May 2025

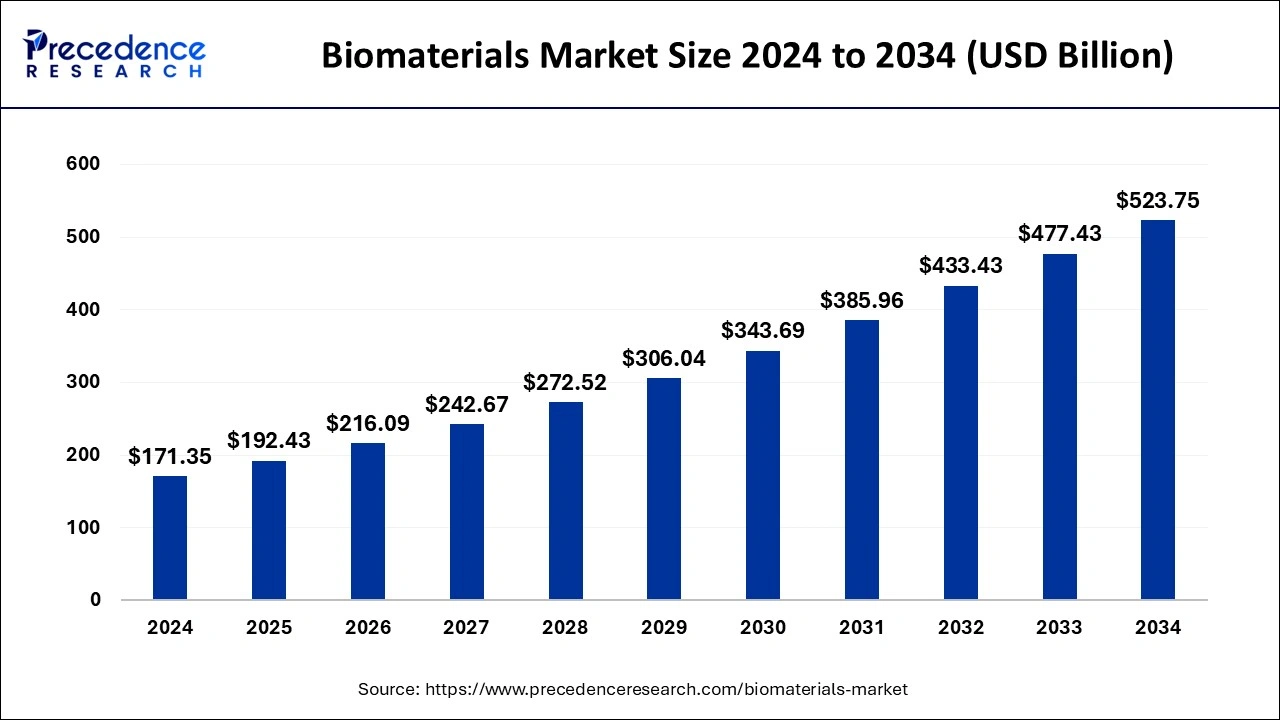

The global biomaterials market size estimated at USD 192.43 billion in 2025 and is anticipated to reach around USD 523.75 billion by 2034, expanding at a CAGR of 11.82% from 2025 to 2034. The North America biomaterials market size is estimated at USD 75.05 billion in 2025 and is expanding at a CAGR of 11.85% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global biomaterials market size accounted for USD 171.35 billion in 2024 and is pridicted to reach around USD 523.75 billion by 2034, growing at a CAGR of 11.82% from 2025 to 2034.

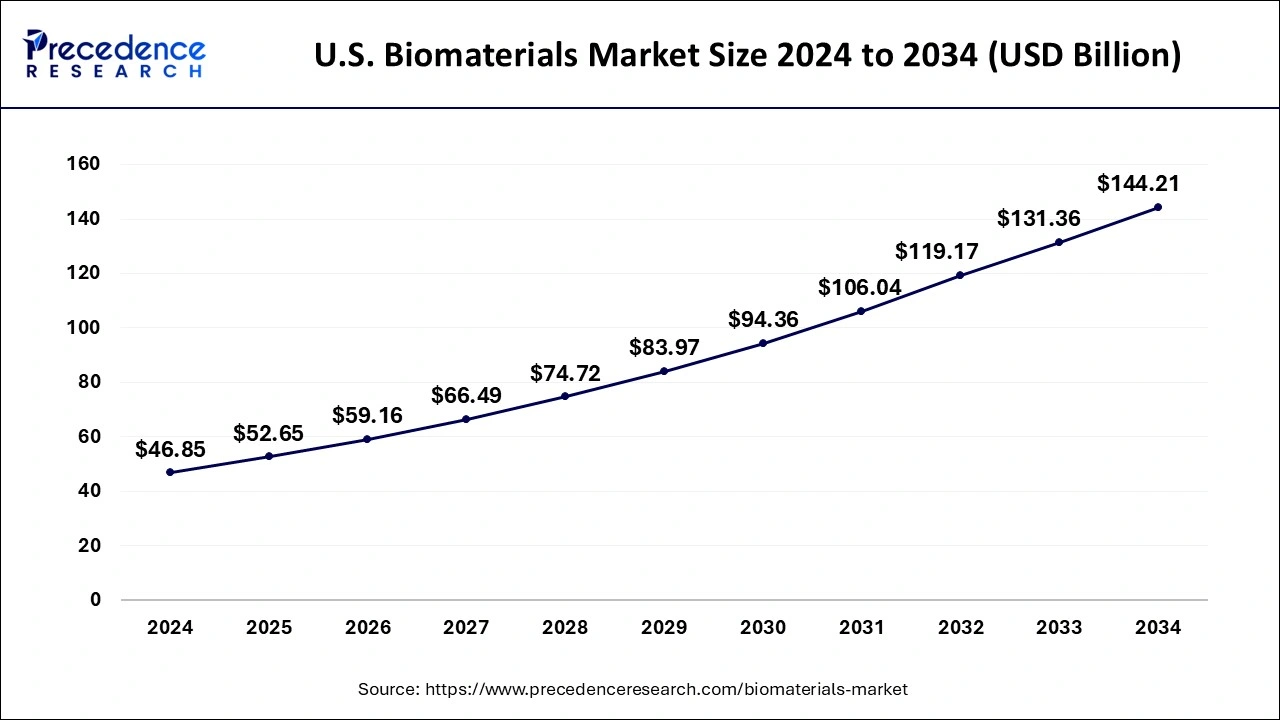

The U.S. biomaterials market size was valued at USD 46.85 billion in 2024 and is expected to reach USD 144.21 billion by 2034, poised to grow at a CAGR of 12% from 2025 to 2034.

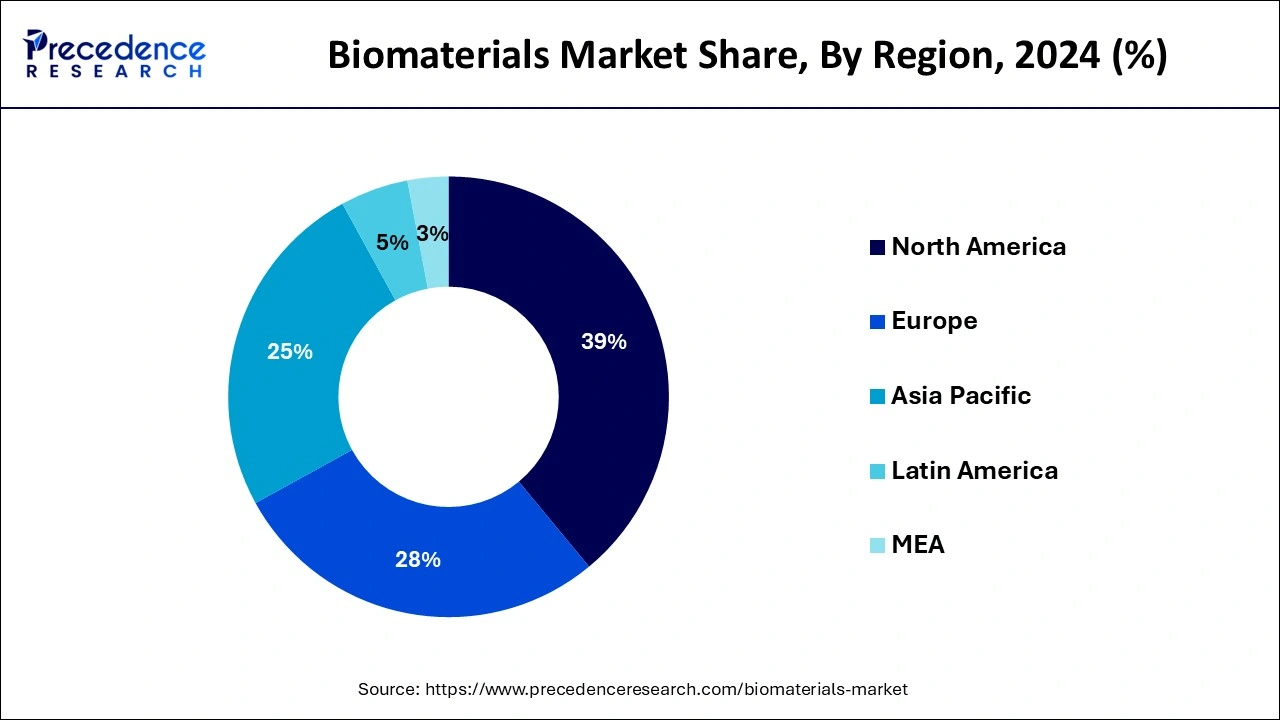

In terms of revenue, North America dominated the global biomaterials market due to initiatives taken by different private and public organizations. Some of the organizations include the National Institute of Standards and Technology and the National Science Foundation that provide assistance and knowledge pertaining to usage of biomaterials in various biomedical applications. This resulted in significant growth in the adoption of biomaterials in the region.

On the other hand, the Asia Pacific anticipated to witness the fastest growth during the analysis period. This is attributed to the major strategies adopted by the regional players to reinforce their presence in both global as well as regional market. For instance, in 2019, Mitsubishi Chemical, a Japan-based company, acquired thermoplastic polyurethane elastomer business from U.S.-based AdvanSource Biomaterials. The acquisition analyzed to help the company to expand its footprint in the global market along with capturing significant share in the international market.

The biomaterials market is a wide-spread industry that revolves around the production and application of products or materials that interact with biological systems. These materials are used in multiple healthcare applications, such as implants, prosthetics and tissue engineering. The global market offers a wide range of materials like polymers, ceramics and composites, designed to be biocompatible and serve specific functions within the human body.

Biomaterials are widely used in dental applications, ophthalmology, cosmetic surgeries, drug delivery systems and wound healing. In addition, biomaterials are widely used to create various medical implants, such as artificial joints and cardiac stents.

The market’s current position is observed to get accelerated as the industry is witnessing advancements in medical technology and improvements in the quality of healthcare services. Significant research and development activities are also observed to promote the market’s expansion in the upcoming period.

Rising prevalence of chronic skeletal and musculoskeletal medical conditions are predicted to propel the demand for biomaterial-based implants, thereby fuelling the market growth. Further, technological advancements have made biomaterials more diverse and have increased their application in various fields such as tissue engineering and bioengineering. The advent of smart biomaterials drives the revenue generation in this market. Increasing demand for smart biomaterials that transfer and produce bioelectric signals similar to body tissues for accurate physiological functions predicted to surge the market growth. Piezoelectric scaffold is a smart material that plays a significant role in tissue engineering.

| Report Highlights | Details |

| Market Size in 2024 | USD 171.35 Billion |

| Market Size in 2025 | USD 192.43 Billion |

| Market Size by 2034 | USD 523.75 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 11.82% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The rising rate of cosmetic surgeries

A report published by the International Society of Aesthetic Plastic Surgery stated that there was an overall 11.2% increase in procedures done by plastic surgeons in 2022. The report also stated that there were more than 14.9 million surgical procedures done in 2022 worldwide.

The demand for cosmetic surgeries and minimally invasive procedures has been on the rise in recent years. People are increasingly seeking enhancements to their physical appearance. This demand includes procedures such as facelifts and dermal fillers that require biomaterials. ongoing advancements in biomaterials have allowed safer and quicker cosmetic procedures. These biomaterials are designed to be biocompatible, reducing the risk of adverse reactions or complications. As the cosmetic industry expands, it is observed that the innovation of improved biomaterials will also increase. Thereby, the element is expected to sustain as a driver for the market.

Regulatory hurdles

The market for biomaterials (production and distribution) is observed to be affected by regulatory hurdles or regulatory challenges. The market is subjected to strict regulatory oversight due to safety concerns. Meeting these requirements can be time-consuming and costly. Such regulatory hurdles can directly impact on the production or investment in biomaterials industry. Regulatory hurdles can even increase the timeline for production of biomaterials. Thereby, the element associated with regulatory hurdles acts as a major restraint for the market.

Innovation in techniques for biomaterial production

Technological advancements allow for the development of new biomaterials with enhanced properties. This also expands the range of materials available for various applications, catering to specific needs in the medical and healthcare sectors. Innovations in biomaterial production are observed to lead to materials that are more biocompatible for the human body. Innovations in the production of biomaterials also broaden the range of potential applications and increase patient safety. Thereby, the element is observed to offer several potential opportunities for the market to expand.

By product, the polymer segment led the global biomaterials market with considerable revenue share in 2024 and projected to continue its dominance in the coming years. This is mainly attributed to the wide range of applications of polymer products. Wide availability of biopolymers along with need for advanced polymers for bio-resorbable tissue fixation application and other orthopedic applications expected to escalate the revenue growth of the segment.

Polymeric biomaterials are one of the keystones of tissue engineering. Continued progression in technologies, such as surface modification, micro manufacturing, nanotechnology, drug delivery, and high-throughput screening, play an important role in expanding the polymeric material usage in the tissue engineering field.

On the other hand, natural biomaterials anticipated to register the highest growth rate over the forecast period due to numerous benefits offered by the product over synthetic biomaterials related to biocompatibility, biodegradability, and remodeling. In the wake of these advantages, natural biomaterials are increasingly used for restoration and replacement of structure as well as function of the damaged tissues or organs.

The orthopedic application segment captured maximum revenue share in the global biomaterials market in 2024. Rising adoption of metallic biomaterials owing to their high load bearing capacity is one of the prime factors that drive the growth of the segment. Besides this, significant developments and on-going investments for the advancement in orthopedic implants by market participants are likely to propel the market growth in the next years to come. For instance, in November 2019, FDA approved Xiphos-ZF spinal interbody device introduced by DiFusion Inc. that is based on Zfuze, a different biomaterial that is made up of titanium and poly-ether-ether-ketone.

Moreover, plastic surgery analyzed to grow at a significant pace during the forecast period owing to increasing number of cosmetic procedures along with significant application of biomaterials in such surgeries. According to the International Society of Aesthetic Plastic Surgery report 2019, nearly 4.3 Million cosmetic procedures were performed in the U.S. during the year 2018 that positively influences the growth of the segment.

The global biomaterials market is highly competitive due to significant investments from market players to maintain a competitive edge and expand their presence. These vendors also adopt inorganic growth strategies such as partnerships, agreements, collaboration, and merger & acquisition to strengthen their product portfolio. They also invest in the development of biomaterials to expand their offerings.

By Product

By Application

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025