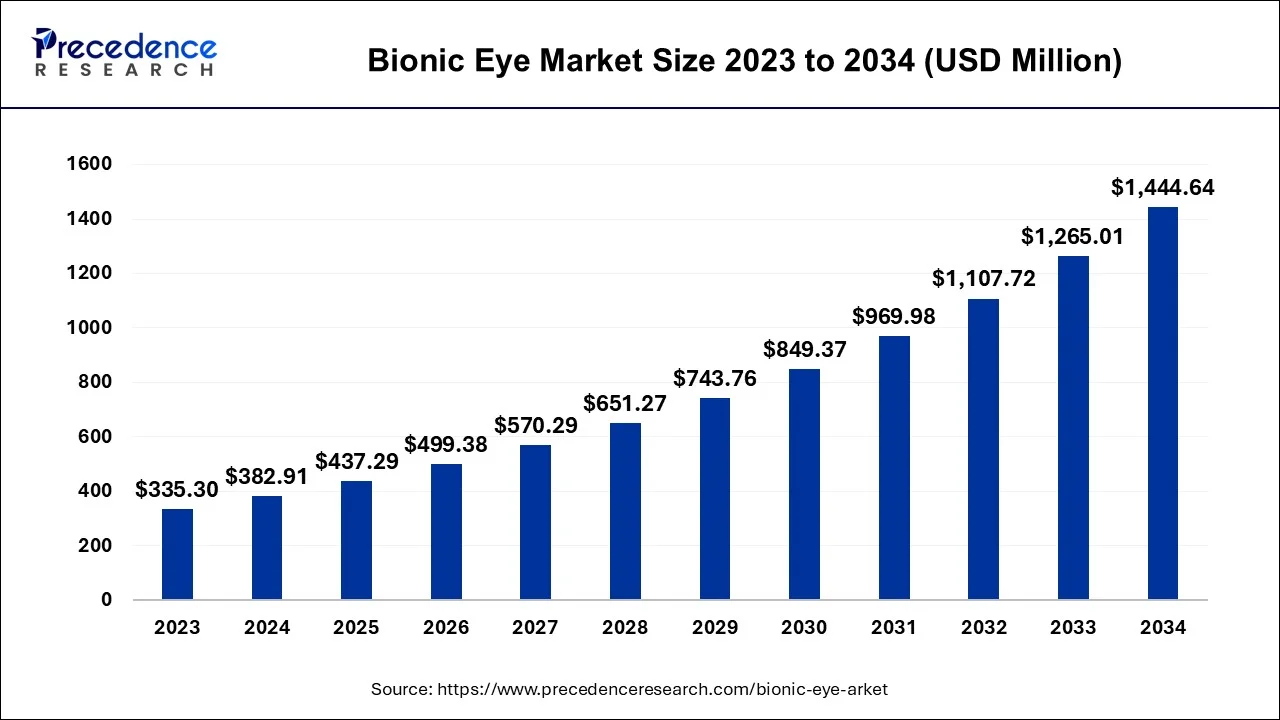

The global bionic eye market size is estimated at USD 382.91 billion in 2024, grew to USD 437.29 million in 2025 and is predicted to surpass around USD 1444.64 million by 2034, expanding at a CAGR of 14.20% between 2024 and 2034. The North America bionic eye market size accounted for USD 176.14 million in 2024 and is anticipated to grow at a fastest CAGR of 14.21% during the forecast year.

The global bionic eye market size accounted forUSD 382.91 billion in 2024, grew to USD 437.29 million in 2025 and is antoicipated to reach around USD 1444.64 million by 2034, expanding at a soild CAGR of 14.20% between 2024 and 2034.

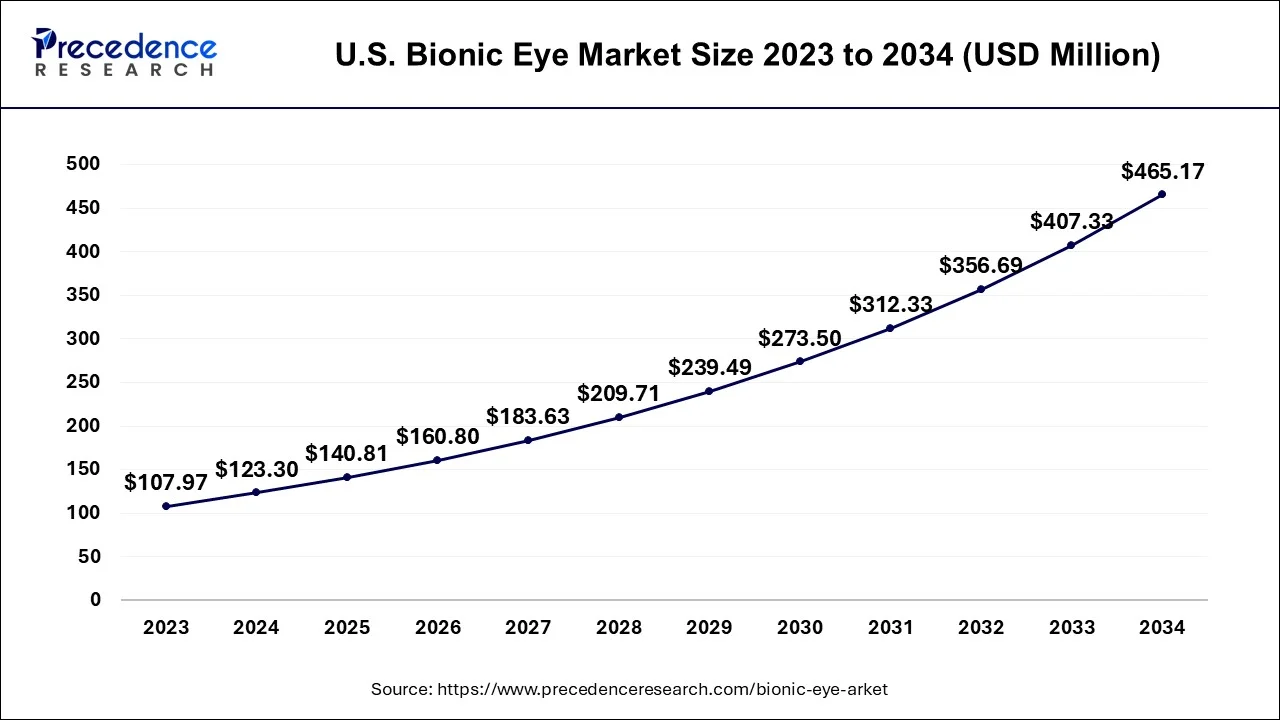

The U.S. bionic eye market size is estimated at USD 123.30 million in 2024 and is expected to be worth around USD 465.17 million by 2034, poised to grow at a CAGR of 14.24% from 2024 to 2034.

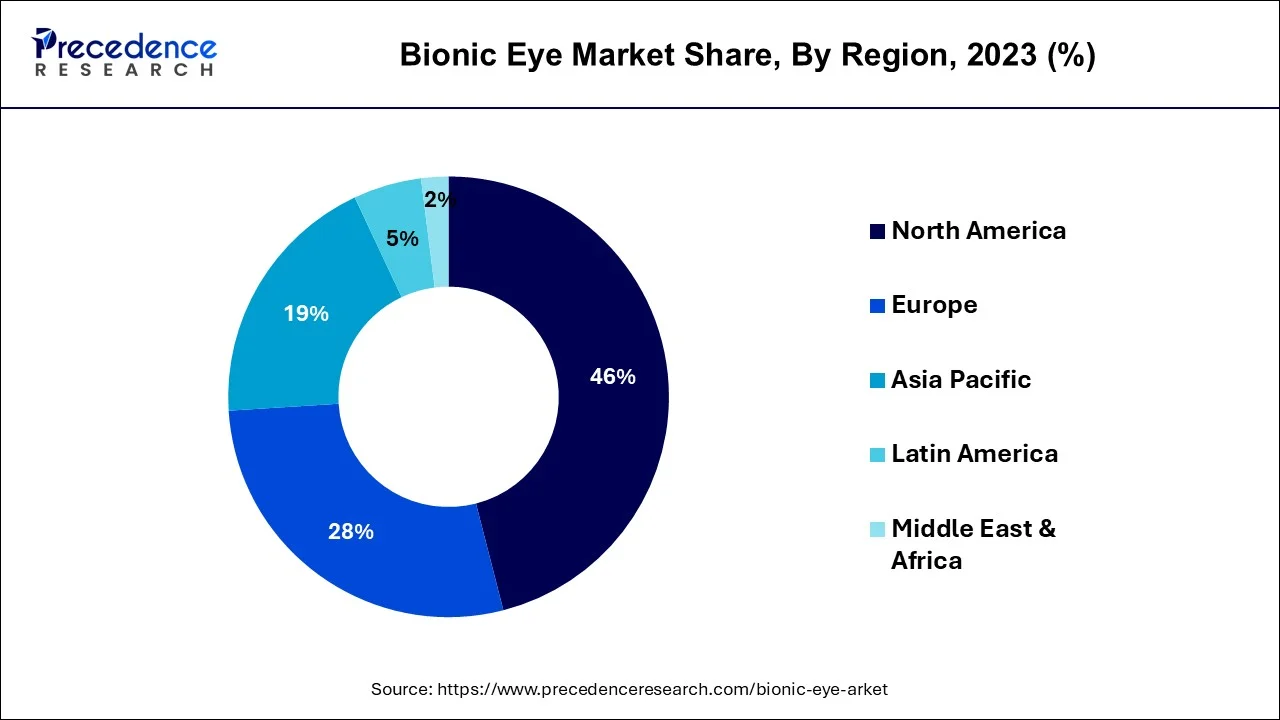

North America has held the largest revenue share 46% in 2023. The bionic eye market in North America is characterized by a robust research ecosystem and increased investment in innovative healthcare technologies. The region hosts several prominent companies specializing in bionic eye development. Moreover, the favorable regulatory environment and strong healthcare infrastructure contribute to the rapid adoption of bionic eye solutions. Rising partnerships between research institutions and industry players are driving technological advancements and expanding the applications of bionic eyes. The increasing prevalence of vision disorders in the aging population further propels market growth.

Asia Pacific is estimated to observe the fastest expansion. In Asia-Pacific, the bionic eye market is experiencing rapid growth driven by a rising prevalence of vision impairments, a surge in research and development initiatives, and increasing healthcare investments. The region's expanding healthcare infrastructure and a growing aging population are key contributors to the market's growth. Moreover, partnerships between local and international players in the field are fostering technological advancements and market expansion, making Asia Pacific a significant emerging market for bionic eye technologies.

Europe's bionic eye market is marked by a growing awareness of vision-related issues and an aging demographic. There is a strong emphasis on research and development, with a focus on improving the visual quality and functionality of bionic eyes. European countries are investing in healthcare innovation and forging partnerships to advance bionic eye technologies. Additionally, favorable reimbursement policies and a burgeoning patient pool create a conducive environment for market expansion. The European market is on the cusp of witnessing a surge in demand for bionic eye solutions as they become more sophisticated and versatile.

The bionic eye market is a dynamic segment of medical technology dedicated to creating visual prostheses and retinal implants. These cutting-edge devices are designed to restore vision for individuals facing vision impairments or blindness. By utilizing advanced electronics and microelectrode arrays, they simulate the functions of the human eye. This innovative approach aims to enhance visual perception and significantly improve the quality of life for patients, marking a promising advancement in the field of ophthalmology.

The bionic eye market combines cutting-edge engineering, neuroscience, and ophthalmology to create artificial vision solutions. These devices offer promising prospects for individuals with conditions like retinitis pigmentosa and age-related macular degeneration, ultimately promoting increased independence and improved daily living for those affected by vision loss.

| Report Coverage | Details |

| Growth Rate from 2024 to 20324 | CAGR of 14.20% |

| Market Size in 2024 | USD 382.91 Million |

| Market Size by 2034 | USD 1,444.64 Million |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Technology, End Users, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising prevalence of vision disorders and technological advancements

The increasing incidence of vision-related disorders, such as retinitis pigmentosa and age-related macular degeneration, is driving the demand for bionic eye solutions. As these conditions become more prevalent, individuals seeking improved visual perception and quality of life are turning to bionic eyes. This growing patient base underscores the market's potential for expansion.

Moreover, the continuous strides in technological advancements have ushered in a new era of bionic eyes that offer enhanced functionality, precision, and user experience. Breakthroughs in microelectronics, materials, and neuroengineering have made these devices more effective and reliable. Improved image resolution, color perception, and motion detection capabilities are now within reach, making bionic eyes more appealing to potential users.

Additionally, the development of smaller, wireless, and remotely customizable bionic eye devices further surges market demand, providing users with greater convenience and flexibility. These technological innovations are driving patients and healthcare providers to explore bionic eye solutions, thereby boosting market growth.

Limited visual quality and invasive procedures

The visual quality provided by current bionic eyes, while a remarkable achievement, often falls short of the expectations of potential users. The images generated by these devices can lack clarity and may not offer a wide field of vision. This can lead to frustration and disappointment for patients who hope for near-normal or high-definition vision. The gap between expectations and reality can deter some individuals from pursuing bionic eye implants, limiting market demand.

Moreover, the invasive nature of the surgical procedures required for bionic eye implantation can be a significant restraint. These surgeries involve the insertion of electrodes or microelectrode arrays into the eye or the brain, which carries inherent risks. Potential complications, the need for highly skilled surgeons, and the discomfort associated with these procedures can dissuade individuals from opting for bionic eyes, constraining market growth. To expand market demand, developers must address these limitations by enhancing visual quality and reducing the invasiveness of implantation procedures.

Enhanced visual quality and expanded applications

The surge in market demand for the bionic eye market is significantly driven by the continuous enhancement of visual quality and the expansion of applications for these innovative devices. Improved visual quality is a critical factor in attracting potential users and increasing the adoption of bionic eyes. As technology advances, bionic eyes are offering users more realistic and detailed visual experiences. Enhanced image resolution, the ability to perceive colors, and even distinguish motion contribute to a more comprehensive and functional visual perception.

Moreover, the expansion of applications for bionic eyes is broadening their relevance and attractiveness to a wider audience, bionic eyes are also finding applications in fields like augmented reality (AR) and virtual reality (VR). These technologies are exploring the integration of bionic eyes to provide users with immersive and enhanced experiences.

Additionally, as bionic eyes become more versatile, their applications extend to areas such as medical diagnostics, aiding surgeons in performing intricate procedures and enabling more precise medical interventions. As the range of applications continues to grow, the market for bionic eyes is poised for substantial expansion, driven by the appeal of enhanced visual quality and a broader spectrum of uses.

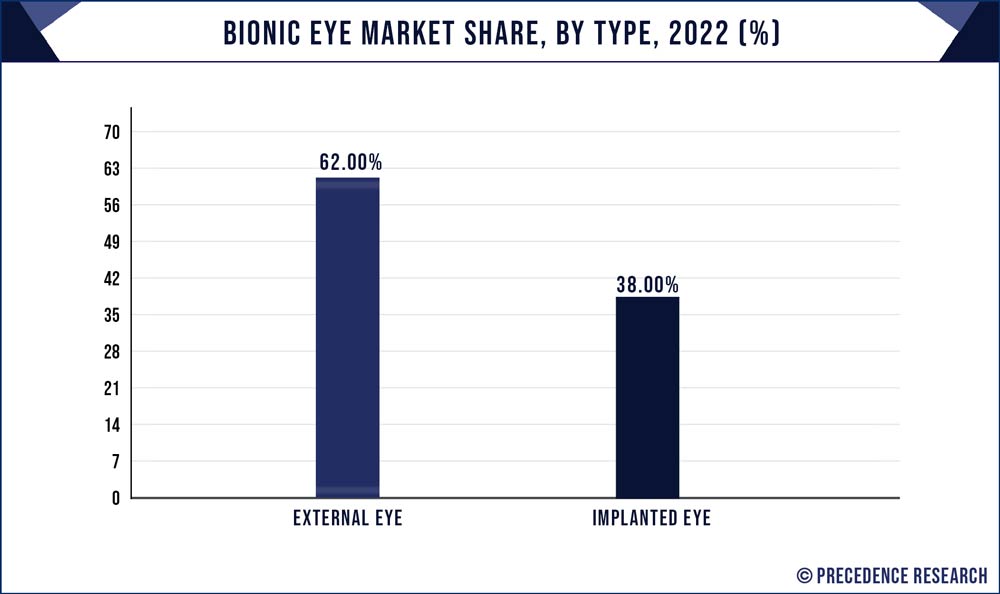

According to the type, the external bionic eyes segment has held 62% revenue share in 2023. External bionic eyes are wearable visual prostheses designed to restore vision for individuals with severe vision impairments or blindness. They typically consist of a camera that captures the surrounding environment, processes visual information, and transmits electrical signals to an implant or electrode array that interfaces with the remaining healthy retinal cells. Trends in external bionic eyes include miniaturization, improved camera technologies, and enhanced connectivity to other devices, offering users more discreet and integrated solutions for vision restoration.

The implanted bionic eyes segment is anticipated to expand at a significantly CAGR of 18.1% during the projected period. Implanted bionic eyes, also known as retinal implants, involve surgically implanted microelectrode arrays within the eye. These devices directly stimulate the retinal cells or interface with the visual cortex, bypassing damaged parts of the visual pathway.

The trends in implanted bionic eyes focus on refining surgical techniques, enhancing electrode materials for longevity and biocompatibility, and improving the user's experience, including higher visual acuity and expanded applications in daily life. Both external and implanted bionic eyes play crucial roles in the quest to restore vision and enhance the quality of life for visually impaired individuals.

The electronic bionic eyes segment held the largest market share of 72% in 2023. Electronic bionic eyes are based on microelectrode array technology and utilize electronic components to stimulate remaining healthy retinal cells or directly interface with the visual cortex. These devices are characterized by their ability to provide users with artificial but functional vision. The trend in electronic bionic eyes is towards improving electrode designs and developing more compact, implantable devices that offer enhanced visual acuity and greater compatibility with the user's visual cortex.

The mechanical bionic eyes segment is projected to grow at the fastest rate over the projected period. Mechanical bionic eyes, on the other hand, rely on physical mechanisms to mimic the natural eye's functions. These devices often incorporate miniature cameras and mechanical components to replicate the eye's movements. The trend in mechanical bionic eyes is moving towards enhancing their natural appearance and mobility, making them more user-friendly and cosmetically appealing. This trend includes the development of wireless control systems and improved eye movement precision, providing users with a more lifelike and functional alternative to traditional prosthetic eyes.

The vision loss and impairment segment has held 68% revenue share in 2023. Within the domain of vision loss and impairment, the bionic eye market serves individuals afflicted by various visual challenges, encompassing conditions like retinitis pigmentosa and age-related macular degeneration. These cutting-edge bionic eye solutions are designed to either restore or enhance the vision of those grappling with severe visual impairments, ultimately contributing to a notable enhancement in their overall quality of life. As technology advances, these solutions offer new hope to individuals previously considered untreatable, driving the growth of the bionic eye market.

The dry age-related macular degeneration (dry AMD) segment is anticipated to expand at a significant CAGR of 17.5% during the projected period. Dry AMD is a prevalent condition characterized by the deterioration of the macula, leading to central vision loss. In the bionic eye market, innovative bionic eye technologies are showing promise in addressing this condition. With ongoing research and development, there is a notable trend toward developing bionic eye solutions tailored to specifically target the visual challenges associated with dry AMD. These advancements offer new opportunities for patients, positioning the market as a key player in addressing age-related vision impairments and expanding its reach in the healthcare sector.

In 2023, the hospitals segment had the highest market share of 59% on the basis of the end user. Hospitals are central end-users in the bionic eye market, holding a critical role in the implantation and post-operative care of individuals receiving bionic eyes. These medical facilities offer specialized surgical units equipped with state-of-the-art technology.

A multidisciplinary team of healthcare professionals, including ophthalmologists and neurosurgeons, is trained to perform bionic eye implantation surgeries and oversee patient recovery. With the market's evolution, hospitals are progressively investing in advanced equipment and staff training to meet the increasing demand from individuals with vision impairments who seek bionic eye procedures for vision restoration.

The ophthalmic clinics segment is anticipated to expand fastest over the projected period. Ophthalmic clinics are specialized facilities that focus on the diagnosis and treatment of eye-related disorders, making them vital in the bionic eye market. These clinics often collaborate with bionic eye manufacturers and researchers to conduct clinical trials, patient assessments, and follow-up care for bionic eye recipients.

Ophthalmic clinics are witnessing a surge in demand as more patients explore bionic eye solutions. These clinics also serve as hubs for advancements in bionic eye technology, conducting trials to evaluate and improve device performance and patient outcomes, thereby contributing to the growth of the market.

Segments Covered in the Report

By Type

By Technology

By End Users

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client