January 2025

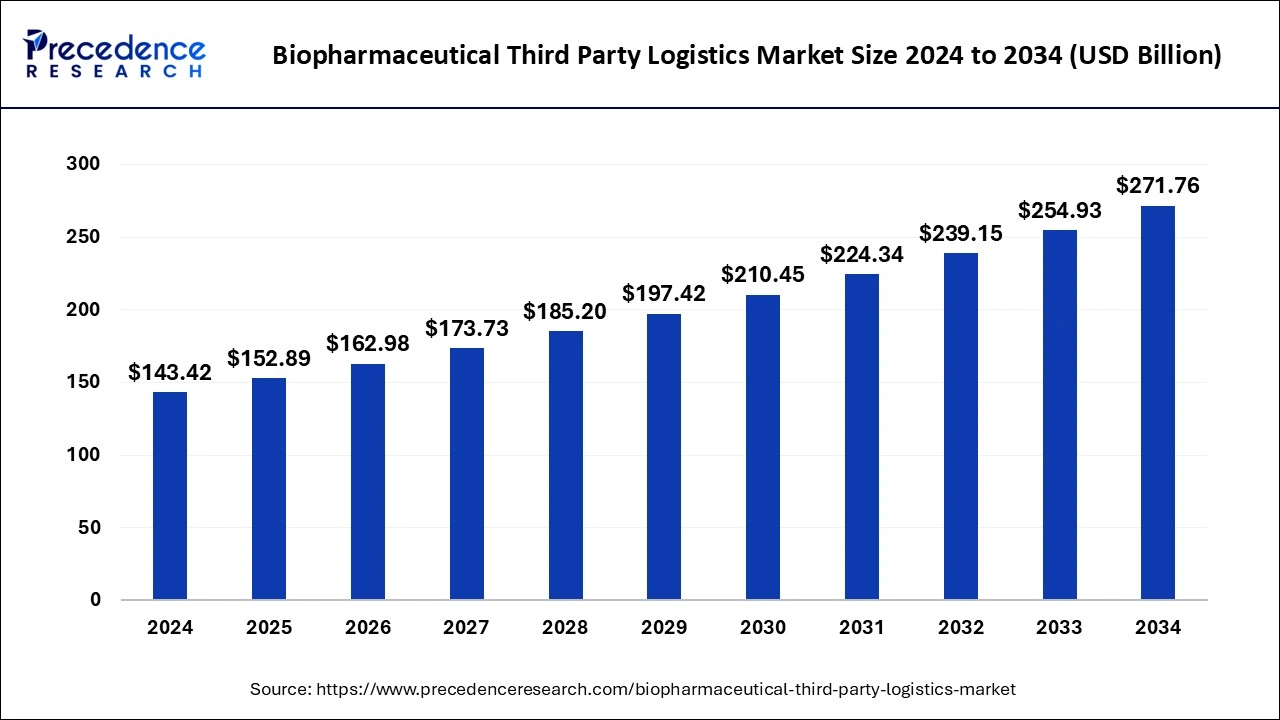

The global biopharmaceutical third party logistics market size is calculated at USD 152.89 billion in 2025 and is forecasted to reach around USD 271.76 billion by 2034, accelerating at a CAGR of 6.60% from 2025 to 2034. The North America market size surpassed USD 61.00 billion in 2024 and is expanding at a CAGR of 6.62% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global biopharmaceutical third party logistics market size accounted for USD 143.42 billion in 2024 and is expected to exceed around USD 271.76 billion by 2034, growing at a CAGR of 6.60% from 2025 to 2034. The market growth is driven by the increasing demand for efficient, temperature-sensitive logistics solutions and the growing production of biologics and personalized medicines.

AI assists the biopharmaceutical logistics industry by enhancing supply chain management's efficacy, precision, and rapidity. AI-driven systems help improve inventory by forecasting demand, efficient storage space usage, and properly handling sensitive products, such as drugs. AI analyzes data in real time, which contributes to efficient route mapping, reduced delivery time, and cost optimization. In addition, AI helps predict when transportation fleets may require maintenance, thus avoiding system failures and guaranteeing the on-time delivery of crucial pharmaceuticals.

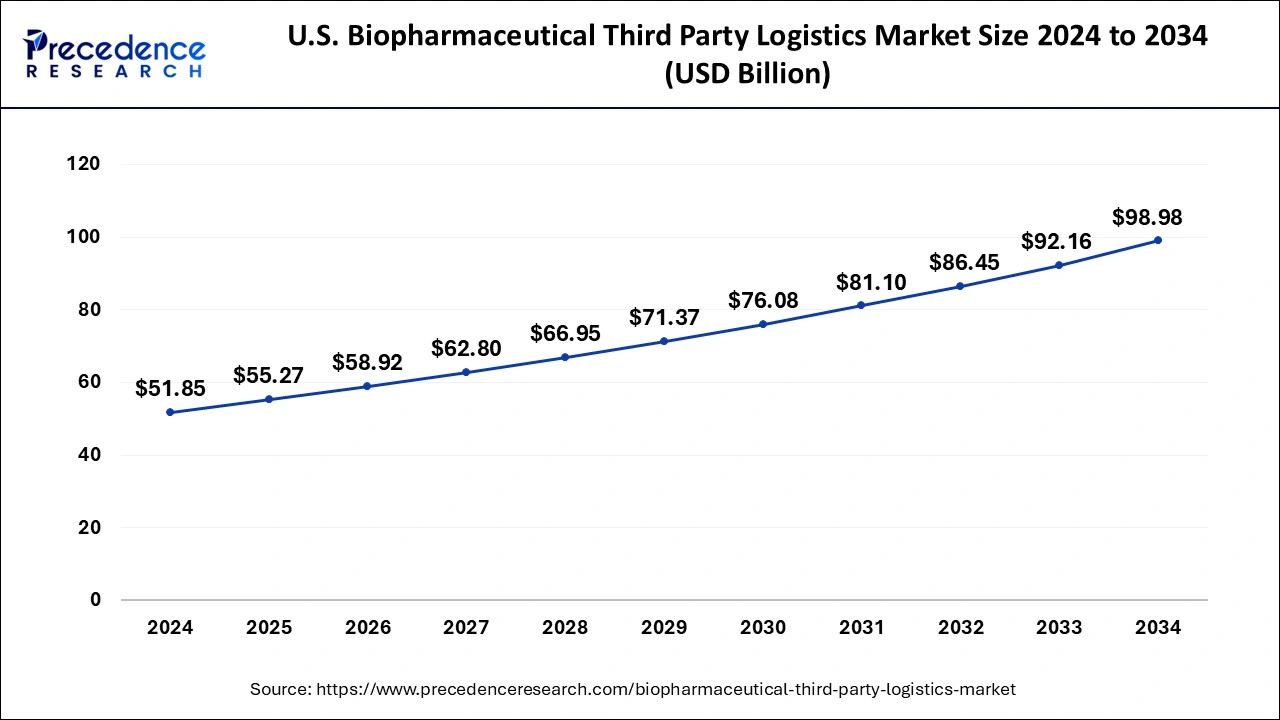

The U.S. biopharmaceutical third party logistics market size was exhibited at USD 51.85 billion in 2024 and is projected to be worth around USD 98.98 billion by 2034, growing at a CAGR of 6.68% from 2025 to 2034.

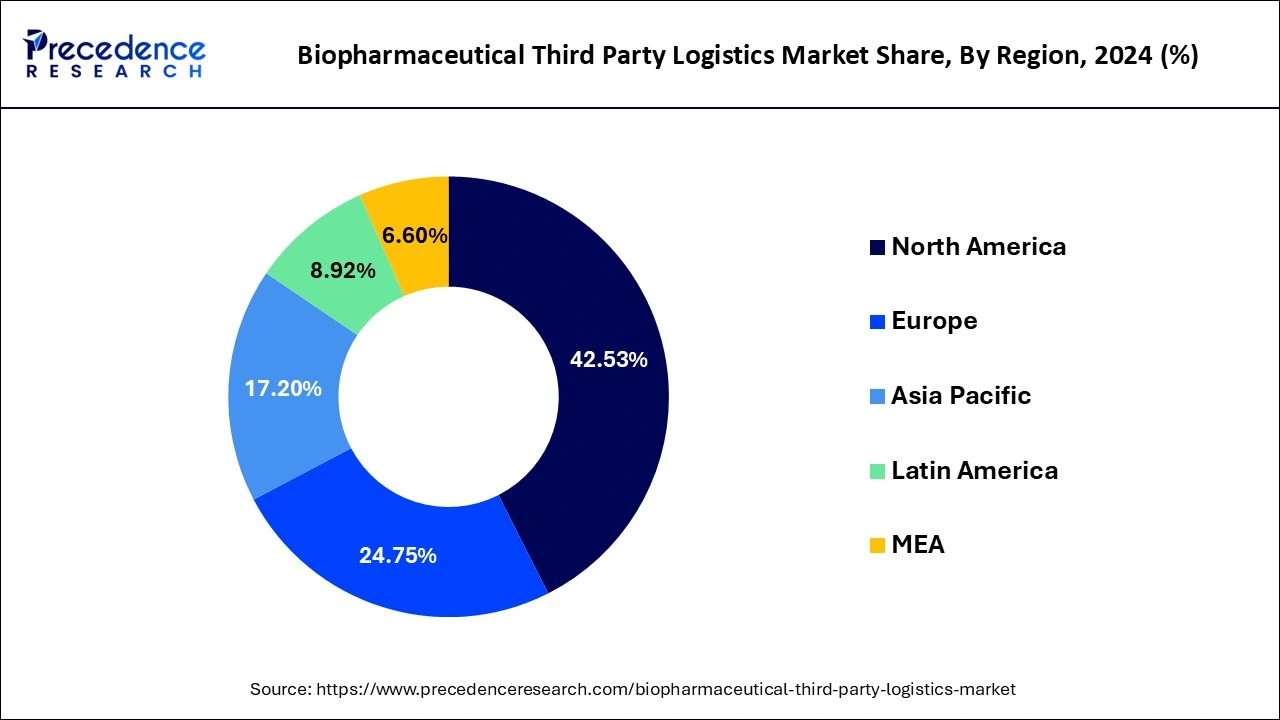

North America was the highest revenue contributor with a market share of around 42% in 2022. This is mainly attributed to the dominance of North America in the biopharmaceutical industry. North America is characterized with the presence of huge biopharmaceutical giants. In fact, the majority of the patents for the newly developed medicines belongs to US. The rapidly growing biopharmaceutical industry in North America is the major driver of the market. Moreover, the burgeoning demand for the various biologics in the region is expected to further drive the growth of the market in the forthcoming years. The increased adoption of the advanced technologies and the rising healthcare expenditure is fueling the growth of the biopharmaceutical industry, which in turn is fostering the growth of the biopharmaceutical third party logistics market.

Asia Pacific is estimated to be the fastest-growing market during the forecast period. The rapidly growing geriatric population and surging adoption of the biologics among the population, owing to the growing prevalence of various chronic diseases is expected to spur the growth of the biopharmaceutical third party logistics market in this region. The expanding manufacturing units of biopharmaceuticals in the countries like China, India, and South Korea is offering immense growth opportunities to the market players in Asia Pacific region.

Third-party logistics providers in the biopharmaceutical industry offer various services, such as warehousing, packaging, transportation, and distribution. They also provide customized services, which are essential for maintaining the stability and effectiveness of biopharmaceuticals. The growing geriatric population, rising prevalence of chronic diseases, rising healthcare expenditure, and growing demand for biopharmaceutical drugs are some of the major factors that contribute to the growth of the biopharmaceutical third party logistics market. Moreover, the rising demand for biosimilars boosts the market growth.

The development of temperature monitoring technologies is another factor that boosts market growth. Several apps have been introduced to monitor the temperature of certain temperature-sensitive medicines that can be operated through a smartphone. For instance, Onset’s InTemp CX400 mobile application is a pharmaceutical cold chain monitoring app that sends notifications to the user regarding temperature excursions and allows users to monitor temperature. The development and deployment of such technologies ensure the safety of the medicines. The adoption of third-party logistics services significantly helps biopharmaceutical companies to reduce their overhead expenses.

| Report Coverage | Details |

| Market Size by 2025 | USD 152.89 Billion |

| Market Size in 2034 | USD 271.76 Billion |

| Growth Rate | CAGR of 6.60% from 2025 to 2034 |

| Leading Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Supply Chain, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing Demand for Temperature-sensitive Shipments

Many biopharmaceutical companies demanding temperature-sensitive shipments are expected to drive the market. Maintaining the stability and efficacy of drugs is essential, and certain temperatures are required during transportation. The increase in demand for biologics and vaccines, which call for particular temperature conditions, is also boosting the demand for temperature-sensitive shipment. Temperature-controlled warehousing and cold chain solution providers are key to the requirements. For example, transporting products like monoclonal antibodies, vaccines, and insulin requires temperature control solutions in the temperature range between 2-8°C. Furthermore, stringent regulations regarding the proper handling and distribution of these products contribute to market expansion.

High Costs of Temperature-controlled Logistics

High costs of temperature-controlled logistics services are expected to hamper market growth. Temperature-controlled logistics solutions require additional equipment, such as temperature monitoring devices and sensors, resulting in high costs. Perishable commodities often require cold chain logistics to control temperature during storage and transportation. However, ensuring the integrity of the cold chain can be challenging, and any failures can lead to product spoilage. Moreover, logistic providers must meet all necessary guidelines set by regulatory bodies to ensure the safety of biopharmaceuticals, which can limit their operational flexibility.

Rising Number of Clinical Trials and Research Activities

The rising number of clinical trials and research activities creates immense opportunities for logistics providers. The rise in clinical trials across the world, especially for advanced biologics and other gene therapeutic products, boosts the need for efficient solutions to transport medical trial goods, investigational products, and biological materials. Companies that operate as third-party logistics providers and carry out clinical trial product shipment services cater to temperature control requirements in the pharmaceutical industry.

Based on the service type, the warehousing & storage segment accounted for a market share of over 43% and dominated the global biopharmaceutical third party logistics market. The surging demand for the warehousing and storage services among the life sciences and pharmaceutical companies has favored the growth of this segment. The warehousing & storage services helps the life science companies to reduce their overheads and contribute towards increasing their profitability. The service providers are also offering value added services like warehousing and packaging, which further attracts the pharmaceutical companies. Moreover, the availability of the robots, and code scanners reduces the turnaround time has boosted the growth of this segment.

The others segment is expected to grow at a significant rate throughout the forecast period. The other segment includes value-added services like custom, packaging, procurement services, duty management, and few other type of services. The third party logistic service providers are heavily investing in the value-added services to gain competitive edge and attract clients. Therefore, the surging investments in the value added services is expected to drive the growth of this segment.

Depending on the supply chain, the non-cold chain logistics dominated the global biopharmaceutical third party logistics market. This segment accounted for a market share of around 81% in 2020. This is attributed to the increased sales of the pharmaceuticals through the distributors. The logistic services offers scalability, reduction of operational cost, higher returns, and lower risks. All these advantages offered by the third party logistic providers has made it an integral part of the biopharmaceutical industry.

On the other hand, the cold chain is estimated to be the most opportunistic segment during the forecast period. The development and rapid growth of the biologics is a major factor that drives the growth of this segment. The biologics require time and temperature controlled distribution.

The biopharmaceutical third party logistics market is moderately fragmented with the presence of several top market players. These market players are investing heavily in the value-added services to gain competitive advantage and gain market share. Furthermore, these market players are engaging in various developmental strategies such as product launches, partnerships, joint ventures, and mergers to exploit the prevailing market opportunities.

By Service Type

By Supply Chain

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

February 2025

October 2024