List of Contents

Biodiesel Market Size and Forecast 2025 to 2034

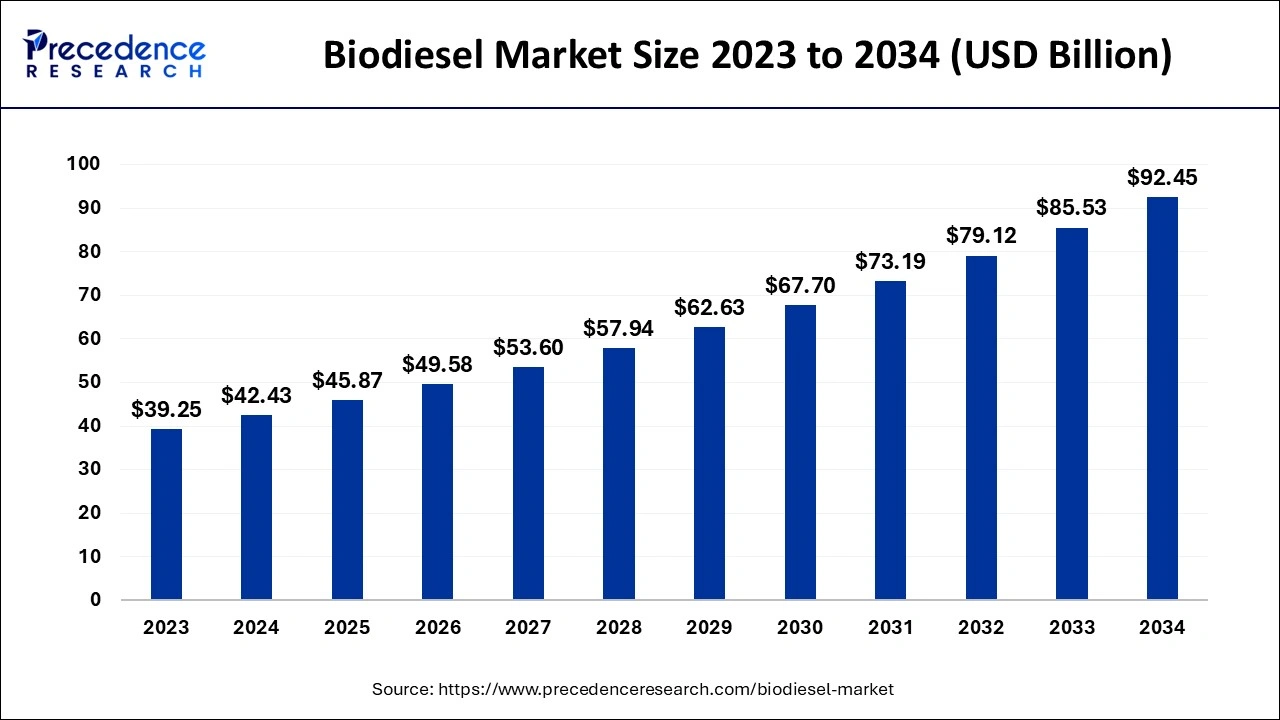

The global biodiesel market size was estimated at USD 42.43 billion in 2024 and is predicted to increase from USD 45.87 billion in 2025 to approximately USD 92.45 billion by 2034, expanding at a CAGR of 8.10% from 2025 to 2034.

Biodiesel Mark Key Takeaways

- By feedstock, the vegetable oil category was responsible for more than 96.4% of worldwide revenue in 2024.

- By application, the fuel sector dominated the market with 79% of total revenue in 2024.

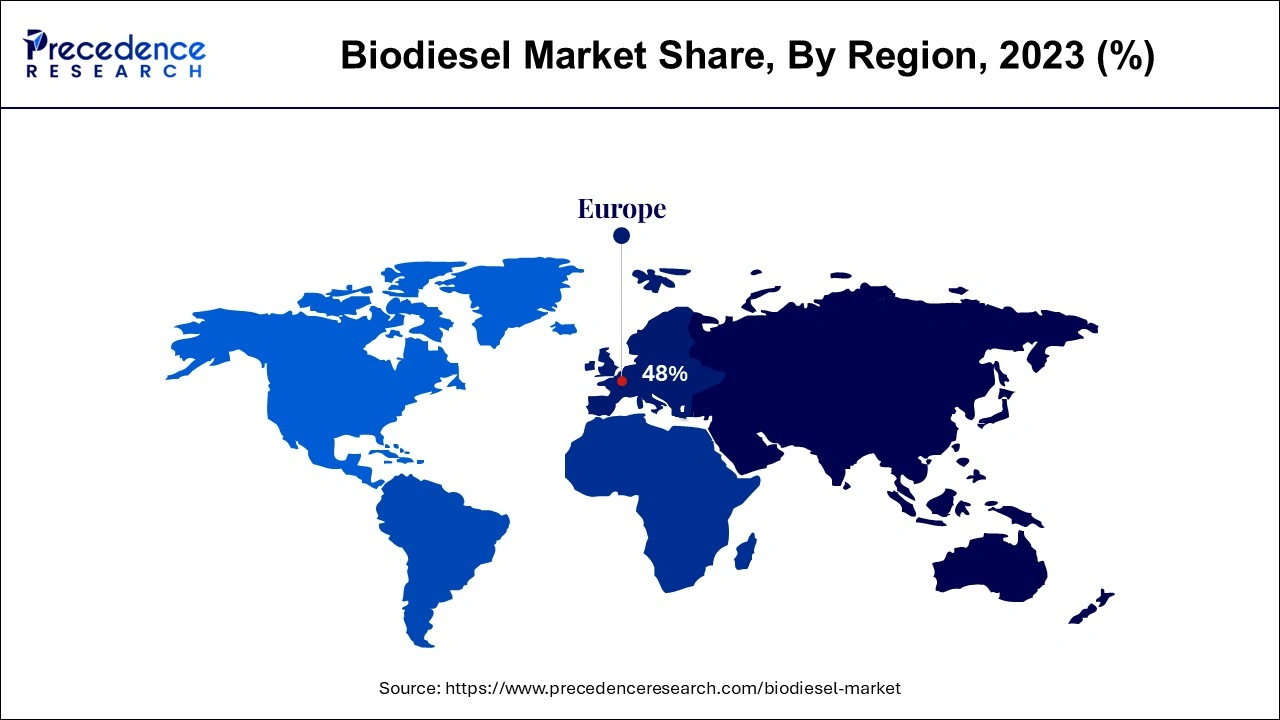

- The Europe region dominated the market with 48% of the total market share in 2024.

AI in the Market

AI is facilitating change in biodiesel production and distribution by enhancing efficiency, lowering costs, and supporting sustainability. AI predicts the quality and consistency in the feedstock analysis, thus reducing the number of rejected batches and improving resource utilization. Real-time process control allows dynamic adjustments to be made in process parameters, optimizing yield and energy consumption. Predictive maintenance allows further reduction in equipment downtime, enhanced throughput, and increased operational costs. Routing based on AI further cuts costs and emissions in the collection of raw materials. Market integration is also strengthened through grid management, biodiesel layer supply forecasting, and automated market insights.

Europe Biodiesel Market Size and Growth 2025 to 2034

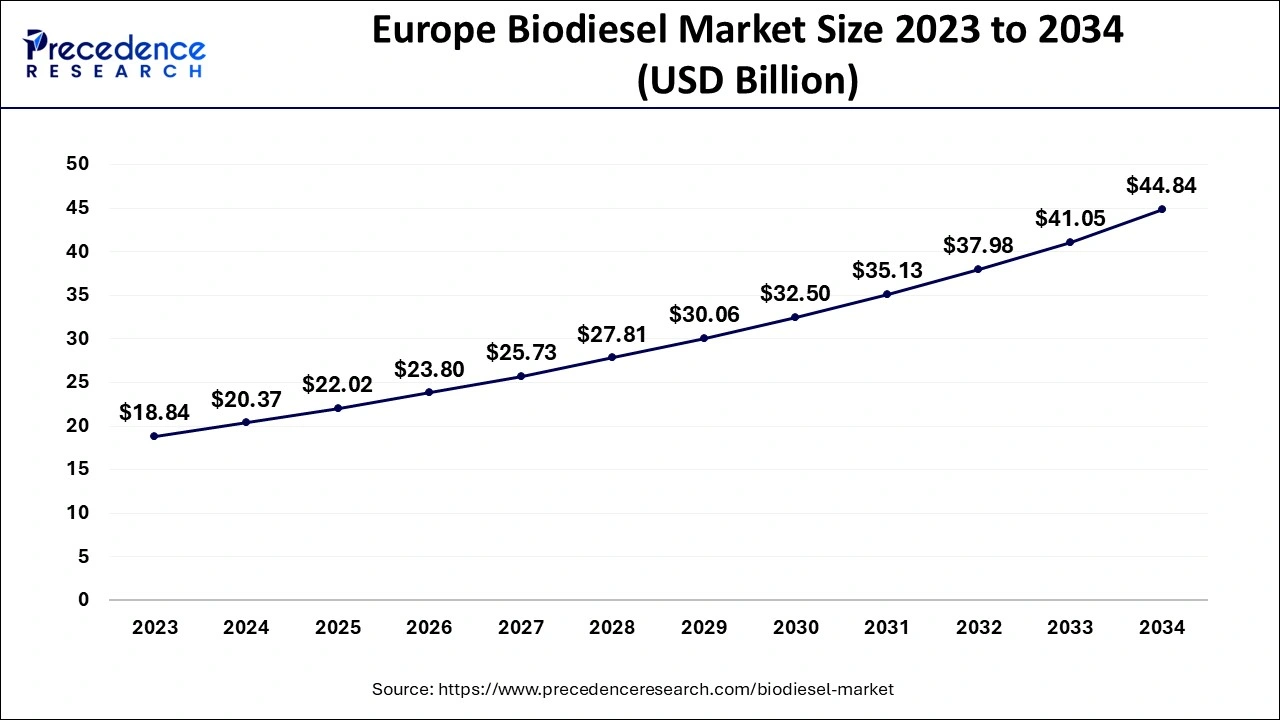

The Europe biodiesel market size was evaluated at USD 20.36 billion in 2024 and is predicted to be worth around USD 44.84 billion by 2034, rising at a CAGR of 8.20% from 2025 to 2034.

The Europe region has captured highest market share in 2024. It has traditionally been the major market for the product due to early acceptance of the product in the region and government focus on switching to bio-based sources from carbon-emitting ones. In Europe, urea-coated oil, palm oil, animal fats, rapeseed oil, soybean oil, and sunflower oil are the most often utilised feedstocks for the production of biodiesel. Germany, the European country with the highest percentage of feedstock production, is the main driver of the region's product demand.

The less interest rate for procuring raw materials is predicted to increase consumption, accelerating market growth throughout the projection period in the region. Asia Pacific is similarly expected to grow at a rapid pace between 2025 and 2034.

The biodiesel market of India is motivated by growing use of sustainable fuels, governmental programs for renewable energy, and an escalating emphasis on lowering carbon emissions in the transportation and industrial sectors. Investment in the biodiesel industry is rising as it provides significant gains and rewards for participants in the renewable energy sector.

India's government-owned oil marketing companies have launched a new tendering process for biodiesel acquisition, aiming to procure around 200 million liters for the initial quarter of the next financial year, in April 2025.

- The Indian government has introduced various initiatives and policies to encourage the production and use of biodiesel, a vital element of sustainable energy. In 2018, India released its National Policy on Biofuels, which set targets of 20% ethanol blending and 5% biodiesel blending by 2030, defined feedstock specifications for different fuels, and detailed the duties of 11 ministries to align government efforts.

It is anticipated that production would rise, which will probably fuel market expansion throughout the course of the projection year. However, market growth is anticipated to be constrained because palm oil is also used in the food industry. In order to reduce pollution and dependence on crude oil, the government's drive to promote green fuels is expected to spur market development throughout the anticipated timeframe. Additionally, by 2023, the Indian government plans to blend more than 5% biodiesel, which is anticipated to spur development during the course of the projection period. South and Central America will generate 10,960.1 million liters in 2023. The rise was attributed to higher domestic consumption as a result of higher levels of blending to use up extra palm oil production.

Due to the vigorous promotion of biodiesel production and consumption in the first half of the last decade, Germany's biodiesel market emerged as the largest national biodiesel market globally. Germany generates considerably more biodiesel than any other EU nation and thus has a crucial role in providing it to the U.S.

- In 2023, the German biodiesel sector generated around 3.7 million tonnes of biodiesel, with 52.3% derived from rapeseed oil. The increase in the blending rates of ethanol and biodiesel may be attributed to the accessibility of cheaper feedstocks for producing these two biofuels.

Germany's biodiesel exports rose by nearly 16% in the first half of this year compared to the same timeframe in 2023, according to a report from the Union for the Promotion of Oil and Protein Plants (UFOP). As per data released by the German Federal Statistical Office, Germany exported approximately 1.7 million tonnes of biodiesel in the first half of 2024, while imports totalled 906,719 tonnes.

Market Overview

It is a renewable and clean-burning diesel alternative that may be utilized in current diesel engines that too without requiring any alterations. It usually includes recycled oils for cooking, feedstock, and animal fats. The market is anticipated to expand as demand for biodiesel to replace conventional fossil fuels in the transportation and power generation sectors rises. The market is quite fragmented since there are so many different suppliers and dealers.

On the other hand, the lack of production capacity and the high potential for R&D in the choice of feedstock for product manufacturing are likely to create chances for new market competitors. An important aspect driving the sector is the increased need for clean fuels that permit complete combustion while reducing Greenhouse Gas (GHG) emissions. Another factor boosting demand is biodiesel's excellent compatibility with modern diesel engines. The demand for biodiesel is anticipated to increase as a result of the growing population, an increase in the number of biodiesel-using automobiles, and other factors. In the automobile sector, biodiesel is highly sought after since it produces less GHGs. As a result, demand inside the United States is anticipated to rise during the course of the projection period.

Biodiesel Market Growth Factors

- The increasing need for renewable and biodegradable fuels instead of the conventionally used fossil fuels is driving for biodiesel imports.

- Government incentives, subsidies, and blending mandates still sustain large-scale biodiesel production.

- Environmental concern and international movement against greenhouse gas emissions drive the expansion of the market.

- The cause for sustainable fuel production is getting positive with the increasing use of waste oils, animal fats, and non-edible feedstocks.

- Production technologies are being improved upon year by year to make them more efficient, less costly, and adaptable to various industries.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 42.43 Billion |

| Market Size in 2025 | USD 45.87 billion |

| Market Size by 2034 | USD 92.45 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.10% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Feedstock, Application, Production Process, and Geography |

Market Dynamics

Key Market Drivers

Increasing demand for cleaner fuels to stimulate the global biodiesel market

- Environmental assistance improved regulatory assistance, geopolitical assistance, consumer assistance, and economic and agricultural assistance are all driving market expansion. Biodiesel generated from vegetable oils is popular in a range of sectors because the saturated fat level is minimal, making the production process easy and cutting total production costs. Furthermore, the feedstock needed to make vegetable oils is much more easily accessible than that required to produce greases and animal fats. The fuel application type segment is predicted to lead the market, followed by power generation.

- The product's primary market is expected to be in Europe. The automotive industry's strong product demand, as well as different government attempts to minimise GHG emissions, are likely to drive market expansion. According to the National Biodiesel Board's 2020 report, utilisation will surpass six billion gallons in there on, off-road, civil aviation, power generation, and home heating applications by 2030, resulting in an annual reduction of approximately 35 million metric tonnes of Carbon dioxide equivalents greenhouse gas emissions. Advances in feedstock will raise consumption to 15 billion gallons by 2050. As a result, the market is likely to expand in the near future.

Growing demand by the automotive sector

- The increased demand from the automotive industry is expected to boost the growth of the Biodiesel Market over the forecast period. Rising demand for gas in commercial trucks to replace crude oil is predicted to help the business. The fuel is healthy for the environment since it emits fewer greenhouse gases than conventional diesel because it contains fewer VOCs. However, the market's development is likely to be restricted by a rise in the sale of electric cars throughout the forecast period.

- Tesla, for example, launched electric vehicles in the Indian market in 2017, noting the country's fourth-largest auto sector and the fact of electric vehicles will significantly reduce pollution levels. As a result of this invention, product demand in fuel applications is expected to be impeded. Furthermore, as OEM support for biodiesel grows and there is increased usage for crude glycerine through biodiesel production, prospects for market expansion are predicted in the coming years.

Key Market Challenges

- Expensive feedstock costs for biodiesel production - The agricultural commodities market influences demand for biodiesel as well as clean-burning fuels above regular petroleum-based fuel. The most frequent feedstock for biodiesel manufacturing is vegetable oil, including such canola oil, soybean oil, and palm oil. Feedstock expenses comprise around 80-85% of overall production costs. The high volatility of feedstock prices, on biodiesel manufacturers rely, jeopardises their financial stability in a longer term. The prices of feedstock will grow in lockstep with prices of biodiesel, reducing profit.

Key Market Opportunities

Depleting petrochemicals

- The worldwide petroleum stockpile is expected to last until roughly 2050. This has encouraged researchers to seek for the finest replacements and develop new growth channels for the overall biodiesel sector. Nonetheless, the call-supply imbalance caused by insufficient production capacity and the vast opportunity for R&D in feedstock selection for production process is expected to provide doors for new market competitors. Furthermore, the market is expected to include collaborations and partnerships between producers in order to generate large product quantities in order to fulfil the need for bio diesel.

Environmental concerns as well as depleting conventional energy sources

- In response to public demand to cut emissions and replace fossil fuels owing to environmental concerns, the largest-ever spectrum of biofuels, including biodiesel, ethanol, bio-methanol, as well as other green fuels, has been produced. Biodiesel raises the cetane number of the gasoline and enhances its lubricity. The majority of the world's energy requirements are now fulfilled by fossil fuels. These sources of energy are non-renewable and are rapidly decreasing. However, because biodiesel is really a renewable energy source (renewable fuel), it may be utilised in place of traditional energy sources.

- With the expanding population and rising demand for vehicles, there is an increase in demand for conventional fuels. There will be plenty of chances when governments regulate conventional fuel usage and impose limits on dangerous gas emissions. Biodiesel is miscible in all quantities with petroleum diesel and may be used straight in diesel engines or combined with petroleum diesel. All of biodiesel's environmentally favourable features, as well as toxicant emission laws, are major elements driving market potential for leading biodiesel makers.

Value Chain Analysis:

- Resource Extraction

Resource extraction for biodiesel is the process of obtaining the raw oils or fats from biological sources, known as feedstocks, before chemical treatment and conversion into fuel.

Key players: Wilmar International Ltd., Cargill Inc.

- Power Generation

Power generation from biodiesel involves operating the fuel in modified or standard diesel engines, gas turbines, or combined-cycle systems to generate electricity.

Key players: Chevron Renewable Energy Group (REG)

- Distribution Network Management

For biodiesel, distribution network management (DNM) involves the strategic planning, optimization, and management of the entire supply chain to move the fuel from the production facilities to the final consumers.

Key players: Shell plc, Reliance Industries Limited (RIL)

- Regulatory Compliance and Energy Trading

Biodiesel regulatory compliance refers to complying with those legal requirements laid down for production, handling, and sales, and may include the acquisition of a permit or proving certain quality standards like those from ASTM International, and complying with environmental and safety regulations for sustainable production and market access.

Key players: Environmental Protection Agency, European Commission

Feedstock Insights

The feedstock segment for vegetable oils is further subdivided into soybean oil, canola oil, palm oil, corn oil, etc. Concurrently, animal fats section is divided into tallow, poultry, white grease, etc. The vegetable oil category accounted 96.4% of global revenue in 2024. But selection of raw materials usually varies by area, depending on feedstock availability and cost. The palm oil, which has been widely utilised in the manufacturing of biodiesel in nations such as Thailand, Germany, Indonesia, France is likely to be a key feedstock for the industry.

Indonesia & Thailand dominate production of palm oil, contributing for more than 79% of global output, along with a significant amount of the commodity utilised to produce biofuel. Whereas Europe was relying on feedstock imports from these Asian countries for biofuel manufacturing.

Application Insights

Based on application the fuel application sector accounted highest revenue share in 2024. In 2024, the automobile gasoline industry dominated product demand. Because it emits less Volatile Organic Compounds (VOCs) than traditional fuels such as diesel, the sector is projected to gain from rising demand for fuel in commercial automobiles as a substitute for crude oil.

The product is used in the marine industry and is anticipated to grow at a sizable CAGR throughout the course of the forecast period due to its biodegradability, lack of aromatics and sulphur, and lack of hazardous properties. Additionally, during the projection period, product sales in agricultural applications are projected to be driven by the development of the agricultural sector and increased automation. Governments all over the globe are constantly working to reduce GHG emissions by generating power from renewable sources. The demand for the product in power producing applications is therefore anticipated to grow at a high CAGR between 2025 and 2034.

Biodiesel Market Top Companies

- FutureFuel Corp

- Ecodiesel Colombia S.A.

- Manuelita S.A.

- TerraVia Holdings, Inc.

- Renewable Biofuels, Inc.

- Ag Processing, Inc.

- Archer Daniels Midland Company (ADM)

- Wilmar International Ltd

- Bunge Ltd.

- Cargill, Inc.

- Louis Dreyfus Company; Biox Corp

- Munzer Bioindustrie GmbH

- Neste Oyj

- Renewable Energy Group, Inc.

Recent Developments

- In May 2025, Nippon Yuka Kogyo, a chemical R&D company, is set to release BioxiGuard, Japan's first antioxidant specifically designed for marine biodiesel fuel, starting August 10.

https://www.nyk.com/english/news/2025/20250521_01.html - In August 2025, Indonesia plans to increase mandatory palm oil content in biodiesel to 50% next year, aiming to reduce reliance on imported fossil fuels, though the programme is unlikely to commence in January.

https://www.reuters.com/sustainability/climate-energy/indonesia-aims-launch-b50-biodiesel-2026-unlikely-january-2025-08-11/

Segments Covered in the Report

By Feedstock

- Vegetable Oil

- Canola Oil

- Soybean Oil

- Palm Oil

- Corn Oil

- Others

- Animal Fats

- Poultry

- Tallow

- White Grease

- Others

By Application

- Fuel

- Automotive

- Agriculture

- Marine

- Power Generation

- Others

By Production Process

- Alcohol Trans-Esterification

- Hydro-Heating

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client