October 2024

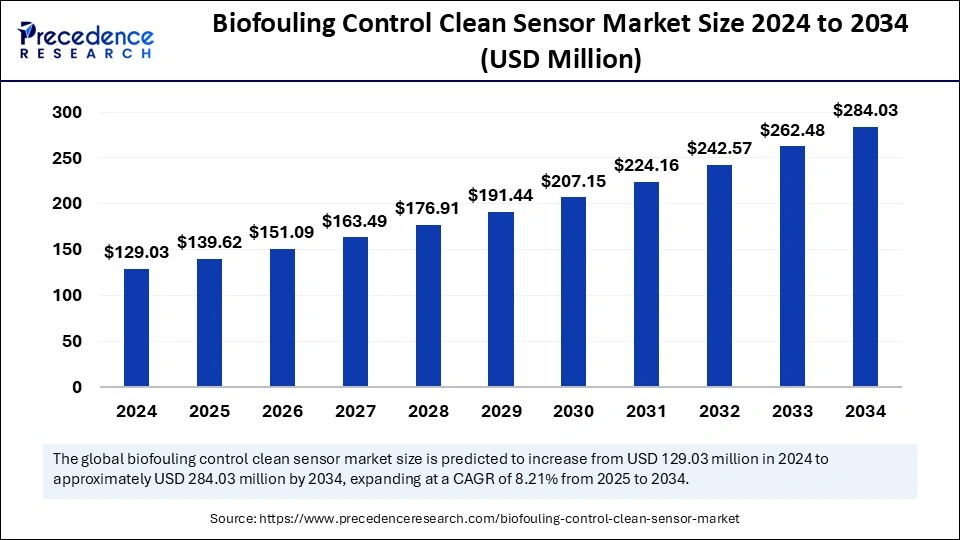

The global biofouling control clean sensor market size is calculated at USD 139.62 million in 2025 and is forecasted to reach around USD 284.03 million by 2034, accelerating at a CAGR of 8.21% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global biofouling control clean sensor market size accounted for USD 129.03 million in 2024 and is predicted to increase from USD 139.62 million in 2025 to approximately USD 284.03 million by 2034, expanding at a CAGR of 8.21% from 2025 to 2034.The demand for real-time monitoring of biofouling events has increased, driving the global market. The increased need for environmentally friendly marine operations and water treatments is boosting the market expansions.

artificial intelligence in biofouling control clean sensors is a transformative step in revolutionizing. AI enables real-time monitoring, predictive maintenance, and optimized cleaning strategies to improve the performance and efficacy of the sensors. AI algorithms are also able to analyze data from sensors and monitoring systems, which helps to predict the risk of biofouling, prevention, maintenance, and reducing downtime. The integration of AI modules analyzes data on water quality, temperature, and pressure, which helps to predict biofouling events.

Ongoing emphasizes researchers for improving the ability of the sensors to integrate with existing infrastructure and other technologies, leveraging the extreme adaptation growth of the biofouling control clean sensors in various industries. Industrial search for an advanced and cost-effective sensor system. Additionally, one of the major factors leveraging AI in the biofouling control clean sensor market. Advancements in technology like AI-powered optical coherence tomography are enabling the detection of biofouling on membrane surfaces and offering high-resolution images, expected to make spectacular approaches in the market in the forecast period

The biofouling control clean sensor market represents increased adoption of the sensor to monitor, detect, and prevent biofouling events and their side effects. The increased adoption of sensors in marine research, aquaculture, and offshore oil and gas, growing awareness of the environmental impact of biofouling, advancements in water treatment operations, and a surge of sensors with advanced features are the major trends, including market growth. Industries are spending on sensor utilization to maintain equipment lifespan, efficacy, effectiveness of operations, and cost-effective approaches.

Strict environmental regulations to maintain sustainability and government investments in various industrial productions are encouraging the utilization of sensors. Furthermore, ongoing investments in offshore oil & gas wind farms, desalination plants, water treatments, and marine engineering are fulfilling the adoption of biofouling control clean sensors. The increased exploration and production activities offshore in deep-sea environments are projected to witness spectacular growth, influencing the market in the forecast period. Researchers are committed to developing advanced sensors for optimization in remote and harsh environments, and enhancing their ability to integrate with existing infrastructure is projected to drive novel opportunities for market expansion.

| Report Coverage | Details |

| Market Size by 2034 | USD 284.03 Million |

| Market Size in 2025 | USD 139.62 Million |

| Market Size in 2024 | USD 129.03 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.21% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increased adoption of marine sensors

The increased demand for biofouling control clean sensors in the marine industry is driving a significant impact on the market growth. The increased risk of equipment damage in the marine industry drives the significant need for advanced sensors. The need for cleaning and maintenance of marine equipment is driving the adoption of marine sensors for the detection of biofilm events.

Biofouling control and clean sensors help to provide real-time monitoring of biofouling events and improve efficacy by optimizing cleaning schedules. These sensors help to reduce the environmental impact of marine operations by preventing invasive species from spreading and reducing the use of chemicals. Strict regulatory complaints regarding water pollution are another key reason driving the adoption of marine sensors. Key vendors are focusing on advancing biofouling control technologies to preserve sensor longevity and accuracy for marine applications.

High cost

The high cost associated with purchasing, installation, maintenance, and energy consumption of biofouling control clean sensors are the major hindrances for the market growth. The high upfront cost of these sensors is hampering their adoption in small and medium-sized organizations. The cost associated with maintaining and replacing biofouling control green sensors is quite expensive. Several biofouling control clean sensors require high energy consumption for operation, which leads to high costs as well as reducing environmental sustainability. However, ongoing developments of cost-effective solutions and advancements in sensor systems for integration with existing infrastructures are projected to overcome this restraint.

Advancement in anti-fouling agent technology

The growing emphasis on the development of sustainable and advanced antifouling agent technologies and the cooling market potential. Manufacturers are developing novel antifouling agents with enhanced efficacy, maintenance, and minimized need for frequent cleaning. The need for reducing harm in the marine industry is driving a surge for advanced antifouling agent technologies with more environmentally friendly solutions.

The growing adoption of antifouling agents in various technologies like offshore oil and gas, aquaculture, and water treatment is emerging in the biofouling control clean sensors. Additionally, the ongoing shift of the integration of anti-fouling agents with biofouling control clean sensors to offer advanced real-time monitoring and detection of biofouling agents is improving the cost-effectiveness and timely maintenance of the sensor.

The electrochemical fouling control system sensor segment held the major biofouling control clean sensor market share in 2024 and is projected to grow at the highest rate during the forecast period. The electrochemical fouling control system detects biofouling events by using electrochemical reactions. The increased demand for these systems in various industries like shipping, offshore, water treatment, and aquaculture is driving the segment's growth. The ability of systems to provide real-time, continuous data increases their popularity among these industries. The electrochemical falling control system provides real-time monitoring of biofouling events, helps to ensure timely maintenance, and reduces the risk of operational inefficiencies or damage. Additionally, industries are majorly adopting this system with sensors due to the requirement of minimal maintenance, which makes them a cost-effective solution for biofouling control. The proven advantages of the electrochemical fouling control system in various industries are surging for advancements in the system sensor to enhance their efficiency and effectiveness.

The marine engineering segment contributed the biggest biofouling control clean sensor market share in 2024. The rise in the design and development of biofouling control clean sensors for the protection of marine engineering applications such as ship hulls, offshore oil rigs, and subsea equipment is a key driver of the market growth. The need for improved performance and reduced maintenance costs of marine vessels and equipment is leveraging the segment growth. Additionally, the biofouling control clean sensors are rapidly being used in marine applications to monitor and control biofouling events and their adverse effect. Environmental regulatory complaints are further encouraging the adoption of these sensors in marine applications.

The industrial production segment is expected to grow at the fastest CAGR during the projection period due to an increase in the use of biofouling control clean sensors for industrial equipment protection, process optimizations, water treatments, and food and beverage processing. These sensors help to reduce maintenance costs and improve equipment lifespan. The water treatment industry has increased adoption of the sensor to ensure the efficiency and effectiveness of the treatment. Additionally, biofouling control clean sensors are rapidly being used in the food and beverage industry to prevent biofouling events and enhance the quality and safety of production. The increasing need for real-time monitoring and control of biofouling events in industrial production is the emerging adoption of these sensors in various industries.

Asia Pacific dominates the global biofouling control clean sensor market with expanding industrialization and growing shipbuilding industries in the region. Well-established industries like power generation, water treatment, and marine are the major adapters of biofouling control clean centers across the region. Asia Pacific has diverted its focus on water treatment, driving high demand for biofouling control clean sensors in the water treatment industry. Government initiatives for implementation now, biofouling control, and clean sensors in various industries are the major factors encouraging sensor adoption in Asia. Countries like China, Japan, and South Korea are leading regional markets due to factors like rapid industrialization, a growing shipbuilding industry, high offshore operations, water treatment challenges, and government support.

China is the major country leading the Asian biofouling control clean sensor market, mainly due to its well-established marine and offshore infrastructure. The robust shipbuilding industry, increasing maritime trade, and government support for related infrastructure are encouraging the adoption of advanced sensors in the country. Additionally, China is the hub of offshore oil & gas operations. High export and import transportation through sea fuel is the major reason for the high adoption rate of sensors in China. Government support allows innovation and development of advanced technologies to improve the efficiency and effectiveness of sensors and industrial productions, making further ways for the market to grow.

Europe is anticipated to win the most significant growth of the market in the forecast period. Regulation and research activities of the euro are the significant drivers of the biofouling control clean sensor market. Europe is a hub for numerous research institutes and organizations associated with the development of advanced sensor technologies. Europe has strict environmental regulations for the reduction of carbon footprint; maintaining environmental sustainability drives significant demand for biofuel control clean sensors in various industries like shipping, offshore, and water treatment. The presence of key ventures is enabling innovation and development of high-quality biofouling control clean sensors to comply with the demands of various industries as well as regulatory requirements.

Countries like Germany, France, and Italy are strong contenders in the market due to their robust industrial bases. The presence of advanced manufacturing capabilities and a high focus on environmental stability are the major factors responsible for the high adoption of biofouling control clean sensors in these countries. The future of the biofouling control clean sensor market in Europe is expected to witness transformative growth with government initiatives and support for the adoption of advanced technologies in various industries and a focus on water treatment operations.

North America will grow at a notable rate in the biofouling control clean sensor market with increased awareness of environmental sustainability and stringent environmental regulations. Industries like shipping, offshore, and water treatment are driving demand for biofouling control clean sensors in North America due to the implementation of stricter environmental regulations in the region. North America has witnessed increased awareness about water treatment infrastructure, driving the adoption of biofouling control clean sensors in the industry. Furthermore, factors like the presence of key players and the research and development institutes are further contributing to the market expansion.

The United States is leading the regional biofouling control clean sensor market driven by advanced water treatment infrastructure, and strict environmental regulations of the country. Technological innovation and investments in research and development, especially for maritime technology and smart home technologies, are demonstrating the reason behind the increasing utilization of biofouling control cleaning sensors in the country. The presence of key vendors and their investments in developing specialized autonomous maritime sensing technology is transforming the market outlook in the U.S.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

February 2025

February 2025

August 2024