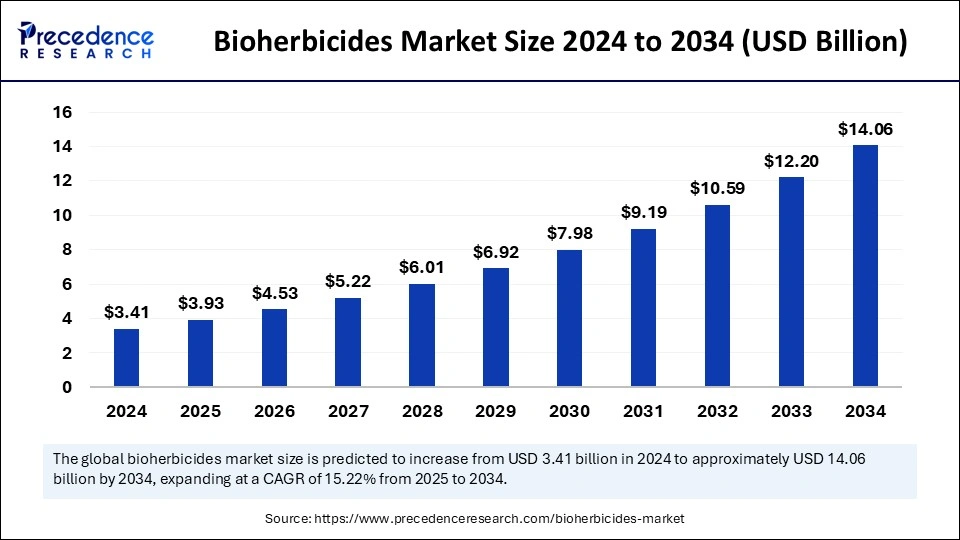

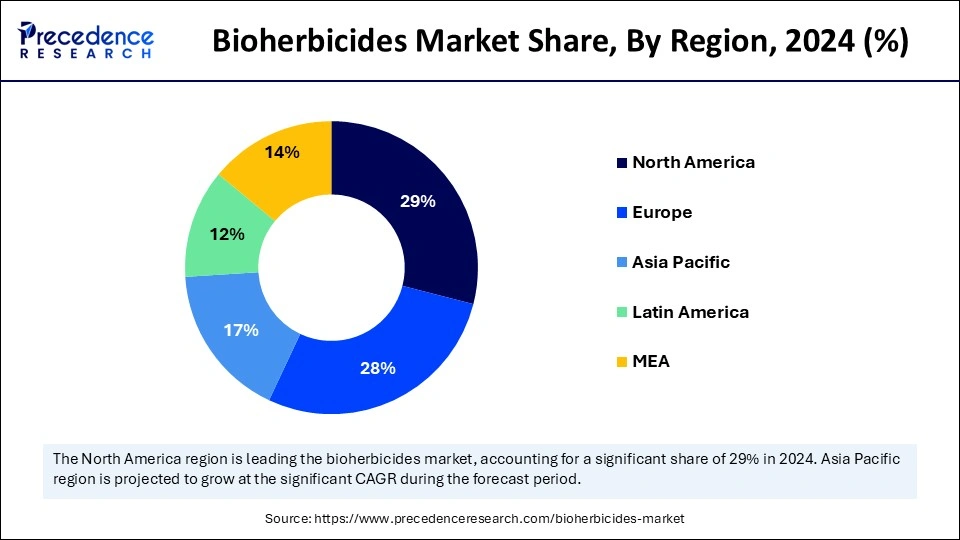

The global bioherbicides market size is calculated at USD 3.93 billion in 2025 and is forecasted to reach around USD 14.06 billion by 2034, accelerating at a CAGR of 15.22% from 2025 to 2034. The North America market size surpassed USD 990 million in 2024 and is expanding at a CAGR of 15.40% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global bioherbicides market size accounted for USD 3.41 billion in 2024 and is predicted to increase from USD 3.93 billion in 2025 to approximately USD 14.06 billion by 2034, expanding at a CAGR of 15.22% from 2025 to 2034. The increasing environmental concerns and the rising demand for eco-friendly alternatives drive the growth of the bioherbicides market.

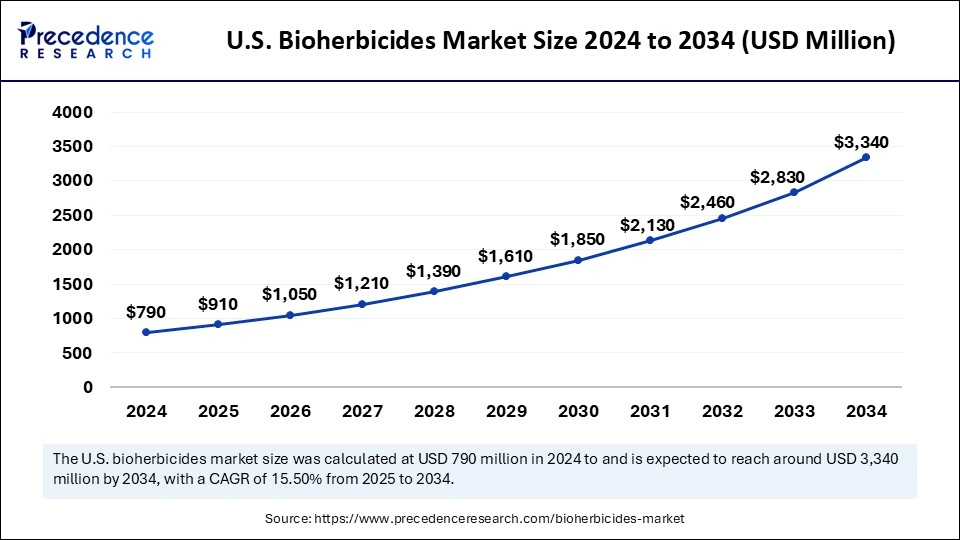

The U.S. bioherbicides market size was exhibited at USD 790 million in 2024 and is projected to be worth around USD 3,340 million by 2034, growing at a CAGR of 15.50% from 2025 to 2034.

North America registered dominance in the bioherbicides market by capturing the largest share in 2024. This is mainly due to the strong focus on organic farming, particularly in the U.S. and Canada. With the heightened demand for organic food, organic farming practices have gained immense popularity, leading to increased demand for effective weed management solutions, including bioherbicides. A rapid shift toward sustainable agricultural techniques is propelled by heightened environmental awareness and a growing consumer preference for organic products. This shift favors bioherbicides as a viable alternative to traditional synthetic herbicides, which have faced criticism for their environmental impact.

In Canada, the agriculture sector is particularly significant within the Prairies province, where vast fields of crops are cultivated. Health Canada plays a critical role in regulating pesticides, including bioherbicides, ensuring their safety and effectiveness for agricultural use. Regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and Health Canada are placing greater emphasis on identifying safer alternatives to chemical pesticides, creating a favorable environment for the growth and implementation of bioherbicides.

North America boasts a dynamic research and development ecosystem where universities and private companies collaborate to innovate and advance bioherbicide solutions. As farmers gain more knowledge about the advantages of bioherbicides, such as reduced environmental footprint and improved soil health, they are increasingly willing to incorporate these products into their farming practices.

Asia Pacific is projected to witness the fastest growth in the market for bioherbicides during the forecast period. The region boasts a vast agricultural sector, which is driving the need for sustainable and effective weed control options. There is heightened awareness regarding the detrimental environmental effects associated with conventional chemical herbicides, including soil degradation and water pollution, which are prompting farmers to shift toward sustainable farming practices.

Governments around the region are actively enacting policies to foster sustainable agriculture. China, in particular, stands out as one of the largest agricultural producers globally. The Chinese government is proactively encouraging sustainable farming techniques, focusing on reducing reliance on chemical pesticides. The rising demand for organic fruits and vegetables further contributes to the growth of the Asia Pacific bioherbicides market.

Europe is considered to be a significantly growing area. The region's strong commitment to sustainable agricultural practices and environmental stewardship is a key factor boosting the regional market growth. The European Union has enacted stringent regulations regarding the use of chemical pesticides, compelling farmers to explore alternative solutions like bioherbicides. Initiatives like the European Green Deal are pivotal in promoting a transition to sustainable farming methodologies. With the growing health-conscious population and the rising concerns about environmental sustainability, there is a marked increase in demand for organic products. Germany can have a stronghold on the European bioherbicides market. This is mainly due to the rapid expansion of the organic food sector. Germany's focus on sustainable agricultural practices and environmental protection further boosts the adoption of bioherbicides.

The bioherbicides market centers around offering innovative, sustainable alternatives to conventional chemical herbicides, emphasizing developing, producing, and distributing weed control solutions derived from natural sources. The primary aim of this market is to promote sustainable agricultural practices while minimizing the ecological impact associated with weed management. This commitment aligns with the increasing consumer demand for organic food and the urgent need to reduce chemical applications in farming. A fundamental driving force behind this shift is the effort to mitigate the adverse effects of synthetic herbicides, including soil and water pollution and harm to non-target organisms. Furthermore, the rise of herbicide-resistant weed populations and the necessity to lower human exposure to toxic chemical residues in food and the environment are significant considerations. Continuous research and development activities to enhance bioherbicides' efficacy, stability, and application techniques further support the bioherbicides market.

| Report Coverage | Details |

| Market Size by 2034 | USD 14.06 Billion |

| Market Size in 2025 | USD 3.93 Billion |

| Market Size in 2024 | USD 3.41 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.22% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising Awareness of Drawbacks of Synthetic Herbicides

Farmers are becoming more aware of synthetic herbicides' detrimental effects on diverse ecosystems, water quality, and soil vitality. This, in turn, boosts the demand for sustainable agricultural practices that prioritize environmental conservation, ultimately driving the growth of the bioherbicides market. With the growing awareness of health and wellness, consumers are increasingly favoring organic food and products, which necessitates the adoption of bioherbicides. Additionally, stringent government regulations governing the use of chemical pesticides and policies advocating for environmentally friendly agricultural methods contribute to this shift.

Low Efficacy and High Production Costs

Despite the advantages offered by bioherbicides, there are several challenges that hinder their widespread adoption. One major concern is that bioherbicides may not provide the same rapid and consistent weed control as synthetic herbicides. Their performance can be heavily influenced by environmental factors such as temperature and humidity, leading to variability in effectiveness. Bioherbicides' production cost is higher than their synthetic counterparts, which may limit their use in price-sensitive markets where cost competitiveness is crucial. Bioherbicides, being natural products, often have shorter shelf lives and may require specific storage conditions to maintain their efficacy. This can pose a logistical challenge for farmers. In addition, limited awareness among farmers regarding the benefits and proper use of bioherbicides hampers the growth of the bioherbicides market.

Research and Development Efforts

The ongoing research and development initiatives aimed at enhancing the efficiency, stability, and application methods of bioherbicides present exciting opportunities in the market. There is a potential for the creation of novel bioherbicides that offer a broader spectrum of weed control, significantly benefiting agricultural practices. The rise in demand for organic food products offers immense opportunities for manufacturers of bioherbicides as consumers increasingly seek chemical-free options. Moreover, integrating bioherbicides with advanced agricultural technologies for targeted applications can improve overall efficiency and reduce operational costs. The development of new bioherbicides that specifically target particular types of weeds or crops also opens avenues for targeted solutions in pest management.

The fruits & vegetables segment dominated the bioherbicides market with the largest share in 2024. Chemical herbicides often pose significant health risks to consumers and lead to ecological disruption by leaving harmful residues on fruits and vegetables. In contrast, bioherbicides present a safer and more sustainable option for weed management, effectively lowering chemical residue levels and promoting long-term soil health. The rise in demand for organic fruits and vegetables augmented the segment.

The turf & ornamental grass segment is expected to expand at a significant CAGR over the studied period. This is mainly due to the rapid shift toward organic gardening and lawn care practices. This, in turn, boosts the demand for bioherbicides that comply with organic certification standards. These natural alternatives are essential for maintaining the health of turf and ornamental grass, reducing reliance on harmful synthetic chemicals. As consumer interest grows in organic green spaces, bioherbicides emerge as a viable solution for effective weed control while simultaneously safeguarding the health of plants, soil, and the surrounding ecosystem.

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client