March 2024

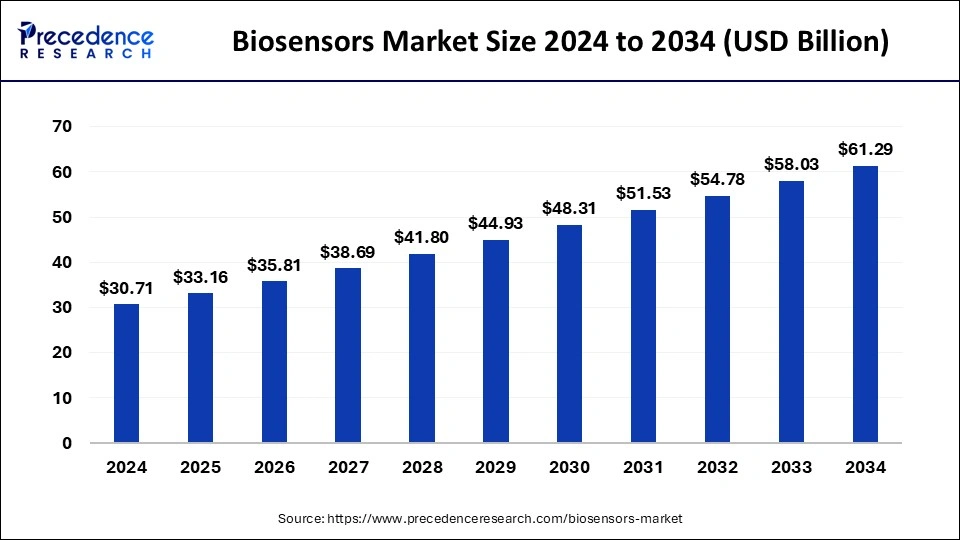

The global biosensors market size accounted for USD 33.16 billion in 2025 and is forecasted to hit around USD 61.29 billion by 2034, representing a CAGR of 7.07% from 2025 to 2034. The North America market size was estimated at USD 12.12 billion in 2024 and is expanding at a CAGR of 6.83% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global biosensors market size was calculated at USD 30.71 billion in 2024 and is predicted to increase from USD 33.16 billion in 2025 to approximately USD 61.29 billion by 2034, expanding at a CAGR of 7.07% from 2025 to 2034.

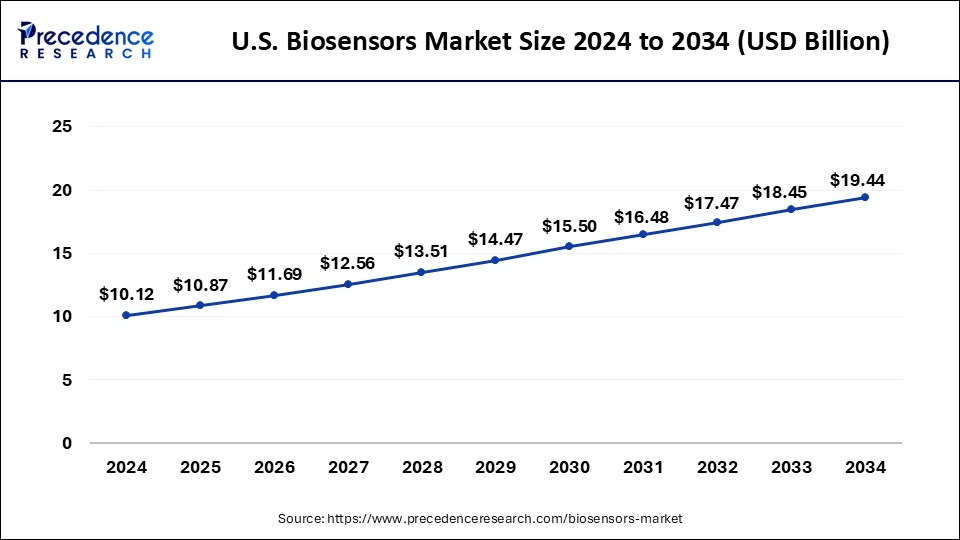

The U.S. biosensors market size was exhibited at USD 10.12 billion in 2024 and is projected to be worth around USD 19.44 billion by 2034, growing at a CAGR of 6.67% from 2025 to 2034.

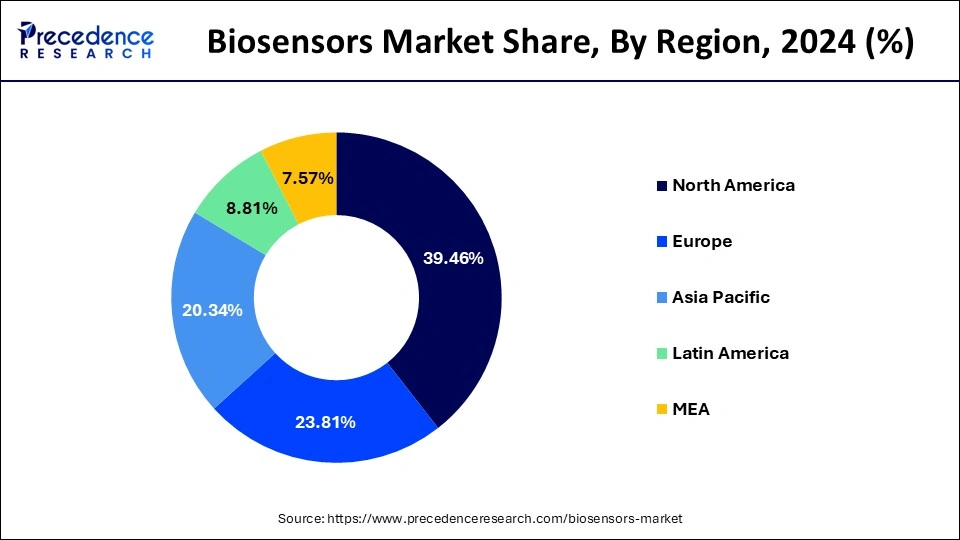

North America dominated the biosensors market in 2024 with 39.46% revenue share. The factors such as rising prevalence of chronic disorders, growing health awareness among the consumers, expansion of healthcare sector, and technological advancements are driving the growth of biosensors market in the region. In addition, the biosensors market in North America region is being driven by growing healthcare expenditures. Moreover, market players are adopting various strategies for increasing their market share in biosensors market. For example, Nova Biomedical got Food and Drug Administration (FDA) approval for its Stat Profile Prime Plus device in point of care use in 2020.

North America Top countries

Pioneering Precision Sensing with Innovation

The U.S. is the central hub of biosensor innovation, housing major players and advanced regulatory support. Emerging market with growing adoption in agricultural and environmental biosensing. Manufacturing base for biotech and biosensor assembly due to tax incentives. It holds a leading position in the biosensor market, driven by strong R&D infrastructure, a robust healthcare system, and favorable reimbursement policies.

Canada has strong academic research backing and an increasing focus on portable diagnostics, driven by research-led advancements, particularly in biopharma and healthcare diagnostics. Canada benefits significantly from the presence of globally renowned biosensor manufacturers and frequent technological breakthroughs in diagnostics and point-of-care testing.

Europe, on the other hand, is expected to develop at the fastest rate during the forecast period. The UK dominates the biosensors market in Europe region. In 2018, the International Diabetes Federation estimated that 32.7 million persons in Europe had diabetes. Thus, the growing prevalence of life related diseases are driving the demand for biosensors in Europe region. In addition, growing geriatric population is also driving the growth of biosensors market in this region.

Europe Major contributing factors

Empowering Sensing with Sustainability and Safety

Worldwide product highlights

| Country | Company | Product | Technological |

| U.S. | Medi sense | Glucose monitoring systems | Enzyme-based electrochemical |

| Switzerland | Roche diagnostics | Accu-Check biosensor platform | Nano-enhanced electrodes, wireless data |

| U.S. | Abbott Laboratories | Freestyle libre | Continuous glucose monitoring with a wearable |

| Sweden | Biacore | SPR biosensor | Surface plasmon resonance for label-free detection |

| Japan | Sysmex corporation | Immunoassay biosensor analyzer | Compact design, integrated AI for diagnosis |

The biosensors are used as medical devices to detect biological substances. The growth of global biosensors market is being driven by the rising prevalence of chronic disorders. According to World Health Organization (WHO), the incidence of chronic diseases is growing at a rapid pace. In addition, the adoption of innovative technologies such as artificial intelligence and internet of things are paving way for the growth opportunities for the global biosensors market.

The biosensors are widely used in healthcare sector for sensing, detecting, and monitoring various kind of disorders among the people. One of the key factors boosting the growth of global biosensors market is rising prevalence of diabetes all around the globe. The biosensors are used to detect blood glucose levels which are directly utilized for the detection of diabetes on a large scale. Thus, this factor is supporting the growth and development of global biosensors market.

The growth of the global biosensors market is being restricted by the stringent government regulations and reimbursement policies. In addition, the adoption of new and latest technologies is quite slow in low- and middle-income nations. This factor is hampering the growth of the biosensors market.

| Report Coverage | Details |

| Market Size by 2034 | USD 61.29 Billion |

| Market Size in 2025 | USD 33.16 Billion |

| Market Size in 2024 | USD 30.71 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.07% |

| Dominated Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Type, Application, End Use, Technology, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

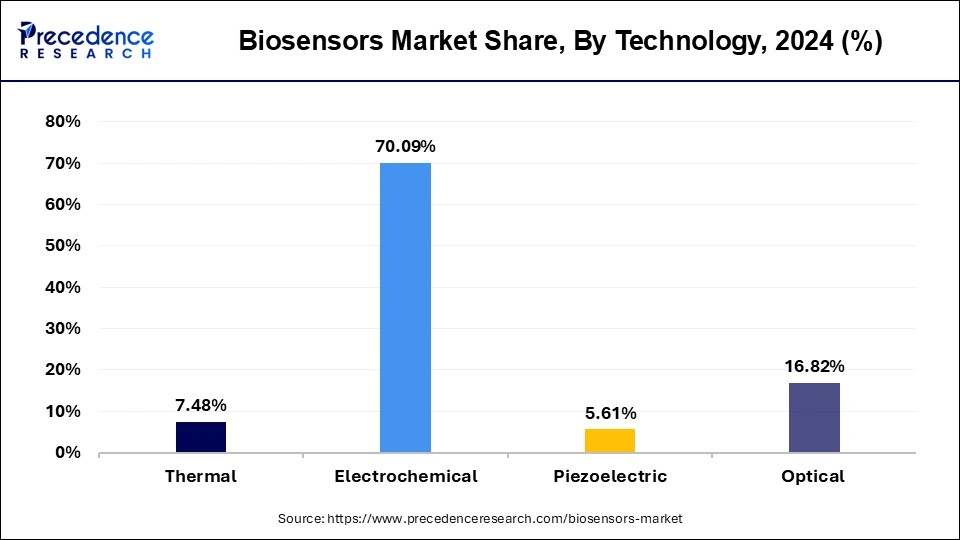

The electrochemical segment garnered revenue share of around 70.09% in 2024. The electrochemical technology is quite advantageous than other types of technologies. The electrochemical biosensors are low in cost and needs low power to operate. As a result, major market players utilize electrochemical technology while manufacturing biosensors. This factor is driving demand for biosensors in the global market.

The optical segment is fastest growing segment of the biosensors market in 2024. The optical biosensors are widely used in the healthcare industry. The optical biosensors are beneficial in nature as compared to traditional biosensors. These types of biosensors help in quick sample preparation and picks biological element by sensing the molecules. Thus, the market for optical biosensors is expected to grow in the near future.

Global Biosensors Market Revenue, by Technology (USD Million)

| Technology | 2022 | 2023 | 2024 |

| Thermal | 1,963.52 | 2,123.40 | 2,296.84 |

| Electrochemical | 18,547.42 | 19,977.59 | 21,523.09 |

| Piezoelectric | 1,489.49 | 1,601.13 | 1,721.54 |

| Optical | 4,354.66 | 4,742.07 | 5,164.63 |

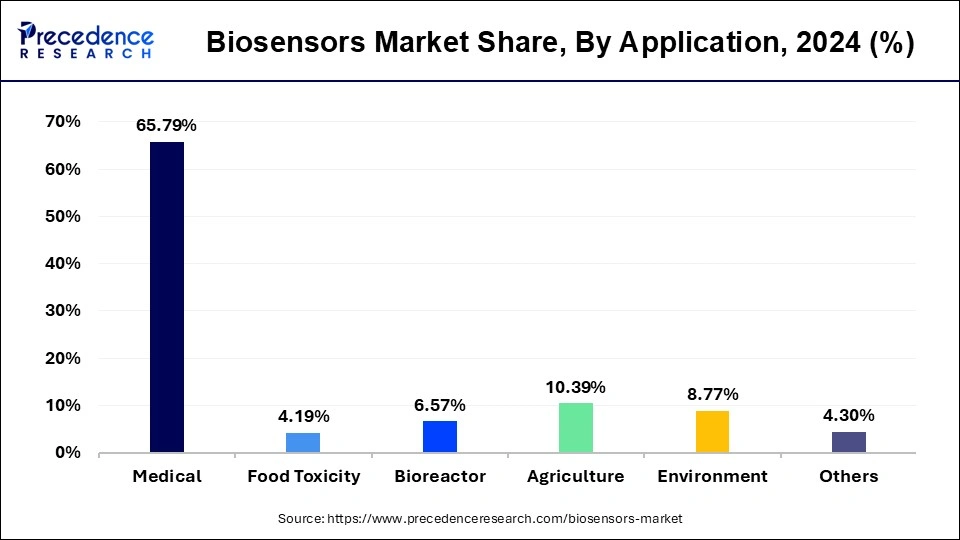

The medical segment accounted largest revenue share in 2024. The biosensors are widely utilized in the medical sector for detecting and diagnosing various disorders. This includes blood glucose tracking, pregnancy monitoring, and cholesterol testing. The biosensors are one of the important tools for detection of cancer and diabetes. Thus, the rising prevalence of such diseases is boosting the growth of global biosensors market.

The agriculture biosensors segment is fastest growing segment of the biosensors market in 2024. The biosensors in agriculture industry are gaining popularity nowadays. The biosensors help farmers to identify wide number of funguses in crops. The biosensors also detect bacteria in the farms. This is helping farmers to maximize their yield. The condition of soil is also determined through biosensors. Thus, biosensors’ demand is growing at a rapid pace for agriculture purpose.

Global Biosensors Market Revenue, by Application ( USD Million)

| Application | 2022 | 2023 | 2024 |

| Medical | 17,270.85 | 18,677.15 | 20,202.69 |

| Food Toxicity | 1,108.15 | 1,193.59 | 1,285.93 |

| Bioreactor | 1,744.69 | 1,875.45 | 2,016.49 |

| Agriculture | 2,704.70 | 2,936.61 | 3,189.15 |

| Environment | 2,292.17 | 2,483.76 | 2,692.00 |

| Others | 1,234.54 | 1,277.64 | 1,319.84 |

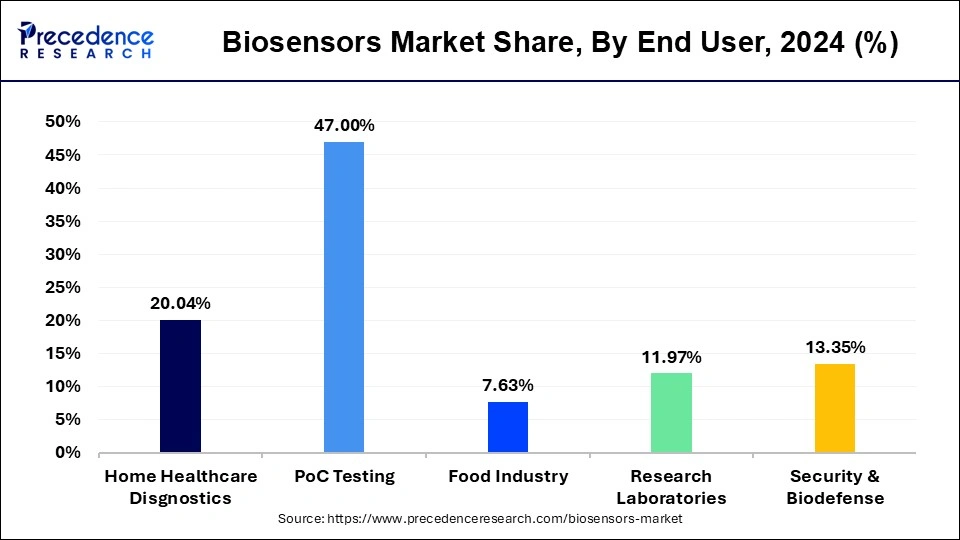

The point of care testing segment hit market share of 47.15% in 2024. The biosensors in the point of care testing market are growing due to the technological advancements. The market players are adopting innovative technologies for manufacturing of biosensors. The biosensors are used for monitoring saliva, urine, and blood of the human body. The results are accurate and precise in nature for detecting various diseases. In addition, growing research and development activities are also driving the growth of the segment.

The food industry segment is fastest growing segment of the biosensors market in 2024. The biosensors are largely used in the food processing sectors. The bacteria are detected in food preservatives. Thus, the growing demand for high quality food products is also driving the demand for biosensors in the food industry.

Global Biosensors Market Revenue, by End Use (USD Million)

| End Use | 2022 | 2023 | 2024 |

| Home Healthcare Disgnostics | 5,276.66 | 5,700.62 | 6,160.09 |

| PoC Testing | 12,350.90 | 13,369.92 | 14,476.40 |

| Food Industry | 2,001.43 | 2,170.88 | 2,355.23 |

| Research Laboratories | 3,167.81 | 3,405.23 | 3,661.32 |

| Security & Biodefense | 3,558.31 | 3,797.56 | 4,053.07 |

By Technology

By Application

By End User

By Type

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2024

February 2025

November 2024

November 2024