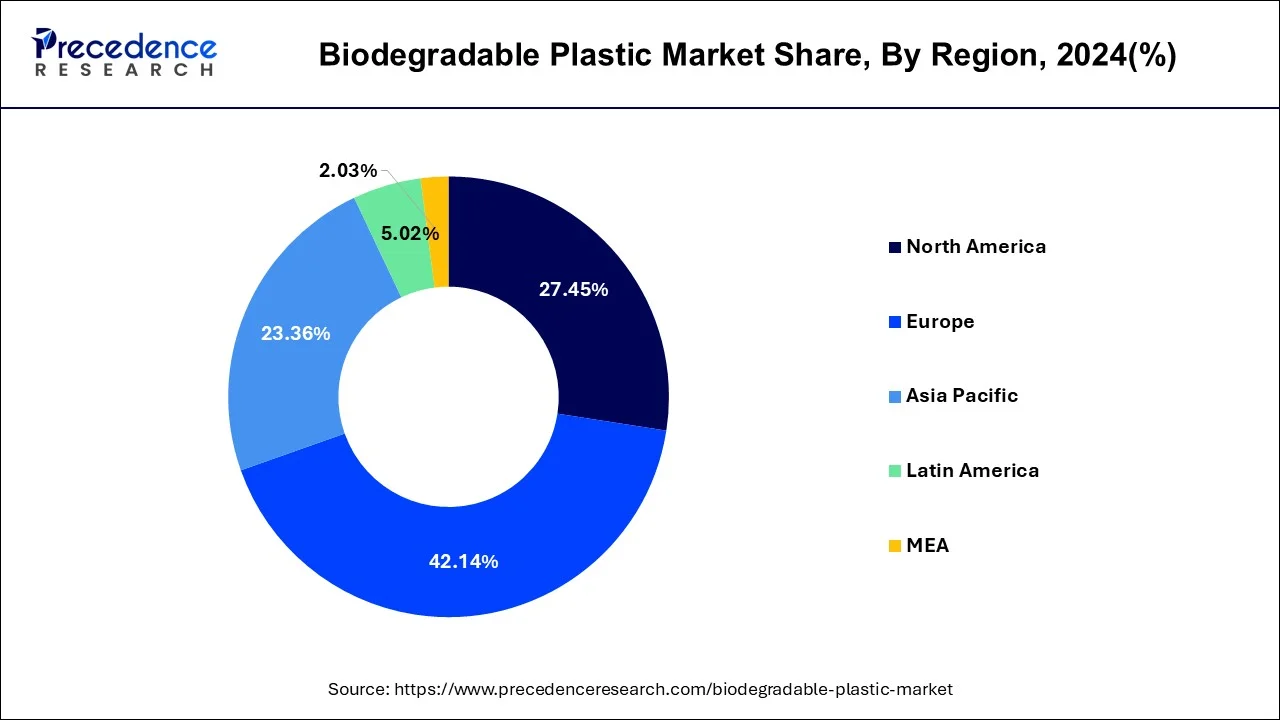

- Europe led the market with the biggest market share of 42.14% in 2025.

- Asia Pacific is estimated to expand at the fastest CAGR during the forecast period.

- By Type, the starch-based segment registered the maximum market share in 2025.

- By Type, the Polyhydroxyalkanoate (PHA) segment is expected to expand at the fastest CAGR over the projected period.

- By End-use, the packaging segment has held a major revenue share in 2025.

- By End-use, the agriculture segment is anticipated to grow at a fastest CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2025: USD 5.36 Billion

- Market Size in 2026: USD 6.06 Billion

- Forecasted Market Size by 2034: USD 19.41 Billion

- CAGR (2025-2034): 15.28%

- Largest Market in 2025: Europe

- Fastest Growing Market: Asia Pacific

Integrating Artificial Intelligence (AI) in Biodegradable plastics

Integration of Artificial Intelligence (AI) in biodegradable plastic market is going to completely change the industry by optimizing production efficiency and streamlining supply chain management. With AI technology, vast amount of data can be analyzed that helps manufacturers in understanding as well as predicting consumer demands and market trends. This helps the manufacturers o allot resources correctly and in turn, reduce wastage. AI-driven automation technology minimizes chances of human error in production while boosting efficiency of the operations. AI can help improve sustainability metrics for production which will further expand the market. AI technology improves overall efficiency, optimizes supply chain and operations, quality control and reduce waste etc., that benefits the biodegradable plastics industry in the forecast period.

Biodegradable Plastic Market Growth Factors

Prohibition on the use of single-use plastic along with rising awareness among people related to the ill effects of plastic waste on the environment are the key factors that stimulate the market growth. Non-decomposable plastics stimulate various types of pollution. In order to tackle this problem governments of various regions have banned the use of non-degradable plastics, thereby promoting the application of biodegradable plastics. Moreover, consumers are also willing to pay more for biodegradable plastics due to their eco-friendly nature which boosts the demand for biodegradable plastics in the near future.

Despite numerous advantages, biodegradable plastics have several shortcomings. There is no particular difference between conventional and biodegradable plastics that creates problems while segregating them. Also, the inclusion of conventional plastics in biodegradable plastics landfills causes problems in the decomposition process.

Moreover, not every biodegradable plastic is decomposable in the natural environment. Besides this, they require a specific environment in terms of temperature and moisture for degradation. Further, some of them release harmful gases such as greenhouse gases while decomposition is counterproductive to the environmental cause and restricts their growth in the near future.

MarketScope

| Report Highlights | Details |

| Growth Rate from 2025 to 2034 | CAGR of 15.28% |

| Market Size in 2025 | USD 5.36 Billion |

| Market Size in 2026 | USD 6.06 Billion |

| Market Size by 2034 | USD 19.41 Billion |

| Largest Market | Europe |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By vehicle class, By architecture and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Reduction in Plastic Waste

The intended breakdown speed of biodegradable polymers is faster than that of conventional plastics. They greatly reduce the long-term waste in landfills and natural ecosystems by breaking down into natural substances like water, carbon dioxide, and biomass through the action of microorganisms. Waste management systems can function more efficiently when biodegradable polymers are used. These products move waste from landfills to composting facilities, where they can be converted into beneficial soil supplements, as they are frequently compatible with composting procedures. When compared to traditional plastics, the manufacture and decomposition of biodegradable polymers typically result in fewer greenhouse gas emissions. This is because they frequently need less energy to make and because the process of their decomposition prevents the production of methane, a strong greenhouse gas that conventional plastics frequently generate as they decompose in anaerobic landfill environments.

Reduction in Plastic Waste

The European Union (EU) is taking a remarkable step towards reducing plastic waste by banning single-use plastics by 2030. Single-use plastic packaging items for fresh fruit and vegetables, condiments in fast food restaurants, mini hotel toiletries, and thin plastic bags for groceries make the packaging of everyday items more sustainable. The region is taking several actions on waste management and the circular economy.

Restraints

Limited Degradation Conditions

For biodegradable polymers to break down efficiently, temperatures above 50°C, which are usually seen in commercial composting facilities, are necessary. The biodegradation process requires a sufficient amount of microbial presence. If the right bacteria are not present in the environment, the degradation process will either proceed much more slowly or not at all. Depending on where they are disposed of, biodegradable plastics might have varying degrees of effectiveness. Inadequate natural decomposition can result in pollution of the environment akin to that produced by traditional plastics. To make sure biodegradable plastics are disposed of properly and may breakdown as intended, waste management systems should be improved and industrial composting facilities should be expanded. maximizing the environmental advantages of biodegradable plastics by educating customers about proper disposal techniques.

Opportunity

Brand Differentiation and Corporate Responsibility

Businesses can set themselves apart by funding R&D to produce cutting-edge biodegradable plastic products. These might include materials that perform better overall, like stronger materials or materials that deteriorate more quickly. Businesses can set a higher priority for suppliers who adhere to strict environmental and social responsibility guidelines and put policies in place to cut down on the amount of energy and trash produced during operations. Customers' sense of responsibility can be increased by informing them about the advantages of biodegradable plastics and the significance of safe disposal procedures. Corporate social responsibility can be exhibited by a firm through its philanthropic support of environmental conservation initiatives and active involvement in local communities.

Segment Insights

Type Insights

Starch-based plastics are predicted to dominate the global biodegradable plastics market for both revenue and volume and garnered nearly 10.5% of growth rate in terms of revenue during the forecast period. Increasing application of starch-based plastics in end-use industries such as automobiles, packaging, and agriculture attributed to the significant growth of the segment. They are largely helpful in reducing the carbon footprint of conventional resins and encounter significant demand in the agriculture and flexible packaging sectors. Further, starch-based biodegradable plastics are less toxic as they are made up of plant-based materials. The packaging industry is one of the major consumers of starch-based plastics owing to their versatile behavior.

Polyhydroxyalkanoate (PHA) is anticipated to register the fastest growth over the analysis period. This is attributed to the increasing use of PHA in medical and other applications. PHA is prominently used in medical implants, drug encapsulation, bone marrow scaffolds, tissue engineering, and bone plates. Apart from medical applications, PHA is also used in the packaging of food & beverages, agriculture foil and films, compost bags, and consumer products. The aforementioned factors are expected to fuel the growth of the segment in the coming years.

End-use Insights

In 2025, packaging is the leading end-use segment in the global biodegradable plastics market. This is mainly attributed to the shifting consumer trend from synthetic to bio-based products. In food packaging, biodegradable plastics offer promising functionality and are used in numerous applications such as wraps, cups, boxes, and plates. The foregoing trend has gained momentum in the recent past, thus driving the demand for biodegradable plastics. Further, the rising preference for packaged food in accordance with the changing lifestyle positively influences the demand for biodegradable plastics in packaging applications.

On the contrary, agriculture witnessed the fastest growth in the global biodegradable plastics market during the analysis period. This is mainly because of the increasing application of mulch films in agriculture application. Biodegradable mulch film offers greater decomposition compared to other bio-plastics in soil and estimated that nearly 75-80% of the content is renewable thus propelling the market growth of the segment.

Regional Insights

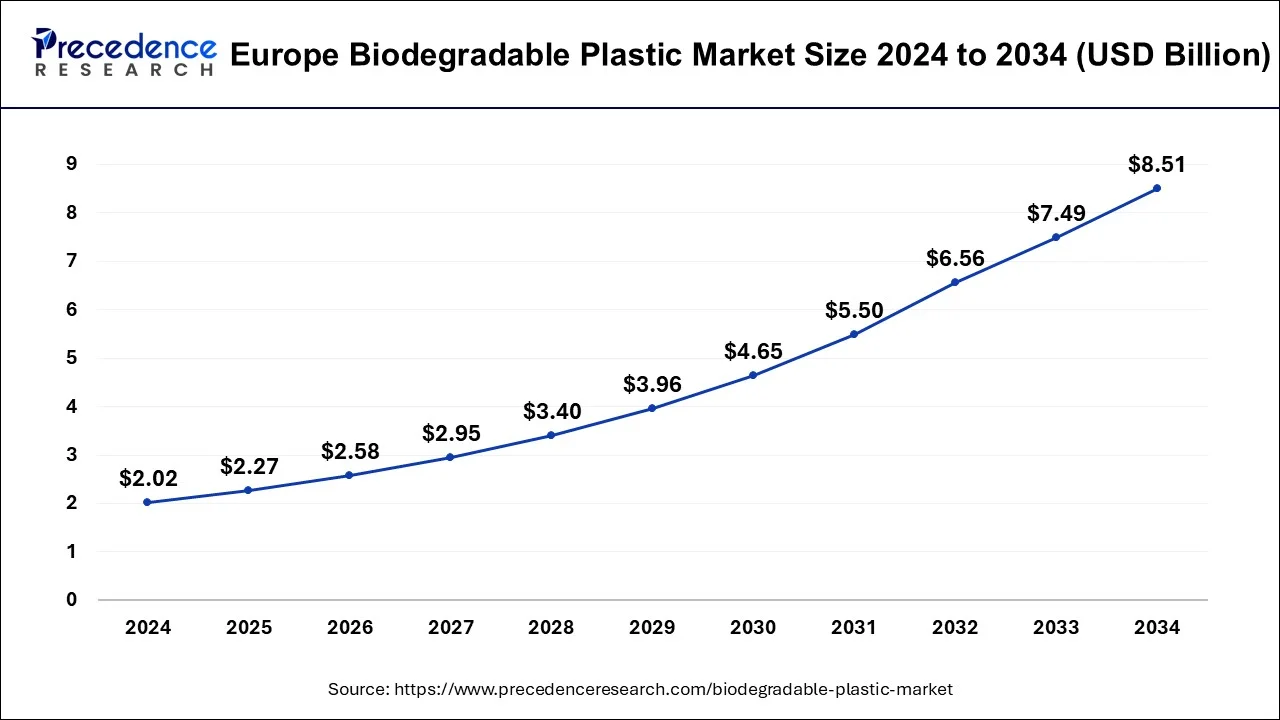

EuropeBiodegradable Plastic Market Size and Growth 2025 to 2034

The Europe biodegradable plastic market size was estimated at USD 2.27 billion in 2025 and is predicted to be worth around USD 8.51 billion by 2034, at a CAGR of 15.65% from 2025 to 2034.

Europe was a front-runner in terms of revenue in the global biodegradable plastics market in 2025. Rising consumer awareness along with the government of Europe has banned the usage of non-degradable plastics are the key factors that fuel the market growth in the region. Rising soil & environment depletion because of the rising usage of plastics has triggered the need for a shifting trend towards bio-based materials that can be reused and are environment friendly.

The European Commission has set very ambitious circularity objectives for plastics. Regulatory targets of the recently revised waste directives are 10% max landfilling of municipal waste by 2035, 50% recycling of plastic packaging by 2025, and 55% by 2030. Chemical recycling represents a positive step towards reducing the disposed of waste and contributing to a circular economy for plastics. There is also a huge potential for new jobs as the sector develops.

- In January 2023, Parliament voted on its position regarding waste shipment rules, which aim to promote reuse and recycling and reduce pollution. MEPs insist that exports of plastic waste to non-OECD countries should be banned and shipments to OECD countries should be phased out within four years.

- According to the European Parliament report in March 2025, globally, researchers estimate that the production and incineration of plastic pumped more than 850 million tonnes of greenhouse gases into the atmosphere in 2019. By 2050, those emissions could rise to 2.8 billion tonnes, a part of which could be avoided through better recycling.

Asia Pacific exhibits the fastest growth over the forecast period owing to a large consumer base along with escalating growth of agriculture and the food & beverage industry in the region. Asia Pacific is considered an agricultural land. As per the Food and Agriculture Organization of the United Nations (FAO), the Asia Pacific occupy nearly one-fifth of the world's agricultural land. The above-mentioned factor significantly propels the agricultural application of biodegradable plastics. Furthermore, the large population in the region has projected the region as a leader in the demand for consumer goods again attributes positive towards the market growth.

Asia Pacific region's growth to be driven by China and India.

On the other side, the Asia Pacific exhibits the fastest growth over the forecast period owing to a large consumer base along with escalating growth of agriculture and the food & beverage industry in the region. Asia Pacific is considered an agricultural land. As per the Food and Agriculture Organization of the United Nations (FAO), the Asia Pacific occupy nearly one-fifth of the world's agricultural land. The above-mentioned factor significantly propels the agricultural application of biodegradable plastics. Furthermore, the large population in the region has projected the region as a leader in the demand for consumer goods again attributes positive towards the market growth.

- For Asia Pacific region, China is a dominant marketplace for biodegradable plastics. This country is a major manufacturer of consumer goods in the world. The ecommerce sector in this county is rapidly rising which has fueled the demand for usage of biodegradable plastic for production of packaging along with consumer goods. China plays an important part in the biodegradable plastic market during the forecast period in Asia Pacific.

Another country that is crucial for the biodegradable plastic market in Asia Pacific region is India. One of the largest exporters of consumer goods as well as agricultural products, the country offers opportunity for wide utilization of biodegradable plastics. There is also a strong presence of food packaging and agriculture industry combined with rising consumer awareness about sustainable practices will help increase demand for biodegradable plastics in the country in the forecast period.

Plastic pollution has become a global crisis, with the United Nations Environment Programme estimating between 19 and 23 million tons of plastic waste leak into aquatic ecosystems each year.

North America is expected to grow significantly in the biodegradable plastic market during the forecast period. The growing awareness, as well as research, in North America is increasing the demand for biodegradable plastic. Moreover, new rules are also being implemented to reduce plastic pollution, due to which the use of biodegradable plastic is also rising. Thus, this promotes the market growth.

U.S Biodegradable Plastic Market Trends:

The industries in the U.S. are focusing on the development of new biodegradable plastics. This, in turn, increases the research conducted in the industries as well as institutions, enhancing their collaborations. Furthermore, these developments are supported by the funding provided by the government.

Canada Biodegradable Plastic Market Trends:

The growing awareness among the population is increasing the use as well as demand for biodegradable plastics. At the same time, the rules and regulations imposed by the government or regulatory bodies are further encouraging their use.

Biodegradable Plastic Market Companies

- Biome Technologies plc

- Mitsubishi Chemical Corporation

- BASF SE

- Plantic Technologies Limited

- Yield10 Bioscience, Inc.

- Corbion

- Eastman Chemical Company

- Dow Inc.

- NatureWorks LLC

- Danimer Scientific

- Toray Industries, Inc.

- p.A.

- TianAn Biologic Materials Co., Ltd.

Recent Developments

- In May 2025, to restrict the use of single-use plastic, compostable bags made from PBAT, a biodegradable and chemical-free polymer, have been introduced in Tripura's Dhalai district by the Kamalpur Nagar Panchayat. To enhance sustainable urban development as well as boost eco-friendly alternatives, this move was part of the Swachh Bharat Mission-Urban. Furthermore, the Central Institute of Plastics Engineering & Technology (CIPET) has certified these PBAT bags for their compostability and biodegradability, which decompose in 180 days. (Source: https://www.msn.com)

- In March 2025, a biodegradable plastic that dissolves in seawater was developed by the researchers of the RIKEN Center for Emergent Matter Science in Japan. Due to its versatility, it is being used in various applications ranging from packaging materials to medical devices. Furthermore, food-safe ingredients in this plastic make it non-toxic and safe for various industries. Moreover, it decomposes quickly, minimizing plastic pollution. ( Source: https://www.news18.com)

- In December 2024, Symphony Environmental Ltd., a United Kingdom-based packaging technology company, launched biodegradable resin for the plastics industry. The new product, branded NbR, is made with natural minerals to reduce the amount of fossil-derived polyethylene (PE) or polypropylene (PP) used, and it has been formulated to biodegrade safely in nature.

- In November 2024, Walki announced a strategic partnership with Lactips to create ‘fully biodegradable, plastics-free' food packaging using natural polymers, designed to be fully recyclable in the paper stream. The companies stated that the EU has taken the lead in addressing the growing plastic waste problem with the Single-Use Plastics Regulation, pushing customers in the food packaging industry to find ways to replace traditional fossil-based plastics with biodegradable alternatives.

- In January 2025, UConn Researchers partnered with a bioplastics company to examine biodegradable plastics. A recent study published in the Journal of Polymers and the Environment found that Mater-Bi, a starch-based polymer produced by Italian company Novamont, degraded by as much as nearly 50% over nine months in a marine environment, significantly more than traditional plastics, and showed promise for reducing marine pollution.

- In February 2024, leading South Korean chemical manufacturer LG Chem Ltd. and food and biotechnology company CJ CheilJedang Corp. have partnered to establish an environmentally friendly bio-nylon joint venture in an effort to reduce carbon emissions and generate new revenue. The CEOs of the two companies, LG Chem and CJ CheilJedang, announced on Thursday that they had inked a head of agreement (HOA) to construct a joint venture plant that would manufacture environmentally friendly nylon using PMDA, or bio-materials made from fermenting corn, sugarcane, and other crops.

- In December 2023, with the introduction of a new end-to-end licensed technology called CAPSULTM for the continuous manufacturing of polycaprolactone (PCL), a biodegradable polyester frequently used in the packaging, textile, agricultural, and horticultural industries, Swiss technology company Sulzer is broadening its line of bioplastics.

Segments Covered in the Report

By Type

- Starch-based

- PBS

- PLA

- PHA

- PBAT

- Others

By End-User

- Consumer Goods

- Agriculture

- Packaging

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting