October 2024

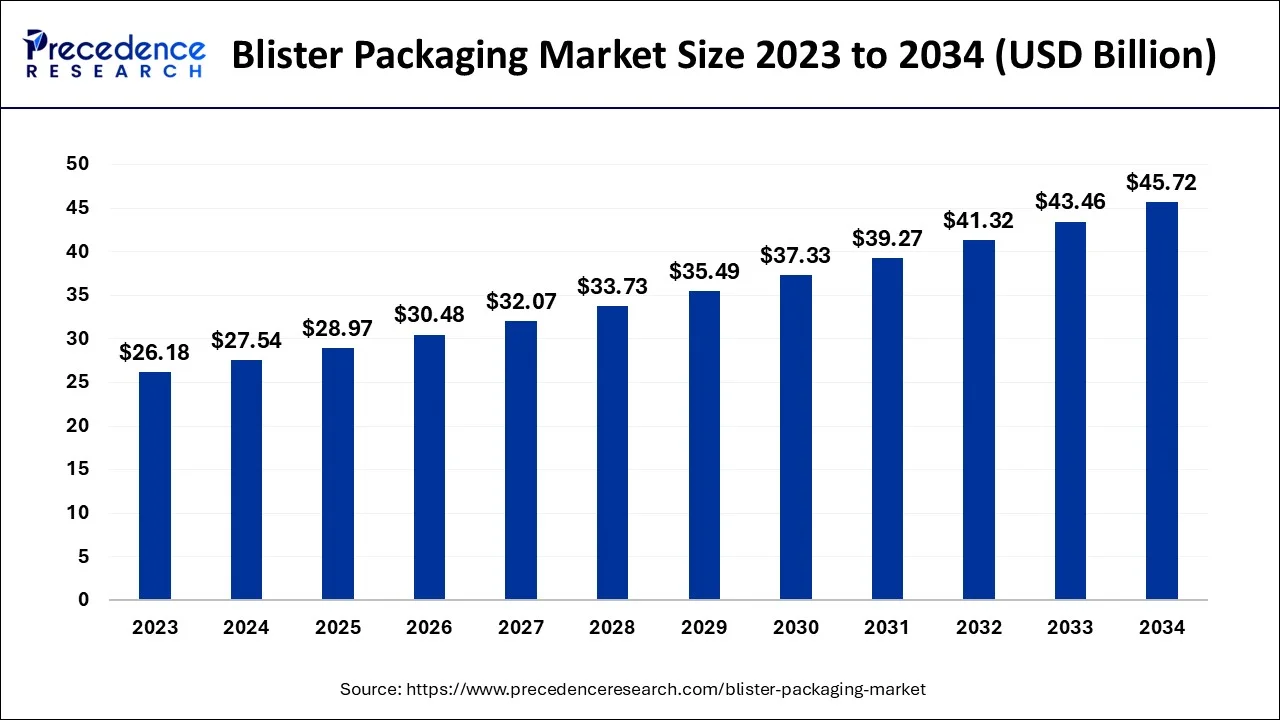

The global blister packaging market size accounted for USD 27.54 billion in 2024, grew to USD 28.97 billion in 2025 and is predicted to surpass around USD 45.72 billion by 2034, representing a healthy CAGR of 5.20% between 2024 and 2034.

The global blister packaging market size is accounted for USD 27.54 billion in 2024 and is anticipated to reach around USD 45.72 billion by 2034, growing at a CAGR of 5.20% from 2024 to 2034.

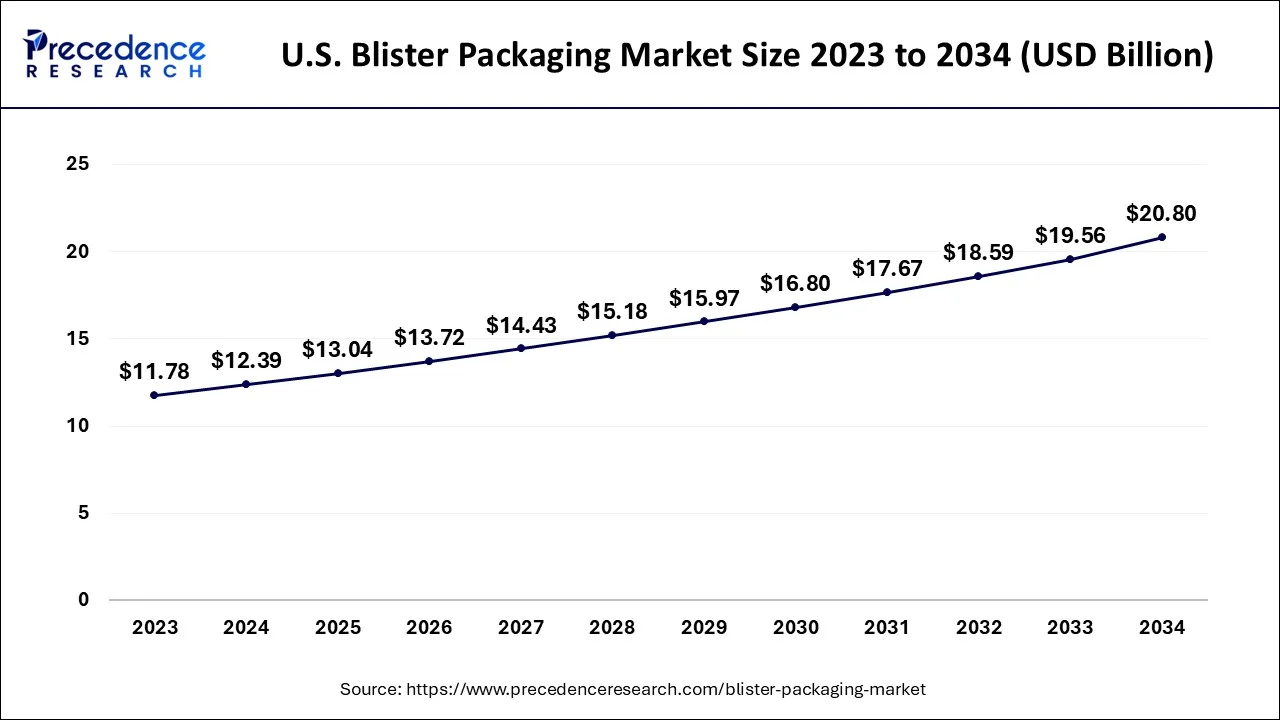

The Asia Pacific blister packaging market size is evaluated at USD 12.39 billion in 2024 and is predicted to be worth around USD 20.80 billion by 2034, rising at a CAGR of 5.30% from 2024 to 2034.

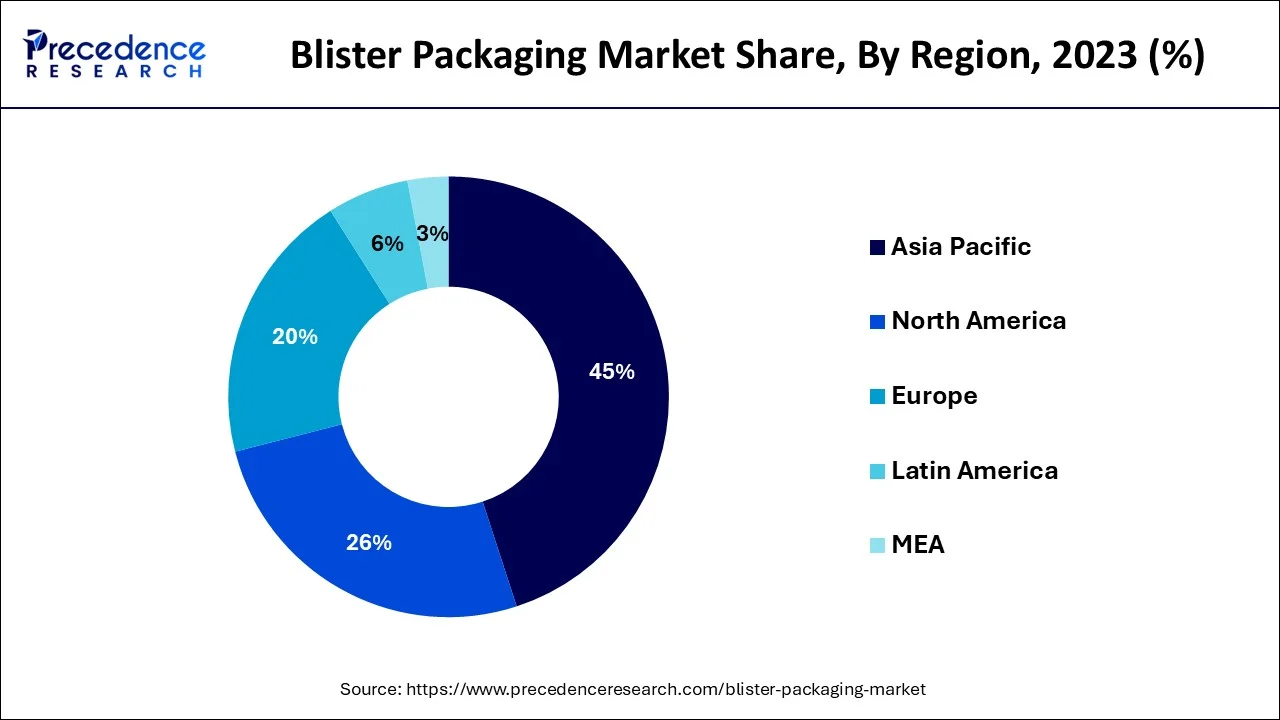

The blister packaging industry is predicted to be dominated by Asia Pacific, which in 2023 had a volumetric share of around 45%. The supremacy is attributable to the region's rapid economic development and the promising prospects for the pharmaceutical sector. The rise of the product is being fueled by the presence of several pharmaceutical medication factories and the substantial population in the area. In addition to housing almost 60% of the world's population, the region serves as a manufacturing powerhouse for the electronics and other consumer goods sectors. Furthermore, the blister packaging industry is expanding due to rising healthcare costs and rising disposable income in China, South Korea, and India.

A pre-formed plastic container with a hollow made by thermoforming plastic and a paper or aluminum foil back is referred to as "blister packing." This kind of packaging allows customers to view a large percentage of the content while protecting it from impurities, heat, UV radiation, and humidity. It eliminates the need for cartons as a consequence, which minimizes the cost of packing. In addition, because it enables for easy product handling and transportation, it is frequently used to pack toys, consumer goods, food, and pharmaceuticals. The industry for blister packaging will expand as a result of the increased demand for medicinal tablets and the creation of creative packaging techniques. Blister Packaging market expansion is anticipated to be fueled by the brisk industrialization of emerging nations and the rising demand for packaged meat and fruit products.

Blister packaging solutions, which are made up of molded plastic components that are generally attached to a piece of paper or metal, are used to package items like tablets and high-volume, low-priced consumer electronics. This kind of packaging mostly utilizes three elements: plastic substrates as a forming film, paper & paperboard or metal as lidding materials. In comparison to other packaging options, this sort of packaging has a variety of benefits, including affordability, ease of handling, protection for each little packed material, and others. In the healthcare sector, blister packs are used to package pharmaceuticals and medical equipment.

Blister solutions are also commonly utilized in the packaging of consumer products and food. Additionally, blister manufacture uses little resources, and the products take up little shelf space, are simple to use, offer great environmental protection, and have a superb hang hook display characteristic. Blister packaging's market share increased due to package manufacturers' ability to provide cost-effective solutions for a variety of clients despite their modest resource requirements and simple access to raw materials.

The rising need for various healthcare facilities is being driven by the aging populations in industrialized economies, particularly in the U.S. and Europe. The Center for Medicare and Medicaid Services estimates that by 2027, national health spending in the United States would increase from 14.9% of GDP in 2016 to 19.5% of GDP. This demonstrates that many elderly populations are anticipated to experience some sort of medical emergency, and medical tablet consumption will increase significantly. As blister packaging is one of the widely used pharmaceutical packaging types, this will drive demand for blister packaging in the coming years. Since many pharmaceutical items are extremely vulnerable to moisture and harsh tropical climates in Asia Pacific economies, improved blister packs are required for these products. Players in the sector are able to improve their packaging features and provide high-protection packaging solutions thanks to ongoing R&D investments and collaboration with pharmaceutical manufacturers.

Consumer preference for pharmaceutical items has gradually shifted away from traditional bottles in favor of blister packaging, which is unit-dose packaging. In the healthcare sector, blister packs are used to package pharmaceuticals and medical equipment. They have several more uses in the culinary, industrial, and consumer products sectors. Blister packaging also offers a great hang-hook presentation, uses fewer resources for packing, and takes up less space on store shelves. Blister packs are therefore more affordable than other packaging types like hard bottles and are therefore more cost-effective.

| Report Coverage | Details |

| Market Size in 2024 | USD 27.54 Billion |

| Market Size by 2034 | USD 45.72 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.20% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Technology, Material, Application, and Geography |

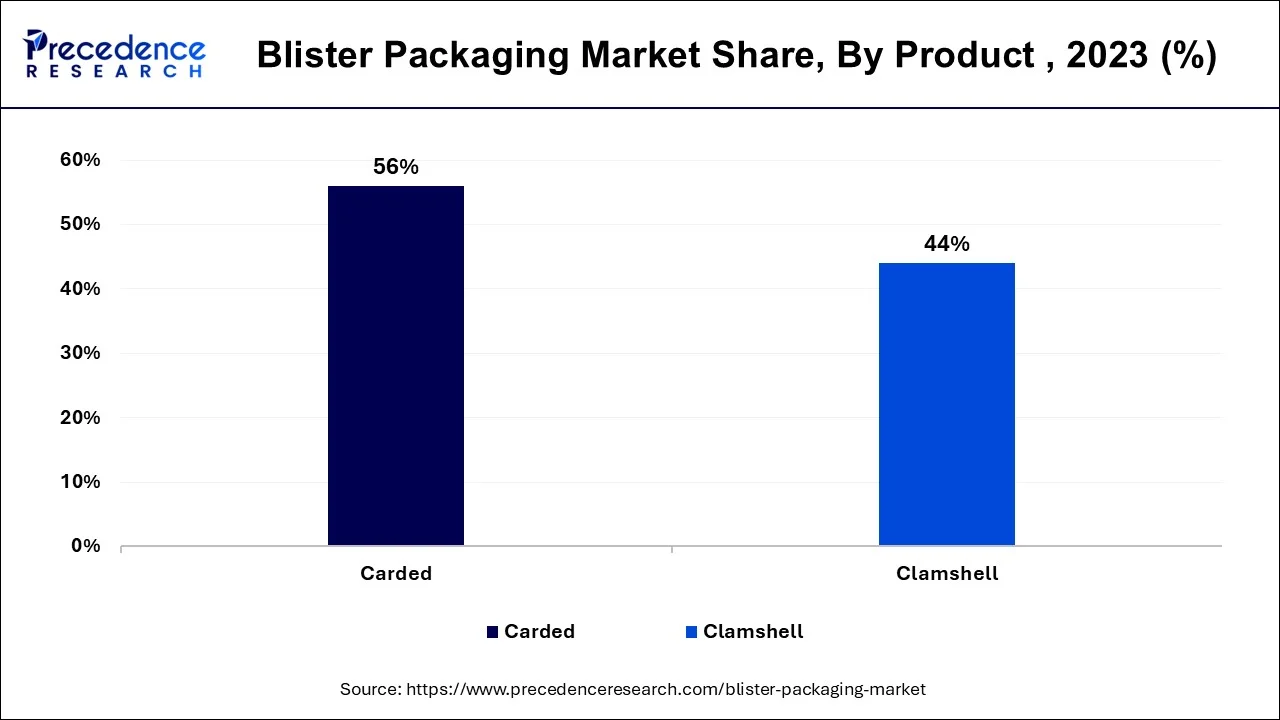

Over the projected period, the carded product type is predicted to gain importance due to its practicality, safety, flexibility, marketing exposure, and capacity to accept several dosages. PVC, PET, or PETG are used in card blister packing to offer strength and protect against any external damages. Packaging that moves very little both helps keep the product's form while reducing the chance of harm. Carded blister packaging is anticipated to increase at a CAGR of about 6.8% throughout the evaluation period.

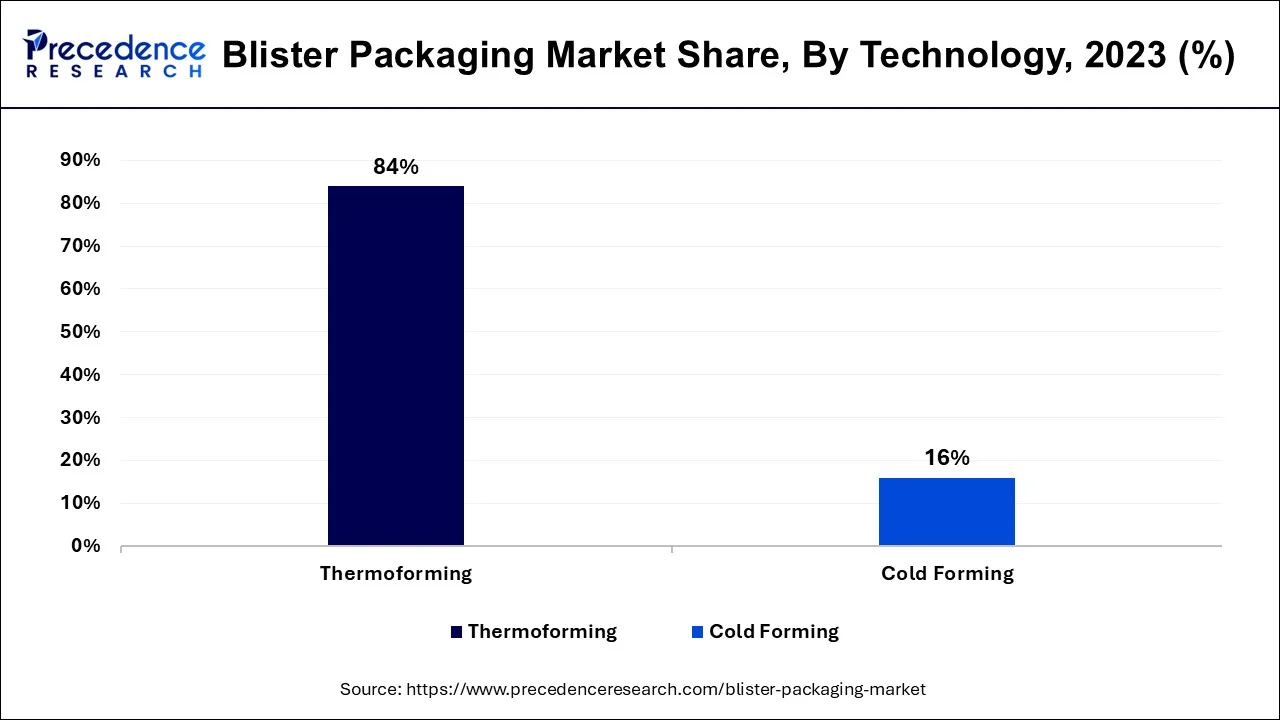

Due to the vast range of end-use sector it may be used in, including the food and healthcare industries, thermoforming now commands the largest market share in the blister packaging industry. For blister packaging, thermoforming technique is chosen over cold forming technology because it has lower initial tool and equipment expenses. Thermoforming technique offers comparative advantages over cold forming, such as safe travel since the compartments are more tightly defined and smaller, reducing the chance of damage, visibility because the blister plastic is transparent, and the ability to create a wide variety of products. Manufacturers like thermoforming because of its large volume manufacturing capacity as well as its dependability, uniformity, and cleanliness. The main driver of demand for thermoforming technology is its low cost, efficient administration, and ease.

During the anticipated period, the plastic films sector will have the biggest market share. The reasons for this segment's high demand may be linked to the product's superior visibility, security, and beautiful packaging. The plastic films sector is going to grow at a highest CAGR during the forecast period.

The consumer goods section came in second on the market behind the healthcare segment. Healthcare items are packaged in blisters to prevent product contamination and to shield them from moisture, gases, light, and temperature. This is fueling the end-use industry in healthcare's need for blister packaging.

By Product

By Technology

By Material

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

January 2025

January 2025

January 2025