January 2025

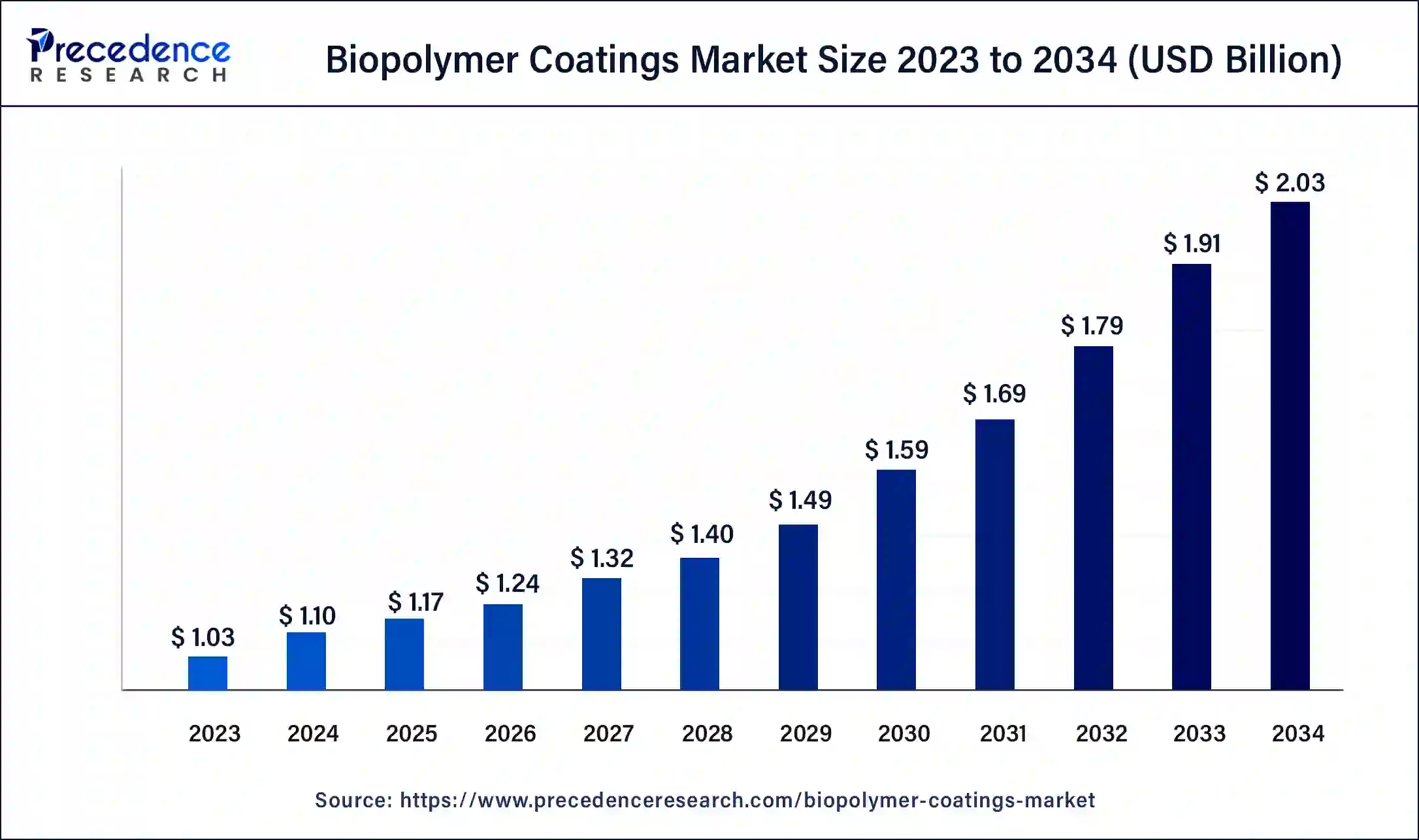

The global biopolymer coatings market size was USD 1.03 billion in 2023, calculated at USD 1.10 billion in 2024 and is projected to surpass around USD 2.03 billion by 2034, expanding at a CAGR of 6.3% from 2024 to 2034.

The global biopolymer coatings market size accounted for USD 1.10 billion in 2024 and is expected to be worth around USD 2.03 billion by 2034, at a CAGR of 6.3% from 2024 to 2034.

Biopolymer coatings are protective layers made from eco-friendly and biodegradable materials obtained from plants, microbes, and other biological sources. These coatings come in different forms, such as proteins, starch, and chitosan. They find applications in the medical, pharmaceutical, and agricultural fields. They are mainly used to prevent contamination and extend the life of products by protecting their surfaces from damage, pressure, or wear.

Biopolymer coatings offer an edge over petroleum-based materials, as they reduce the environmental impact. With the growing focus on sustainability to reduce carbon footprint, the biopolymer coatings market has witnessed significant growth over the years due to the rising popularity of these protective coatings among industries.

The increasing government initiatives to promote the use of biodegradable materials in various industries, including packaging, automotive, and healthcare, to reduce carbon emissions are major factors that boost the growth of the global biopolymer coatings market. For instance, in February 2024, Danimer Scientific, a leading manufacturer and developer of biodegradable materials, announced the expansion of its business in Rochester, New York. A special biodegradable material called Rinnovo, produced at cheaper prices, is tested in this plant. This expansion has further enhanced the facility's production capacity, producing 20 tons of Rinnovo, which is 20 times more than before. Moreover, government regulation against the manufacturing of single-use plastics in several countries encouraged plastic manufacturers to ramp up their biodegradable plastic production.

The growing environmental concerns and the rising usage of biodegradable products further propel the demand for biopolymer coatings. With the rising concerns regarding environmental degradation, the use of biodegradable products, including biopolymer coatings, has increased. This also triggered the rate of research & development in the field of biopolymer coatings and bioplastics. For instance,

Apart from notable developments in bioplastics and biopolymer coatings, the market is still emerging and has a promising future growth opportunity. To curb environmental pollution, governments and plastic manufacturing companies are collaborating or partnering to move the future towards a more renewable and greener environment. Henceforth, the aforementioned factors are likely to support the growth of the biopolymer coatings market remarkably in the coming years.

| Report Coverage | Details |

| Market Size in 2023 | USD 1.03 Billion |

| Market Size in 2024 | USD 1.10 Billion |

| Market Size by 2034 | USD 2.03 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.4% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, End-User and Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Advancements in Material Science: The need for improved biopolymer coatings with better features prompted advancements in materials. Therefore, key market players are continuously focusing on innovation, which has resulted in improved biopolymer coatings with the best resistance properties to chemicals and moisture, making them suitable for various industrial applications.

Rising Environmental Concerns: The growing usage of plastic in several industries at a mass level has led to a rise in environmental concerns, resulting in rising adoption of biopolymers that are eco-friendly and cause less harm to the environment. Thus, biodegradable polymers such as polylactic acid, cellulose, starch, and poly(vinyl alcohol) are in high demand in the food & beverages and pharmaceutical industries for packaging applications. This major change boosts the biopolymer coatings market.

High Cost: While biopolymers exhibit exceptional properties over synthetic polymers, their high costs may limit their adoption. Additionally, the prices of raw materials and technologies required for producing biopolymer coatings are usually high. This may deters new entrants from investing in the market, thus hampering the market growth.

Government Initiatives and Expanding Area of Application: In many countries, governments have begun implementing stringent regulations to reduce the usage of plastics and minimize plastic waste generated by industries. This has forced industries to use biopolymers, as they can easily decompose and cause less harm to the environment. Moreover, the rising area of applications of biopolymer coatings further boosts their adoption to a larger extent.

The bio PU coatings segment captured the largest share of the market in 2023. This is mainly due to its wide application in the automotive, architectural, furniture, and textile industries. The segment growth is also attributed to the low environmental impact, biodegradability, easy availability, and low cost of bio PU coatings. These coatings are made from renewable sources, such as biomass or plant-based oils, thus reducing reliance on fossil fuels and minimizing environmental impact.

The bio PBS coatings segment is projected to expand at a substantial growth rate in the coming future. These coatings have superior biodegradability, melt processability, thermal properties, and chemical resistance, making them suitable for food & beverage packaging, resulting in the rising demand in the food & beverages industry. On the other hand, the PLA coatings segment is also anticipated to grow rapidly during the forecast period, owing to their high use in the food & beverage industry. PLA-based biopolymer coatings are widely used for vegetable, fruit, alcohol, nut, and water packaging.

The packaging industry segment led the market in 2023. This is mainly due to the rising demand for sustainable packaging solutions across various industries. The growing environmental concerns worldwide increased the demand for eco-friendly packaging materials. This further encourages packaging companies to invest in biopolymers, as they are a promising alternative to chemical-based polymers.

Asia Pacific dominated the market with the largest share in 2023 due to rapid industrialization in developing countries, such as China and India. These countries are the fastest-growing in terms of food packaging, medical, automotive, and various other industries. Moreover, these countries are increasingly focusing on achieving sustainability goals. Other than India and China, Australia, Japan, Singapore, Malaysia, and other Asian countries are also flourishing well in the industrial growth that propels the growth of the biopolymer coatings market in the region.

The market in North America is projected to expand at a high CAGR in the coming years due to the rapid expansion of the food and packaging industries in the region, significantly boosting the demand for biopolymer coatings. Moreover, the increasing demand for sustainable packaging solutions is expected to contribute to the regional market expansion.

Segments Covered in the Report

By Product

By End User

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

January 2025

January 2025